New Zealand has become a global hub for innovation, particularly in the tech industry. With a supportive business environment and a growing ecosystem of startups, the government offers a variety of tax incentives to encourage growth and innovation.

For tech entrepreneurs, leveraging tax credits for tech entrepreneurs in New Zealand can significantly reduce financial pressures while driving innovation and scalability.

In this comprehensive guide, we explore the most beneficial tax credits for tech entrepreneurs in New Zealand, outlining their advantages, eligibility criteria, and application processes. Whether you’re a startup or an established tech business, these credits can be a game-changer for your company’s growth.

The Role of Tax Credits in Supporting Tech Entrepreneurs

Why Tax Credits Are Vital for the Tech Industry

Tax credits are essential for fostering innovation and providing financial relief for tech businesses. They incentivize research and development (R&D), help startups reduce operational costs, and encourage global competitiveness. These initiatives not only bolster individual businesses but also contribute to New Zealand’s reputation as a hub for technological advancement.

Key reasons why tax credits for tech entrepreneurs in New Zealand are indispensable:

- Financial Relief: They reduce the cost burden for startups and small businesses.

- Encouragement for Innovation: By making R&D more affordable, these credits stimulate technological advancements.

- Economic Growth: Supporting tech businesses helps build a stronger, more diverse economy.

Overview of Tax Policies in New Zealand for Tech Entrepreneurs

The New Zealand government prioritizes fostering a dynamic tech ecosystem. Tax policies aim to:

- Promote sustainable innovation.

- Attract foreign investment.

- Support local startups with global aspirations.

7 Tax Credits Available for Tech Entrepreneurs

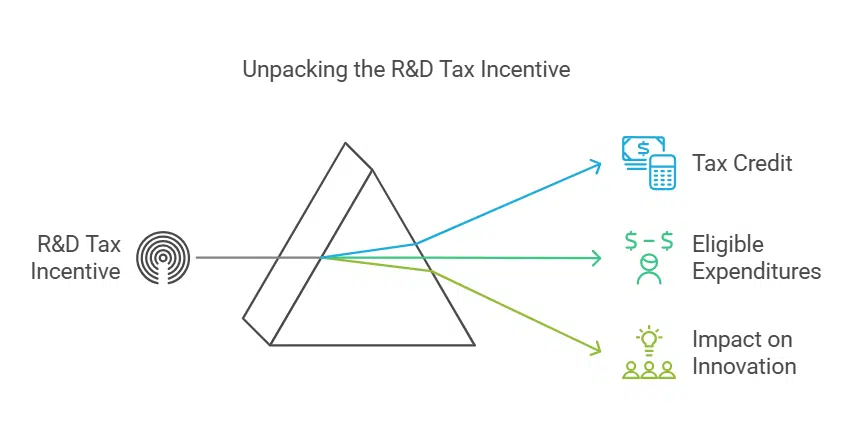

1. Research and Development (R&D) Tax Incentive

The R&D Tax Incentive is a cornerstone for tech businesses focusing on innovation. It provides a 15% tax credit on eligible R&D expenditures, helping companies reduce the costs of product development and experimentation. This tax credit has been particularly effective in supporting cutting-edge projects that require significant capital and intellectual investment.

What It Covers:

- Salaries for R&D staff.

- Costs for prototypes and trials.

- Software development expenses.

| Eligibility Criteria | Details |

| Company Location | Must operate in New Zealand |

| R&D Activities | Should aim to create new or improved processes |

| Minimum Expenditure | NZD 50,000 annually |

Benefits for Tech Startups:

- Reduces the cost of high-risk projects.

- Encourages technological breakthroughs.

Example:

A software company developing an AI-driven app claimed an R&D tax credit, which covered 15% of its NZD 100,000 R&D costs, saving NZD 15,000. This savings enabled the company to reinvest in further software enhancements and expand its team.

2. Innovation Growth Grant

This grant is designed for high-growth tech businesses looking to scale their R&D efforts. While no longer open to new applicants, existing participants benefit significantly by receiving consistent funding that supports their ongoing innovation.

How It Helps:

- Provides funding for companies investing heavily in R&D.

- Encourages long-term innovation and scalability.

| Criteria | Details |

| Eligibility | Existing recipients only |

| Funding Cap | Varies by project |

| Focus | High-growth tech companies |

Case Study:

A renewable tech startup used the Innovation Growth Grant to fund its solar panel optimization research, enabling it to bring a breakthrough product to market. The grant covered 50% of their R&D costs, significantly accelerating their development timeline.

3. Digital Business Tax Credit

This tax credit incentivizes businesses to transition into digital operations, a critical step in modernizing processes and reaching broader markets. With the ongoing digitization of global industries, this credit ensures New Zealand’s tech startups remain competitive.

Eligible Activities:

- Website creation and optimization.

- Development of e-commerce platforms.

- Integration of digital marketing tools.

| Activity | Percentage Covered |

| E-commerce Development | 30% |

| Digital Marketing Tools | 20% |

Current Trends:

Tech startups increasingly leverage this credit to establish a robust online presence, which is vital in today’s digital economy. For example, a local e-commerce startup claimed this credit to build a sophisticated platform, boosting online sales by 45% within a year.

4. Technology Development Tax Credit

This tax credit supports companies developing new technologies, emphasizing commercialization and market entry. It plays a pivotal role in helping tech startups transition from idea to market-ready product.

How It Benefits Entrepreneurs:

- Encourages risk-taking in new technology projects.

- Reduces the financial burden of bringing innovations to market.

| Benefit | Description |

| Financial Relief | Offsets R&D and development costs |

| Market Advantage | Helps startups bring innovative products faster |

Example:

A biotech startup developing cutting-edge diagnostic tools used this credit to offset development costs, enabling faster product deployment. This move allowed the company to secure a significant market share in its first year.

5. Export Market Development Tax Credit

For tech companies expanding internationally, this credit supports activities like market research, promotional events, and trade shows. This tax credit has proven essential for businesses aiming to establish a global footprint.

Covered Expenses:

- Travel and accommodation for trade events.

- Costs associated with international market research.

- Advertising and promotional campaigns.

| Expense Type | Percentage Covered |

| Trade Shows | 40% |

| Market Research | 30% |

Success Stories:

A SaaS company used this tax credit to participate in global trade shows, resulting in partnerships that expanded their client base across Europe. With an investment of NZD 50,000, the company received NZD 20,000 in credits, which was reinvested in further market exploration.

6. Energy Efficiency and Sustainability Tax Credit

This credit incentivizes tech businesses to adopt sustainable and energy-efficient practices, aligning with global trends toward greener operations.

Qualifying Investments:

- Solar panel installations.

- Energy-efficient data centers.

- Adoption of renewable energy technologies.

| Investment | Tax Credit Percentage |

| Renewable Energy Systems | 35% |

| Energy-Efficient Equipment | 25% |

Importance:

Aligning with global sustainability trends not only reduces costs but also enhances brand value. A local data center startup leveraged this credit to install energy-efficient cooling systems, reducing operational costs by 30% annually.

7. Skills and Training Tax Credit

To address the skills gap in tech, this credit supports workforce training and upskilling initiatives. This ensures the industry has access to a steady pipeline of skilled professionals.

Eligible Training:

- Software development programs.

- AI and data analytics training.

- Cybersecurity certifications.

| Training Type | Percentage Covered |

| AI and Data Training | 40% |

| Cybersecurity Certifications | 30% |

Long-Term Impact:

Building a highly skilled workforce ensures New Zealand’s tech industry remains competitive globally. For instance, a tech company invested in AI training for its team, which improved efficiency and reduced operational costs by 20%.

How to Maximize the Benefits of Tax Credits

Developing a Tax Credit Strategy

- Identify Eligibility: Review all tax credits to determine eligibility for multiple programs.

- Track Expenditures: Maintain detailed records to ensure accurate claims.

Common Mistakes to Avoid

- Missing deadlines due to lack of preparation.

- Misinterpreting eligibility criteria.

Seeking Professional Advice

- Tax advisors can optimize your applications.

- Software tools streamline the documentation process.

Takeaways

Tax credits are invaluable for fostering growth and innovation in New Zealand’s tech industry. By utilizing the tax credits for tech entrepreneurs in New Zealand discussed above, businesses can reduce costs, innovate sustainably, and expand globally.

From the R&D Tax Incentive to sustainability-focused credits, each program offers unique advantages tailored to different business needs.

Tech entrepreneurs should proactively explore these opportunities, ensuring their businesses thrive in an increasingly competitive global market. Seek professional guidance to maximize benefits and stay ahead in New Zealand’s dynamic tech ecosystem.