If 2024 was the year people braced for “higher for longer,” 2025 was the year money started moving again. The biggest shift was psychological as much as financial. When the cost of money stops rising and starts easing, decisions that were delayed suddenly come back to life. That is why the top financial trends of 2025 felt like multiple waves hitting at once.

Investors took more risk, but they also held more liquidity. Businesses rechecked borrowing and refinancing options. Consumers felt the difference through savings rates, credit terms, and payment speed.

One theme connected everything: speed got rewarded, but mistakes got punished harder. A market that moves quickly is not forgiving. In 2025, trust became an asset class of its own.

The Three Forces That Drove Most Money Decisions

Three forces shaped most of the year’s behavior. If you understand these, you can usually understand why money flowed where it did.

- First, speed mattered more than ever. Capital, payments, and information moved faster, which made timing more important and reduced the margin for sloppy execution.

- Second, trust became expensive. Markets punished unclear disclosures, weak governance, and anything that looked like it could blow up later. That showed up in everything from private credit to tokenization to consumer lending.

- Third, rules tightened while innovation accelerated. This sounds contradictory, but it is the real pattern of modern finance. Technology kept moving, but regulation increasingly decided who could scale safely.

These forces also explain why 2025 did not reward everyone equally. Systems beat vibes. Discipline beats hype.

Top Financial Trends of 2025: What Actually Ruled the Year

Here is the big picture in one place. This is not a list of everything that happened. It is a list of what consistently shaped decisions across markets and households.

| Trend | What People Saw in 2025 | What It Meant in Practice |

| Rate cuts returned | Easing signals spread | Refinancing and risk appetite grew |

| Cash stayed powerful | High yield with liquidity | Waiting became a rational strategy |

| AI stayed dominant | Tech narratives persisted | Proof of earnings mattered more |

| Gold surged | Hedging went mainstream | Uncertainty pricing stayed elevated |

| Private credit expanded | More non-bank lending | Underwriting quality became central |

| Tokenization matured | More “plumbing” talk | Efficiency became the true pitch |

| Stablecoins got serious | Compliance drove growth | Rules shaped who could scale |

| Crypto stayed volatile | Big swings and scrutiny | Governance mattered more than hype |

| Payments sped up | Instant transfers spread | The fraud arms race intensified |

| Consumer credit stayed hot | Yield hunting continued | Delinquencies became the risk line |

Now let’s break down the 10 trends that most defined the year.

The Top 10 Top Financial Trends That Dominated 2025

Here are the most followed financial trends of 2025:

1) Rate Cuts Returned, and the Cost of Money Repriced

When the direction of rates changes, the entire system reprices. Borrowers look at refinancing again. Risk assets get a tailwind because future cash flows look more valuable when discount rates fall. Even cautious investors start thinking about what they were missing during the tight-money years.

The important nuance is that easing does not remove risk. It simply changes where risk sits. If inflation surprises upward, rate cuts pause. If growth disappoints, credit risk rises. That is why 2025 felt like a turning point without feeling stable.

For businesses, this trend was practical. Companies rechecked debt maturity schedules, renegotiated terms, and reconsidered expansions that were not viable under higher rates.

2) Cash Stayed King, and Liquidity Became a Strategy

In a year where cash paid meaningfully, liquidity stopped feeling like laziness. It became an intentional choice. Investors who held cash kept optionality and could move quickly when opportunities appeared.

This also changed how people approached portfolios. Some investors reduced their urgency to buy long-duration bonds or chase risk for yield. They parked money, collected yield, and waited for clearer signals.

The hidden impact was behavioral. When cash yields are attractive, “patience” becomes easier. That can reduce impulsive moves, but it can also delay productive allocation if people become overly comfortable sitting still.

3) AI Stayed the Market Engine, but Proof Replaced Pure Narrative

AI remained one of the strongest magnets for attention and capital. The difference in 2025 was that markets demanded evidence. It was not enough to say “AI.” Companies needed to show demand, pricing power, and sustainable margins.

This trend expanded beyond obvious tech names. It pulled into chips, cloud infrastructure, data centers, networking, and energy. AI became less of a product story and more of an industrial buildout story.

For investors, the key was avoiding theme blindness. When a theme dominates, it tempts people to ignore valuation and concentration. In 2025, the market rewarded execution and punished overpromising.

4) Gold and Metals Rose as Hedging Went Mainstream

Gold’s strength reflected more than one story. Some people used it as a hedge against policy uncertainty. Some treated it as protection against currency stress. Others simply treated it as a portfolio diversifier when confidence felt fragile.

The bigger shift was cultural. Metals moved from “niche hedge” into “mainstream risk management.” That matters because mainstream adoption changes persistence. When more people view an asset as insurance, demand becomes less dependent on a single narrative.

Metals also benefited from simplicity. In a world filled with complex products, gold is easy to understand. That makes it attractive when people want protection without complexity.

5) Private Credit Expanded, and the Underwriting Question Got Louder

Private credit kept expanding into spaces banks avoided or priced too conservatively. This growth gave businesses more funding options. It also shifted power toward non-bank lenders who can write flexible deals.

But expansion brings a core risk: underwriting discipline. When money floods into a category, standards can slip. The danger is not that private credit exists. The danger is that people chase yield without understanding what sits underneath it.

In 2025, more attention went to transparency, covenants, and what happens under stress. Investors and borrowers both had to ask harder questions about terms, recovery processes, and concentration.

6) Tokenization Matured Into an Infrastructure Conversation

Tokenization started sounding less like crypto marketing and more like back-office modernization. The mature pitch is not “the future of everything.” It is “reduce settlement friction, improve tracking, and enable more efficient movement of assets.”

This is why institutions started discussing tokenization more seriously. Efficiency scales. Cost reduction scales. Better settlement mechanics scale.

Still, the hard questions remain. Who controls the rails? How do custody and enforceability work? What happens when systems disagree? The winners here will not be those who tokenize the most things. They will be those who make the system reliable.

7) Stablecoins Became a Regulated Financial Product

Stablecoins moved closer to mainstream finance because regulation and compliance became central. In 2025, the conversation shifted toward reserves, disclosures, governance, and operational controls.

This trend matters because it changes the competitive landscape. Compliance is expensive. That favors better-capitalized issuers and pushes the market toward consolidation among players who can meet standards.

For everyday users, the meaning is straightforward. Stablecoins became less like a hack and more like a financial product. That brings more legitimacy, but also more rules and less tolerance for sloppy operations.

8) Crypto Stayed Mainstream, With Volatility and Legal Risk Built In

Crypto did not become calm in 2025. It became more institutionally present while staying volatile. That combination created a different kind of maturity. It forced participants to treat governance, custody, and compliance as part of the product.

The practical lesson is position sizing and risk framing. If you cannot survive a large drawdown emotionally and financially, the position is too big. If you cannot explain the legal and operational risk, you do not understand the asset.

Crypto’s “mainstream” status does not remove uncertainty. It increases the number of stakeholders who care about rules, lawsuits, and market integrity.

9) Faster Payments Grew, and Fraud Became a Real-Time Problem

Payments continued to move toward instant and interoperable rails. For consumers and businesses, this looked like convenience. Transfers felt immediate. Settlement felt smoother. Financial workflows became more automated.

But speed changes the risk surface. Fraud also becomes real-time. Scammers do not need days to exploit weak verification. They need minutes.

This is why trust and identity became strategic. Better verification, monitoring, and dispute handling became core infrastructure, not optional add-ons. In 2025, speed without safeguards became an obvious liability.

10) Consumer Credit Became a Yield Target, Including BNPL and Portfolios

Consumer credit remained a place where yield looked attractive. Capital flowed into credit cards, installment products, and structured consumer portfolios. This can expand access and keep credit markets functioning.

The risk is that consumer credit is cyclical. Losses often appear late, after aggressive growth and optimistic assumptions. When delinquency trends shift, the pricing can change quickly.

In 2025, the smart lens was credit quality and survivability. Who can handle a slow month? Who can handle a rise in charge-offs? Who is relying on perfect repayment behavior?

How to Use Top Financial Trends 2025 Without Getting Played

Trends are useful when you treat them like signals, not guarantees. A trend tells you where money flowed and why. It does not promise the same outcome next year.

Follow the mechanism, not the headline. Ask what changed in incentives, costs, or infrastructure. If you can’t explain the mechanism in plain language, you probably don’t understand the risk.

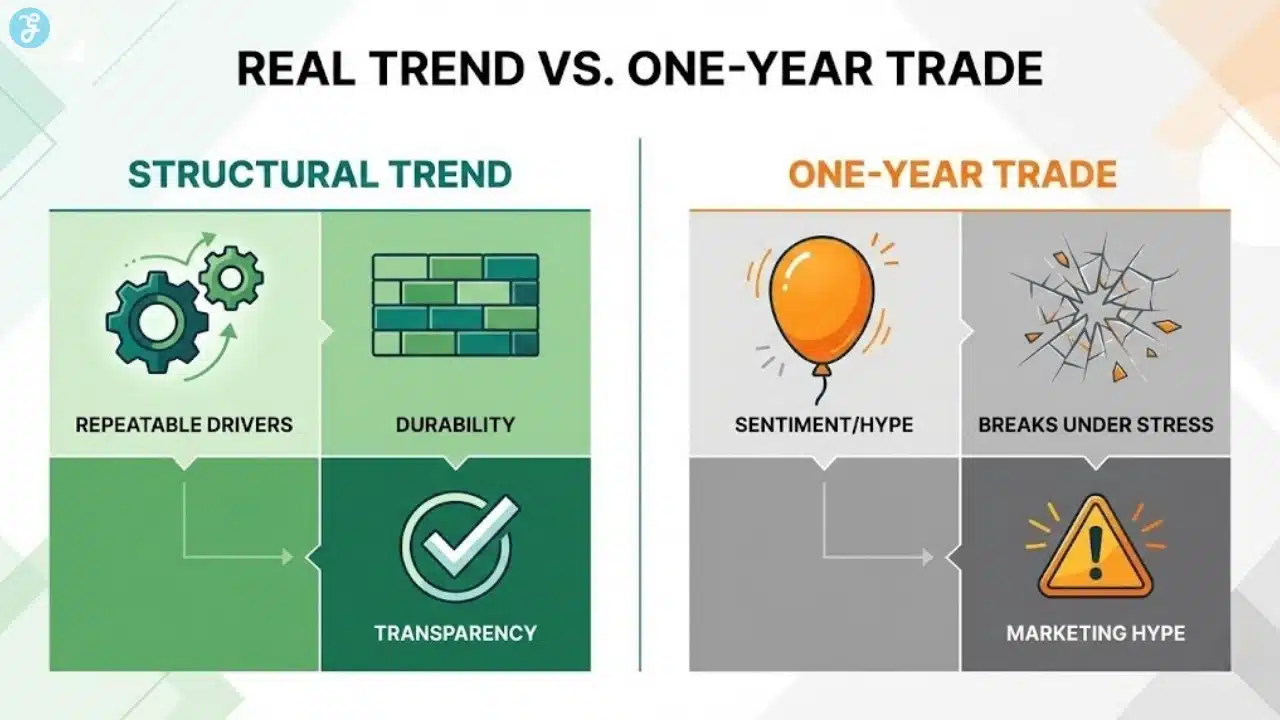

Separate structural shifts from one-year trades. Structural shifts tend to survive a bad quarter. One-year trades often depend on sentiment and liquidity staying perfect.

Finally, ask what breaks first. Every trend has a failure mode. If the trend collapses when one assumption changes, it is not a plan. It is a bet.

How These Trends Changed Everyday Money

A lot of people think “financial trends” only matter to traders. In 2025, the trends spilled into everyday choices.

Cash started competing with Risk again. When savings yields are attractive, people hold liquidity longer and delay decisions like buying riskier assets or locking into long-term commitments.

Payments got faster, which made money feel more immediate. That improved convenience, but it also increased fraud pressure because scammers love speed.

Credit got more complex. Consumer lending products kept expanding, and more capital chased yield in consumer portfolios. That can help access, but it can also turn households into a trade.

Even the AI wave showed up in daily life. Customer service, underwriting, marketing, and portfolio tools are increasingly using automation. That created new productivity but also new error patterns, especially when systems were overly confident.

The practical lesson is simple: trends shape the environment you live in, even if you never “invest” in them.

How to Tell If a Trend Is Real or Just a One-Year Trade

Not every trend deserves a permanent seat at the table. Some trends are structural shifts with durable drivers. Others are temporary trades fueled by liquidity and narrative.

Look for the engine. Structural trends usually have repeatable drivers such as regulation changing incentives, technology lowering costs, or infrastructure that keeps getting used. One-year trades often rely on sentiment and timing.

Use this test:

| Test | Structural Trend Signal | One-Year Trade Signal |

| Driver | Repeatable incentive change | Mostly sentiment-driven |

| Durability | Survives bad quarters | Breaks quickly under stress |

| Infrastructure | Builds rails and standards | Mostly marketing and positioning |

| Transparency | Clear trade-offs discussed | Certainty and urgency sold |

A simple rule helps: if a trend is sold as inevitable, be skeptical. Real trends are messy and full of trade-offs. Hype hates trade-offs.

What Made 2025 Feel Like a Turning Point?

The year shifted incentives across the system. Easing cycles change how portfolios are built, how debt is priced, and how much risk people feel comfortable taking. Even if you never buy a stock, you can still feel the ripple through loans, mortgages, hiring plans, and consumer confidence.

But 2025 also showed that easing does not mean “easy.” Some assets are priced in perfect outcomes. Others stayed nervous about inflation surprises, geopolitical shocks, and the risk that growth could slow faster than expected. The result was a market that could feel bullish and fragile at the same time.

This is where many people got confused. They expected one clean narrative. Instead, 2025 delivered a world where capital moved faster, but certainty did not increase.

Common Mistakes People Made in 2025

The biggest mistake was confusing speed with safety. When markets move quickly, people assume momentum equals certainty. In reality, speed increases fragility because reversals happen fast.

Another mistake was concentration without awareness. Many people built portfolios that were accidentally dominated by one theme. Even if the theme was good, concentration raised the risk of a drawdown that felt “sudden” but was actually predictable.

A third mistake was chasing yield without asking what they were being paid for. Yield is not free. If the yield is higher than expected, risk is usually hiding somewhere, often in credit quality or liquidity constraints.

The fourth mistake was trusting “clean” summaries without checking sources. In a world of automation, false specificity can creep in. A number that looks credible can still be unsupported.

What These Trends Suggest for 2026

If 2025 was the year money started moving again, 2026 will test whether the pace is sustainable. The key question is whether markets can move fast without repeated trust shocks.

A few signposts matter most. Watch rate paths and inflation surprises. Watch concentration risk in AI-linked trades. Watch consumer credit health and delinquency trends. Watch digital-asset regulation and enforcement patterns.

If those hold steady, risk appetite can remain warm. If they break, markets can reprice quickly because capital is more mobile than ever.

A Simple Risk Dashboard You Can Use in 2026

Most people do not need more predictions. They need a consistent way to make decisions when headlines flip weekly. A small personal “risk dashboard” helps you stay steady.

Start with exposure. Know how much of your money depends on one theme, one sector, or one macro outcome. Concentration is not always wrong, but it should be intentional.

Then track stress points. Savers worry about inflation. Investors worry about drawdowns. Business owners worry about cash flow gaps. Each group has a different “break point,” and that break point should guide decisions more than social media narratives.

Use this monthly checklist:

| Area | What to Watch | Why It Matters |

| Rates | Central bank tone and inflation data | Reprices borrowing and valuations |

| Liquidity | Credit spreads and stress signals | Shows fragility early |

| Concentration | Theme exposure in holdings | Prevents one-story blowups |

| Credit health | Delinquencies and consumer strain | Warns of late-cycle risk |

| Trust and fraud | Scam patterns and security events | Speed makes errors expensive |

Finally, set decision rules before you need them. Decide what would trigger rebalancing, de-risking, or locking gains. When you pre-commit, you stop chasing noise.

Smart “Money Moves” by Type of Reader

Different readers should act differently. The same trend can help one person and hurt another.

| If You Are | A Reasonable 2026 Move | What to Avoid |

| A saver | Lock some yield, keep liquidity | Chasing risky yield blindly |

| An investor | Stress-test concentration | Theme-only buying with no fundamentals |

| A small business owner | Re-check financing as rates shift | Over-leveraging off one good quarter |

| A high-income planner | Balance growth, hedges, liquidity | Treating hedges like guaranteed wins |

| A fintech operator | Build compliance and fraud defenses | Growing faster than controls |

Wrap-Up: What Ruled 2025, and What to Remember

The biggest lesson from the top financial trends of 2025 is that finance now runs on speed and trust. Policy moved capital, technology moved it faster, and risk management decided who kept it. When speed rises, small errors become expensive, so process matters more than ever.

If you track mechanisms instead of hype, you make better decisions. The winners in the next cycle will not only spot what is hot. They will understand what breaks when conditions change and plan for that stress test.

Frequently Asked Questions (FAQs)

Here are the answers to some of the most commonly asked questions among readers about the top financial trends in 2025:

What were the biggest drivers behind the top financial trends of 2025?

Central bank pivots reshaped the cost of money and revived risk appetite. AI investment influenced expectations across equities and infrastructure. Regulation and fraud pressures also grew, especially in payments and digital assets.

Did lower rates automatically make markets safer in 2025?

No. Easing improved sentiment but also encouraged risk-taking in pockets like credit and high-valuation themes. Markets stayed sensitive to inflation surprises and geopolitical stress.

Why did cash remain so popular in 2025?

Cash offered yield and flexibility at the same time. Many people preferred paid liquidity instead of locking into longer-term bets, especially while narratives shifted quickly.

Are stablecoins becoming safer for mainstream users?

Rules and compliance expectations increased, which can improve transparency. Safety still depends on issuer quality, reserve practices, and operational controls.

What should beginners do if financial trends feel overwhelming?

Start with fundamentals: emergency cash, manageable debt, and diversified exposure aligned to clear goals. Use trends as context, not commands, and avoid big moves driven by headlines.