Running a small business in Malaysia comes with various financial responsibilities, and one of the most crucial aspects is tax management. Understanding tax deductions can significantly reduce your tax burden, ensuring that you maximize savings while staying compliant with regulations.

Tax deductions help businesses reinvest in their growth, manage operational costs effectively, and improve overall profitability. Many small business owners miss out on potential deductions due to a lack of knowledge or improper documentation. Keeping accurate financial records and understanding which expenses qualify for deductions can help businesses avoid unnecessary tax liabilities.

This guide will explore 10 tax deductions every small business in Malaysia should claim, helping you optimize your tax strategy and boost your bottom line.

Understanding Tax Deductions for Small Businesses in Malaysia

Tax deductions allow businesses to reduce their taxable income by deducting specific expenses incurred during business operations. This means lower taxes and more savings for reinvestment. Deductions apply to a variety of costs, including operating expenses, employee salaries, professional services, and asset depreciation. By understanding and claiming the right deductions, businesses can legally reduce their tax liabilities and free up more resources for expansion.

Why Tax Deductions Matter for Small Businesses

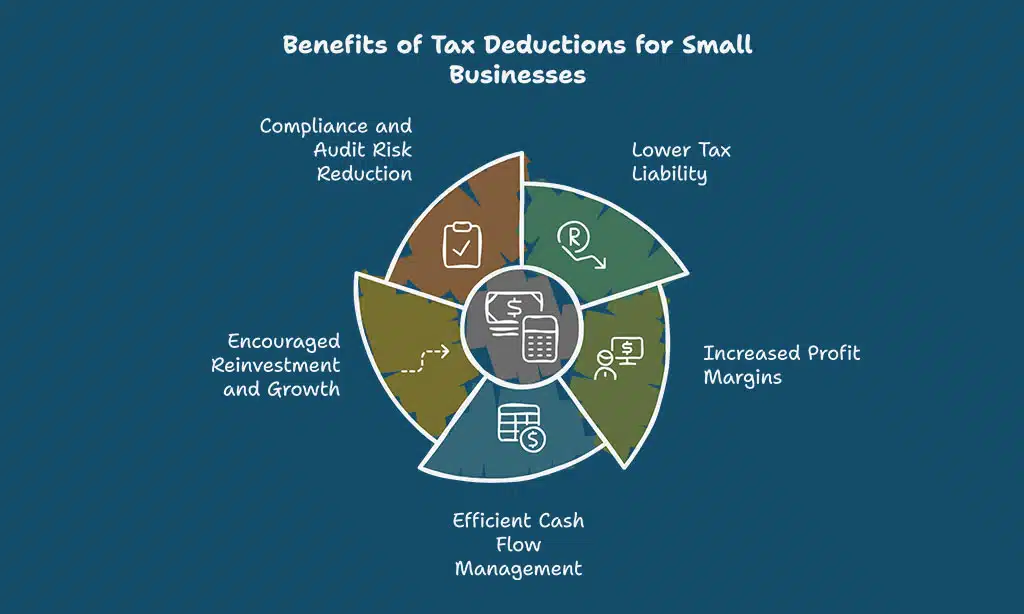

Claiming tax deductions is essential for small businesses because it:

- Lowers overall tax liability: Reducing taxable income means paying less tax.

- Increases net profit margins: More money stays within the business.

- Helps manage cash flow efficiently: Tax savings can be used for daily operations.

- Encourages reinvestment and growth: Businesses can allocate more funds toward innovation, hiring, and expansion.

- Ensures compliance and reduces audit risks: Properly claimed deductions keep your business in good standing with the tax authorities.

Eligibility Criteria for Business Tax Deductions in Malaysia

To claim tax deductions, your expenses must:

- Be wholly and exclusively incurred in generating business income.

- Have proper documentation [receipts, invoices, contracts, etc.].

- Comply with the Income Tax Act 1967 and guidelines from the Inland Revenue Board of Malaysia [LHDN].

10 Tax Deductions Every Small Business in Malaysia Should Claim

Tax deductions are essential for small businesses to minimize taxable income and retain more earnings for growth. Each deduction category provides businesses with an opportunity to optimize expenses while ensuring compliance with tax laws.

By identifying and properly documenting eligible expenses, businesses can significantly improve their financial efficiency. Understanding how each deduction works and applying the right strategies will help businesses make informed financial decisions.

Below are 10 tax deductions every small business in Malaysia should claim to maximize tax savings.

1. Business Operating Expenses

Operating expenses are essential costs required to keep a business running smoothly and are fully deductible if they are directly related to business operations. These expenses include rent, utilities, office supplies, repair and maintenance costs, and transportation expenses.

Proper record-keeping and documentation are crucial to ensure compliance with tax regulations and maximize deductions. Businesses should track recurring expenses and categorize them correctly for accurate tax reporting.

Below is a table summarizing common deductible operating expenses:

| Expense Category | Deductibility Status |

| Office Rent | Fully Deductible |

| Utilities [Electricity, Water, Internet] | Fully Deductible |

| Office Supplies | Fully Deductible |

| Repair & Maintenance | Fully Deductible |

| Transportation & Fuel | Partially Deductible |

- Office rent and co-working space fees.

- Utility bills [electricity, water, internet, phone lines].

- Office supplies [stationery, printing materials, software subscriptions].

- Repair and maintenance costs for office premises and equipment.

- Company vehicle expenses [fuel, maintenance, road tax, insurance].

2. Employee Salaries and EPF Contributions

Employee salaries are one of the biggest expenses for small businesses, but they are also fully deductible under Malaysian tax law. Contributions to statutory funds such as EPF [Employees Provident Fund], SOCSO, and EIS are also tax-deductible. In addition to regular wages, allowances, overtime payments, and commissions are included in deductible payroll expenses.

Employers should ensure timely contributions to statutory funds to avoid penalties and maintain eligibility for tax deductions.

Proper record-keeping, including salary slips and EPF contribution statements, is essential for compliance. Below is a table summarizing deductible employee-related expenses:

| Payroll Expense | Deductibility Status |

| Salaries & Wages | Fully Deductible |

| Overtime Payments | Fully Deductible |

| Commissions | Fully Deductible |

| EPF Contributions | Up to 19% Deductible |

| SOCSO & EIS Contributions | Fully Deductible |

3. Marketing and Advertising Costs

Investing in marketing is essential for business growth, allowing businesses to increase brand awareness and attract new customers. Most marketing and advertising expenses are tax-deductible, provided they are directly related to promoting the business.

This includes costs for digital advertising, social media campaigns, branding, event sponsorships, and influencer marketing.

Businesses should maintain records of advertising expenses to ensure compliance with tax regulations. Below is a table outlining deductible marketing expenses:

| Marketing Expense | Deductibility Status |

| Digital Advertising | Fully Deductible |

| Print & Media Ads | Fully Deductible |

| Event Sponsorships | Subject to Approval |

| Branding & Logo Design | Fully Deductible |

| Influencer & Affiliate Marketing | Fully Deductible |

- Digital advertising [Google Ads, Facebook, LinkedIn, Instagram].

- Traditional advertising [newspapers, billboards, TV commercials].

- Branding expenses [logo design, website development, promotional materials].

- Sponsorship of business events or conferences.

4. Professional Services and Consultancy Fees

Small businesses often require accounting, legal, and consultancy services, which are tax-deductible and essential for smooth operations. These services help businesses stay compliant with tax regulations, resolve legal matters, and improve overall efficiency.

Common deductible professional services include legal consultations for contracts, accounting services for financial reporting, and business advisory for strategic planning. By outsourcing these tasks, businesses can focus on growth while ensuring regulatory compliance.

Maintaining invoices and agreements with service providers is crucial for claiming deductions. Below is a table highlighting deductible professional services:

| Service Type | Deductibility Status |

| Legal Consultation | Fully Deductible |

| Accounting & Bookkeeping | Fully Deductible |

| Business Advisory | Fully Deductible |

| Tax Consultancy | Fully Deductible |

| HR & Payroll Services | Fully Deductible |

5. Business Travel and Accommodation Expenses

Business-related travel expenses are deductible if they are incurred for official purposes, ensuring that businesses can reduce taxable income while managing necessary trips.

These expenses include transportation, accommodation, and meals that are directly linked to client meetings, conferences, and business expansion efforts.

To qualify, records such as receipts, travel itineraries, and meeting confirmations must be maintained. Below is a table outlining common deductible travel expenses:

| Expense Type | Deductibility Status |

| Flight Tickets | Fully Deductible |

| Hotel Accommodation | Fully Deductible |

| Meals & Entertainment | Partially Deductible |

| Taxi & Local Transport | Fully Deductible |

| Conference Fees | Fully Deductible |

- Flight and transportation costs.

- Hotel stays and lodging.

- Meals and entertainment [subject to limits].

6. Training and Skill Development Costs

Investing in training enhances employee skills and business productivity, leading to better performance and efficiency. Malaysian businesses can claim tax deductions for various skill development programs, ensuring that employees stay updated with industry trends and best practices.

Eligible training expenses include certification programs, industry-specific workshops, leadership training, and online learning platforms. Employers should ensure that the training directly benefits the business to qualify for deductions. Below is a table outlining deductible training expenses:

| Training Type | Deductibility Status |

| HRDF-Approved Courses | Fully Deductible |

| Industry Seminars & Workshops | Fully Deductible |

| Online Professional Courses | Fully Deductible |

| Leadership & Management Training | Fully Deductible |

| Software & Technical Training | Fully Deductible |

- Courses and certification programs.

- Workshops and industry seminars.

- Online learning subscriptions.

7. Depreciation of Business Assets

Businesses can claim capital allowances to offset the cost of assets used in operations, which helps reduce taxable income over time. Capital allowances apply to machinery, equipment, office furniture, business vehicles, and software used for business purposes.

Different asset categories have varying depreciation rates, ensuring businesses can spread the cost over multiple years. Claiming capital allowances effectively improves cash flow and allows businesses to reinvest in essential resources. Below is a table outlining the common capital allowance rates:

| Asset Type | Depreciation Rate |

| Computers & Software | 40% |

| Office Equipment | 10%-20% |

| Business Vehicles | 20% |

| Machinery & Tools | 14% |

| Furniture & Fixtures | 10% |

| Asset Type | Depreciation Rate |

| Computers & Software | 40% |

| Office Equipment | 10%-20% |

| Business Vehicles | 20% |

8. Insurance Premiums for Business Protection

Certain insurance policies are deductible, including premiums paid for policies that protect business assets, employees, and liabilities. These insurance policies help safeguard the business from financial risks while also reducing taxable income.

Eligible deductions include property insurance, liability insurance, and key person insurance, among others. To maximize tax benefits, businesses should ensure that policies are directly related to business operations and maintain proper documentation.

Below is a table highlighting common deductible insurance policies:

| Insurance Type | Deductibility Status |

| Property Insurance | Fully Deductible |

| Business Liability Insurance | Fully Deductible |

| Key Person Insurance | Subject to Conditions |

| Employee Health Insurance | Fully Deductible |

| Cybersecurity Insurance | Fully Deductible |

- Property insurance.

- Liability insurance.

- Key person insurance.

9. Bad Debts Write-Offs

If a business cannot recover outstanding payments from clients, the bad debts can be written off as a tax deduction. To qualify for this deduction, businesses must demonstrate that all reasonable efforts to collect the debt have failed.

This includes sending multiple reminders, offering payment plans, and, if necessary, initiating legal action. Writing off bad debts ensures that businesses do not pay taxes on income they never received. Keeping proper documentation, such as correspondence records and legal notices, strengthens the claim during tax audits.

The table below outlines key aspects of bad debt deductions:

| Requirement | Description |

| Proof of Non-Recovery | Businesses must show evidence of collection attempts. |

| Accounting Treatment | Debt must be officially written off in financial records. |

| Legal Action | Not mandatory but strengthens the claim if pursued. |

| Documentation | Maintain all invoices, notices, and legal letters. |

| LHDN Approval | Required for significant amounts to ensure compliance. |

10. Donations and CSR Contributions

Businesses that contribute to government-approved charities can claim deductions, which helps reduce their taxable income while supporting social causes. Eligible donations must be made to organizations recognized by the Inland Revenue Board of Malaysia [LHDN]. These include contributions to registered non-profits, disaster relief funds, educational programs, and medical research institutions.

Additionally, businesses engaging in Corporate Social Responsibility [CSR] initiatives, such as environmental projects and community support programs, may also qualify for deductions.

Proper documentation, including official donation receipts and approval letters, is essential to ensure tax compliance.

| Contribution Type | Deductibility Status |

| Cash Donations | Fully Deductible |

| Sponsorships | Fully Deductible |

Takeaways

Understanding and claiming 10 tax deductions every small business in Malaysia can significantly reduce tax burdens and improve financial efficiency. These deductions help businesses retain more capital, reinvest in growth, and ensure financial stability. By leveraging SME tax incentives and maintaining accurate records, businesses can optimize their tax planning strategies while avoiding unnecessary liabilities.

Consulting with tax professionals can further enhance compliance and help businesses take advantage of all available deductions. Keeping up with changing tax regulations and documenting deductible expenses meticulously will ensure long-term financial success.

Ultimately, optimizing tax strategies is a crucial aspect of running a financially sound business. The savings gained from tax deductions can be reinvested into expansion, employee benefits, technology upgrades, and overall business sustainability.

By taking a proactive approach, small businesses in Malaysia can secure long-term profitability while maintaining compliance with tax regulations. Start optimizing your business taxes today to maximize savings and improve profitability!