As a rental property owner in the USA, going green is not only good for the environment but also financially rewarding. With various federal and state tax incentives available, you can significantly reduce your taxable income by making energy-efficient and eco-friendly upgrades to your rental properties.

These tax deductions for green rental property owners in USA help maximize savings, lower maintenance costs, and increase tenant demand for sustainable living spaces.

This guide provides an in-depth look at the top 15 tax deductions for green rental property owners in USA, explaining their benefits and how to claim them. Whether you’re upgrading appliances, installing solar panels, or improving insulation, these deductions can add up to substantial financial benefits.

Additionally, we will include real-world case studies, data trends, and tables for quick reference to help you make informed decisions.

Understanding Tax Deductions for Green Rental Properties

Tax deductions are expenses that rental property owners can subtract from their taxable income, ultimately reducing the amount of taxes owed to the IRS. For green rental property owners in the USA, these deductions specifically apply to energy-efficient improvements, eco-friendly upgrades, and renewable energy investments.

Who Qualifies for These Green Tax Deductions?

To qualify for these deductions, property owners must:

- Own residential rental property in the USA.

- Invest in IRS-approved energy-efficient improvements.

- Retain receipts and documentation for tax filing.

- Meet eligibility criteria for specific federal and state tax credits.

15 Tax Deductions for Green Rental Property Owners in USA

Going green with your rental properties not only benefits the environment but also provides significant financial advantages. There are numerous tax deductions available for green rental property owners in USA that can help offset the costs of sustainability investments. By leveraging these tax breaks, landlords can reduce expenses, increase energy efficiency, and attract eco-conscious tenants.

1. Energy-Efficient Home Improvements

Upgrading your rental property with energy-efficient features can lead to significant tax savings. The IRS allows deductions for:

- Smart thermostats (e.g., Nest, Ecobee)

- High-performance windows and doors

- Energy-efficient insulation

- LED lighting installations

These upgrades lower energy consumption, enhance tenant comfort, and contribute to long-term savings. Installing double-pane windows, high-efficiency heat pumps, and cool roofs can also qualify for rebates in various states.

| Energy-Efficient Upgrade | Average Cost | Potential Tax Credit/Deduction |

| Smart Thermostat | $150 – $300 | Up to 30% of the cost |

| Insulated Windows | $500 – $1,000 per window | 10% of cost (max $500) |

| LED Lighting Upgrade | $50 – $200 | 10% of cost up to $500 |

2. Energy-Efficient Appliances

Purchasing ENERGY STAR-certified appliances qualifies for tax deductions. These include:

- Refrigerators

- Washing machines

- Dishwashers

- HVAC systems

These appliances consume less energy and water, reducing utility costs and environmental impact. For example, an ENERGY STAR refrigerator uses 15% less energy than non-certified models, helping tenants save on bills.

| Appliance | Average Cost | Potential Savings Per Year |

| ENERGY STAR Fridge | $700 – $1,500 | $100 – $150 |

| Efficient Dishwasher | $400 – $1,200 | $30 – $50 |

| High-Efficiency Washer | $500 – $1,300 | $50 – $70 |

3. Green Roofing & Sustainable Building Materials

Installing a cool roof or using sustainable materials can qualify for deductions under federal energy efficiency programs. Eco-friendly materials such as bamboo flooring, recycled metal roofing, and low-VOC paints can also enhance property value. Investing in green roofs, which provide insulation and stormwater management, can reduce heating and cooling costs by 30% annually.

4. Water Conservation Systems

Water-efficient systems help property owners save on utility bills while qualifying for tax deductions. Eligible installations include:

- Rainwater harvesting systems

- Low-flow toilets and showerheads

- Drip irrigation systems

- Xeriscaping (drought-resistant landscaping)

| Water Conservation Upgrade | Average Cost | Potential Tax Credit/Deduction |

| Low-Flow Toilet | $100 – $300 | Up to 30% of the cost |

| Rainwater Collection System | $1,000 – $5,000 | State-specific credits available |

| Drip Irrigation System | $500 – $2,000 | 10% of cost (varies by state) |

5. Solar Energy Tax Credit (Investment Tax Credit – ITC)

The Investment Tax Credit (ITC) allows rental property owners to deduct 30% of the cost of solar energy systems, including solar panels and battery storage systems. This incentive is available until 2032.

Case Study: Solar Power Savings

John, a rental property owner in Texas, installed a 5kW solar panel system for $15,000. With the 30% ITC, he received a $4,500 tax credit, reducing the effective cost to $10,500. Over the next 10 years, his tenants saved an average of $1,500 annually on electricity bills.

6. Electric Vehicle (EV) Charging Station Installation

Installing EV charging stations at your rental property can attract eco-conscious tenants and provide tax incentives. The Alternative Fuel Vehicle Refueling Property Credit covers 30% of the installation cost, up to $1,000 per unit.

| EV Charger Type | Average Cost | Potential Tax Credit |

| Level 1 Charger | $300 – $600 | 30% of cost (max $1,000) |

| Level 2 Charger | $1,000 – $3,000 | 30% of cost (max $1,000) |

7. LEED Certification & Green Building Tax Benefits

Leadership in Energy and Environmental Design (LEED) certification increases property value and rental income. Many states offer tax incentives, and some insurance providers offer discounted premiums for certified properties.

8. Energy Audits & Consulting Fees

Hiring a professional to conduct an energy audit can uncover efficiency improvements. The cost of these audits and consulting fees is tax-deductible.

9. State and Local Green Energy Incentives

Many states provide rebates and tax credits for green renovations. Check DSIRE (Database of State Incentives for Renewables & Efficiency) for state-specific programs.

10. Depreciation of Energy-Efficient Upgrades

Under Modified Accelerated Cost Recovery System (MACRS), property owners can depreciate green upgrades like solar panels, insulation, and high-efficiency HVAC systems over five years, reducing taxable income.

11. Interest Deductions on Green Renovation Loans

If you finance green upgrades with a loan, interest payments may be tax-deductible, reducing the cost of sustainability investments.

12. Home Office Deduction for Green Rental Property Management

If you manage rental properties from a dedicated home office, a portion of expenses like utilities, rent, and office supplies is tax-deductible.

13. Sustainable Landscaping and Tree Planting Credits

Tax deductions are available for eco-friendly landscaping, native plants, and tree planting to enhance green space and reduce cooling costs.

14. Green Rental Property Maintenance & Repairs

Deduct expenses for eco-friendly cleaning supplies, pest control, and maintenance services that reduce environmental impact.

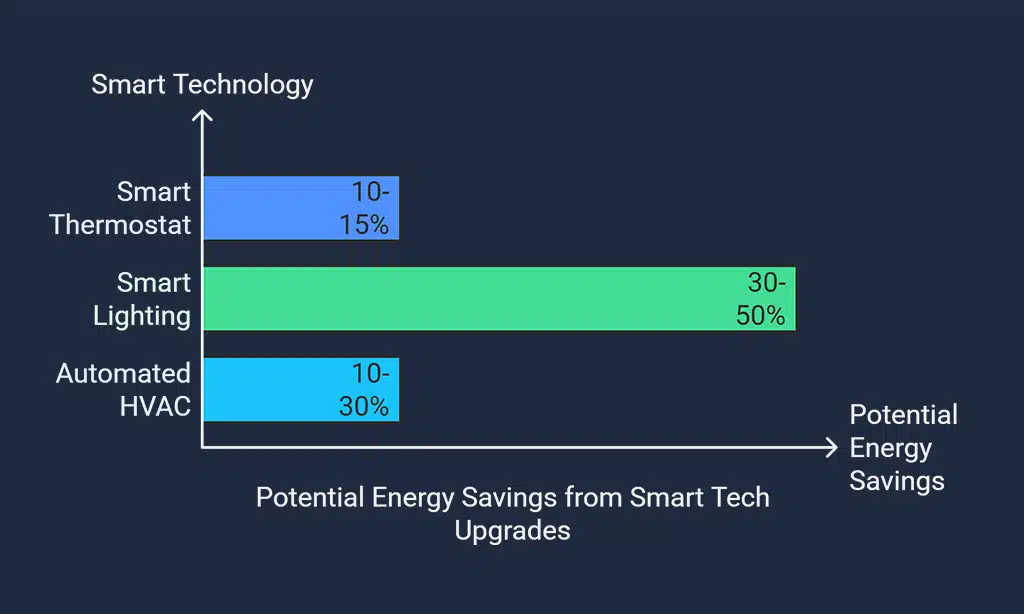

15. Smart Technology Upgrades

Adding smart water meters, automated lighting, and intelligent HVAC systems not only reduces operational costs but may also qualify for tax incentives.

| Smart Tech Upgrade | Average Cost | Potential Savings |

| Smart Thermostat | $150 – $300 | 10-15% energy savings |

| Smart Lighting | $50 – $200 | 30-50% energy savings |

| Automated HVAC | $500 – $2,000 | 10-30% energy savings |

How to Claim Green Rental Property Tax Deductions?

- Identify Eligible Deductions – Keep track of energy-efficient upgrades.

- Maintain Records – Save receipts, invoices, and certifications.

- Use IRS Forms – File IRS Form 5695 for energy credits and Schedule E (Form 1040) for rental property deductions.

- Consult a Tax Professional – Get expert advice for maximum savings.

Common Mistakes to Avoid

- Failing to keep receipts for upgrades.

- Not checking eligibility before filing.

- Overlooking state incentives in addition to federal benefits.

Takeaways

Investing in energy-efficient and eco-friendly upgrades for rental properties is a smart financial decision.

These 15 tax deductions for green rental property owners in USA can help lower costs, increase sustainability, and enhance property value. By staying informed and leveraging these tax benefits, you can create an environmentally responsible and profitable rental business.

Consult a tax professional today to maximize your green tax deductions and optimize your rental property investments!