Trump Venezuela intervention has turned a long-running sanctions-and-diplomacy standoff into a direct test of sovereignty, energy politics, and regime change playbooks. With Nicolás Maduro in U.S. custody and Washington hinting at “running” Venezuela, the next decisions could reshape the region’s security and the global norm against force.

The capture of Nicolás Maduro by U.S. forces and his transfer to New York to face U.S. drug-trafficking charges is not just another spike in U.S.-Venezuela tensions. It is a strategic hinge point: it forces governments, markets, and institutions to decide whether this is a one-off “law enforcement” exception or a precedent that quietly rewrites what powerful states can do when they label foreign leaders as criminal threats. Reuters reports that the operation has already become a legality fight at the United Nations, with UN Secretary-General António Guterres warning it sets a “dangerous precedent.”

At the same time, the economic temptation is obvious. Venezuela holds the world’s largest proven crude reserves, roughly 303 billion barrels, around 17% of global reserves, according to the U.S. Energy Information Administration (EIA). Even if Venezuela’s current output is relatively small in global terms, the long-run prize is enormous, and the mere possibility of sanctions relief plus foreign investment can move expectations. The Financial Times notes prices initially dipped then rebounded as traders weighed whether Venezuela becomes a bigger supplier or a near-term disruption risk.

What comes next depends less on the raid itself and more on the follow-through: whether Washington tries to shape governance inside Venezuela, whether Caracas’s power brokers fracture or consolidate, and whether other global powers decide they must respond to protect the broader principle of sovereignty.

How We Got Here

For most of the past decade, Venezuela’s crisis has been a mix of political repression, economic collapse, and external pressure. The economic story matters because it explains why Venezuela is both fragile and fiercely contested.

- Oil dependence and collapse: Venezuela’s state oil company PDVSA has long been the fiscal spine of the state. EIA describes how heavy state control and underinvestment contributed to a steep production decline. It estimates Venezuela produced 742,000 b/d of crude oil in 2023, a 70% cumulative decline from 2013 levels.

- Sanctions and partial openings: Venezuela’s ability to recover output has been constrained by sanctions and by the technical challenge of producing extra-heavy crude, which often requires imported diluents and foreign expertise.

- Human rights and legitimacy disputes: Multiple international bodies have documented severe repression. The UN Human Rights Office reported findings that Venezuela’s government continued actions that may amount to crimes against humanity, including persecution on political grounds.

- Migration as regional pressure: The crisis spilled across borders. R4V estimates 6,906,690 Venezuelan refugees and migrants in Latin America and the Caribbean (a regional count). Switzerland’s SECO economic report describes a broader emigration figure of nearly 8 million Venezuelans (a wider framing of the diaspora).

Against that backdrop, the current shock is that Washington leapt from coercion to capture. Reuters reports U.S. Special Forces seized Maduro and he is detained in New York; the operation included strikes and blackouts, and it has triggered condemnation by Maduro allies while leaving U.S. partners cautious.

Key Statistics That Explain The Stakes

- Proven crude reserves: ~303 billion barrels (largest globally), ~17% of world reserves (EIA, for 2023).

- Current oil output (order of magnitude): Venezuela’s underperformance is central to the opportunity and risk narrative; AP describes the industry as producing around 1.1 million barrels per day in recent context.

- Debt overhang: Reuters puts Venezuela’s external liabilities at roughly $150–$170 billion, versus estimated 2025 GDP of $82.8 billion.

- Diaspora pressure: 6.9 million Venezuelans in Latin America and the Caribbean (R4V).

- Macro fragility and inflation risk: SECO notes the IMF projection context: a 4% GDP contraction in 2025 and 5.5% in 2026, alongside inflation risks and data uncertainty.

A Short Timeline Of Escalation And Vulnerability

| Period | What Changed | Why It Matters Now |

| 2013–2023 | Production collapse and institutional decay | Limited state capacity means any transition can turn chaotic quickly. |

| 2017 | Sovereign default and deepening debt disputes | Creditors, arbitration awards, and asset fights (like Citgo-linked litigation) become a post-crisis battlefield. |

| 2024–2025 | Intensified repression and legitimacy disputes | A crackdown environment raises the risk that power change triggers retaliation rather than reconciliation. |

| Jan 3–5, 2026 | U.S. captures Maduro; global legal and diplomatic backlash | The core question shifts to precedent: is this “law enforcement” or de facto intervention. |

Core Analysis: Why This Matters And What Comes Next

The International Law Test: “Law Enforcement” Versus Use Of Force

The central dispute is not whether Maduro is accused of serious crimes under U.S. law. It is whether one state can use military force inside another state to seize its leader without host-state consent or UN authorization, then call it policing.

Under the UN Charter, members must refrain from the “threat or use of force against the territorial integrity or political independence” of any state (Article 2(4)). Self-defense (Article 51) is narrowly framed, and Reuters reports legal experts widely regard the operation as illegal absent UN authorization, Venezuelan consent, or a valid self-defense claim.

Even if Washington argues Maduro is the head of a “narco-terror” enterprise, that framing collides with another norm: immunity protections for sitting heads of state, which international law debates have tried to balance against accountability. Academic analyses of immunity show how contested these boundaries become when states try to prosecute high officials outside international frameworks.

Why it matters:

If the raid is normalized, other powers gain rhetorical cover to seize dissidents, rivals, or leaders abroad under “criminal” labels. That is the slippery slope Guterres is warning about, according to Reuters.

What comes next:

Expect UN-centered escalation: emergency debates, draft resolutions, and procedural fights. But the veto reality means the Security Council may not constrain the U.S. directly, pushing pressure into diplomacy, sanctions reciprocity, and regional blocs.

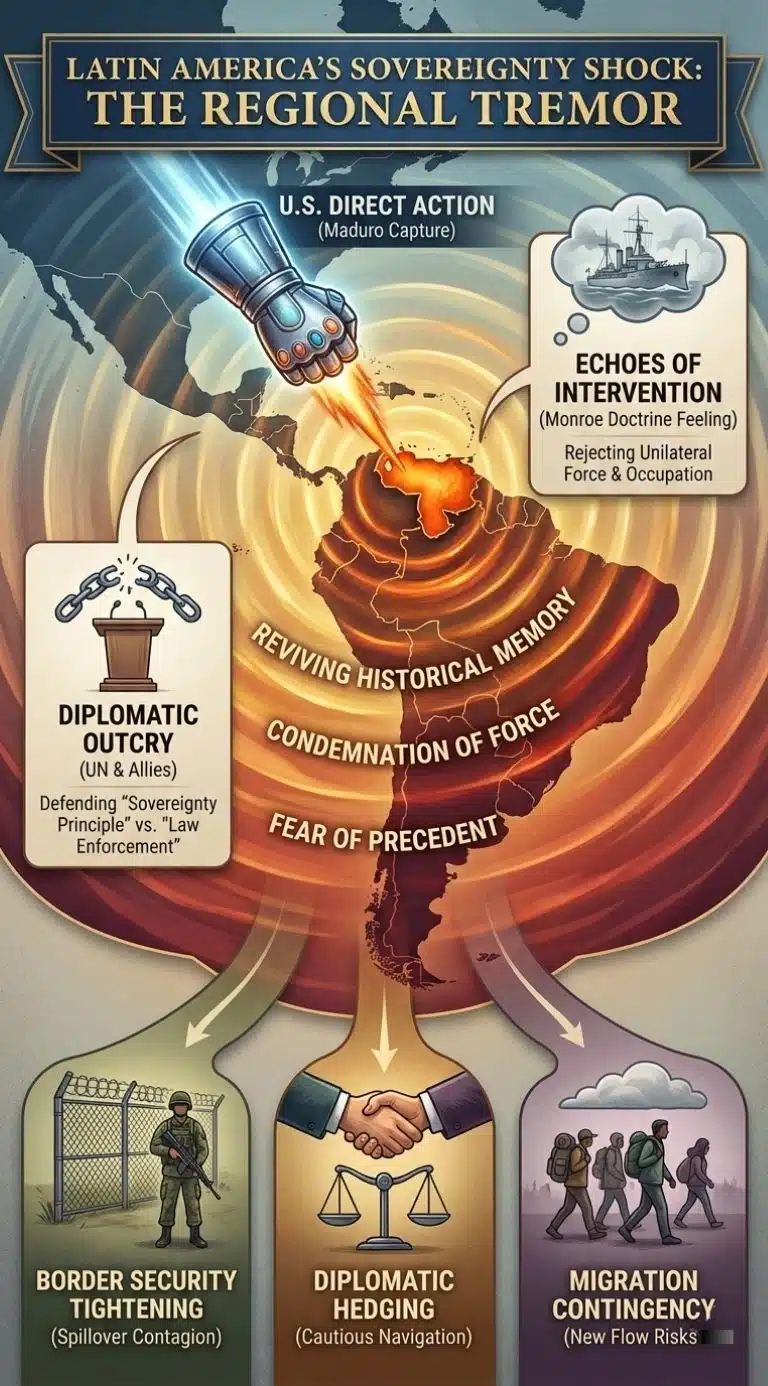

Latin America’s Sovereignty Shock: The Monroe Doctrine Feeling Returns

Latin American politics has long been shaped by a paradox: many governments reject Maduro’s authoritarianism while also rejecting U.S. force as a solution. This operation forces leaders into a narrow corridor: condemn the violation of sovereignty and you look like you are protecting Maduro; welcome U.S. action and you risk reviving the region’s historical memory of intervention.

Reuters describes global condemnation and cautious allied responses, while The Guardian reports Colombia’s president framed the raid as an attack on regional sovereignty and warned of refugee pressures. Reuters also reports Trump threatened potential military action against Colombia days later, intensifying fears that “Venezuela” could become a template rather than an exception.

Why it matters:

Even governments that dislike Maduro may now prioritize a line-in-the-sand principle: if the U.S. can seize a sitting leader in Caracas, what prevents similar logic elsewhere under the banner of narcotics, gangs, or migration?

What comes next:

Watch for three immediate regional dynamics:

- Border security tightening (especially Colombia-Venezuela) to contain spillover and armed group opportunism.

- Diplomatic hedging: condemn force, call for transition, avoid endorsing occupation-like language.

- Migration contingency planning as uncertainty prompts new flows.

Inside Venezuela: The Highest-Risk Variable Is The Power Vacuum

AP reports Venezuela’s Supreme Court named Vice President Delcy Rodríguez interim president and describes how the move sidesteps constitutional expectations for a quick election by labeling Maduro’s absence “temporary.” That is a signal: the system’s instinct is continuity, not immediate opening.

This matters because Venezuela’s crisis is not just “Maduro versus opposition.” It is also a dense web of:

- military command interests,

- patronage networks linked to PDVSA revenues,

- sanctioned economic actors,

- and security structures accustomed to repression.

Human-rights reporting underscores how coercive governance has become entrenched, which often makes transitions more dangerous.

Why it matters:

If Washington’s move fractures the ruling coalition, Venezuela could face a messy competition among factions rather than a clean democratic handoff. If the coalition holds, the U.S. may find it captured a leader but not the state.

What comes next:

The most important near-term indicators are not speeches. They are:

- whether security forces remain unified,

- whether the interim leadership can control state media, borders, and PDVSA operations,

- and whether opposition groups can organize without triggering intensified repression.

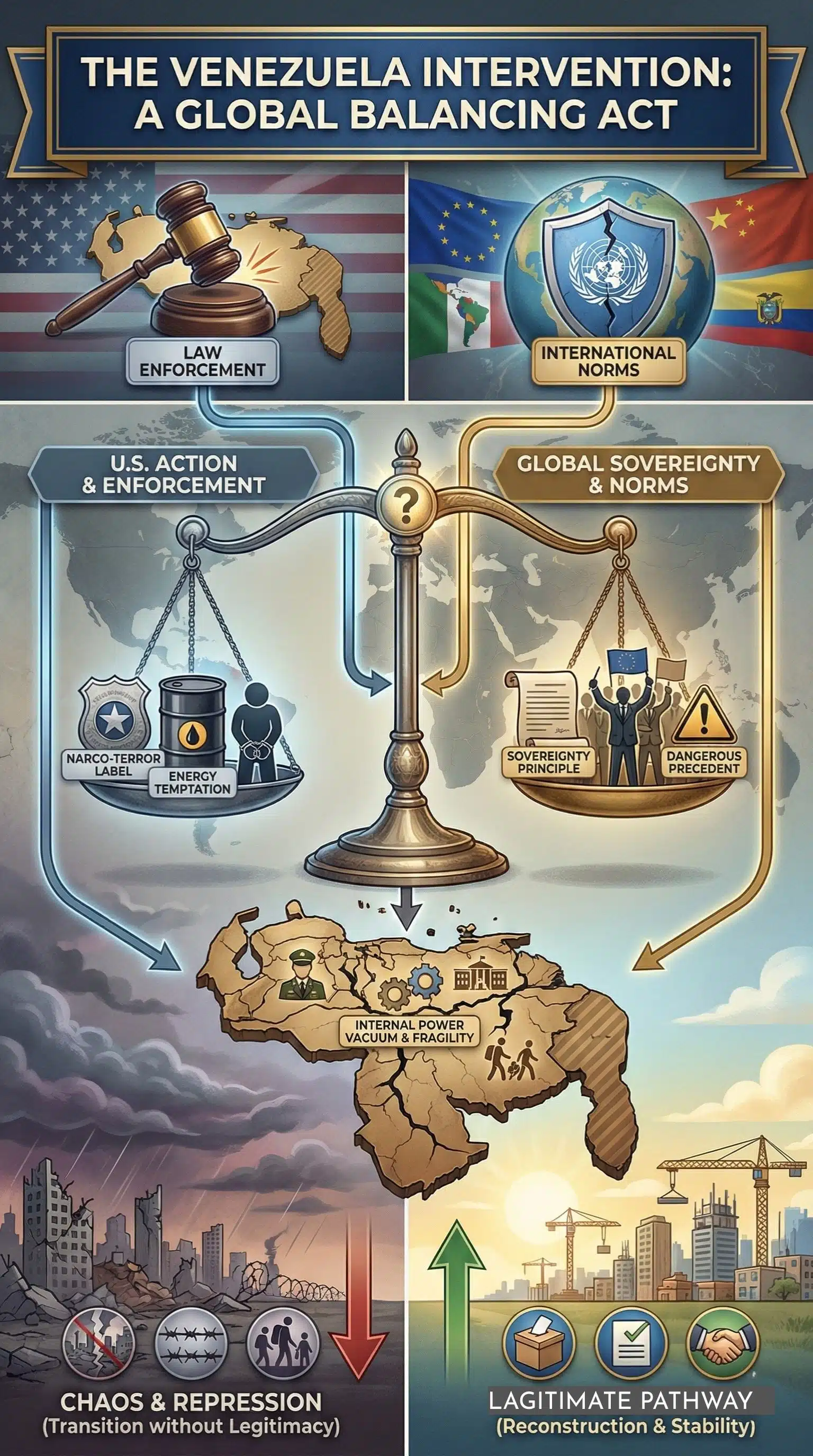

Oil Is Not The Whole Story, But It Shapes Every Incentive

Venezuela’s current production is small relative to global supply, which is why markets have not panicked. Reuters reports oil traded with only modest moves, with Brent around $60–$61 and WTI near $57 in the immediate aftermath. The Financial Times notes the market’s ambivalence: near-term disruption risk versus longer-term supply expansion if investment and sanctions relief follow.

The deeper point is optionality. Venezuela’s reserves are enormous (EIA). If U.S. policy shifts from containment to reconstruction-plus-production, it could eventually add meaningful supply over time. Reuters reports Goldman Sachs expects Venezuela’s 2026 output to depend on sanctions policy and cites scenarios where higher output could pressure prices longer term.

Comparative View: Short-Term Disruption Versus Long-Term Expansion

| Scenario | What Happens To Venezuelan Output | Likely Market Effect | Main Constraint |

| “Instability first” | Output declines due to sabotage, labor flight, or logistics breakdown | Temporary upside risk for prices, but limited globally | Security, governance, infrastructure |

| “Sanctions relief with limits” | Output stabilizes and inches up | Mild downward pressure on long-run expectations | Licensing, compliance, capacity limits |

| “Investment-led ramp” | Multi-year recovery toward higher output | Downside pressure on prices and OPEC+ strategy | Capital, technology, politics, legal risk |

Why it matters:

Energy markets respond to credible future supply. A credible pathway to Venezuelan recovery can depress prices even if today’s barrels do not move much. That is why “who runs Venezuela” is an oil question, not just a diplomatic one.

What comes next:

Expect a tug-of-war between:

- U.S. domestic demands for cheaper fuel and “wins,”

- compliance and reputational risk for oil majors,

- and Venezuelan technical constraints, especially extra-heavy crude requirements described by EIA.

Debt, Assets, And The Coming Scramble For Venezuela’s Balance Sheet

Political shocks often trigger financial aftershocks. Reuters reports Venezuela’s defaulted liabilities are estimated at $150–$170 billion, with creditor battles ranging from bonds to arbitration claims, while bonds trade at steep discounts. This is not just finance trivia. Debt restructuring can dictate policy.

A transitional government that seeks legitimacy might pursue:

- IMF engagement,

- an orderly restructuring,

- and clearer oil-sector rules to attract investment.

But a U.S.-directed transition, or even a perception of it, could complicate recognition. Creditors may litigate harder if they sense a “regime change moment,” while rivals may argue any restructuring is illegitimate.

Why it matters:

A democratic transition without financial stabilization is brittle. A financial opening without legitimacy is combustible. Venezuela needs both, but the raid makes sequencing harder.

What comes next:

Watch for:

- court moves around overseas assets,

- early signals about whether sanctions will be modified to permit restructuring talks,

- and whether any interim authority claims the mandate to negotiate sovereign obligations.

Great-Power Signaling: China And Russia See A Precedent, Not A Country

China’s response is revealing because it frames this as a global governance dispute. Reuters reports China’s foreign minister said no country should act as the “world’s judge,” emphasizing sovereignty principles. That is not only about Venezuela. It is also about what China worries the U.S. might justify elsewhere, and what China might want to prevent being justified against it.

Meanwhile, European reactions show another axis: the EU urged democracy restoration that respects Venezuelans’ will and international law, according to Reuters. This is classic allied discomfort: many European governments view Maduro as illegitimate, but fear legitimizing unilateral force.

Why it matters:

If major powers treat the raid as acceptable, the post-1945 constraint on force weakens. If they treat it as unacceptable but cannot stop it, they may respond asymmetrically elsewhere, increasing global volatility.

What comes next:

Look for:

- coordinated diplomatic pressure and UN speeches,

- potential economic retaliation or legal actions,

- and increased “sphere-of-influence” rhetoric that erodes multilateral problem-solving.

Winners, Losers, And The Real Risk: A Transition Without A Plan

| Actor | Potential Upside | Primary Risk |

| Venezuelan civilians | Chance of change after years of repression | Short-term violence, shortages, and intensified crackdowns |

| Regional neighbors | Possible long-run stabilization | New refugee surge and border insecurity |

| U.S. policymakers | “Decisive action” narrative and leverage | Legal blowback, occupation-like commitments, precedent risks |

| Oil markets | Long-run supply upside | Near-term instability and sanctions uncertainty |

| Creditors | Higher recovery odds if restructuring begins | Chaotic claims race and legitimacy disputes |

| China and Russia | Rally sovereignty narrative | Loss of influence and assets, plus precedent anxiety |

Expert Perspectives: The Case For Action, The Case Against It

The argument for the raid (as supporters frame it):

- Maduro is accused of narco-terrorism and drug trafficking, and a “law enforcement” approach is necessary when a state is captured by criminal networks.

- A swift capture avoids the drawn-out humanitarian damage of sanctions and stalemate politics.

- Removing the leader can unlock oil investment and fiscal recovery, which could stabilize the region.

The argument against it (as critics frame it):

- International law does not grant a “criminal exception” to sovereignty. Reuters reports legal experts see the operation as lacking UN authorization, consent, or valid self-defense.

- Head-of-state immunity norms, even when contested, exist to prevent precisely this kind of escalation spiraling into interstate conflict.

- The hard part is governance, not capture. AP’s reporting on Delcy Rodríguez’s interim ascent suggests the system can reconstitute quickly, leaving the U.S. with responsibility but limited control.

- Oil recovery is not a switch. EIA details how extra-heavy crude and infrastructure decay create real technical bottlenecks.

The most neutral synthesis is this: even if Maduro’s removal was morally satisfying to many, the method matters because it changes the rules for everyone. That is why the UN reaction centers on precedent, not sympathy for Maduro.

The Look Ahead: Milestones That Will Decide The Outcome

Predictions should be cautious here because the situation is fluid. Still, several near-term milestones will reveal the true trajectory.

1) The UN Track

Expect intense debate and symbolic resolutions. The key outcome may be diplomatic isolation rather than legal enforcement, given Security Council dynamics. Reuters reports scrutiny at the UN is already underway.

2) The “Interim” Question In Caracas

AP’s reporting suggests Venezuelan institutions may try to keep the leadership “temporary” and avoid quick elections. If that happens, the U.S. faces a dilemma: escalate further, bargain, or declare victory and disengage.

3) Sanctions, Licenses, And Oil Company Behavior

Goldman’s view reported by Reuters is that Venezuela’s 2026 output path hinges on sanctions policy. Watch whether the U.S. signals:

- targeted license expansion for specific firms,

- conditional relief tied to elections,

- or a harder blockade posture.

4) Debt Restructuring Signals

If there is any credible transition, the debt pile becomes unavoidable. Reuters’ estimates highlight how outsized liabilities are relative to the economy. A serious plan would likely require multilateral support and clear governance legitimacy.

5) Regional Contagion Risks

Trump’s rhetoric toward Colombia, reported by Reuters, raises the risk that neighbors treat this as the start of a broader coercive campaign. Even if no further action occurs, the threat alone can shift defense postures and politics across the hemisphere.

Most likely path (near term): high diplomatic heat, uncertain governance inside Venezuela, and a cautious market response that keeps oil prices range-bound unless production is disrupted or sanctions policy swings sharply.

Highest-impact risk: Venezuela enters a prolonged “transition without legitimacy,” combining repression, fragmentation, and external meddling, which would intensify migration and organized-crime spillovers rather than reduce them.

Final Thoughts

The Trump Venezuela intervention is a rare event that forces clarity: the world can condemn Maduro’s repression while still rejecting a precedent that normalizes cross-border capture of leaders by military force. The next phase will not be decided by who holds Maduro. It will be decided by whether Venezuela gets a legitimate political pathway, whether regional governments rally around sovereignty or opportunism, and whether energy and debt incentives drive policy faster than institutions can absorb the shock.

If Washington pivots from raid to “running” Venezuela, it inherits the hardest problems: rebuilding legitimacy, managing armed actors, stabilizing an oil-heavy economy, and preventing a refugee surge. If it pivots away quickly, it may still have set a precedent that others will reuse in less defensible circumstances. Either way, this is bigger than Caracas. It is a stress test for how power, law, and markets interact in 2026.