If you are comparing St Kitts vs Grenada citizenship for business, the decision in 2026 comes down to one core question: do you prioritize aggressive asset protection or strategic market access? following the historic 2024 Memorandum of Agreement (MOA), the era of “cheap” passports is over, with investment thresholds now harmonized at a $200,000 minimum. This shift forces investors to look past the price tag and focus purely on ROI.

In this high-stakes Caribbean showdown, two titans stand apart. St. Kitts & Nevis remains the “Platinum Brand” for wealth preservation and speed, while Grenada serves as the geopolitical “Swiss Army Knife” for entrepreneurs targeting the US and China. This guide delivers the definitive commercial analysis to help you decide which jurisdiction deserves your capital.

The “E-2 Visa” Factor: Grenada’s Ace in the Hole

The single most significant differentiator in this comparison is the United States E-2 Investor Visa. For many investors, this factor alone ends the debate immediately.

The Grenada Advantage

Grenada is the only Caribbean Citizenship by Investment (CBI) nation that holds a US-Grenada Treaty of Commerce (signed in 1983). This treaty allows Grenadian citizens to apply for the E-2 visa, a non-immigrant classification that permits you to reside and work in the United States to direct and develop a business in which you have invested a substantial amount of capital.

For a tech founder in Bangalore, a manufacturer in Shenzhen, or a crypto entrepreneur in Lagos, this is a “backdoor” to the American market that bypasses the erratic H-1B lottery and the years-long waiting lists of the EB-5 Green Card program. Once you obtain your Grenadian citizenship (approx. 6–9 months), you can theoretically apply for the E-2 visa at a US consulate. If approved, you, your spouse, and your children (under 21) can move to the US. Your spouse gains open-market work authorization, and your children can attend US schools.

St. Kitts’ Position

St. Kitts & Nevis does not have an E-2 treaty with the United States. A St. Kitts passport grants you a 10-year B-1/B-2 tourist visa (upon application), allowing you to attend meetings and conferences, but you cannot live or actively manage a company on US soil.

Business Use Case: The “Silicon Valley” Strategy

- Scenario: You run a SaaS company and need to open a sales headquarters in Austin, Texas.

- With St. Kitts: You are a tourist. You can visit for meetings, but you cannot be on the payroll or run daily operations.

- With Grenada: You can move to Austin on an E-2 visa, serve as CEO of your US subsidiary, and scale the business locally.

Tax Regimes Compared: True Zero vs. Territorial

While both nations are marketed as “tax havens,” the nuances of their tax codes in 2026 are critical for corporate structuring. The definition of “tax-free” differs significantly between the two.

St. Kitts & Nevis: The Fortress of Zero Tax

St. Kitts & Nevis is the closest thing to a “pure” tax haven remaining in the modern world.

- 0% Personal Income Tax: This applies to worldwide income. Whether you earn money from a local bakery in Basseterre or a hedge fund in Hong Kong, the personal income tax rate is 0%.

- No Capital Gains or Inheritance Tax: Your wealth can grow and pass to the next generation without state erosion.

- VAT Adjustments: To stimulate business post-MOA, the government has adjusted VAT rates (currently ~13-17%), but this affects consumption, not income.

Grenada: The Territorial System

Grenada operates under a territorial tax system.

- Foreign Income Exemption: You pay 0% tax on income earned outside of Grenada. If you live in Grenada but your business is registered in Dubai, you pay no tax on those dividends.

- The “Local” Catch: If you decide to move your physical headquarters to St. George’s and transact locally, you will face personal income tax on local earnings and a corporate tax rate of approximately 28%.

2026 Tax Exposure Comparison

| Tax Category | St. Kitts & Nevis 🇰🇳 | Grenada 🇬🇩 |

| Global Personal Income | 0% (Tax-Free) | 0% (Foreign Source Only) |

| Local Income Tax | 0% | 10% – 28% (Progressive) |

| Capital Gains Tax | 0% | 0% |

| Corporate Tax (Resident) | 33% (Exempt for Nevis LLCs) | ~28% |

| Inheritance/Gift Tax | 0% | 0% |

| Crypto Tax Policy | Friendly (Virtual Asset Bill) | Conservative / Unregulated |

Global Mobility and Market Access: The “China” Difference

Passport strength is often measured by a simple number (e.g., “150 countries”), but for a business person, quality of access trumps quantity.

The Numbers Game

St. Kitts & Nevis technically holds the stronger travel document. In the 2026 rankings, it offers visa-free or visa-on-arrival access to approximately 155–167 countries, including the UK, the Schengen Area (Europe), Russia, and Singapore. It is a powerful tool for global mobility.

The Strategic Gap: China

Grenada holds a rare and powerful card: Visa-Free Access to China.

Grenada and China have a mutual visa waiver agreement. For an import/export business owner who needs to visit factories in Guangzhou or trade fairs in Shanghai, a Grenada passport allows you to board a plane without the hassle of applying for a Chinese visa. St. Kitts & Nevis maintains diplomatic relations with Taiwan, not the People’s Republic of China, meaning St. Kitts citizens must apply for visas to enter mainland China.

European Access [Schengen]

Both nations currently enjoy visa-free access to the EU Schengen zone. However, be aware of the upcoming ETIAS (European Travel Information and Authorisation System) implementation. Both St. Kitts and Grenada citizens will need to register online before visiting Europe, likely starting mid-2026. This is not a visa, but an electronic waiver similar to the US ESTA.

Investment Thresholds and Costs [2026 Updates]

The 2024 MOA forced a “price harmonization” to prevent the devaluation of Caribbean citizenship. You can no longer find legal options for $100,000. In 2026, the entry price is steeper, but the asset quality is higher.

St. Kitts & Nevis Costs

St. Kitts positions itself as the “Premium” product, charging a premium price.

- SISC (Donation): The “Sustainable Island State Contribution” starts at $250,000 for a single applicant or a family of up to four.

- Real Estate: The minimum investment in a government-approved real estate project is $325,000. However, for a standalone private home (which offers higher resale value), the minimum is often $600,000.

- Fees: Post-approval government fees are lower here compared to Grenada, balancing out the higher donation cost for larger families.

Grenada Costs

Grenada remains slightly more cost-effective, especially for larger families or those looking to add siblings.

- NTF (Donation): The “National Transformation Fund” minimum is $235,000 for a main applicant and up to three dependents.

- Real Estate: The minimum is $270,000 for a share in a tourism project (like a luxury hotel). Investors must hold this asset for 5 years.

- “Sibling” Clause: Grenada is famous for allowing the inclusion of unmarried siblings (with no age limit) and parents/grandparents (no age limit) more easily than St. Kitts.

Minimum Investment Checklist [2026]

| Investment Route | St. Kitts & Nevis | Grenada |

| Donation (Single) | $250,000 (SISC) | $235,000 (NTF) |

| Donation (Family of 4) | $250,000 (SISC) | $235,000 (NTF) |

| Real Estate (Share) | $325,000 (Condo) | $270,000 (Hotel Share) |

| Private Home | $600,000+ | $350,000+ |

| Holding Period | 7 Years | 5 Years |

| Interview Requirement | Mandatory (Virtual) | Mandatory (Virtual) |

Speed and Due Diligence: “Platinum Standard” vs. “Deep Vetting”

Time is money. If your business deal relies on you having a second passport now, the processing timeline is your most critical metric.

St. Kitts & Nevis [The Ferrari]

St. Kitts has the oldest program (est. 1984) and the most streamlined processing unit.

- Speed: Applications are typically processed in 4–6 months.

- Efficiency: The Citizenship by Investment Unit (CIU) in St. Kitts is known for its responsiveness. They have recently introduced a “Board of Governors” to oversee the unit, ensuring that while due diligence is strict (mandated by the EU/US), the administrative workflow remains rapid.

- The Interview: St. Kitts was the first to implement mandatory virtual interviews for applicants aged 16+. This adds a layer of scrutiny but ultimately protects the value of the passport you are buying.

Grenada [The Volvo]

Grenada is known for “Deep Vetting.” Their due diligence is notoriously rigorous, involving multiple layers of international checks.

- Speed: Processing often takes 6–9 months.

- Scrutiny: Because of the E-2 treaty with the US, Grenada is under immense pressure to ensure no “bad actors” enter the system. Their background checks are forensic. This is a double-edged sword: it slows down your application, but it gives the Grenadian passport a high level of “street cred” with international banks and border agents.

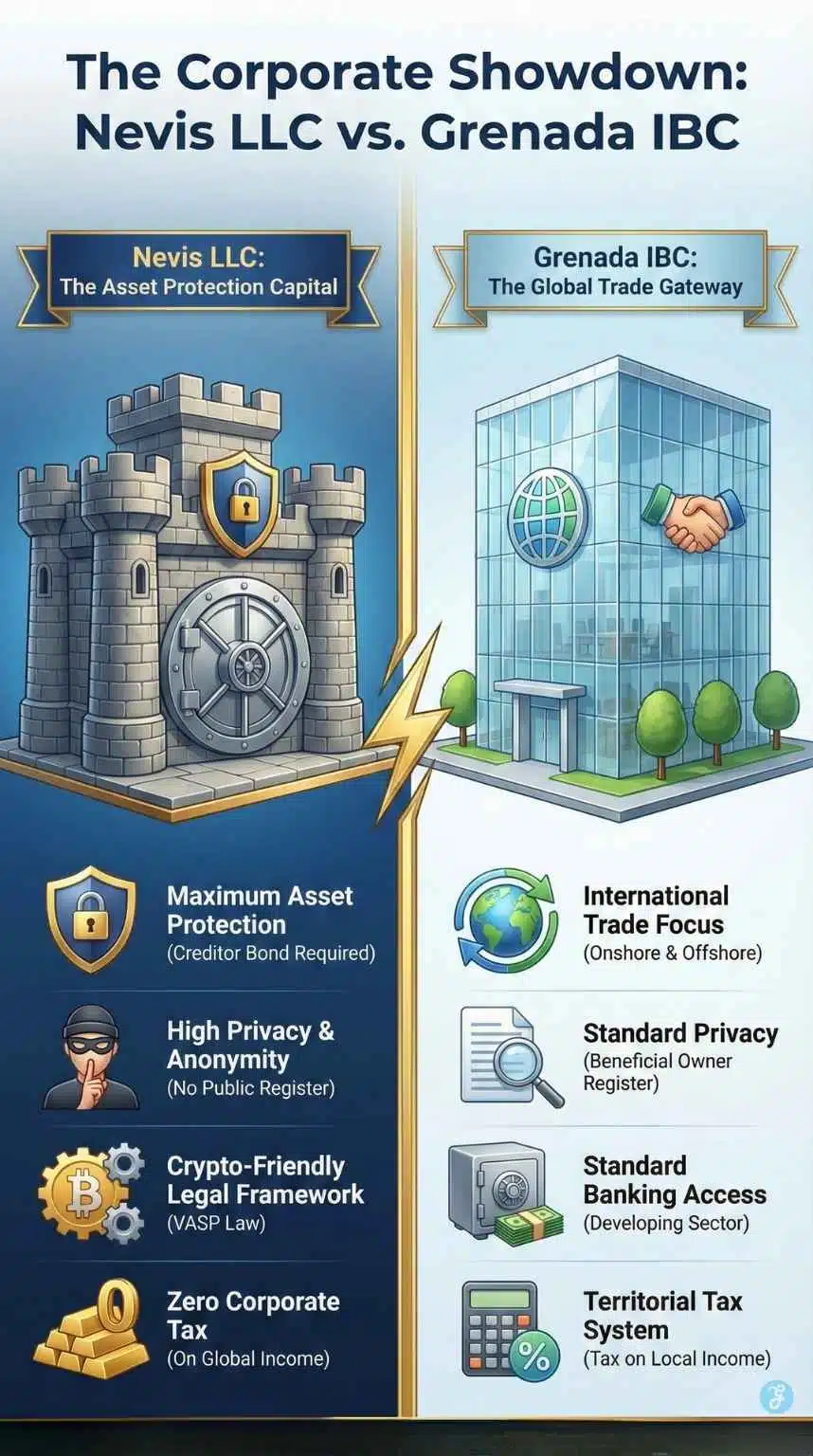

Corporate Environment: Nevis LLC vs. Grenada IBC

Beyond the passport, you must consider where to incorporate your business entities. This is where St. Kitts & Nevis, specifically the island of Nevis, dominates the conversation.

Nevis: The Asset Protection Capital

Nevis (the smaller island of the federation) has its own distinct financial services sector. The Nevis LLC (Limited Liability Company) is a world-famous legal structure.

- Lawsuit Protection: Nevis law makes it incredibly difficult for foreign creditors to seize assets held in a Nevis LLC. A creditor must post a $100,000 bond just to file a lawsuit in the Nevis courts.

- Privacy: There is no public registry of beneficial owners or managers.

- Cost: Setting up a Nevis LLC is affordable (approx. $1,800–$2,500), and maintenance is low.

- Crypto Friendly: St. Kitts & Nevis has passed the “Virtual Asset Bill,” creating a legal framework for crypto exchanges and ICOs, making it a haven for Web3 entrepreneurs.

Grenada: Developing but Standard

Grenada offers International Business Companies (IBCs), but it lacks the specialized asset protection legislation of Nevis.

- Focus: Grenada’s business sector is more “onshore” focused—tourism, agriculture (spices), and education (St. George’s University).

- Banking: Opening an offshore bank account in Grenada can be slower and more bureaucratic for non-residents compared to the streamlined banks in St. Kitts.

Deep Dive: Banking, Liquidity and The “Exit Strategy”

A second citizenship is an asset, but unlike a stock or bond, it is illiquid. Understanding how to bank with your new identity and how to eventually divest your investment is critical for your 10-year business horizon.

Banking in the Caribbean: The 2026 Reality

Contrary to popular belief, walking into a Caribbean bank with your new passport does not guarantee an instant account opening. Since the 2024 financial de-risking regulations, both St. Kitts and Grenada have tightened Know Your Customer (KYC) protocols.

- Grenada (The Documentation Route):

- Top Banks: Republic Bank (Grenada), Grenada Co-operative Bank.

- The Process: Non-resident accounts are possible but paper-heavy. You will need a “Bank Reference Letter” from your home country bank (e.g., Citibank, HSBC) and a Tax Identification Number (TIN) from your country of tax residence.

- Pro Tip: If you become a “tax resident” of Grenada (by spending ~183 days there), the due diligence drops significantly, and you gain access to local lending rates for mortgages (approx. 6–8%).

- St. Kitts & Nevis (The Offshore Hub):

- Top Banks: St. Kitts-Nevis-Anguilla National Bank, The Bank of Nevis.

- The “Nevis” Advantage: If you form a Nevis LLC, opening a corporate account is streamlined because the jurisdiction is built for this specific purpose. However, personal accounts for non-residents still require proof of “economic ties” to the island (e.g., your real estate deed or utility bill).

The Exit Strategy: Reselling Your Investment

Smart investors always ask: “How do I get my capital back?” The rules for reselling your citizenship-qualifying investment differ sharply.

- Grenada (5-Year Churn): You must hold your real estate investment for 5 years. After this period, you can sell the property to another CBI applicant. This is a massive advantage because it keeps the asset liquid; the next buyer gets citizenship, and you get your capital back (minus fees).

- St. Kitts & Nevis (7-Year Lock): The mandatory holding period for private homes is generally 7 years. The government enforced this to prevent “passport flipping” and to stabilize property values. If you buy a luxury villa in St. Kitts, view it as a long-term lifestyle hold rather than a short-term flip.

Lifestyle and Physical Residency: The “Plan B” Aspect

In the event of another global pandemic or geopolitical crisis, you may need to physically relocate to your new country. What is life actually like?

St. Kitts & Nevis: Luxury & Leisure

St. Kitts is a high-end tourist destination. It features the Park Hyatt, a private jet terminal, and the mega-yacht marina at Christophe Harbour.

- Vibe: Sophisticated, resort-heavy, and quiet.

- Infrastructure: excellent roads and internet connectivity (vital for digital businesses).

- Real Estate: High-quality luxury villas and condos designed specifically for the wealthy expat market.

Grenada: Authentic & Vibrant

Grenada is known as the “Spice Isle.” It is greener, more mountainous, and feels less like a manicured resort and more like a living Caribbean nation.

- Vibe: Authentic, community-focused, and lively.

- St. George’s University (SGU): The presence of a massive American medical university means there is a large expat community of students and professors, creating a demand for rental properties and diverse dining options.

- Safety: Grenada is located south of the hurricane belt, making it statistically safer from major storms than St. Kitts, a crucial factor for insuring physical business assets.

Future-Proofing Your Citizenship: Crypto and Europe

The landscape of 2026 is defined by digital assets and digital borders. Here is how both nations stack up against the threats and opportunities of the future.

The Crypto Factor: St. Kitts’ Virtual Asset Bill

If your wealth is on the blockchain, St. Kitts & Nevis is the superior jurisdiction.

- The Legislation: The Virtual Asset (Amendment) Act 2024 created a clear legal framework for “Virtual Asset Service Providers” (VASPs). Unlike other jurisdictions that operate in a grey area, St. Kitts provides legal certainty for crypto exchanges, wallet providers, and ICO issuers.

- Tax Implication: Because St. Kitts has 0% Capital Gains Tax, realizing profit from Bitcoin or Ethereum sales (while tax resident there) is generally a non-taxable event.

- Grenada’s Stance: Grenada is more conservative. While not anti-crypto, they lack the specific “Digital Asset” legislation that provides protection for Web3 businesses. Banks in Grenada may flag large crypto-sourced wire transfers more aggressively than those in Nevis.

The European “ETIAS” Wall [Late 2026]

A major concern for all Caribbean passport holders is the European Union’s new ETIAS (European Travel Information and Authorisation System).

- The Reality: Starting late 2026, visa-free travel to Europe will no longer be “spontaneous.” Citizens of St. Kitts and Grenada will need to apply for an electronic waiver (costing ~€20) at least 96 hours before travel.

- The Equalizer: This applies to both St. Kitts and Grenada equally. Neither passport offers an exemption.

- The Risk: The ETIAS system gives the EU a “digital switch” to screen Caribbean citizens. St. Kitts’ recent strict due diligence reforms (mandatory interviews) were specifically designed to satisfy EU requirements and ensure its citizens are “whitelisted” for ETIAS approval.

Strategic Verdict: Which Should You Choose?

The decision ultimately comes down to your primary business objective. We can categorize the best choice based on four distinct investor personas:

Persona A: The Market Expander

- Goal: You want to sell products in the USA or manufacture in China.

- Winner: Grenada. The combination of the E-2 Visa treaty for the US and visa-free access to China makes this the ultimate “Commercial Passport.” It connects you to the world’s two largest economies.

Persona B: The Wealth Protector

- Goal: You want to legally minimize taxes and protect your assets from frivolous lawsuits.

- Winner: St. Kitts & Nevis. The 0% worldwide tax regime, combined with the impenetrable asset protection laws of a Nevis LLC, makes this the superior choice for family offices and high-net-worth individuals.

Persona C: The Crypto Nomad

- Goal: You hold significant wealth in Bitcoin and want a jurisdiction that understands blockchain.

- Winner: St. Kitts & Nevis. With the Virtual Asset Bill and 0% capital gains tax, a digital Nomad can cash out crypto profits without a tax event (consult a tax professional).

Persona D: The Family Legacy

- Goal: You want a safe, stable second home for your parents, siblings, and children.

- Winner: Grenada. The ability to include siblings and parents of any age more easily, combined with the safety from hurricanes and the educational infrastructure of SGU, makes it a better “lifestyle” choice.

Final Thought: The Price of Sovereignty

In 2026, a second citizenship is no longer a luxury; it is a necessary insurance policy for your business continuity. While the Caribbean Showdown between St. Kitts and Grenada is fierce, the market has spoken. If your business needs access, go to Grenada. If your business needs protection, go to St. Kitts.

The initial investment of $200,000+ may seem steep compared to the prices of five years ago, but the cost of not having a Plan B, when borders close or tax laws change, is infinitely higher. Choose the passport that solves your most expensive problem.