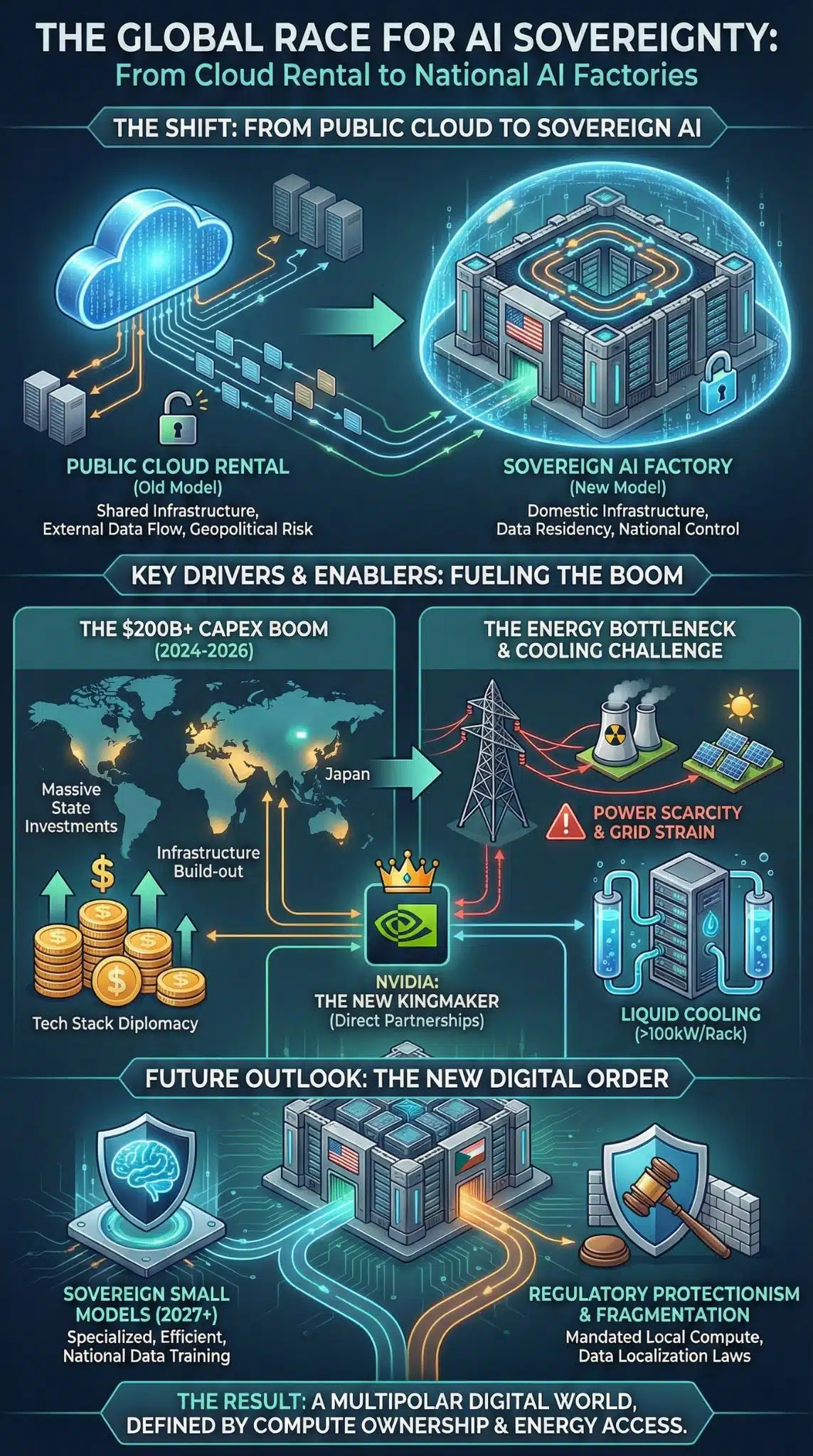

In 2026, the definition of national power has shifted from oil reserves and nuclear warheads to gigawatts of compute and sovereign silicon. As the US and China tighten their grip on the global technology stack, mid-sized powers—from the Gulf States to Europe and Japan—are frantically building “AI Factories” to ensure they are not reduced to digital vassal states. This escalating Sovereign AI race is redefining geopolitics, industrial policy, and national security in real time. This is no longer just a tech trend; it is the new industrial revolution of the 21st century.

The Great Decoupling: Why Nations Are Retaking Control

For the past decade, the global digital economy relied on a “rental” model: the world rented compute power from a trifecta of US giants—Amazon, Microsoft, and Google. By 2025, however, the geopolitical risks of this dependency became undeniable. The expansion of US export controls on semiconductors and the looming threat of data weaponization made one thing clear: if you don’t own the infrastructure, you don’t own the intelligence.

We are now witnessing the “hardware-ization” of AI policy. It is no longer enough to have a national AI strategy written on paper; nations need the physical GPUs spinning within their borders, under their laws, powered by their energy grid. This shift has birthed the “Sovereign AI” market—a sector projected to drive nearly 20% of global data center growth by 2027.

The urgency is driven by “AI Nationalism”—the belief that Artificial Intelligence is a fundamental national capability, akin to energy security or defense manufacturing. Leaders in Tokyo, Paris, and Abu Dhabi have realized that relying on foreign infrastructure for the engine of their future economy is a strategic vulnerability they can no longer afford.

The Geopolitical Pivot: Tech Stack Diplomacy

The most significant trend in 2026 is the emergence of “Tech Stack Diplomacy.” Nations are using their sovereign wealth funds and regulatory power to negotiate direct technology transfers. This is starkest in the Middle East, where the UAE and Saudi Arabia have pivoted from oil exports to compute imports.

By leveraging massive capital reserves, these nations are not just buying chips; they are buying entire ecosystems. The UAE’s massive investment vehicles, such as MGX, have effectively successfully courted Western tech giants to build locally, but on local terms. This challenges the traditional US-centric model where data flows out and services flow in. Instead, we see a model where the infrastructure is anchored locally, complying with strict data residency laws, while still utilizing Western IP.

Comparative Analysis: The Old Cloud vs. The Sovereign Cloud

| Feature | Traditional Public Cloud (Hyperscaler) | Sovereign AI Cloud (National) |

| Data Residency | Data often fragmented across global regions | Data legally mandated to stay within borders |

| Control Plane | Managed by US/China Tech Giants | Managed by Local Consortia / State Telcos |

| Latency | Variable, optimized for global traffic | Ultra-low, optimized for national industries |

| Legal Risk | Subject to US CLOUD Act / Foreign Subpoenas | Insulated by National Jurisdictions |

| Primary Goal | Efficiency & Scale | National Security & Economic Capture |

The Infrastructure Boom: Concrete, Copper, and Cooling

The physical manifestation of this trend is a construction boom of unprecedented scale. We are moving from “Hyperscale” (standard cloud data centers) to “Gigascale” (AI factories).

In Japan, the government’s massive ¥10 trillion ($65B+) push through 2030 has revitalized its semiconductor and data center sectors. Projects like the Rapidus foundry and SoftBank’s 300MW+ AI data centers in Hokkaido are not merely commercial ventures; they are state-backed imperatives to regain technological relevance.

The engineering challenges are immense. A traditional data center rack consumes 10-15 kilowatts (kW) of power. Sovereign AI clusters, running dense NVIDIA Blackwell architectures, demand 100kW to 120kW per rack. This requires a complete rethink of cooling (shifting to liquid cooling) and structural design.

Note: The shift to liquid cooling is no longer optional. With rack densities exceeding 100kW, air cooling is physically insufficient. This creates a secondary market boom for specialized engineering firms in Europe and Asia.

Economic Nationalization: Keeping Value at Home

Why spend billions building what you could rent for millions? The answer lies in the “Economic Multiplier of AI.”

If a nation trains its healthcare models on US servers, the intellectual property (IP) and the economic value capture tend to accrue to the infrastructure provider. By domesticating the “AI Factory,” nations aim to keep the entire value chain—from data generation to model training to inference application—within their GDP.

Projected Sovereign AI Investment Commitments (2024-2026)

| Region / Country | Key Initiative | Estimated Investment (USD) | Primary Strategic Goal |

| Japan | AI Promotion Act / Rapidus | ~$65 Billion | Revitalize semiconductor manufacturing & domestic AI compute. |

| Saudi Arabia | Vision 2030 / PIF Projects | ~$40 Billion+ | Diversify economy beyond oil; become regional AI hub. |

| France / EU | AI Continent Action Plan | ~$25 Billion (Public/Private) | “Digital Sovereignty” – reducing reliance on US Big Tech. |

| India | Sovereign AI Compute Mission | ~$10 Billion+ | “AI for All” – creating low-cost compute for domestic startups. |

| UK | National AI Research Cloud | ~$4 Billion | Academic and scientific leadership in AI safety and discovery. |

The Energy Equation: The 100GW Bottleneck

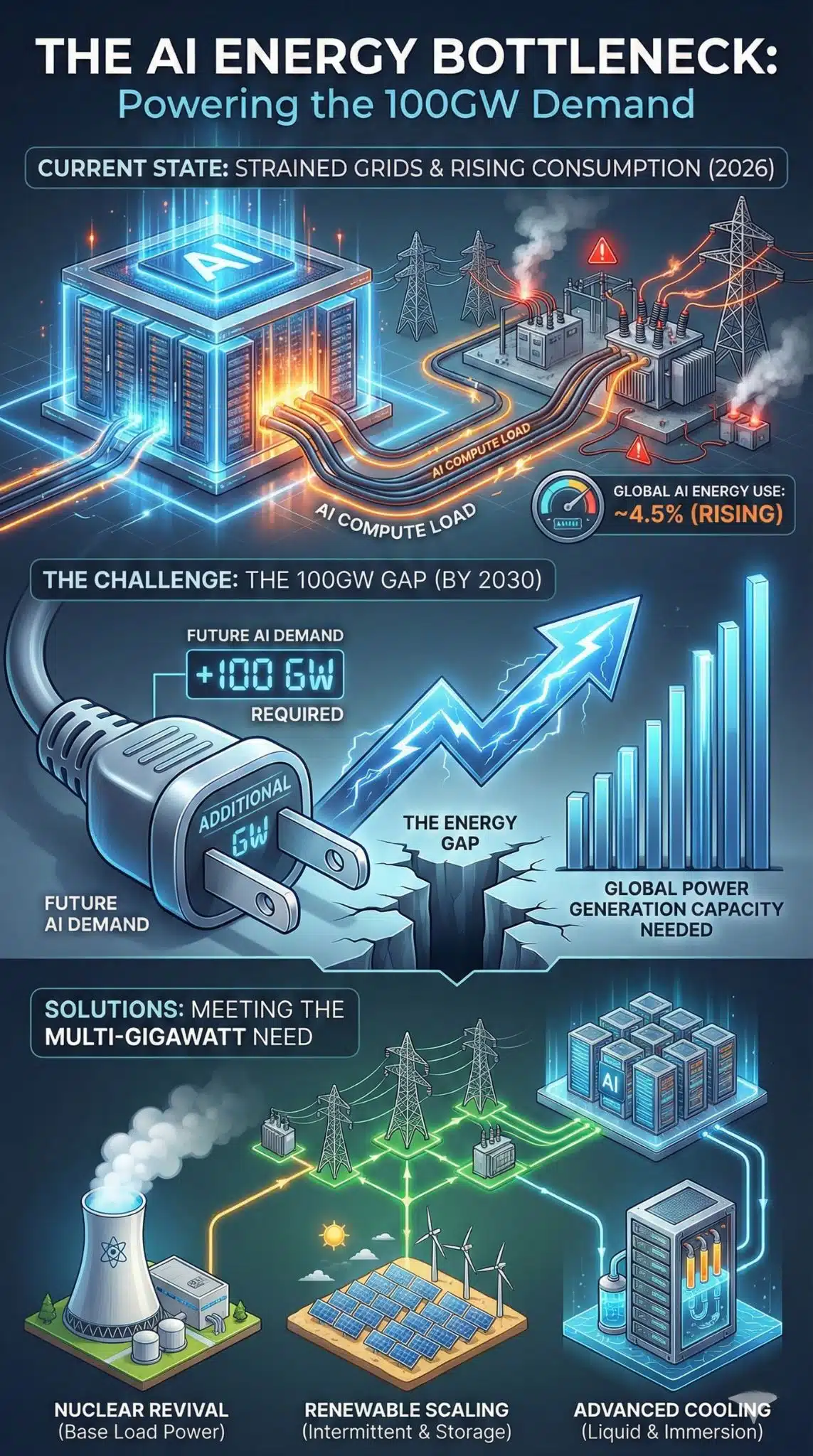

The greatest threat to AI sovereignty is not silicon scarcity, but energy scarcity. Training a sovereign Large Language Model (LLM) is energy-intensive; running it at a national scale is energy-exorbitant.

Current projections suggest that by 2030, AI data center demand could require an additional 75 to 100 gigawatts (GW) of generation capacity globally. This has forced a pragmatic—and controversial—return to nuclear energy.

- Japan: Restarting idled nuclear plants to power data centers.

- United States: Hyperscalers signing power purchase agreements (PPAs) with nuclear operators.

- Middle East: Leveraging vast solar arrays but grappling with the cooling costs (water/power) in desert climates.

Key Energy Statistics (2026 Outlook)

- AI Energy Share: AI data centers now account for ~4.5% of US electricity consumption, up from <2% in 2020.

- Grid Strain: Major hubs (Northern Virginia, Dublin, Tokyo) are enforcing “power pauses,” delaying new data center connections by 2-3 years.

- Green Premium: Sovereign clouds powered by 100% renewable energy are commanding a 15-20% price premium due to regulatory mandates in the EU.

Expert Perspectives

To understand the nuance of this shift, we must look at the diverging views on the effectiveness of this nationalism.

- The Pro-Sovereignty View: Analysts at firms like Gartner and IDC argue that “sovereignty is the only hedge against geopolitical volatility.” If a trade war cuts off access to US cloud APIs, a nation without domestic compute is instantly paralyzed. Domestic infrastructure acts as a national insurance policy.

- The Skeptic’s Counter-Argument: Critics, including researchers at the Brookings Institution, warn of “fragmentation and inefficiency.” By fracturing the global cloud into national silos, we risk raising costs and slowing innovation. A sovereign cloud in France or Japan will likely never match the economies of scale of a global AWS or Azure region, potentially leaving local startups paying higher prices for inferior compute.

“The irony of Sovereign AI is that while it promises independence, it often deepens reliance on a single hardware monopolist—NVIDIA. You may not be renting the server from Amazon anymore, but you are still buying the shovel from the same single supplier.” — Tech Policy Analyst, Jan 2026.

Future Outlook: What Happens Next?

As we look toward the remainder of 2026 and into 2027, three distinct phases will likely emerge in the Sovereign AI race:

- The “Hardware Hangover” (Late 2026): Billions of dollars in GPUs will arrive in countries that lack the skilled talent to optimize them. We will see a “utilization gap” where expensive hardware sits idle due to a shortage of ML engineers and cooling specialists.

- The Rise of “Sovereign Small Models” (2027): Realizing that training trillion-parameter models is too expensive for most nations, the focus will shift to “Sovereign SLMs” (Small Language Models)—highly specialized, efficient models trained on national datasets (e.g., a Japanese legal model, a Swedish healthcare model) that run on smaller, domestic infrastructure.

- Regulatory Protectionism (2027-2028): Governments will likely move from incentivizing domestic compute to mandating it. Expect laws requiring that “critical national data” (health, finance, government) must be processed on sovereign soil, effectively banning foreign hyperscalers from specific lucrative sectors.

The race for AI sovereignty is fundamentally a race for agency. In the 20th century, nations that did not industrialize were left behind. In the 21st century, nations that do not “cognitize”—by building their own AI factories—risk becoming mere colonies in a digital empire.

Final Thoughts

The race for AI sovereignty marks a definitive end to the era of borderless digital trust. As nations decouple from global hyperscalers to build domestic “AI Factories,” the geopolitical map is being redrawn in silicon and gigawatts. While the immediate hurdles of energy scarcity and talent gaps are steep, the long-term trajectory is set: national security now demands digital autonomy. For world leaders, the choice is no longer between efficiency and control, but between owning the future or renting it.