Singapore is a global hub for technology and innovation, attracting entrepreneurs with its pro-business policies and competitive tax advantages. For tech startups and SMEs, leveraging tax credits can significantly reduce operating costs and maximize profitability.

Understanding available tax credits for tech entrepreneurs in Singapore ensures businesses remain financially sustainable while fostering growth.

This article explores 7 tax credits for tech entrepreneurs in Singapore, detailing their benefits, eligibility criteria, and application processes. By optimizing these incentives, tech businesses can enhance cash flow, fund research, and scale internationally.

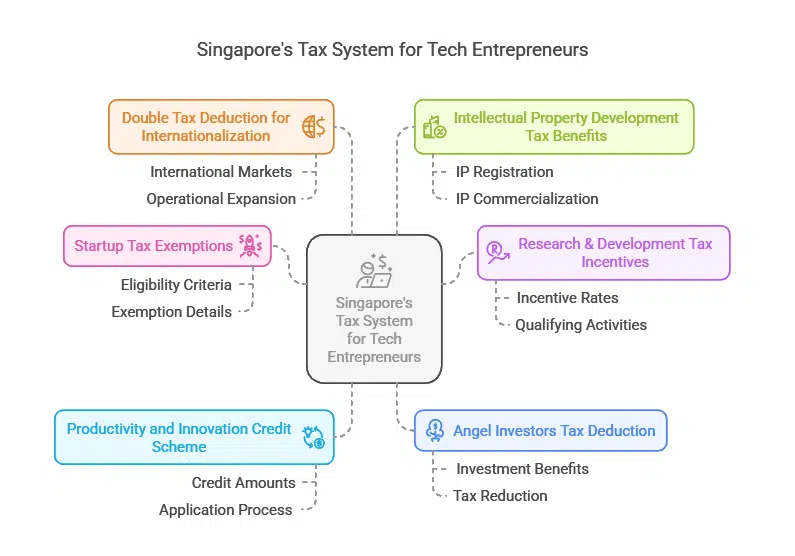

Understanding Singapore’s Tax System for Entrepreneurs

Singapore offers one of the most business-friendly tax structures in the world. With a corporate tax rate capped at 17%, the country provides various tax reliefs to support entrepreneurship and innovation. The Inland Revenue Authority of Singapore (IRAS) oversees these tax schemes, ensuring businesses comply with the regulations.

Key elements of Singapore’s tax system that benefit tech entrepreneurs include:

- Startup Tax Exemptions (SUTE) and Partial Tax Exemptions (PTE)

- Research & Development (R&D) Tax Incentives

- Productivity and Innovation Credit (PIC) Scheme

- Angel Investors Tax Deduction (AITD)

- Double Tax Deduction for Internationalization (DTDi)

- Intellectual Property (IP) Development Tax Benefits

7 Tax Credits for Tech Entrepreneurs in Singapore

Singapore’s tax system provides a range of financial incentives designed to foster innovation, encourage startups, and support the growth of tech-driven businesses. These tax credits can significantly reduce costs for emerging tech companies, allowing them to reinvest savings into research, development, and expansion.

Whether you’re a new startup or an established tech entrepreneur, understanding how to leverage these tax benefits is crucial for maintaining competitiveness in Singapore’s fast-evolving digital economy.

1. Startup Tax Exemption (SUTE) Scheme

The Startup Tax Exemption (SUTE) Scheme aims to support new businesses by offering generous tax exemptions during their initial years.

Eligibility Criteria:

- Must be incorporated in Singapore

- Must be a tax-resident company

- Must not be an investment holding or property development company

Tax Benefits:

| Chargeable Income (SGD) | Exemption (%) | Taxable Amount After Exemption (SGD) |

| First 100,000 | 75% | 25,000 |

| Next 100,000 | 50% | 50,000 |

| Beyond 200,000 | 0% | Full Taxable |

How to Apply:

- File a corporate tax return via IRAS myTax Portal

- Ensure compliance with all tax residency and operational requirements

2. Partial Tax Exemption (PTE) for SMEs

For tech startups that do not qualify for SUTE, the Partial Tax Exemption (PTE) Scheme offers reduced tax rates.

Tax Benefits:

- 75% tax exemption on the first $10,000 of chargeable income

- 50% exemption on the next $190,000

Application Process:

- Automatically applied upon filing corporate tax returns

3. Research and Development (R&D) Tax Incentives

Singapore encourages innovation through its R&D Tax Incentive Scheme, which offers enhanced tax deductions for eligible R&D activities.

Eligible Activities:

- Development of new technology, software, or prototypes

- Innovation in AI, cybersecurity, or biotech

- Process improvements and automation

Tax Benefits:

- 250% tax deduction on eligible R&D expenses

- Cash conversion option for businesses with limited taxable income

4. Productivity and Innovation Credit (PIC) Scheme

The PIC Scheme supports tech entrepreneurs in automation, training, and innovation.

Qualifying Activities:

- IT and automation equipment

- Employee training and upskilling

- Software acquisition

Tax Benefits:

| Expense Type | Deduction Rate |

| IT Equipment | 400% |

| Training Programs | 400% |

| Intellectual Property | 400% |

5. Angel Investors Tax Deduction (AITD) Scheme

Investors who fund early-stage tech startups in Singapore can benefit from the AITD Scheme, attracting more capital to the startup ecosystem.

Key Features:

- Angel investors can claim 50% tax deductions on qualifying investments

- Minimum investment of SGD 100,000 in an eligible tech startup

6. Double Tax Deduction for Internationalization (DTDi)

Tech businesses expanding overseas can claim tax deductions on international marketing and expansion expenses.

Eligible Expenses:

- Overseas business development

- Trade fairs and exhibitions

- Market entry strategies

Tax Benefits:

- 200% tax deduction on eligible expenses

- Maximum claimable amount of SGD 150,000 per year

7. Intellectual Property (IP) Development Tax Benefits

Tech companies developing new intellectual property can claim tax deductions under Singapore’s IP Development Tax Benefits.

Eligible Assets:

- Patents, copyrights, trademarks, and trade secrets

- Licensing and commercializing proprietary technologies

Tax Benefits:

| Type of IP | Tax Deduction (%) |

| Patents | 200% |

| Trademarks | 100% |

| Licensing Agreements | 200% |

How to Apply for Tax Credits in Singapore?

Applying for tax credits requires careful documentation and adherence to IRAS guidelines. Here’s a step-by-step approach:

- Determine Eligibility: Review requirements for each tax scheme

- Prepare Documentation: Gather expense records, invoices, and reports

- Submit Application: Use myTax Portal to file claims

- Monitor Compliance: Ensure accurate reporting to avoid penalties

Wrap Up

Singapore’s tax credits for tech entrepreneurs provide substantial financial relief, enabling startups to innovate, expand, and thrive. By leveraging incentives such as SUTE, PTE, R&D tax deductions, and IP tax benefits, tech businesses can maximize profitability while staying competitive.

Understanding and applying for these tax incentives is crucial for long-term success. Entrepreneurs should consult tax professionals to optimize benefits and ensure compliance. Investing time in tax planning today can lead to significant financial gains tomorrow!