President Donald Trump announced on Tuesday that his administration is imposing a 50% tariff on all copper imported into the United States. This latest measure marks the fourth significant trade restriction of his second term, adding to an already growing list of tariffs that include 25% on imported cars and car parts, and 50% on steel and aluminum. The announcement came during a Cabinet meeting at the White House.

However, the administration has not yet confirmed when the copper tariff will go into effect, leaving uncertainty for U.S. importers, manufacturers, and global trade partners. According to officials, the implementation timeline could depend on ongoing investigations and trade negotiations.

The National Security Angle and Section 232

The decision to impose the copper tariff is based on a Section 232 investigation, which was launched in February 2025. This provision in U.S. law allows the president to impose tariffs on certain imports if they are determined to threaten national security.

The administration has argued that copper is a strategic resource, vital for a wide range of industries—from electrical wiring and renewable energy infrastructure to military equipment and automobile manufacturing. The goal of the tariff is to reduce U.S. reliance on foreign copper and encourage domestic production.

U.S. Copper Imports and Top Suppliers

In 2024, the United States imported $17 billion worth of copper, according to data from the U.S. Department of Commerce. Chile was the top foreign supplier, accounting for $6 billion in copper shipments to the U.S., followed by Canada, Mexico, and Peru. These countries could face major disruptions in trade volume and revenue as a result of the new tariff policy.

Copper Prices Skyrocket to Record Highs

Following the announcement, copper prices surged dramatically. Futures traded in New York jumped by as much as 15%, reaching a record high of $5.68 per pound. This historic spike represents a broader trend in 2025, where copper prices have already increased 38% year-to-date, largely driven by anticipation of supply constraints and tariff-related speculation.

The surge is partly due to stockpiling by manufacturers, who are trying to purchase large quantities of copper ahead of the tariff’s implementation to avoid additional costs.

Impact on Industries and Consumers

Copper plays a vital role in numerous sectors, including:

-

Electronics: Used extensively in semiconductors, circuit boards, and batteries.

-

Automobiles: Especially critical for electric vehicles (EVs), which use significantly more copper than gas-powered cars.

-

Construction: Widely used in plumbing, roofing, and wiring.

-

Defense: Essential for communications systems and various military-grade equipment.

A 50% tariff on copper could significantly increase the cost of production for U.S.-based manufacturers and drive higher consumer prices for a wide range of products. Industry experts have warned that such a sharp tariff will effectively act as a tax on U.S. consumers, particularly those purchasing cars, electronics, and home appliances.

Business Analysts Warn of Broader Consequences

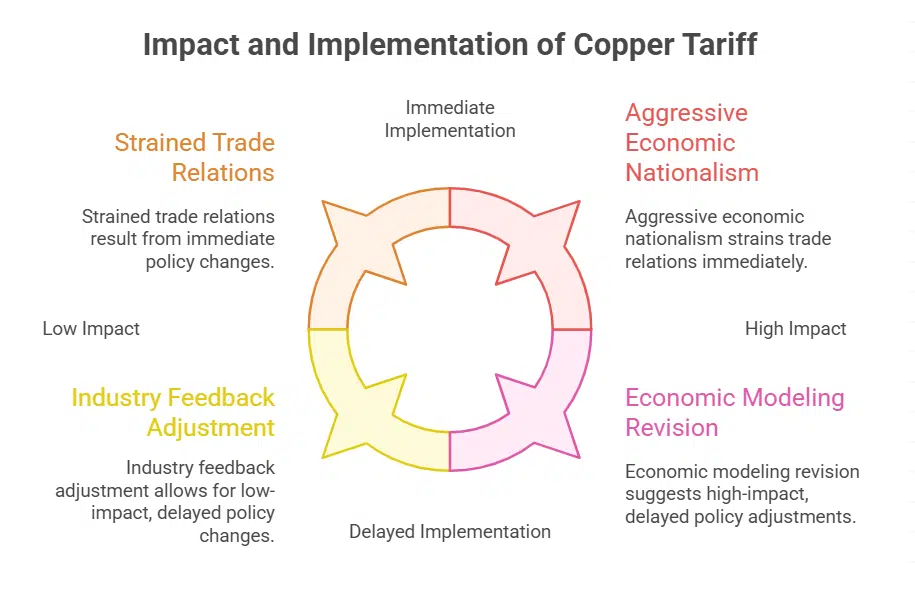

Policy analysts have expressed concern over the scale and timing of the copper tariff. Some experts view the measure as an aggressive form of economic nationalism, potentially straining trade relations with key allies and partners.

There is also speculation that the administration might stagger the implementation of the tariff or adjust it based on industry feedback and economic modeling. Analysts have urged businesses to closely monitor upcoming announcements from the Department of Commerce and the Office of the U.S. Trade Representative.

Pharmaceutical Tariffs Also on the Horizon

During the same Cabinet meeting, President Trump signaled that another major tariff round—targeting pharmaceuticals—is coming “very soon.” These new tariffs are expected to be as high as 200%, although a specific timeline has not been announced.

Unlike copper, pharmaceutical imports were exempt from tariffs during Trump’s first term. However, the administration has shifted its focus toward boosting domestic drug manufacturing, especially in light of the COVID-19 pandemic’s impact on global supply chains.

The U.S. government launched an investigation into pharmaceutical imports in mid-April 2025, also under the Section 232 clause. The aim is to determine whether dependency on foreign drug manufacturing poses a risk to national health and security.

Australia Reacts to Pharma Tariff Threat

One of the first international responses came from Australia, whose pharmaceutical industry relies heavily on exports to the U.S. The Australian government has raised concerns and is now urgently seeking more clarity about the tariff proposal. Officials have stated that the country’s pharmaceutical sector could face significant losses if the new tariffs are enforced.

Australia is not alone. Other U.S. allies with strong pharmaceutical export economies—such as Germany, Switzerland, and Ireland—are also expected to push back or seek exemptions.

Trump Extends “Reciprocal Tariff” Pause to August

Adding to the week’s trade developments, the president has extended the pause on “reciprocal” tariffs until August 1, 2025. These tariffs had been temporarily paused in April and were initially scheduled to resume this week. The extended pause buys more time for negotiations and letters have been sent to foreign leaders informing them of potential new tariff rates if agreements are not reached.

These tariffs are part of a broader Trump policy designed to match the trade restrictions of other countries. Under this policy, if a country imposes high tariffs on U.S. goods, the U.S. will reciprocate with equal or higher tariffs on imports from that country.

What This Means for the Global Economy

The combined impact of the copper tariff, proposed pharmaceutical tariffs, and reciprocal measures could significantly reshape global trade dynamics. Economists warn that such actions could lead to:

-

Retaliatory tariffs by affected countries

-

Trade slowdowns in critical sectors

-

Supply chain disruptions

-

Inflationary pressures on U.S. goods

At the same time, the tariffs reflect Trump’s continued focus on “America First” economic policy, which seeks to boost domestic production and reduce reliance on foreign imports. While popular among certain U.S. manufacturing sectors, this approach has also drawn criticism for increasing costs for consumers and creating trade tensions with long-time allies.

President Trump’s decision to impose a 50% tariff on copper imports and his plan for 200% pharmaceutical tariffs represent a significant shift in U.S. trade policy in 2025. While the intended goal is to boost domestic industries and enhance national security, the move could come with unintended consequences for both global suppliers and American consumers.

As of now, businesses across multiple sectors are bracing for impact, awaiting further clarity on the effective dates, enforcement strategies, and possible exemptions. The global markets have already responded with volatility, particularly in commodities, signaling that these tariffs may have far-reaching economic consequences in the months ahead.