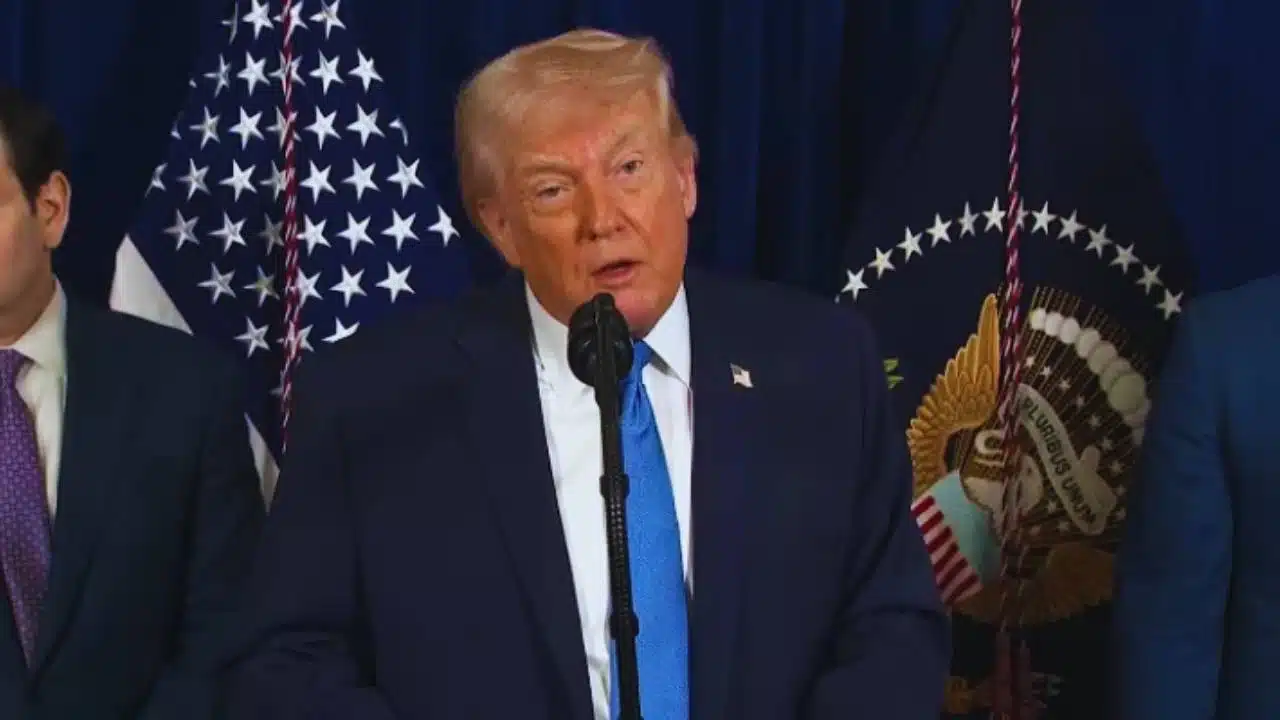

President Donald Trump said Jan. 3, 2026 that China will keep receiving Venezuelan oil as the U.S. expands sanctions and a tanker blockade after a raid that detained Nicolás Maduro, jolting exports and raising market and legal questions.

What Trump Announced And Why It Matters Now?

Trump’s comments put Trump Venezuela oil exports at the center of a rapidly widening international crisis. In remarks following a dramatic U.S. operation in Venezuela, he signaled two goals that can pull in opposite directions.

First, he described a tougher U.S. pressure campaign designed to cut off revenue streams linked to Maduro’s government and affiliated networks. Second, he suggested that China will still get Venezuelan crude, and that exports to Beijing could even increase under a new order shaped by Washington.

That combination matters because Venezuelan oil is not just a commodity. It is a political lifeline for Caracas and a strategic feedstock for buyers that can process heavy crude. Venezuela also sits on some of the world’s largest proven crude reserves, most of them extra-heavy barrels concentrated in the Orinoco Belt. The country’s ability to convert reserves into steady exports has been battered by years of underinvestment, infrastructure decay, and restrictions that complicate financing, shipping, and insurance.

Trump also argued that U.S. oil producers would spend billions to rebuild Venezuela’s energy system. He presented that plan as a way to restore output, stabilize the country, and “unlock” reserves. Critics say such promises collide with on-the-ground constraints, including equipment damage accumulated over years, a shortage of skilled labor, the need for imported parts and diluents, and the political risk of operating in a volatile transition.

At the same time, the oil story has moved from rhetoric to real-world disruption. Tanker activity and port clearances have been affected by rising security risks, tighter restrictions, and uncertainty about who is in control and what rules apply. That means Trump’s statement about China comes as the practical mechanics of exporting Venezuelan crude are under strain.

How The Blockade And New Sanctions Tightened The Screws?

The administration’s strategy has relied on two main tools: financial pressure through sanctions and physical pressure through maritime enforcement.

On the sanctions side, the U.S. Treasury expanded actions at the end of 2025 against firms and vessels accused of operating in Venezuela’s oil sector and moving crude through sanctions-evasion networks. Such measures can freeze property under U.S. jurisdiction and deter global service providers from supporting shipments, even when those providers are not American. In practice, the “chilling effect” often spreads beyond the specific targets, because insurers, banks, shipowners, and port operators tend to avoid any transaction that could trigger compliance exposure.

On the maritime side, the U.S. announced a “blockade” focused on sanctioned tankers traveling to or from Venezuela. Reports around the policy describe interdictions and seizures, and international legal experts have debated whether the enforcement approach amounts to a de facto maritime blockade under international law. U.N.-linked experts criticized ship seizures in the region and framed the policy as legally problematic. The administration has argued that its actions are lawful and tied to national security, including counternarcotics claims and self-defense rationales.

A key feature of this approach is uncertainty. Even limited interdictions can push shipping firms to reroute, pause, or demand higher premiums. If a vessel cannot secure insurance or port services, the cargo can become “stranded” in commercial terms. For heavy crude, timing matters because storage fills quickly, and production can be forced down if exports stall.

What has changed most in recent weeks is the pace and scale of disruption. Ship seizures and tighter risk controls have been reported alongside administrative turmoil and cyber-related disruptions inside Venezuela’s oil system. The result is a trade environment where even buyers willing to accept discounted barrels may struggle to move cargoes smoothly.

Key Developments Affecting Venezuela Oil And Exports

| Date | Development | Why It Matters For Exports |

| Dec. 2025 | U.S. announces blockade-style enforcement against sanctioned tankers | Raises shipping risk and disrupts logistics, insurance, and chartering |

| Dec. 31, 2025 | U.S. adds new sanctions targeting oil-trading networks and specific tankers | Increases compliance risk and discourages service providers |

| Early Jan. 2026 | U.S. operation detains Nicolás Maduro | Triggers political shock, legal disputes, and operational uncertainty |

| Jan. 2026 | Tanker activity slows and export approvals stall | Storage pressure rises and production cuts become more likely |

Why Exports To China Are Central To The Story?

China has been one of the most important destinations for Venezuelan crude for years, especially as Western market access narrowed. Venezuelan barrels have often moved to Asia at steep discounts due to sanctions-related risk and the costs of longer shipping routes and complex blending needs. Those discounts can make the crude attractive to refiners that can process heavier grades.

Venezuela’s relationship with China also has a financial layer. Over time, Venezuela received large volumes of financing linked to oil deliveries. Even after the scale of those arrangements shifted, Venezuela still owed China billions, and oil shipments have been used as a way to service obligations and maintain trade ties.

Trump’s claim that China will continue receiving Venezuelan oil can be read in several ways:

- A bargaining signal to Beijing. By indicating that China’s supply can continue, the White House may be implying that cooperation on Venezuela could be rewarded with stability in oil flows.

- A pressure message to Caracas. If the U.S. can influence where Venezuelan barrels go and under what conditions, the administration can try to reshape incentives for any future leadership structure.

- A market message. The statement may also be intended to calm fears of a total global supply shock, even as enforcement tightens.

But there is a practical challenge. Exporting Venezuelan crude is not simply a matter of political permission. Much of the country’s production is heavy and may require diluents or blending to meet shipping and refinery needs. If sanctions and maritime enforcement limit access to diluents, parts, or services, exports can slow even if there are willing buyers.

Shipping data and tanker-tracking services have indicated that loading activity at Venezuela’s main export hubs can stall quickly when port approvals stop or when vessels refuse to enter Venezuelan waters. Even a short stoppage can create a chain reaction: storage tanks fill, floating storage increases, and producers may be forced to curb output.

Venezuela Oil Snapshot For Context

| Metric | Latest Widely Reported Level | What It Tells Readers |

| Proven crude reserves | ~303 billion barrels | Enormous long-term potential, mostly extra-heavy crude |

| Recent crude production | ~1.0 to 1.1 million barrels per day | Far below historical peaks due to decay and constraints |

| Exports before late-2025 disruption | Roughly around 1 million barrels per day in stronger months | Trade remains significant when logistics function |

| Heavy crude dependence | Very high | Requires specialized refining capacity and blending solutions |

| Key export hub | José (Anzoátegui) | Bottleneck risk when shipping and port approvals freeze |

Immediate Market Impact And How U.S. Refineries Could Feel It?

Venezuela’s crude is not “replaceable barrel-for-barrel” in every market. Many Venezuelan streams are heavy and sulfur-rich, and they fit best into complex refineries that invested in equipment to process heavier feedstocks. When those barrels disappear, refiners often shift to other heavy sources, adjust blending strategies, or reduce runs depending on availability and economics.

The most sensitive areas tend to be:

- Heavy crude substitution. Alternatives can be constrained by other producers’ capacity, contract structures, and geopolitics.

- Freight and insurance costs. Risk premiums rise quickly when interdictions or seizures become part of the trade environment.

- Regional product pricing. Even if global benchmarks do not spike, localized disruptions can affect diesel, gasoline, and other refined products.

There is also a corporate dimension. U.S. companies with historical exposure to Venezuela have faced a patchwork of restrictions for years. Chevron has operated through joint ventures and U.S. authorizations that allowed limited activity under strict conditions. Those permissions have shifted over time, including wind-down requirements tied to U.S. sanctions policy. That history matters because it shapes what “billions in investment” would actually require: stable legal permissions, security for personnel, clarity on ownership, and a workable framework for profits, taxes, and governance.

For oil markets, the key question is whether disruption in Venezuela stays isolated or spreads into broader shipping lanes and regional stability. If the situation prompts wider regional tensions or affects other flows, the price impact could become more visible.

What Happens Next In Caracas, Washington, And The U.N.?

The political crisis is now tightly interwoven with oil.

Inside Venezuela, the immediate leadership question has moved into the courts and state institutions. Venezuela’s Supreme Court has issued an order directing Vice President Delcy Rodríguez to assume the role of interim president, citing continuity of administration and national defense. Venezuelan officials have denounced the U.S. action, while reactions inside the country have been mixed, including both protests and celebrations reported in different areas.

Internationally, the dispute is moving to the United Nations. The U.N. Security Council is scheduled to meet to discuss the U.S. intervention. The U.N. secretary-general has warned that the action sets a dangerous precedent and raises serious concerns under international law and the U.N. Charter. The U.S. has defended the operation, framing it as justified under self-defense and as part of a broader campaign against a “narco-terrorist” network.

For oil, the next steps depend on three practical tests:

- Can exports restart quickly. If port approvals resume and tankers return, flows to Asia could recover. If not, storage constraints could force production cuts.

- Will the U.S. clarify the operating framework. If Washington wants U.S. firms to invest, it must define legal permissions, security guarantees, and a transition plan that markets consider credible.

- How China responds. Beijing may weigh energy security, geopolitical costs, and the precedent of U.S. control over another country’s resource flows.

Trump’s messaging on Trump Venezuela oil exports signals a high-stakes attempt to reshape Venezuela’s oil future while simultaneously managing China’s access to a strategically valuable crude supply. In the short term, the trade mechanics of tankers, insurance, and port approvals will likely matter more than speeches. In the longer term, whether Venezuela’s oil sector can be rebuilt will depend on stability, credible governance, and clear international rules that companies can operate under without constant disruption.