The financial sector is no longer just “digitizing”—it is becoming autonomous. For years, we spoke about the potential of AI and blockchain, but Q1 2026 marks the shift from experimental pilots to practical, consumer-facing reality. The era of “Financial Agents” has arrived, and the way money moves is changing faster than regulation can keep up.

This analysis breaks down the 8 most critical Fintech Trends of Q1 2026, covering everything from the rise of biometric payments to the explosion of “Low-Fi” authenticity in banking apps. Whether you are an investor, a founder, or just a user trying to keep up, these are the shifts defining the market right now.

The 8 Fintech Trends to Watch in Q1 2026

Here are 8 fintech trends to keep an eye out for during the first quarter of 2026:

1. Autonomous AI Agents (“Self-Driving Money”)

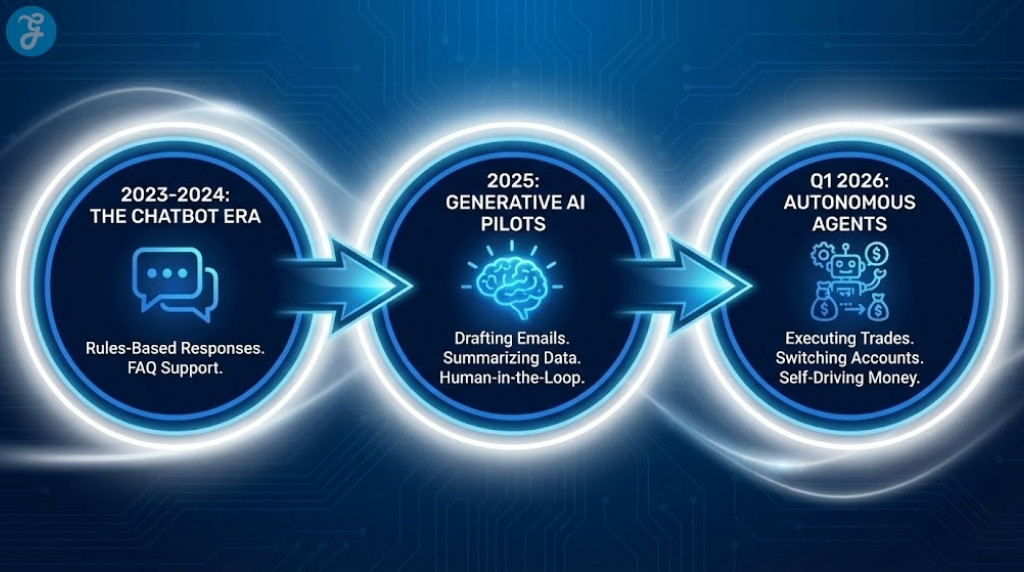

The buzzword of 2025 was “Generative AI,” but the reality of 2026 is “Agentic AI.” We have moved beyond chatbots that simply answer questions. We now have autonomous agents capable of executing complex workflows without human intervention. These agents can monitor interest rates, automatically switch your savings to a higher-yield account, or rebalance your investment portfolio while you sleep.

Best For: Users who want “set it and forget it” financial health.

Pros:

- Eliminates decision fatigue.

- Optimizes returns in real-time.

- Reduces manual admin work.

Cons:

- Requires a high level of trust in the software.

- Privacy concerns regarding data access.

2. RWA Tokenization Goes Mainstream

Real World Assets (RWA) are finally moving on-chain at an institutional scale. In Q1 2026, we are seeing the first major consumer apps offering fractionalized ownership of treasury bonds and real estate via stablecoins. This isn’t just for crypto natives anymore; traditional banks are building “walled garden” blockchains to settle these assets instantly, bypassing the 3-day wait times of legacy systems.

Best For: Retail investors seeking institutional-grade assets.

Pros:

- Drastically improved liquidity for illiquid assets.

- 24/7 trading capability.

- Lower minimum investment thresholds.

Cons:

- The regulatory landscape is still fragmented.

- Smart contract risk remains a factor.

3. Biometric Payment Standardization

The physical wallet is disappearing. Major retailers and transit systems are rolling out “Pay by Palm” and advanced facial recognition terminals. Unlike previous iterations, the Q1 2026 standard focuses on privacy-preserving local authentication, meaning your biometric data stays on your device or an encrypted token, rather than a central database.

Best For: High-volume retail and transit.

Pros:

- Unmatched speed and convenience.

- Harder to steal than a physical card.

- Reduces friction at checkout.

Cons:

- Deep-rooted privacy fears among older demographics.

- High infrastructure cost for merchants.

4. Embedded Finance 2.0 (Insurance & Lending)

Embedded finance has evolved from simple payments (like Uber) to complex financial products living inside non-financial apps. You can now buy instant travel insurance the moment your flight is delayed, directly within the airline app, or secure a micro-loan for freelance equipment inside a gig-work platform. The financial service is invisible, contextual, and instant.

Best For: Gig economy platforms and e-commerce.

Pros:

- Offers occur exactly when the user needs them.

- Seamless user experience.

- Higher conversion rates for service providers.

Cons:

- Risk of consumer over-indebtedness.

- Opaque data sharing practices.

5. The “Low-Fi” Authenticity Movement in Banking

A fascinating cultural shift is happening in response to AI fatigue. Neobanks and fintech startups are ditching the polished, corporate “Memphis Design” aesthetic for a raw, “Low-Fi” look. This includes plain text emails, brutalist app interfaces, and transparent, jargon-free communication. For Gen Z, this lack of polish signals honesty and human connection in an increasingly synthetic world.

Best For: Neobanks targeting Gen Z.

Pros:

- Builds high trust and community loyalty.

- Stands out against AI-generated content.

- Lower marketing production costs.

Cons:

Can feel unprofessional to older generations.

Risk of appearing “cheap” rather than authentic.

6. Quantum-Resistant Cybersecurity

With quantum computing advancements accelerating, the threat of “Harvest Now, Decrypt Later” has forced banks to act. Q1 2026 sees the quiet rollout of Post-Quantum Cryptography (PQC) standards across major financial institutions. While invisible to the consumer, this infrastructure upgrade is critical to ensuring that today’s encrypted data cannot be cracked by tomorrow’s quantum computers.

Best For: Enterprise banking and government contracts.

Pros:

- Future-proofs sensitive financial data.

- Prevents catastrophic systemic failure.

- Builds institutional confidence.

Cons:

- Extremely expensive to implement.

- Slows down legacy system performance.

7. Cross-Border Stablecoin Rails

SWIFT is facing its stiffest competition yet. Regulated stablecoins have become the default settlement layer for B2B cross-border transactions. Businesses are bypassing the correspondent banking network entirely, using stablecoins to settle supplier invoices in seconds rather than days. This is no longer “crypto”; it is simply efficient fintech infrastructure.

Best For: International trade and supply chain management.

Pros:

- Settlement in seconds, not days.

- Massive reduction in transaction fees.

- Total transparency of fund movement.

Cons:

- Currency fluctuation risks (if not fully backed).

- Geopolitical regulatory friction.

8. Green Fintech Accountability

Regulatory pressure has moved carbon tracking from a “nice-to-have” feature to a compliance necessity. Banking apps now include mandatory carbon footprint tracking for transactions, and “Green Loans” with lower interest rates for energy-efficient purchases are becoming standard. This is driven not just by consumer demand, but by strict new ESG reporting requirements for financial institutions.

Best For: Eco-conscious consumers and regulated banks.

Pros:

- Encourages sustainable spending habits.

- Helps banks meet regulatory targets.

- Aligns financial goals with climate goals.

Cons:

- Can feel intrusive to some users.

- The accuracy of carbon data is often debated.

How to Prepare for the Shift

Navigating the Fintech Trends of Q1 2026 requires a proactive approach. You don’t need to adopt every tool, but you must audit your current stack. Here is your checklist:

Audit Your Privacy: Are you ready for biometric payments, or do you need to secure your identity data first?

Evaluate AI Trust: Are you comfortable giving an autonomous agent control over your savings, or do you prefer a “human-in-the-loop” hybrid model?

Check Your Assets: If you hold cash, could it be working harder in a tokenized treasury product?

Here’s a quick comparison: key fintech shifts in Q1 2026:

| Trend | Key Technology | Impact Level | Best For |

| Autonomous Agents | Agentic AI | Consumer & B2B | Automated wealth management |

| RWA Tokenization | Blockchain / Smart Contracts | Institutional | Fractional investing |

| Biometric Payments | Palm/Face Recognition | Consumer | Frictionless retail |

| Embedded Finance 2.0 | API Integration | Consumer | Insurance & Lending |

| Low-Fi Authenticity | UX / Branding | Consumer (Gen Z) | Building brand trust |

| Quantum Security | PQC (Post-Quantum Crypto) | Enterprise | Data protection |

| Stablecoin Rails | Regulated Digital Currencies | B2B | Cross-border settlement |

| Green Accountability | Carbon APIs | Consumer | ESG Compliance |

Our quick picks:

Most Disruptive: Autonomous AI Agents. The shift from “chatbots” to “agents that do things” is the biggest leap in fintech history.

Mass Adoption Ready: Biometric Payments. “Pay by Palm” is rolling out in major retail chains, making wallets obsolete.

Best for Investors: RWA Tokenization. Real estate and treasury bonds moving on-chain offer new liquidity opportunities.

Wrap-Up

The start of 2026 is defined by a move toward autonomy and authenticity. While Autonomous AI Agents drive efficiency, the Low-Fi Authenticity movement ensures we don’t lose the human touch. These Fintech Trends of Q1 2026 are not fleeting fads; they are the foundational pillars of the next decade of finance. Whether you are paying with your palm or investing in tokenized real estate, the future of money and fintech is already here.