Credit insurance plays a crucial role in securing businesses from the risk of non-payment by clients and customers.

Whether you are a small enterprise or a large corporation, having a reliable credit insurance policy can protect your cash flow and ensure financial stability.

India’s credit insurance sector has seen significant growth in recent years, with several providers offering tailored solutions to meet the needs of businesses across industries.

This article will explore the top credit insurance providers in India, their features, benefits, and how to choose the best one for your business.

What is Credit Insurance and Why Does It Matter?

Credit insurance is a type of business insurance that protects companies from the risk of non-payment of invoices by customers.

It ensures that businesses receive compensation in case of a default, insolvency, or protracted payment delay.

Key Benefits of Credit Insurance

- Protection Against Bad Debts: Shields businesses from financial losses due to unpaid invoices.

- Improved Cash Flow: Ensures steady revenue even if customers default on payments.

- Stronger Business Growth: Encourages companies to take on new clients with reduced risk.

- Enhanced Creditworthiness: Improves borrowing capacity by reducing financial risks.

- Better Risk Management: Helps businesses assess client reliability before extending credit.

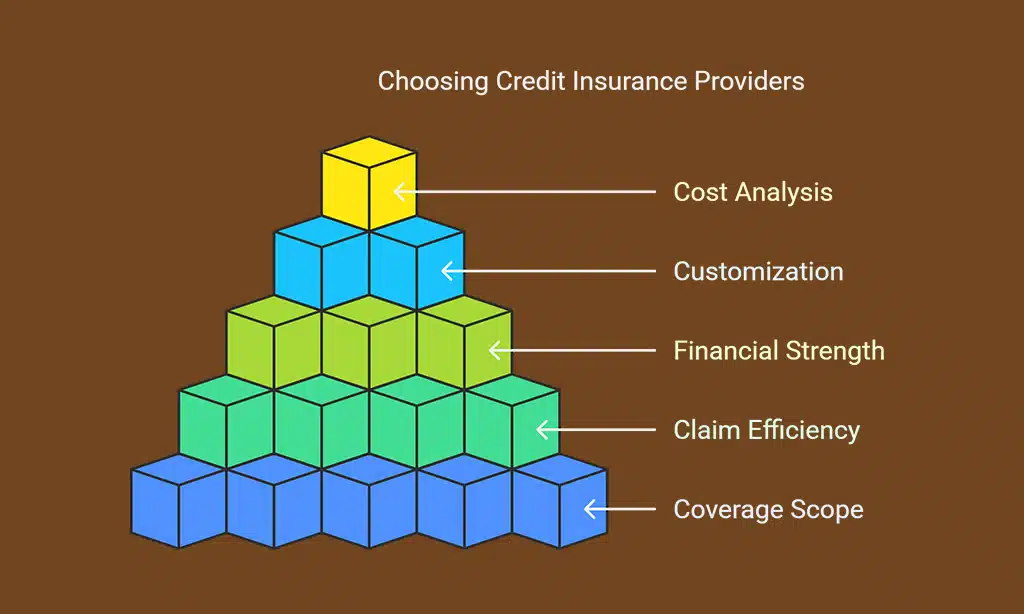

Factors to Consider When Choosing a Credit Insurance Provider

Choosing the right top credit insurance providers in India depends on several factors. Here are the key aspects to evaluate:

Coverage Scope and Policy Terms

- Does the policy cover both domestic and international clients?

- Are specific industries excluded?

- What percentage of the invoice amount is covered?

Claim Process and Settlement Efficiency

- How easy is the claims process?

- What is the provider’s claim settlement ratio?

- Are there any hidden conditions?

Financial Strength and Reputation

- How long has the provider been in the industry?

- Does the provider have strong financial backing?

- What do customer reviews and testimonials say?

Customization and Flexibility

- Are policies adaptable to different business needs?

- Can businesses opt for tailored coverage options?

Cost vs. Benefits Analysis

- What are the premium rates?

- Do the benefits justify the costs?

Customer Support and Digital Services

- Does the provider offer 24/7 customer service?

- Are digital services like mobile apps or online claim submissions available?

Top 7 Credit Insurance Providers in India (2025 Edition)

Here is a detailed overview of the top credit insurance providers in India, highlighting their features and benefits.

1. ICICI Lombard Credit Insurance

ICICI Lombard is one of the leading providers of credit insurance in India, offering comprehensive coverage and a wide range of policy options. It is particularly beneficial for businesses engaged in international trade, ensuring protection against financial risks from unpaid invoices.

- Key Features: Comprehensive coverage, flexible premium options, tailored policies for large enterprises.

- Best For: Large businesses and exporters.

- Claim Process: Quick online claim filing and efficient settlement.

- Customer Rating: ⭐⭐⭐⭐☆ (4.5/5)

| Feature | Details |

| Coverage Type | Domestic & International |

| Claim Settlement Time | 15-30 Days |

| Industry Focus | Exporters, Large Enterprises |

2. SBI General Credit Insurance

SBI General Insurance offers cost-effective credit insurance solutions tailored for small and medium enterprises (SMEs). With its extensive network and trusted brand name, SBI General ensures seamless claim settlements and customer support.

- Key Features: Affordable premium rates, SME-friendly policies, risk assessment support.

- Best For: Small and medium enterprises (SMEs).

- Claim Process: Seamless claim processing with dedicated customer support.

- Customer Rating: ⭐⭐⭐⭐☆ (4.3/5)

| Feature | Details |

| Coverage Type | Domestic |

| Claim Settlement Time | 20-35 Days |

| Industry Focus | SMEs, MSMEs |

3. HDFC ERGO Credit Insurance

HDFC ERGO specializes in digital-first credit insurance solutions, making it easy for businesses to manage policies online. It offers flexible policy terms and quick claim approvals to ensure financial security.

- Key Features: Customizable coverage, digital-first services, fraud protection.

- Best For: Startups and growing enterprises.

- Claim Process: Fast-track claim approvals.

- Customer Rating: ⭐⭐⭐⭐☆ (4.4/5)

| Feature | Details |

| Coverage Type | Domestic & International |

| Claim Settlement Time | 15-25 Days |

| Industry Focus | Startups, SMEs |

4. Tata AIG Credit Insurance

Tata AIG is known for its industry-specific credit insurance policies that cater to businesses across various sectors. The company has a strong reputation for transparency and customer-centric services.

- Key Features: Industry-specific coverage, transparent claim policies, competitive premiums.

- Best For: All businesses, especially manufacturing and export firms.

- Claim Process: Straightforward and transparent.

- Customer Rating: ⭐⭐⭐⭐⭐ (4.7/5)

| Feature | Details |

| Coverage Type | Domestic & International |

| Claim Settlement Time | 10-20 Days |

| Industry Focus | Manufacturing, Export Firms |

5. Bajaj Allianz Credit Insurance

Bajaj Allianz provides highly competitive credit insurance policies with a strong customer support network. It is an excellent choice for businesses looking for financial protection against delayed payments.

- Key Features: Competitive pricing, robust customer support, flexible policy add-ons.

- Best For: Large corporations and enterprises.

- Claim Process: Simple process with minimal paperwork.

- Customer Rating: ⭐⭐⭐⭐☆ (4.2/5)

| Feature | Details |

| Coverage Type | Domestic & International |

| Claim Settlement Time | 12-22 Days |

| Industry Focus | Large Corporations, Enterprises |

6. Reliance General Credit Insurance

Reliance General focuses on affordability and AI-driven risk assessment tools to provide credit insurance coverage tailored for small businesses and startups.

- Key Features: Cost-effective plans, AI-driven risk assessment, real-time claim tracking.

- Best For: Small businesses and startups.

- Claim Process: AI-enabled claim evaluation for faster processing.

- Customer Rating: ⭐⭐⭐☆ (3.9/5)

| Feature | Details |

| Coverage Type | Domestic |

| Claim Settlement Time | 14-24 Days |

| Industry Focus | Small Businesses, Startups |

7. ECGC (Export Credit Guarantee Corporation of India)

ECGC is a government-backed credit insurance provider that specializes in protecting Indian exporters from payment risks in global trade. It offers structured solutions for businesses involved in international transactions.

- Key Features: Government-backed insurance for exporters, extensive trade coverage.

- Best For: Businesses engaged in international trade.

- Claim Process: Structured, with dedicated export support services.

- Customer Rating: ⭐⭐⭐⭐⭐ (4.8/5)

| Feature | Details |

| Coverage Type | International |

| Claim Settlement Time | 20-30 Days |

| Industry Focus | Export Businesses, International Trade |

Takeaways

Finding the right top credit insurance providers in India is essential for securing your business against bad debts and financial instability.

Whether you run a small business, a large corporation, or an export firm, selecting a provider that offers flexible, cost-effective, and comprehensive coverage is crucial.

Compare the listed providers, assess your business needs, and choose wisely to ensure your financial security in 2025 and beyond.