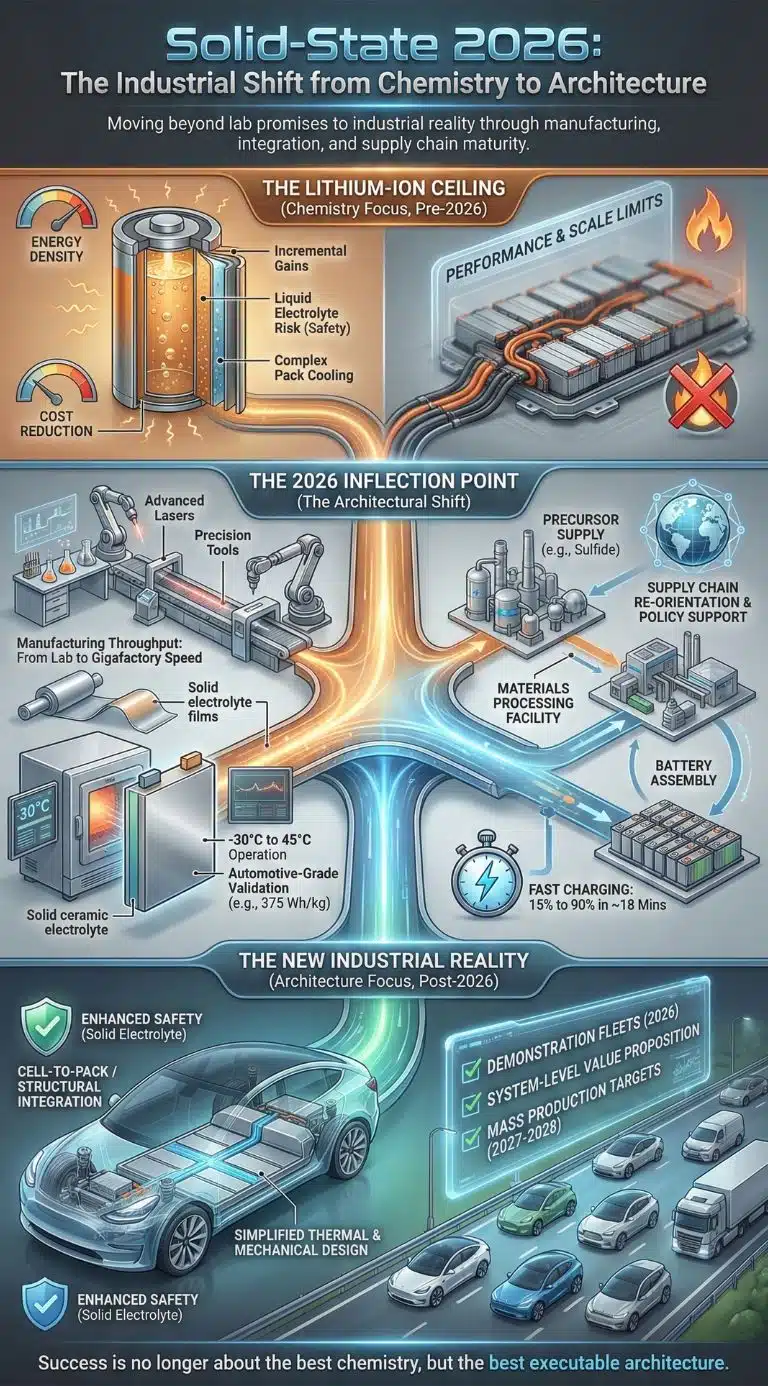

Solid-state EV battery architecture is moving from lab promise to industrial reality in 2026: carmakers are validating lithium-metal cells, suppliers are scaling solid electrolytes, and pack design is being rewritten. The payoff is longer range, faster charging, safer EVs, but bottlenecks are shifting.

How The Industry Got Here: The Lithium-Ion Playbook Is Running Out Of Easy Wins

For 15 years, the EV battery story has been mostly linear: scale lithium-ion production, squeeze costs, and incrementally improve energy density. That playbook worked. Battery demand crossed 1 terawatt-hour in 2024, a milestone that signals batteries are no longer a niche component but a global industrial pillar.

But scale creates its own ceiling. Once pack prices and manufacturing processes mature, the “next” gains are harder. Meanwhile, EV adoption is moving from early adopters to the mass market, where buyers are more sensitive to charging speed, cold-weather performance, and total cost of ownership. The result is an industry that still loves lithium-ion, but increasingly needs a new architecture, not just a better version of the old one.

That is the core reason solid-state keeps returning. Not because liquid-electrolyte batteries are “bad,” but because the next phase of EV growth rewards design leaps that change the trade-offs.

Key Statistics Shaping The 2026 Solid-State Moment

- Global lithium-ion pack prices hit a record low of $108/kWh in 2025, down 8% from 2024, per BloombergNEF. BloombergNEF

- In 2025, stationary storage packs averaged $70/kWh (down 45% year over year), and BEV packs averaged $99/kWh. BloombergNEF

- BloombergNEF puts average LFP packs at $81/kWh and NMC packs at $128/kWh in 2025. BloombergNEF

- The IEA highlights that EV batteries are increasingly shaped by chemistry shifts (including more LFP) as the industry scales. IEA

- Stellantis and Factorial validated automotive-sized solid-state cells at 375 Wh/kg, with fast charging from 15% to 90% in 18 minutes, and a target demo fleet by 2026. Stellantis.com

These numbers matter because solid-state is entering a world where conventional batteries are already cheap and improving. That raises the bar: solid-state must deliver clear system-level advantages, not just lab performance.

Why Solid-State EV Battery Architecture Is Shifting In 2026

Solid-state is often marketed as “beyond lithium,” but the real shift is beyond the current lithium-ion architecture, not beyond lithium as an element. Many leading solid-state designs still use lithium, often more of it, especially if they rely on lithium-metal anodes. The “beyond” is about structure:

- replacing flammable liquid electrolytes with solid materials

- enabling lithium-metal or anode-less designs that can boost energy density

- redesigning packs around pressure management, interfaces, and heat flow

The 2026 inflection is happening because multiple players are now crossing from coin cells and small prototypes into automotive-sized formats and manufacturable process steps.

A single example captures the shift in tone: Stellantis and Factorial described their progress not as a science experiment, but as an OEM-validation milestone, including pack integration work and a 2026 demonstration fleet. That is what “architecture” means in practice: the cell is only the beginning.

Comparative Snapshot Of Where The Industry Is Heading

| Attribute | Mainstream Li-Ion (2025 Reality) | Emerging Solid-State Direction (2026 Signal) |

| Cost baseline | $108/kWh avg pack price (all segments) | Higher today, must justify premium |

| Safety narrative | Improving, but liquid electrolyte risk remains | Solid electrolytes aim to reduce fire risk |

| Differentiator | Cost, scale, incremental efficiency | Energy density + fast charge + system simplification |

| Biggest constraint | Materials volatility, trade barriers | Yield, interfaces, manufacturability |

Breakthrough 1: Large-Format Cells Are Finally Proving They Can Behave Like Automotive Hardware

The hidden reason solid-state timelines kept slipping is that scale changes physics. Lab cells can look fantastic because they avoid the messy realities of large-area uniformity, defect tolerance, and repeated mechanical stress.

In 2025, Stellantis and Factorial claimed validation of 77Ah automotive-sized solid-state cells at 375 Wh/kg, with 600+ cycles progressing toward qualification, and operation across -30°C to 45°C. Stellantis.com

Why this is a 2026 story: Stellantis is explicitly moving from validation to a demonstration fleet by 2026, and the press release emphasizes pack architecture optimization, not just electrochemistry.

Interpretation: this is the moment solid-state stops being judged mainly by “headline specs” and starts being judged by whether OEMs can build reliable packs and warranty them. If demonstration fleets hold up in 2026, the conversation shifts from if to how expensive, and for which vehicle classes.

Breakthrough 2: Manufacturing Is Moving From “Can We Make It?” To “Can We Make It Fast Enough?”

Solid-state’s bottleneck is increasingly a factory question. QuantumScape’s June 2025 update is a good illustration because it focuses on throughput and footprint, not just battery performance.

QuantumScape said its “Cobra” separator process entered baseline production, designed to enable high-throughput, continuous-flow separator manufacturing, with about a 25x improvement in heat-treatment speed versus its prior “Raptor” process, and a smaller equipment footprint.

That detail matters because separator manufacturing is one of the hardest parts to scale for some solid-state designs. If separator lines remain slow and capital intensive, solid-state stays trapped in “premium niche.” If the process becomes faster and more compact, it becomes plausible to imagine gigafactory-level buildouts.

Interpretation: 2026 is likely to reward the companies that treat solid-state as a manufacturing platform problem. The winners may look less like “battery startups” and more like “advanced process engineering companies.”

Breakthrough 3: The Supply Chain Is Re-Orienting Around Solid Electrolytes, Not Just Lithium Carbonate

A common misunderstanding is that battery supply chain risk is only about lithium. In reality, mature EV supply chains are a choreography of cathode materials, anodes, electrolyte solvents, separators, and equipment.

Solid-state shifts this choreography. It introduces new dependencies, especially for sulfide-based electrolytes.

Reuters reported that Idemitsu plans a large-scale lithium sulphide plant (a key material for some all-solid-state batteries), aiming for completion by June 2027, with 1,000 metric tons/year capacity, and an estimated 21.3 billion yen cost. Reuters also reported this could support solid electrolyte supply for roughly 50,000 to 60,000 EVs annually, with Toyota as the initial customer.

Interpretation: this is what “industrialization” looks like. When chemical companies build dedicated plants for electrolyte precursors, solid-state stops being only an R&D race and becomes a procurement race. And procurement races have geopolitical consequences because they create new strategic materials and new chokepoints.

This also helps explain why 2026 is a real turning point: the industry is building the upstream scaffolding now, so that 2027–2028 targets have a shot at being more than slides.

Breakthrough 4: Automakers Are Treating Solid-State As A Pack And Platform Decision, Not A Cell Choice

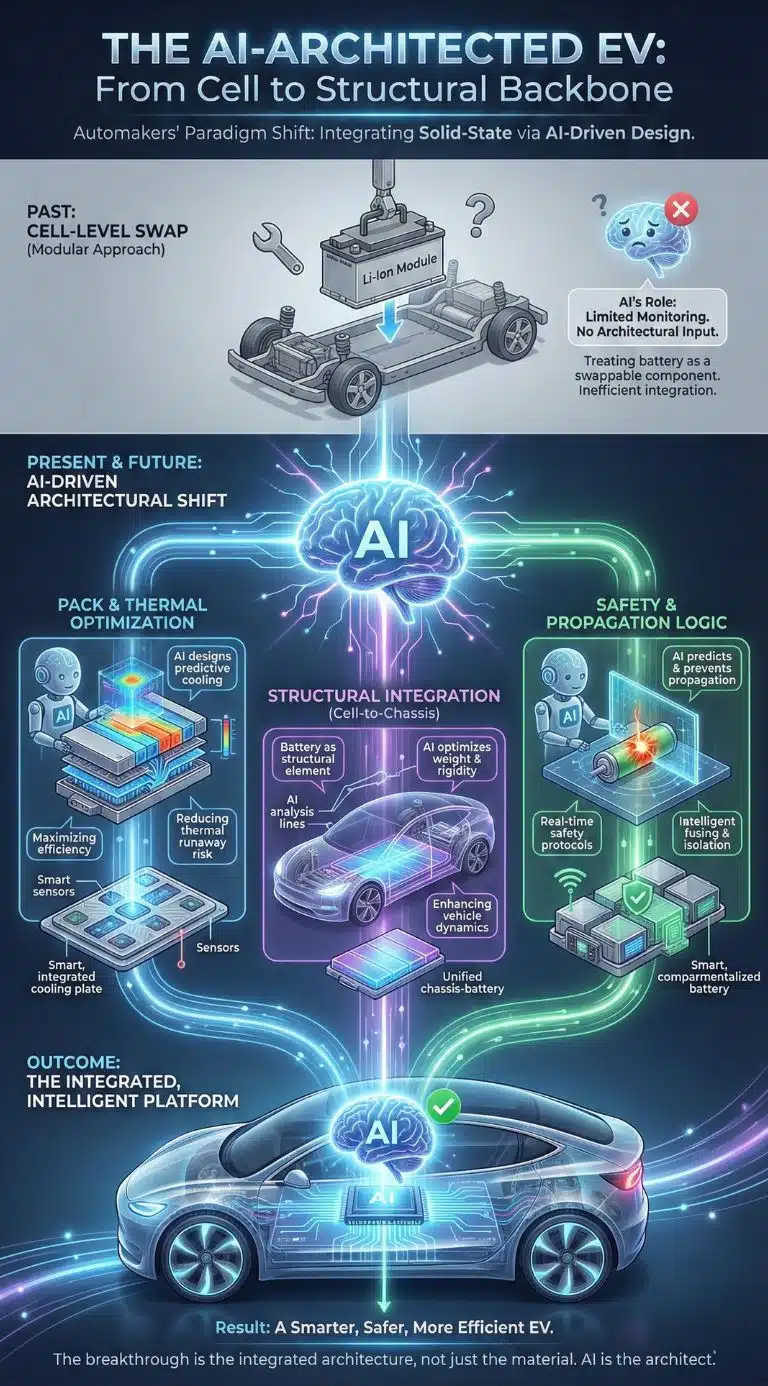

The most important shift in 2026 may be psychological inside automakers. The first decade of mass EVs treated battery packs as expensive modules to be packaged into existing vehicle architectures. The next decade treats the battery as a structural and thermal backbone.

Stellantis explicitly says its collaboration with Factorial extends beyond cells into “optimizing pack architecture,” vehicle integration, and system efficiency.

Samsung SDI’s roadmap messaging also points in the same direction: it frames solid-state as part of a broader “super-gap” technology suite, including cell-to-pack concepts and fast charging ambitions. Interpretation: solid-state will not succeed simply by swapping a new cell into an old pack. Its value proposition comes from redesigning the pack around what solid-state allows (and requires), including:

- different thermal behavior

- different mechanical constraints, including stack pressure management

- different safety and propagation logic

- potentially fewer components if some designs reduce separator needs

This is why the word architecture is the right lens. The real breakthrough is not a single material, but the integration of materials, pack design, and manufacturing.

Breakthrough 5: National Industrial Policy Is Quietly Converting Solid-State Into A Strategic Asset

Japan’s policy posture shows how governments increasingly treat batteries as “infrastructure” rather than consumer electronics.

Toyota said its next-generation battery development and production plans, including “all-solid-state batteries,” were certified by Japan’s METI under a “Supply Assurance Plan for Batteries.” The release also lists production plans that begin from 2026 and scale toward 9 GWh/year for certain next-generation batteries.

Separately, Reuters noted Toyota’s partnerships and upstream moves (like Idemitsu’s lithium sulphide plan) are explicitly tied to Toyota’s goal of launching EVs with all-solid-state batteries in the 2027–2028 window.

Interpretation: when industrial policy becomes an enabler, “time-to-market” is no longer determined only by engineering. It is shaped by permitting, subsidies, and guaranteed demand signals. That can accelerate commercialization, but it can also distort it by keeping suboptimal approaches alive longer than the market would.

Breakthrough 6: The Cost Baseline Is Collapsing, Which Changes Solid-State’s Business Case

Here is the twist that makes 2026 genuinely interesting. Solid-state is advancing, but lithium-ion is not standing still.

BloombergNEF’s 2025 survey shows the world is approaching a world where many battery applications are already at or near psychologically important thresholds. Average BEV packs were $99/kWh, and stationary storage packs $70/kWh in 2025.

Those prices are not just trivia. They reshape strategy in three ways:

- Solid-state must target segments where its advantages are monetizable.

Long-range premium vehicles, performance models, and applications where safety and energy density are worth paying for. - Conventional chemistries buy time.

If automakers can hit cost targets with LFP or improved NMC, they can delay risky transitions. - The first solid-state “win” may be system-level.

If solid-state reduces pack complexity, improves crash safety, or unlocks platform simplification, its value can show up outside the cell bill of materials.

Cost And Chemistry Reality Check

| 2025 Benchmark (BNEF) | Number |

| Global average pack price (all segments) | $108/kWh |

| BEV pack average | $99/kWh |

| Stationary storage pack average | $70/kWh |

| Average LFP pack price (all segments) | $81/kWh |

| Average NMC pack price (all segments) | $128/kWh |

Interpretation: solid-state is moving forward in a market that is becoming brutally price-competitive. That is why many 2026 announcements emphasize manufacturing efficiency and scale, not just performance.

Who Wins And Who Loses If Solid-State Scales

| Likely Winners | Why | Likely Losers | Why |

| Solid electrolyte and precursor suppliers | New high-value materials category | Some liquid electrolyte solvent ecosystems | Demand share shifts, margin pressure |

| High-precision process equipment makers | Ceramic films, coating, sintering, dry processing | Legacy separator leaders (certain segments) | Some solid-state designs reduce separator needs |

| Automakers with platform redesign capability | Can capture system-level value | “Cell swap” EV programs | Harder to exploit architecture gains |

| Battery makers with yield discipline | Scale is the differentiator | Overhyped timelines | Market punishes missed ramp claims |

This is not a guarantee, but it reflects how architecture shifts usually redistribute value: toward process know-how and upstream specialty materials.

Expert Perspectives: Why Skeptics Still Have A Point

If you only read company press releases, you would think solid-state is inevitable. But the skeptic case is not anti-innovation, it is pro-economics.

A high-profile example came from Panasonic’s leadership, reported by the Financial Times, suggesting solid-state could remain a niche, with early value in smaller devices rather than mainstream EVs.

Even without adopting Panasonic’s exact conclusion, the reasoning is important:

- Yield and defects are brutally expensive at automotive scale.

- Interface stability can look fine in tests but degrade over long cycles and real-world vibration.

- Pressure management and pack mechanical design can add cost and complexity.

- Cheap lithium-ion reduces urgency for consumers and OEMs.

Neutral synthesis: 2026 is not the year solid-state “wins.” It is the year solid-state stops being judged by prototypes and starts being judged by manufacturing ramps, supply contracts, and fleet performance.

What Happens Next: The Milestones That Will Define 2026–2028

A Practical Timeline To Watch

| Year | Milestone | Why It Matters |

| 2024 | Battery demand passes 1 TWh | Confirms batteries are a core industrial sector |

| 2025 | Cobra separator process enters baseline production | Manufacturing throughput becomes central |

| 2025 | OEM-validation claims on large-format cells (375 Wh/kg) | Solid-state judged as automotive hardware |

| 2026 | Demonstration fleets and platform integration | Real-world reliability and pack design become decisive Stellantis.com |

| 2027 | Electrolyte precursor capacity comes online (Idemitsu target) | Upstream supply chain becomes real |

| 2027 | Mass production targets by some majors (e.g., Samsung SDI) | Commercial claims meet factory reality news |

The Two Most Important Questions Investors And Consumers Should Ask

- Does solid-state reduce total system cost, not just improve cell specs?

If pack complexity rises faster than energy density, the economics break. - Which architecture wins: sulfide, oxide, polymer, or hybrid?

The industry may not converge quickly. Different solutions may dominate different vehicle segments.

Final Thoughts: Why 2026 Matters More Than The First “Solid-State EV” Headline

The most important outcome of 2026 may be clarity.

Solid-state batteries are no longer a single promise. They are becoming a set of competing architectures, each with different manufacturing requirements and supply-chain implications. The breakthroughs that matter are not flashy range claims, but quieter signals: validated large-format cells, faster separator manufacturing, chemical plants for electrolyte precursors, and policy frameworks that treat batteries as strategic infrastructure.

At the same time, lithium-ion’s relentless cost decline creates a harsh reality. With global pack prices at $108/kWh in 2025 and BEV packs averaging $99/kWh, solid-state must earn its place by delivering value that consumers can feel and automakers can monetize. BloombergNEF

So “beyond lithium” in 2026 is really “beyond incrementalism.” The battery race is shifting from chemistry headlines to architectural execution. The next winners will be the ones who can manufacture, integrate, and warranty the future, not just invent it.