In a bold and controversial move, U.S. President Donald Trump has signed an executive order to double tariffs on imported steel and aluminum, raising them from 25% to 50%, a decision that is already sending shockwaves through global markets and reigniting fears of a prolonged trade war.

The announcement was formalized late Tuesday evening and went into effect just after midnight. The Trump administration confirmed that this measure is being implemented under Section 232 of the Trade Expansion Act of 1962, citing national security concerns as the primary justification.

Why the Tariffs Were Doubled

President Trump first introduced the 25% tariffs on steel and aluminum imports in mid-March 2025. Now, less than three months later, the decision to double the tariff rate has raised eyebrows among economists, businesses, and U.S. allies.

Speaking at a campaign-style event last Friday at a United States Steel Corp. plant in Pennsylvania, Trump defended the hike as a necessary step to protect American jobs, revitalize domestic industry, and end reliance on what he called “unfair foreign dumping.”

“We can’t let other countries flood our markets with cheap metals and destroy American manufacturing,” Trump declared. “This is about national pride, national power, and putting America first.”

However, he did not offer detailed data or a specific economic trigger to justify the sudden increase from 25% to 50%. The White House’s statement merely emphasized that it is a “strategic recalibration” aimed at reinforcing the earlier measures that, according to administration officials, were not producing the desired effects fast enough.

Impact on U.S. Industry and Supply Chains

While Trump’s tariff policy has been popular with domestic steelmakers and metal unions, it has sparked concern among major U.S. industries that rely heavily on imported steel and aluminum.

Sectors such as:

- Automotive manufacturing

- Construction

- Consumer electronics

- Food and beverage packaging

are all expected to see a rise in production costs, which could trickle down to consumers in the form of higher prices.

Industry analysts point out that U.S. production alone cannot meet demand, and doubling tariffs on imports could tighten already fragile supply chains. Some businesses have even warned of potential job losses and delays in infrastructure projects if alternative suppliers or domestic production capabilities cannot quickly fill the gap.

Global Reactions and Trade Fallout

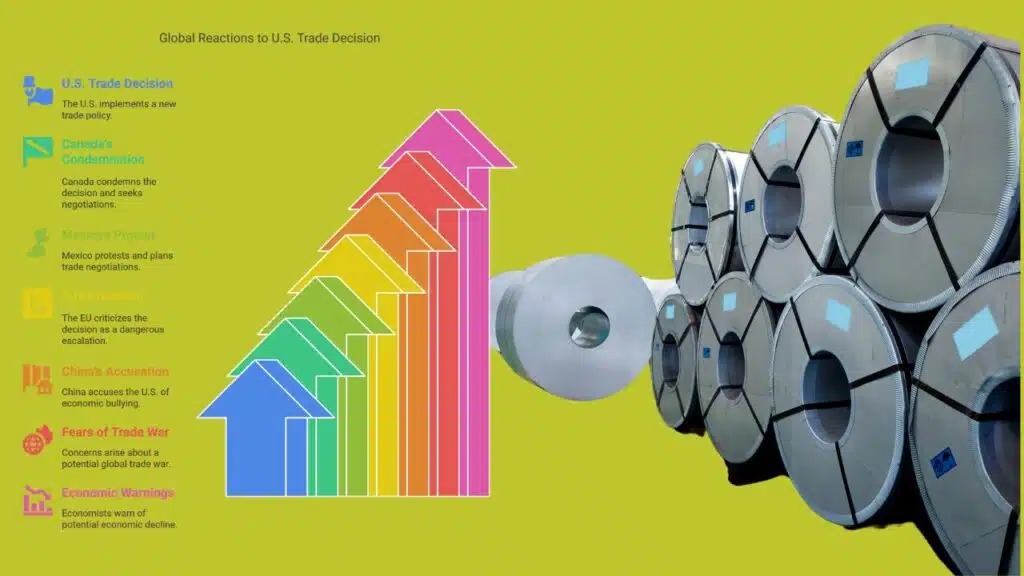

The decision has triggered immediate backlash from U.S. trading partners and international economic watchdogs.

- Canada, one of the largest suppliers of aluminum to the U.S., condemned the move and is currently seeking diplomatic channels to negotiate an exemption.

- Mexico stated that it would push back through diplomatic protests and trade negotiations.

- The European Union called the measure “a dangerous escalation” that undermines the spirit of international cooperation and could result in retaliatory tariffs on American goods.

In Asia, China, already embroiled in trade disputes with the United States, criticized the policy as “economic bullying.” Beijing’s Ministry of Commerce accused the Trump administration of using national security as a façade to advance protectionist economic interests.

These reactions are creating renewed fears of a global trade war similar to the one that dominated headlines during Trump’s first term in office. Economists from the Peterson Institute for International Economics warned that such moves, if sustained, could lead to a sharp decline in global trade volumes and investor confidence.

No Progress on Negotiations Despite 90-Day Pause

Earlier this year, Trump announced a 90-day pause on parts of his “reciprocal tariff” program in an effort to create breathing room for new trade negotiations. However, since that announcement in April, there has been little to no progress on securing new or improved trade deals with major U.S. partners.

Insiders from the U.S. Trade Representative’s office, speaking anonymously, expressed frustration over stalled talks with allies who have grown skeptical of U.S. trade reliability. The sudden escalation of tariffs is likely to deepen that mistrust.

Connection to Nippon Steel and the U.S. Steel Deal

The timing of this tariff escalation also coincides with Trump’s recent endorsement of a $14 billion acquisition deal between Nippon Steel of Japan and United States Steel Corp., a move he initially opposed.

During his Pennsylvania speech, Trump praised Nippon Steel for committing to major investments and for agreeing to conditions ensuring U.S. oversight. These included keeping U.S. Steel’s headquarters in Pittsburgh and giving the U.S. government a “golden share”—a rare mechanism allowing intervention in corporate decisions for national security reasons.

Some analysts suggest that the tariff increase was, in part, a strategic play to boost the value of U.S. Steel before the acquisition completes and to signal strength in negotiations.

Legal Challenges and Scrutiny in U.S. Courts

Meanwhile, the legality of Trump’s steel and aluminum tariffs remains under challenge in several U.S. courts. Critics argue that Section 232 has been overstretched beyond its original intent, which was to protect defense-related industries during emergencies—not to serve as a long-term economic weapon.

A coalition of importers and manufacturers has filed lawsuits claiming the administration’s use of national security as justification lacks transparency and economic grounding. Several federal judges are reviewing whether Trump exceeded executive authority.

The Next Deadline: “Liberation Day” Tariffs Looming

Trump’s move comes ahead of a self-imposed July 8, 2025 deadline, dubbed “Liberation Day” by his administration, during which a broader set of tariffs could be enforced if trading partners don’t meet U.S. demands.

Trump has called on countries to submit their “best offers” to avoid further penalties. These offers must include new commitments on digital trade, strategic resources, fair market access, and curbs on state subsidies. Officials said that any country failing to comply could face tariffs not just on metals, but on a wider range of goods and services.

This adds pressure on international negotiators to act quickly, as the U.S. shifts toward what Trump calls “reciprocal and patriotic trade.

Market Reactions and Economic Outlook

The financial markets reacted quickly to the news:

- U.S. steel companies like Cleveland-Cliffs and Nucor saw their stocks climb by 3-5% in after-hours trading.

- Conversely, global steelmakers such as Tata Steel and ArcelorMittal faced losses on international exchanges.

- The Dow Jones Industrial Average opened slightly down on Wednesday, as traders digested the long-term implications of the tariff escalation.

Economists remain divided on the move. While Trump’s supporters hail the decision as necessary to ensure economic self-reliance, critics argue that it could cause ripple effects across global manufacturing, consumer prices, and diplomatic relations.

A High-Stakes Trade Gamble

President Trump’s decision to double tariffs on imported steel and aluminum to 50% signals a renewed era of economic nationalism, placing America’s industrial policy at the center of his second-term agenda.

While it may deliver short-term political wins and appease domestic steel producers, the long-term impact could be disruptive for American manufacturers, global trade partners, and the broader international order. As deadlines loom and tensions rise, all eyes will now be on how global leaders respond—and whether diplomacy or escalation will define the months ahead.

The Information is Collected from MSN and BBC.