Picking the right car insurance feels like a maze. You see terms like “third-party insurance”, “zero depreciation cover”, and “comprehensive insurance”, and you freeze.

It can waste your time and cash.

Under the Motor Vehicles Act, every car needs third-party insurance in India. That plan covers only damage you cause to others. This guide will show you the gaps, the perks, and the costs of third-party liability and comprehensive insurance.

You will also learn how to boost your no claim bonus. Read on.

Key Takeaways

- Every car in India needs third-party insurance under the Motor Vehicles Act, 1988. It costs as little as ₹2,094 per year for private cars up to 1000 cc and covers only damage you cause to others, not your own vehicle.

- Comprehensive insurance covers both third-party liability and your own damage from collisions, fire, theft, floods, and more. Its online premium for a sedan runs about ₹8,000–₹12,000 yearly and you can add zero depreciation, personal accident, engine protection, and roadside assistance.

- Third-party plans cost less than half of comprehensive cover and suit older or low-use cars. A sedan’s third-party rate is around ₹5,000 annually, making it ideal for drivers on a tight budget who need just the legal minimum.

- Only comprehensive policies qualify for a No Claim Bonus of up to 50% on renewal. You can switch from third-party to comprehensive at renewal and, with many insurers like Tata AIG, retain your bonus and continue cashless claims at network garages.

What is Third-Party Insurance?

Third-party insurance pays for liability when you damage another car or hurt someone. The IRDAI makes this cover mandatory and your insurance company uses a premium calculator in its mobile app to set your rate.

Features of Third-Party Insurance

Liability cover meets India’s road rules. It saves you from large third-party payouts.

- Covers liabilities for others under third party insurance for bodily injury or property damage.

- Meets IRDAI’s compulsory motor insurance rule for all vehicles in India.

- Starts at Rs. 2,094 yearly for non-commercial private cars up to 1000cc.

- Provides no protection for own damage or loss to your vehicle or personal items.

- Blocks claims if you drive without a valid driver’s license or under the influence of alcohol.

- Omits cover for losses from natural calamities, war, mutiny or nuclear attack.

- Does not carry zero depreciation cover, personal accident cover or roadside assistance.

- Disallows no claim bonus (NCB) on third-party liabilities due to no own damage cover.

- Appeals to budget drivers who need basic legal and financial protection.

- Insurers such as Tata AIG and reliancegeneral.co.in sell these policies online or via agents.

Benefits of Third-Party Insurance

Third-party car insurance saves cash on older, low-use vehicles. It meets IRDAI and Motor Vehicles Act rules.

- Cuts insurance premiums to less than half the cost of comprehensive coverage.

- Meets IRDAI legal requirements and keeps you on the right side of the law.

- Covers bodily harm and property damage for third parties with basic liability cover.

- Simplifies policy terms by skipping no claim bonus tracking for faster renewals.

- Allows quick online policy renewal through insurance companies like Tata AIG.

- Suits cars that you plan to sell soon or drive only now and then.

- Offers optional personal accident cover as a low-cost add-on for driver safety.

What is Comprehensive Insurance?

Comprehensive insurance gives your car a blanket of protection by covering collisions, theft, fire, and natural disasters under IRDAI rules. You can add zero depreciation, personal accident, engine shield or tyre guard riders, and pick from a chain of approved workshops, all with a set insured declared value.

Features of Comprehensive Insurance

Comprehensive car insurance gives you broad coverage for your ride. It covers your vehicle damage and third-party liability.

- Own damage cover pays for crash, fire, theft, flood repair.

- Third-party liability covers injury and property damage to others.

- Zero Depreciation Cover excludes wear deduction, so you claim full part cost.

- Roadside Assistance Cover adds towing, fuel refill, battery jumpstart help.

- Engine Protection Cover guards against oil leaks, water damage, mechanical failures.

- Consumables Cover funds nuts, bolts, brake pads, windshield washer fluid.

- No Claim Bonus Protection preserves your NCB even after one claim.

- IDV (Insured Declared Value) sets your max claim amount at policy start.

- IRDAI-approved insurers like Tata AIG offer up to 80% renewal discount.

- Network Garages enable cashless repairs at partner workshops.

Benefits of Comprehensive Insurance

This comprehensive car insurance shields your vehicle from more than just third-party liabilities. It saves you from surprise repair bills.

- It pays for repairs after road accidents, fire, flood, hail and theft under comprehensive coverage.

- New or high-value cars benefit from zero depreciation cover for full part value.

- You can add engine protection, consumables cover and roadside assistance cover.

- IRDAI-compliant IDV stays fixed on renewal to secure fair claim payouts.

- No Claim Bonus grows each claim-free year to cut down car insurance premiums.

- Personal accident cover protects you and passengers against injuries or death.

- You get access to network garages, with cashless claims via Tata AIG and other insurers.

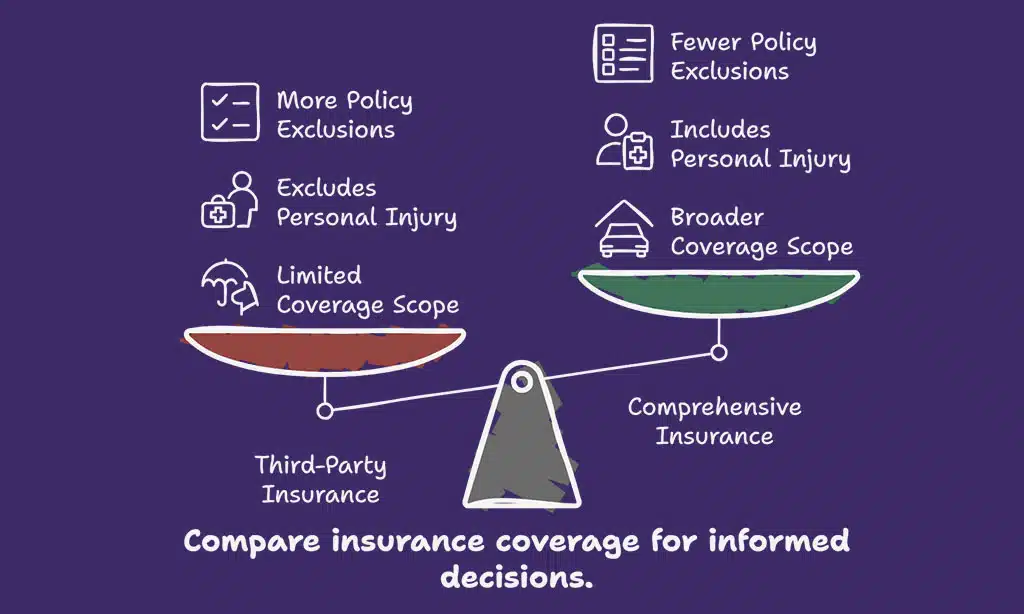

Key Differences Between Third-Party and Comprehensive Insurance

A budget rider takes a plan with third-party liability, while a safety seeker grabs full car cover with own damage and personal accident benefits.

Weigh coverage limits, add-on options and no claim bonus perks, then call an agent or use a regulator app to seal the best deal.

Coverage

Third-party car insurance pays for harm you cause to another vehicle or person. It covers legal fees and medical bills under third-party liability. It does not cover your own damage.

Comprehensive car insurance covers both third-party liability and your vehicle’s own damage. Comprehensive cover shields your car from fire, theft, natural calamities, and man-made calamities.

This plan lets you add zero depreciation cover, personal accident cover, roadside assistance cover, consumables cover, and engine protection cover. Insurers use the IDV to set your payout limit.

IRDAI rules let you file claims through network garages. No claim bonus applies to both plan types.

Cost

Comprehensive car insurance carries a steep premium since it covers vehicle damage, third-party liability, personal accident cover, zero depreciation cover and add-on covers. A sedan might cost ₹8,000 to ₹12,000 a year in online car insurance, thanks to higher IDV and network garages access.

IRDAI rules push up rates, but you get wider protection and a no claim bonus boost after crash-free years.

Some drivers choose third-party car insurance for its low cost and legal compliance. A similar sedan costs about ₹5,000 annually for third-party liability insurance under IRDAI guidelines.

You can add roadside assistance cover or consumables cover if you need extra aid on the road.

Add-ons Available

A comprehensive plan lets drivers add layers of protection. They can choose a zero depreciation cover to block parts depreciation, a personal accident cover for medical costs, or a roadside assistance cover for 24×7 towing.

Consumers can add a return to invoice cover to match the car’s IDV after total loss. They can also opt for an engine protection cover, a consumables cover for oils and filters, or theft protection.

Third-party car insurance has no customization. IRDAI sets the rules for these add-on covers.

Legal Requirements

Indian law demands third-party car insurance. This cover acts as compulsory insurance under law. The Motor Vehicles Act, 1988 sets this rule. The IRDAI oversees legal compliance in vehicle insurance.

Third-party liability cover must match Section 145. It covers harm to people or property. You need it to register the car. You also need it at every policy renewal. You avoid fines and penalty points.

Comprehensive car insurance stays optional. It blends third-party liability with own damage coverage. You can choose add-on covers, such as zero depreciation and personal accident plans.

Also pick engine protection, return to invoice and roadside assistance cover. The sum insured (IDV) limits own damage payout. You pay higher premiums, but gain financial protection for theft, natural calamities and accidents.

Many buyers pick this plan for peace of mind.

Exclusions in Both Insurance Types

Both plans bar claims for wear‐and‐tear, engine failure, driving under the influence, and unapproved mods—eager to see which IDV caps and IRDAI limits bite? Read on!

Exclusions in Third-Party Insurance

Third-party plans do not cover car damage. They only pay for the other party’s loss.

- Own vehicle repair costs remain your responsibility under third-party car insurance. You must pay for dents, scratches or total loss.

- Injuries to you or your passengers sit outside policy exclusions. No personal accident cover means you pay hospital bills.

- Claims filed after policy renewal date get rejected under IRDAI rules. An expired policy voids cover and wipes your no claim bonus.

- Driving without a valid licence voids third-party liabilities. You face fines and lose financial protection.

- Operating under the influence of alcohol also bars payouts. The insurer rejects these claims as per policy exclusions.

- Damage caused during war, mutiny or nuclear attack remains excluded. You cover any fallout on your own.

Exclusions in Comprehensive Insurance

Comprehensive car insurance seems solid. It still leaves out wear and tear, mechanical breakdowns, and damages from policy expiration.

- Wear and tear on parts sits outside policy exclusions, leaving repair bills to the owner.

- Mechanical or electrical breakdown falls outside coverage, tire or tube damage tops at 50% replacement cost, and you need engine protection cover to add this benefit.

- Damage during policy lapse voids any claim under IRDAI rules and you can lose your no claim bonus at renewal.

- Traffic violations and drunk driving void coverage for all liabilities, including third-party liability, under legal compliance rules.

- Depreciation on replaced parts cuts your payout unless you opt for zero depreciation cover.

- Consumables like brake pads and engine oil stay outside own damage coverage, but you can add consumables cover for these items.

- Consequential damages from a crash, such as bent frames, do not get covered under comprehensive car insurance.

- Loss from natural calamities, like floods and cyclones, and man-made calamities, like riots, sit outside base cover without an add-on.

- Return to invoice cover fills the gap when insurers pay only up to the insured declared value (IDV) at claim.

- Driver injury and death need a personal accident cover, as base comprehensive insurance excludes these costs.

- Towing fees and on-road help needs roadside assistance cover since comprehensive insurance does not include this service.

Factors to Consider When Choosing Between Third-Party and Comprehensive Insurance

Balance your budget, IDV, NCB, add-on covers like engine protection or roadside assistance, IRDAI guidelines, and mobile app tools to pick the right plan, then read on to learn more.

Age and Value of the Car

Cars lose value fast. The insured declared value (IDV) ticks down by 15% each year after the first two years. A five-year-old sedan might drop to INR 2 lakh. Owners of older rides or those eyeing a quick sale often pick third-party insurance.

It costs less, covers third-party liability, and fits legal compliance. You can add personal accident cover or roadside assistance cover, but this policy skips own damage coverage.

A new hatchback holds about 80% of its showroom price in the first year. That high IDV pushes premiums on third-party plans skyward. Comprehensive car insurance suits here with zero depreciation cover, theft protection, and cover for natural calamities.

IRDAI sets your IDV at renewal, so you get fair value on policy renewal. Plus, you bag a no claim bonus up to 50% if you drive safe.

Driving Habits and Usage

Drivers who use cars now and then can save money. They may pick third-party car insurance. It covers third-party liabilities and meets IRDAI rules. Policies cost less, and owners stay legal.

Many skip roadside assistance cover and zero depreciation cover.

People who drive daily need more cover. Comprehensive insurance meets demand for own damage coverage and high IDV. Personal accident cover and roadside assistance cover boost peace of mind.

Zero depreciation cover cuts repair bills. Drivers can build no claim bonus with safe miles.

Budget and Affordability

Most buyers opt for third-party car insurance to keep costs low. They pay lower premiums and meet IRDAI rules. This policy covers only third-party liabilities. It excludes own damage and add-on covers like zero depreciation cover or consumables cover.

Comprehensive insurance raises the premium tag. It uses your car’s IDV and add-ons to set rates. It offers up to 80% discount on a no claim bonus. It lets you grab personal accident cover, roadside assistance cover, and engine protection cover.

Risk Tolerance

Risk tolerance reflects a driver’s comfort with potential costs. A low threshold pushes you to choose broad cover, also called comprehensive car insurance. That plan pays for theft and natural calamities, and you get personal accident cover too.

It costs more premium. A high threshold might guide you to pick liability cover, also called third-party car insurance. That plan gives basic protection under IRDAI rules.

You can use a digital insurer site to view idv (insured declared value) and no claim bonus (ncb) details. You check claims steps online to see repair options at network garages. This tool helps you compare policy premiums.

It lets you match your spending limit with cover choice.

Takeaways

Picking the right policy can save you big time. Third-party car insurance suits tight budgets, it meets IRDAI rules, and it covers liability. Full-cover policies add own damage cover and personal accident protection.

You can add zero depreciation waiver, motor safeguard, or roadside assistance. Think about the car’s age, your miles and your claims history. A clear record wins a larger no claim bonus and cuts the premium.

The right choice brings peace of mind on Indian roads.

FAQs on Third-Party vs Comprehensive Insurance

1. What is the main difference between third-party car insurance and comprehensive car insurance?

Third-party car insurance covers damage you cause to others. It meets IRDAI rules, and it is cheap. Comprehensive car insurance covers third-party liabilities and your own damage. It costs more, but it shields you from dents, theft and natural calamities, like an umbrella in a storm.

2. What add-on covers can I get with comprehensive coverage?

You check your IDV (insured declared value) before you buy. It sets your payout cap. You can choose zero depreciation cover, it stops value dip on old parts. You can add personal accident cover, it pays for injuries after a crash. Roadside assistance cover saves you when your car breaks down, even in a remote patch. You also get consumables cover, engine protection cover, return to invoice cover, theft protection. These are add-on covers that plug your cover gaps.

3. Can I save on car insurance premiums with a no claim bonus?

Yes, a no claim bonus (NCB) cuts your car insurance premiums after a year without a claim. At policy renewal, IRDAI rules let you apply your NCB. You can transfer your NCB when you sell your car or change policies. It feels like a reward for safe driving.

4. How do policy exclusions affect my cover?

Policy exclusions list what is not covered, like mechanical breakdown, wear and tear, consequential damages. They also bar claims for driving under the influence of alcohol or driving without a license. Natural calamities or man-made calamities may need a special cover. Always read the fine print before you sign.

5. Do I need third-party insurance for legal compliance?

IRDAI makes third-party insurance mandatory in India, it gives basic financial protection for third-party liabilities. You cannot drive without it, or you risk penalties. If you drive drunk or without a driving license, your claim is void. This cover is the bare minimum.

6. How do I file an insurance claim and find network garages?

You can file an online car insurance claim using your insurer’s app. Check your policy to spot network garages near you. If you add roadside assistance cover, they tow your car for free. A cashless repair at a network garage can save you time and cash.