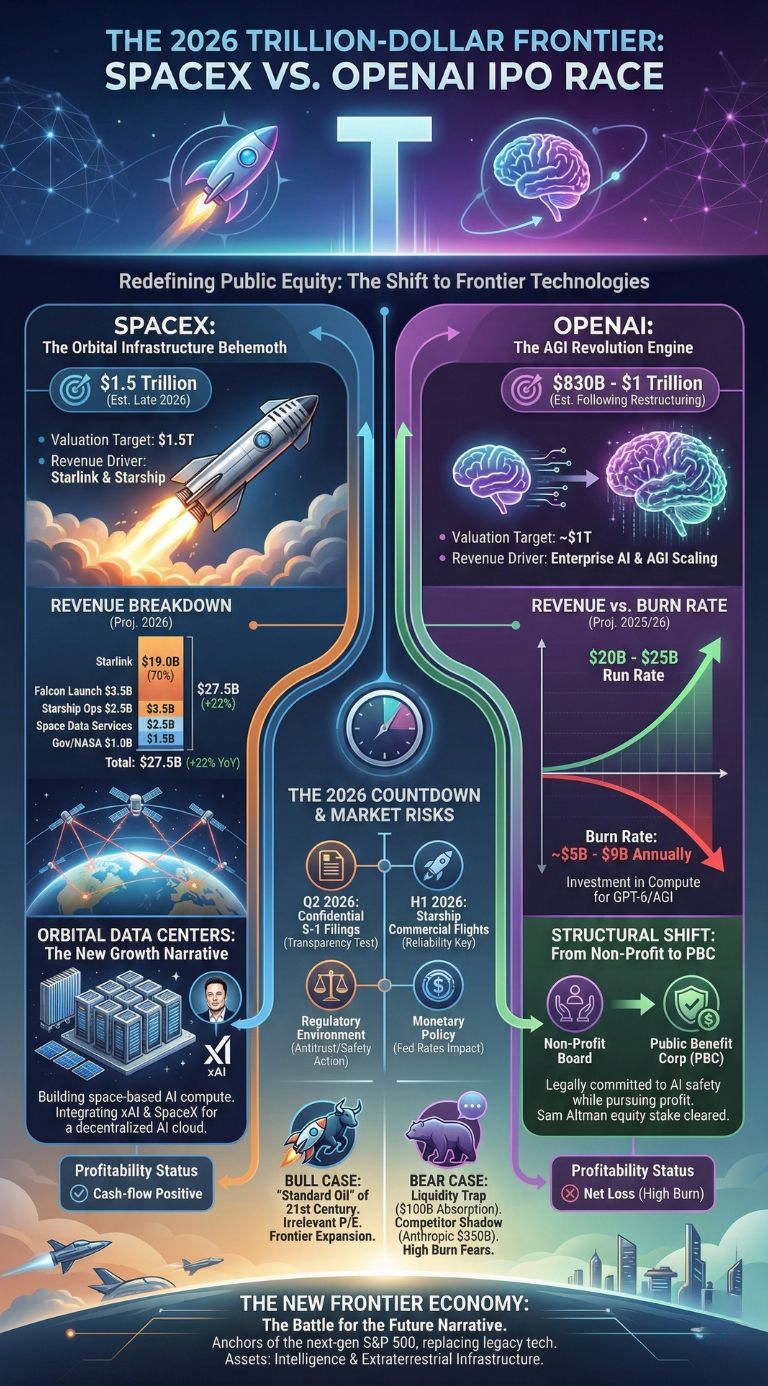

The potential public debuts of OpenAI and SpaceX in 2026 represent more than just massive financial exits; they signal a fundamental shift in the global economy toward frontier technologies. With combined rumored valuations approaching $3 trillion, these IPOs could redefine market indices and the very nature of public equity investment.2

Key Takeaways

- Valuation Targets: SpaceX is reportedly targeting a $1.5 trillion valuation for its late 2026 IPO, while OpenAI aims for a $1 trillion debut following a major corporate restructuring.3

- Revenue Drivers: SpaceX’s valuation is anchored by the maturation of Starlink (9 million subscribers) and the Starship program, whereas OpenAI’s growth relies on reaching AGI and scaling its enterprise revenue, which hit a $20 billion run rate in late 2025.

- Structural Shifts: OpenAI is transitioning into a Public Benefit Corporation (PBC) to facilitate its public listing, moving away from its legacy non-profit-controlled structure.5

- Orbital Data Centers: A significant new growth narrative for SpaceX involves building space-based AI data centers, a move that could integrate Elon Musk’s xAI and SpaceX into a singular infrastructure powerhouse.

- Market Sentiment: Investors are weighing the “generational shift” in technology against fears of a private market bubble, particularly as OpenAI continues to burn billions in its quest for artificial general intelligence.

The landscape of venture capital and public markets is currently witnessing a phenomenon that occurs once in a generation. For years, the “decacorn” (private companies valued over $10 billion) was the gold standard of success. Today, the conversation has shifted toward the “teracorn”—private entities eyeing trillion-dollar valuations.

The rumors surrounding an Initial Public Offering (IPO) for both OpenAI and SpaceX in 2026 have electrified Wall Street.8 Unlike the dot-com era or the SaaS boom of the 2010s, these companies are not just selling software; they are building the infrastructure for the next century of human progress. SpaceX controls the path to the stars and the world’s most expansive internet constellation, while OpenAI sits at the helm of the generative AI revolution.

How did we reach this precipice? For SpaceX, it has been a 25-year marathon of engineering triumphs and private capital patience. Elon Musk famously resisted an IPO for years, citing the risk that public shareholders would prioritize short-term profits over the long-term goal of colonizing Mars.10 For OpenAI, the journey has been a sprint—a rapid transformation from a non-profit research lab to a commercial juggernaut that redefined the “unicorn” trajectory in less than 36 months.

The Financial Engineering of a Trillion-Dollar Debut

Valuing a private company at $1 trillion requires more than just optimism; it requires a demonstrated path to dominance. In late 2025, SpaceX successfully completed a secondary share sale that valued the company at $800 billion, effectively doubling its valuation from just 18 months prior.11 This surge was fueled by the operational success of Starlink and the successful “booster catches” of the Starship program.

OpenAI, conversely, is navigating a more complex financial path. While its revenue has skyrocketed from virtually zero to an estimated $20 billion annualized run rate by the end of 2025, its “burn rate” remains a point of contention.12 Estimates suggest the company could be losing between $5 billion and $9 billion annually as it invests in the massive compute power required for GPT-6 and beyond.

Comparison of Rumored IPO Fundamentals (Est. 2026)

| Metric | SpaceX (Projected) | OpenAI (Projected) |

| Target IPO Valuation | $1.5 Trillion | $830 Billion – $1 Trillion |

| Annual Revenue (2025/26) | $22B – $24B | $20B – $25B |

| Primary Revenue Source | Starlink (70% of revenue) | Enterprise AI Subscriptions |

| Profitability Status | Cash-flow positive | Net Loss (High burn rate) |

| Key Competitive Moat | Reusable Launch Hardware | Advanced Model Reasoning (o1/GPT-6) |

| Lead Investment Banks | Morgan Stanley, Goldman Sachs | Thrive Capital, Microsoft (Strategic) |

The divergence in their paths is clear: SpaceX is an industrial and infrastructure play with high barriers to entry and increasing margins.13 OpenAI is a software and compute play with lower barriers to entry (as seen with Anthropic and xAI) but potentially infinite scalability if it achieves AGI.

Structural Metamorphosis: From Non-Profit to Public Benefit

One of the most critical hurdles for the OpenAI IPO is its governance. Historically, OpenAI was controlled by a non-profit board whose mission was to ensure AGI benefits all of humanity. However, a 2026 IPO necessitates a structure that public investors can trust.

OpenAI’s transition to a Public Benefit Corporation (PBC) is a strategic middle ground.14 It allows the company to pursue a profit motive while legally retaining its commitment to AI safety and public benefit. This shift also includes a significant restructuring of its relationship with Microsoft, which currently holds a 27% stake.15 Reports indicate that California regulators have already cleared the path for this recapitalization, allowing CEO Sam Altman to hold a direct 7% equity stake—a move that would make him one of the world’s wealthiest individuals upon listing.

Evolution of OpenAI Valuation and Structure

| Year | Milestone | Valuation | Key Outcome |

| 2023 | Thrive Capital Tender Offer | $29 Billion | Initial employee liquidity |

| 2024 | $6.6B Funding Round | $157 Billion | Shift to “Capped Profit” focus |

| 202516 | Secondary Market Trading17 | $500 Billion18 | Restructuring into a PBC19 |

| 2026 (Est) | Rumored IPO Filing | $830B – $1T | Full public market access |

The “Space AI” Convergence: Why SpaceX is More Than a Rocket Company

Analysts often struggle to categorize SpaceX. Is it a defense contractor? A telecommunications provider? In 2026, a new category has emerged: Orbital Data Infrastructure.

Rumors suggest that the 2026 IPO is being timed to coincide with the launch of “Space Data Centers.” By utilizing the Starlink constellation and the massive payload capacity of Starship, SpaceX aims to host AI processing in orbit. This solves two terrestrial problems: cooling and energy. In the vacuum of space, heat rejection and solar power are abundant.

This creates a synergistic loop with Elon Musk’s other venture, xAI. If SpaceX provides the “hardware” (the orbital racks) and xAI provides the “software” (the models), Musk could build a decentralized AI cloud that is immune to terrestrial regulation and energy shortages. This “vertical integration of the future” is why bulls believe a $1.5 trillion valuation is not just possible, but perhaps conservative.

SpaceX Revenue Breakdown by Segment (2025 Actuals vs. 2026 Forecast)

| Segment | 2025 Revenue (Est) | 2026 Revenue (Proj) | Key Growth Factor |

| Starlink | $15.5 Billion | $19.0 Billion | Direct-to-Cell and Aviation |

| Falcon Launch | $4.5 Billion | $3.5 Billion | Market Saturation/Internal Use |

| Starship Operations | $1.0 Billion | $2.5 Billion | NSSL Phase 3 Contracts |

| Government/NASA | $1.5 Billion | $1.0 Billion | Moon/Mars Milestones |

| Space Data Services | $0 | $1.5 Billion | Initial Orbital AI Compute |

| Total | $22.5 Billion | $27.5 Billion | +22% YoY Growth |

Market Risks: The “Aspirational” Valuation vs. Reality

While the excitement is palpable, veteran market analysts warn of the “Liquidity Trap.” The scale of these IPOs is unprecedented. If OpenAI and SpaceX both list in 2026, they would require the public markets to absorb nearly $100 billion in new shares almost simultaneously.

There is also the “competitor shadow.” Anthropic, OpenAI’s chief rival, is also rumored to be eyeing a 2026 IPO at a valuation of $350 billion. If Anthropic lists first and shows a more disciplined path to profitability, it could “chill” the appetite for OpenAI’s high-burn model. Similarly, if Tesla’s stock experiences volatility—as it has throughout 2025—it could affect the perceived “Musk Premium” on SpaceX.

The Competitive Landscape: 2026 “Trillion-Dollar Race” Participants

| Company | Status | Valuation Rumor | Strategic Edge |

| SpaceX | Rumored Q4 2026 | $1.5 Trillion | Launch Monopolist |

| OpenAI | Rumored Q3 2026 | $830B – $1T | First-mover in GenAI |

| Anthropic20 | Likely H1 202621 | $350 Billion22 | Focus on Safety/Enterprise23 |

| xAI | Private (Musk) | $230 Billion | Integrated with X/Tesla |

| Stripe | Anticipated | $120 Billion | Fintech Infrastructure |

“The real bubble may not be in the technology, but in the private market’s expectation of public market liquidity. Public investors are increasingly demanding ‘earnings’ rather than just ‘earnings potential’—a shift that might be painful for OpenAI.” — Market Analyst, Morningstar (January 2026)

Expert Perspectives: Interpretation of the 2026 Surge

The consensus among institutional investors is divided. One camp, often led by firms like Ark Invest and Thrive Capital, views these companies as the “Standard Oil” of the 21st century. They argue that traditional valuation metrics like P/E ratios are irrelevant for companies that are fundamentally expanding the boundaries of the human experience.

The opposing camp, comprised of value-oriented fund managers, points to the historical precedent of the “Nifty Fifty” or the 1999 tech peak. They argue that even if OpenAI succeeds in creating AGI, the cost of compute and the commoditization of models might prevent the company from ever achieving the margins required to justify a trillion-dollar market cap.

For SpaceX, the argument is more grounded in physics and logistics. As the only entity capable of mass-launching heavy payloads, SpaceX has a “chokehold” on the space economy. However, skeptics wonder if the transition from a “visionary mission” to a “publicly traded utility” will stifle the very innovation that made SpaceX successful.

What Happens Next? The 12-Month Countdown

As we move through 2026, several key milestones will determine if these rumors become reality:

- The “S-1” Filings: Watch for confidential filings in the second quarter of 2026. This will be the first time the public gets a look at OpenAI’s true balance sheet and the “equity-to-Microsoft” ratio.

- Starship Reliability: For SpaceX, the “cadence of success” is everything. If Starship begins regular commercial flights to orbit in the first half of 2026, the $1.5 trillion valuation will likely stick.

- The Regulatory Environment: Any antitrust action against OpenAI (due to its Microsoft ties) or SpaceX (due to its launch dominance) could delay these listings.

- Monetary Policy: If the Federal Reserve maintains a “higher-for-longer” interest rate stance, the appetite for high-valuation growth stocks may dampen, forcing both companies to delay or downsize their offerings.

Final Words: The Dawn of the Frontier Economy

The 2026 IPO race between OpenAI and SpaceX is not just a battle for capital; it is a battle for the narrative of the future. If these companies successfully transition to the public markets, they will likely become the anchors of the S&P 500, replacing legacy tech giants. They represent the “Frontier Economy”—an era where the most valuable assets are not oil or land, but intelligence and extraterrestrial infrastructure.24

Whether these valuations represent a peak in “AI hype” or the beginning of a multi-decade expansion remains to be seen. However, one thing is certain: the financial world will never be the same after the summer of 2026.