Buying property in France can be a dream come true for many, whether it’s a charming countryside cottage or a sleek Parisian apartment. However, navigating the French property market for the first time can feel overwhelming, especially if you’re unfamiliar with the process.

This guide provides 10 tips for first-time property buyers in France to help make your journey smoother, from understanding the legal landscape to negotiating the best deal.

Whether you’re seeking a holiday home or planning to relocate, these insights will empower you to make informed decisions.

Why Buy Property in France?

Buying a property in France is not just a financial decision but also a lifestyle upgrade. With its unique blend of history, culture, and stunning landscapes, France continues to attract property buyers from around the globe.

Whether you’re seeking a countryside retreat or an urban dwelling, the French property market offers something for everyone. Understanding the benefits of investing in France is the first step toward making an informed decision.

The Allure of the French Lifestyle

France offers an enviable lifestyle marked by world-class cuisine, rich cultural heritage, and picturesque landscapes. From the sun-drenched beaches of the French Riviera to the rolling vineyards of Bordeaux, there’s something for everyone. For first-time property buyers in France, choosing a location that aligns with your lifestyle goals is key.

Popular regions include:

- Provence for its scenic beauty and mild climate.

- Paris for its cosmopolitan allure.

- Normandy for a tranquil rural setting.

Financial and Investment Opportunities

France’s stable property market makes it an attractive choice for long-term investment. Property values in prime locations have shown consistent growth, and there’s strong demand for rental properties, especially in tourist-heavy areas. For first-time property buyers in France, this could mean potential rental income and a safe investment for the future.

A 2025 survey by BNP Paribas Real Estate highlights that the French property market saw a 3.2% increase in property values year-on-year, particularly in urban and suburban areas.

Preparing for Your Property Purchase

Taking the first steps toward purchasing property in France can be both exciting and daunting. As a first-time buyer, it’s essential to lay the groundwork through careful planning and thorough research. From understanding market trends to setting a realistic budget, preparation is the key to making informed decisions that align with your long-term goals.

Researching the French Property Market

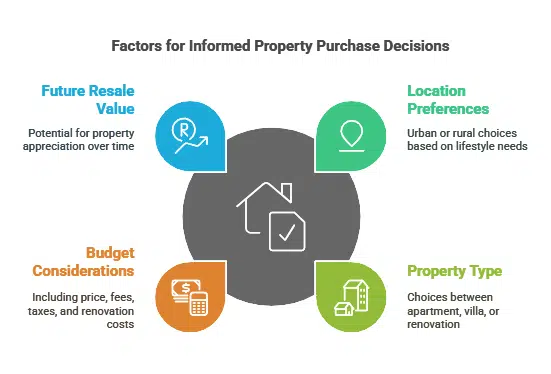

Understanding the local property market is crucial. First-time property buyers in France should consider factors such as location, property type, and budget. Useful tools for research include:

- French property websites like SeLoger and Le Bon Coin.

- Engaging with local real estate agents who have in-depth knowledge of specific areas.

| Factor | Details |

| Location Preferences | Urban areas for convenience or rural regions for tranquility. |

| Property Type | Apartment, villa, farmhouse, or renovation projects. |

| Budget | Include property price, fees, taxes, and renovation costs. |

| Future Resale Value | Research potential for property appreciation over time. |

Setting a Realistic Budget

Apart from the property’s price, there are additional costs to consider. These include notary fees, property taxes, and potential renovation expenses. Below is a table illustrating approximate additional costs:

| Expense | Percentage of Property Price | Details |

| Notary Fees | 7-8% | Includes legal document preparation. |

| Property Taxes | 1-3% | Varies based on location and property value. |

| Agency Fees | 5-6% | Paid if purchasing through an agent. |

| Renovation Costs | Varies | Depends on property condition and scope. |

Setting a realistic budget helps first-time property buyers in France avoid financial surprises and ensures a smooth transaction.

Navigating the French Legal System

Purchasing property in France involves navigating a unique legal landscape that ensures transparency and protection for both buyers and sellers. First-time property buyers in France need to familiarize themselves with the legal steps to avoid any complications.

From understanding property laws to hiring the right professionals, careful attention to legal details can save you time and stress.

Understanding French Property Laws

French property laws can differ significantly from those in other countries. Ownership structures, such as leasehold versus freehold, must be carefully understood. Additionally, buyers should be aware of zoning regulations and property restrictions to avoid legal pitfalls.

| Aspect | Details |

| Ownership Structures | Leasehold (limited duration) vs. Freehold (full ownership). |

| Zoning Regulations | Determine how the land or property can be used. |

| Building Restrictions | Specific rules for renovations or expansions in historic areas. |

Hiring a Notaire

A notaire plays a critical role in the property buying process. They ensure all legal aspects of the transaction are handled properly. First-time property buyers in France should:

- Choose a notaire experienced in property transactions.

- Confirm their impartiality, as they represent both buyer and seller.

- Request a detailed explanation of the acte de vente and other contracts.

10 Essential Tips for First-Time Property Buyers

Buying property for the first time can be an exhilarating yet daunting task, especially in a foreign country like France. With a unique real estate market, complex legal systems, and varying regional factors, it is essential to equip yourself with the right knowledge.

These tips for first-time property buyers in France will guide you through the process, ensuring you make confident, informed decisions every step of the way.

1. Choose the Right Location

Location is paramount. Consider proximity to amenities, transport links, and lifestyle preferences. First-time property buyers in France should visit the area multiple times to gauge its suitability. For instance, properties in Provence offer stunning landscapes but may lack the urban conveniences of Paris.

Location Comparison

| Region | Pros | Cons |

| Paris | Vibrant city life, excellent transport | High property prices, limited space |

| Provence | Scenic beauty, peaceful environment | Limited public transport, seasonal demand |

| Bordeaux | Thriving wine industry, great weather | Increasing competition for properties |

2. Work with a Real Estate Agent

A local real estate agent can simplify the search process. Look for agents who specialize in helping first-time property buyers in France and understand the nuances of the market.

- Agents can help identify properties that match your budget and preferences.

- They provide valuable insights into local market trends and legal requirements.

3. Understand Your Financing Options

Exploring financing options is essential. First-time property buyers in France should consider:

- Mortgages from French banks.

- International lenders with experience in French property transactions.

- Options for low-interest loans offered to EU residents.

Financing Options

| Source | Interest Rate (2025) | Eligibility |

| French Banks | 3-4% | Open to residents and non-residents |

| International Banks | 4-6% | Varies based on country of origin |

| EU Loans | 2-3% | Available to EU citizens and residents |

4. Inspect the Property Carefully

Conducting a thorough inspection is crucial to avoid unexpected repair costs. Include checks for:

- Plumbing and electrical systems.

- Structural integrity.

- Roof and insulation conditions.

- Compliance with local building codes.

Consider hiring a professional property surveyor for detailed assessments.

5. Negotiate Effectively

Negotiation can significantly impact your final cost. First-time property buyers in France should:

- Research comparable properties.

- Offer slightly below the asking price to start negotiations.

- Use a local agent’s expertise to understand fair market value.

6. Learn About Tax Implications

Understanding the tax system in France is crucial for managing long-term costs. Property owners must account for taxes like the taxe foncière (land tax) and the taxe d’habitation (residence tax). For first-time property buyers in France, these taxes can vary significantly by location and property type.

Common Property Taxes in France

| Tax | Who Pays | Details |

| Taxe Foncière | Paid by property owner | Based on property value and location. |

| Taxe d’Habitation | Paid by occupant | May not apply for vacant or second homes. |

| Capital Gains Tax | Paid on sale of property | Exemptions available for primary residences. |

7. Prepare for Renovation Costs

If the property requires renovations, ensure these costs are factored into your budget. Renovation expenses can range from minor cosmetic changes to significant structural repairs. First-time property buyers in France should prioritize hiring local contractors familiar with French building codes.

Common Renovation Costs

| Renovation Type | Estimated Cost (EUR) | Details |

| Kitchen Remodel | 8,000 – 15,000 | Includes cabinets, appliances, and fixtures. |

| Bathroom Upgrade | 5,000 – 10,000 | Plumbing, tiling, and fixtures. |

| Roof Repairs | 7,000 – 20,000 | Depends on size and materials used. |

8. Check for Hidden Costs

Hidden costs can add up quickly, especially for first-time property buyers in France. Examples include utility connection fees, local service charges, and ongoing maintenance expenses. Being proactive about these costs helps avoid surprises later.

Examples of Hidden Costs

| Cost Type | Estimated Expense (EUR) | Details |

| Utility Connections | 500 – 1,500 | Gas, electricity, and water setup fees. |

| Service Charges | 1,000 – 3,000 annually | Maintenance fees for shared facilities. |

| Local Taxes | Varies | May include garbage collection or road taxes. |

9. Be Aware of the Buying Process Timeline

The process of buying property in France typically takes 3-6 months from start to finish. Key stages include signing the compromis de vente (initial agreement) and the acte de vente (final deed). First-time property buyers in France should plan for potential delays due to legal checks or financing approvals.

Typical Buying Timeline

| Stage | Duration | Details |

| Property Search | 1-3 months | Time varies depending on buyer’s criteria. |

| Compromis de Vente | 1-2 months | Includes cooling-off period for buyers. |

| Acte de Vente | 1 month | Finalizes the sale and transfers ownership. |

10. Don’t Rush the Process

Buying property is a significant investment. First-time property buyers in France should take their time evaluating all aspects of the purchase, from location and financing to legal considerations. Case studies highlight that rushed purchases often lead to unexpected challenges, such as overlooked structural issues or unanticipated costs.

By following these expanded tips and utilizing the detailed tables provided, first-time property buyers in France can navigate the process more confidently and make informed decisions.

Takaways

Purchasing your first property in France can be an exciting and fulfilling journey. With careful planning, thorough research, and the right professional guidance, you can turn your dream of owning a home in this beautiful country into reality.

Remember, each step—from selecting the perfect location to understanding legal nuances—is a building block toward a successful investment. By implementing these tips for first-time property buyers in France, you’ll be well-prepared to make informed decisions and enjoy the rewards of property ownership for years to come.