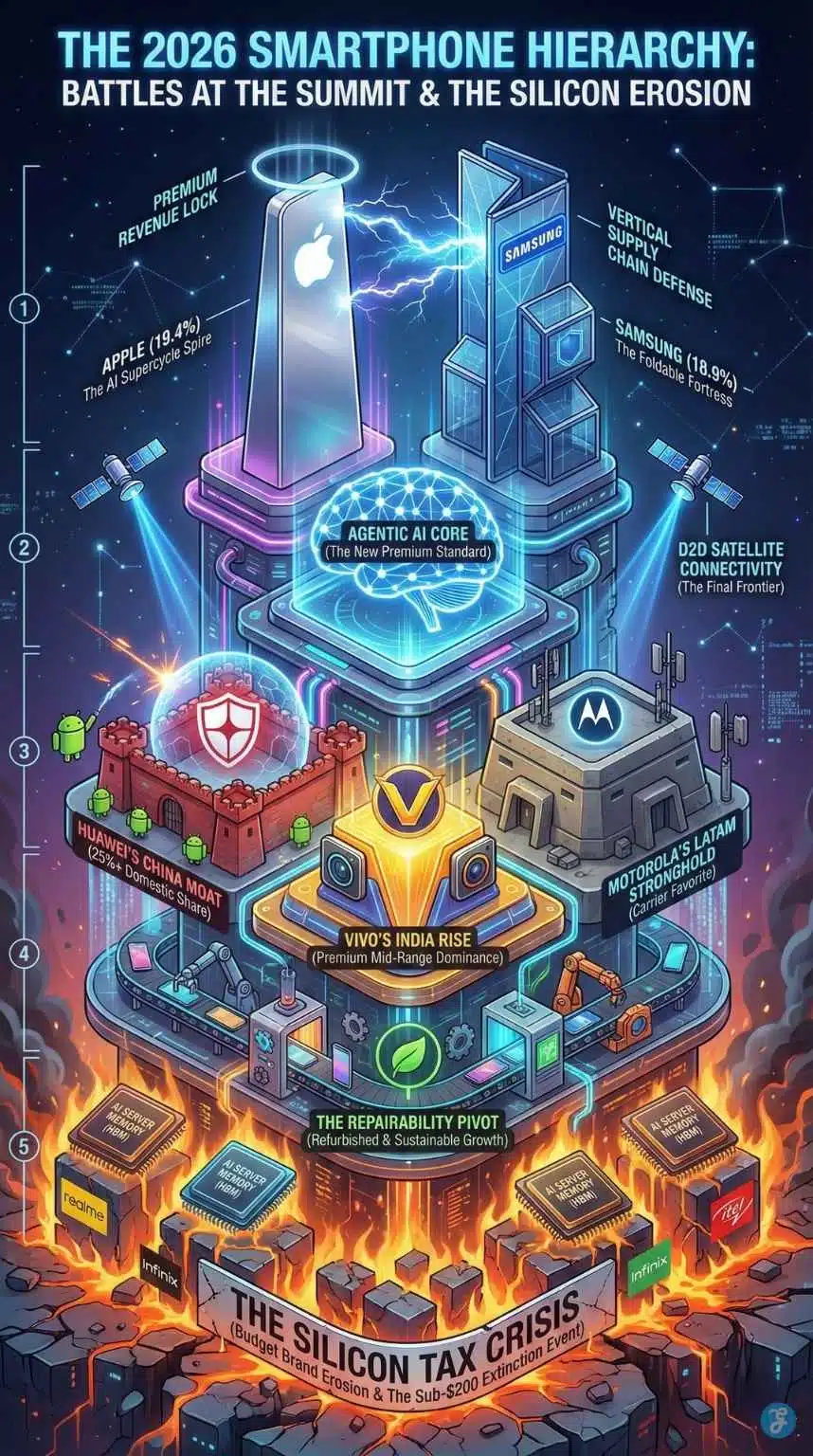

Smartphone Market Share 2026 is shaping up to be a definitive test of resilience rather than just a race for volume. As we move deeper into the decade, the industry faces a paradoxical crisis: technology is advancing at breakneck speed with “Agentic AI” and tri-fold displays, yet the global market volume is projected to contract by approximately 2.1% compared to previous years.

This decline is not due to a lack of consumer interest, but rather a perfect storm of rising component costs—specifically memory chips cannibalized by the booming AI server industry—forcing prices up and squeezing out the budget players. For the first time in history, the battle isn’t just about who can sell the most phones; it’s about who can survive the “Silicon Tax.”

While Apple and Samsung are locked in a dead heat at the top, capturing nearly 40% of the global market combined, smaller players in China and India face an existential threat as bill-of-materials (BoM) costs skyrocket.

Key Takeaways: The 2026 Forecast

-

Market Contraction: Global shipments are expected to dip by ~2.1%, largely hitting the sub-$200 sector.

-

The Duopoly Tightens: Apple and Samsung are projected to hold ~19% market share each, distancing themselves from the pack.

-

Price Hikes Incoming: Average Selling Prices (ASPs) are forecast to rise by 6.9% globally, with India seeing potentially 10-15% hikes.

-

The “Silicon Tax”: A shortage of high-end memory chips (diverted to AI servers) is driving up manufacturing costs by 15-20%.

-

Rise of “Agentic AI”: The marketing buzz is shifting from “AI assistants” to “autonomous agents” that act on your behalf.

The “Zero-Sum” Reality: Contextualizing the 2026 Battlefield

Before analyzing the specific brand wars, it is crucial to understand the unique hostility of the 2026 market. Unlike previous years, where a “rising tide lifted all boats,” 2026 is defined by a shrinking ocean. With global shipments contracting by ~2.1%, growth is no longer organic—it must be stolen.

This scarcity has triggered a “K-Shaped” polarization in the industry:

-

The Premium Tier (>$800): Thriving. Consumers are willing to pay extra for “Agentic AI” and status, insulating Apple and Samsung from the worst of the economic downturn.

-

The Budget Tier (<$200): Collapsing. The “Silicon Tax” (rising memory costs) has made sub-$150 phones mathematically impossible to manufacture with decent margins, leaving brands like Transsion and Realme fighting over a vanishing customer base.

Consequently, the battles listed below are not friendly competitions for new users; they are aggressive campaigns to cannibalize competitors’ existing market share. Every percentage point gained by one brand in 2026 is a direct loss inflicted upon another, setting the stage for the most ruthless year in smartphone history.

10 Biggest Smartphone Market Share Battles in 2026

From the historic disruption at the industry’s summit to the desperate survival tactics in the budget trenches, these are the ten definitive conflicts reshaping the global smartphone hierarchy in 2026.

1. The War for the Crown: Apple vs. Samsung (The 19% Deadlock)

The headline battle for Smartphone Market Share 2026 remains the duel between the titans. Entering the year, Apple has managed to carry significant momentum from its iPhone 17 “supercycle,” challenging Samsung’s historical dominance.

| Metric | Apple (Projected 2026) | Samsung (Projected 2026) |

| Global Market Share | 19.4% | 18.9% |

| Primary Growth Driver | iPhone 17 Air / Emerging Markets | Galaxy S26 Ultra / Foldables |

| Strategic Advantage | High ASP resilience | Vertical Integration (Screens/Memory) |

- The Apple Surge: Apple’s strategy of simplifying its lineup with the ultra-slim “iPhone Air” model has paid off, attracting upgraders who were previously holding onto older devices. Their dominance in the premium sector allows them to absorb component price hikes without alienating customers.

- Samsung’s Defense: Samsung faces a tougher road. The Galaxy S26 series is rumored to face “price complications” due to the rising cost of the Snapdragon 8 Gen 5 and memory modules. However, Samsung’s internal control over display and memory production gives it a lever to pull that Apple doesn’t have. Expect Samsung to aggressively push its A-series in Latin America to defend its volume lead.

2. The “Silicon Tax”: Why the Budget Phone is Dying

The most significant untold story of 2026 is the death of the ultra-low-end smartphone.

-

The Cause: The AI boom requires massive amounts of HBM (High Bandwidth Memory). Manufacturers like SK Hynix and Samsung Semiconductor have shifted production lines away from standard mobile RAM to server-grade memory.

-

The Effect: This has created a shortage of standard LPDDR5X RAM used in phones. BoM costs for entry-level devices have spiked by 20-30%.

-

The Victim: Brands like Realme, Infinix, and Itel, which thrive on razor-thin margins in the sub-$150 category, are being forced to either raise prices (killing demand) or exit certain tiers entirely. This “Silicon Tax” is artificially deflating global shipment numbers.

3. The Battle for China: Huawei’s “Harmony” Fortress

While the world worries about chips, Huawei is playing a different game in China.

-

The Shift: By 2026, Huawei’s HarmonyOS Next, which completely dropped support for Android APKs, will have matured. This has created a “moat” around the Chinese market.

-

Market Impact: Huawei is projected to capture a staggering 25-28% of the domestic Chinese market in Q1 2026, pushing Apple to a distant second.

-

The Patriot Premium: Chinese consumers are increasingly opting for the Mate 80 series, viewing it as a badge of technological sovereignty. For Apple, China is becoming a harder nut to crack, forcing it to pivot focus toward India and Vietnam for growth.

4. India: Premiumization Amidst Inflation

India, usually the battleground for volume, is becoming a battleground for value.

-

Price Shock: Retail associations in India have warned of a 10-15% price hike across the board in 2026 due to currency fluctuation and the aforementioned component shortages.

-

The Winner: Vivo. The BBK-owned brand has successfully navigated this by dominating the “premium mid-range” ($300-$500) sector. They have convinced Indian users to pay more for better cameras and design, insulating them slightly from the entry-level bloodbath.

-

The Loser: Xiaomi’s budget Redmi dominance is under fire as they struggle to keep their popular “Note” series under the critical ₹20,000 price point without sacrificing specs.

5. The AI Shift: From “Assistive” to “Agentic”

In 2024 and 2025, AI on phones was about “summarizing emails” or “magic erasing photos.” In 2026, the market share for high-end phones will be driven by Agentic AI.

-

What is it? Phones that can do things for you autonomously (e.g., “Book me a ride to the airport and email my wife my ETA”).

-

Market Share Impact: This feature set is exclusive to devices with NPU capability (Neural Processing Units). This effectively splits the market into two: “Smart Phones” (Legacy) and “Intelligent Phones” (Agentic).

-

Dominance: Apple (Apple Intelligence) and Google (Gemini Nano) are the clear leaders here, using this software advantage to lock users into their hardware ecosystems.

6. Foldables: The Tri-Fold Comparison

2026 is officially the year the “Tri-Fold” goes mainstream.

-

Samsung vs. The World: After watching Huawei launch the first tri-fold, Samsung is expected to strike back with the Galaxy Z Tri-Fold globally.

-

Market Share Niche: While foldables still represent less than 5% of total volume, they represent nearly 15% of total revenue for Samsung.

-

Durability War: The key differentiator in 2026 isn’t just the screen size, but the dust resistance. Samsung’s ability to offer IP-rated dust resistance on a tri-fold device is expected to give it a 70% share of this ultra-niche, ultra-expensive market segment.

7. The Sub-$200 Extinction Event

As mentioned, the rising cost of memory is decimating the entry-level market.

-

Global Impact: Shipments in Africa and Southeast Asia are predicted to slow down significantly.

-

The Strategy Shift: Brands like Transsion (Tecno/Infinix) are pivoting. Instead of flooding the market with $100 phones, they are pushing $200 5G devices, hoping to upsell their user base.

-

Risk: This is a gamble. If consumer purchasing power in these regions doesn’t match the price hikes, we could see a massive contraction in the “Next Billion Users” onboarding rate.

8. OS Wars: The Fragmentation of Android

For a decade, it was iOS vs. Android. In 2026, the “Android” block is fracturing.

-

China: HarmonyOS has effectively replaced Android for 20% of the world’s population.

-

The Rest: Google is tightening its grip on “Stock Android” with the Pixel line (holding ~6% share in Western markets), while Samsung pushes One UI as a distinct experience.

-

Result: The concept of a unified “Android Market Share” is becoming less relevant. Developers now have to optimize for three distinct major platforms: iOS, Google-Android, and HarmonyOS.

9. Regional Shifts: The Latin American Fortress

While eyes are on Asia, Motorola has quietly built a fortress in Latin America.

-

The Comeback: Leveraging the gap left by LG years ago, Motorola has secured nearly 30% market share in key LATAM countries like Brazil and Mexico.

-

Why? They avoided the flagship wars and focused on reliable, mid-range phones that carriers love. In 2026, as Chinese brands struggle with the “Silicon Tax” (import duties + chip costs), Motorola’s established local manufacturing hubs give them a pricing edge.

10. The Profit vs. Volume War

Finally, the most important metric for investors: Profit Share.

-

The Divergence: While volume dips, revenue is hitting record highs ($578.9 billion projected).

-

The King of Cash: Apple is expected to capture nearly 80% of the industry’s operating profit in 2026. Even if Samsung sells nearly as many phones, Apple makes vastly more money per unit.

-

The Danger Zone: For brands with less than 5% market share (Sony, Asus, etc.), 2026 might be the end of the road. The R&D costs for AI and the component costs for hardware are making the boutique smartphone business unsustainable.

Future Outlook: Beyond the Glass Rectangle (2027 & Beyond)

As the dust settles on the battles of 2026, the industry is already looking toward the next major form factor shift. If 2026 was the year of “Agentic AI,” 2027 is shaping up to be the year the physical definition of a smartphone finally changes.

The “iPhone Fold” Event Horizon

The industry’s worst-kept secret is expected to finally materialize in late 2027. Supply chain leaks suggest Apple has secured hinge patents that eliminate the “crease” entirely. The entry of an “iPhone Fold” (likely a flip-style foldable) would instantly validate the form factor for the mass market, potentially pushing foldable market share from 5% to 20% in a single year.

Samsung’s “Rollable” Response

Not to be outdone, Samsung is reportedly moving past folding screens entirely. Prototypes for the Galaxy Z Roll—a device that expands from a 6-inch phone to a 7.5-inch tablet by unrolling a flexible OLED display—are expected to debut. This technology aims to solve the thickness issue that currently plagues foldables.

The End of the “App Grid”

With Agentic AI maturing, the interface of the future (2027-2030) will likely move away from rows of app icons. Instead, we expect a shift toward “Intent-Based Interfaces,” where the OS predicts what you need (a boarding pass, a weather alert, a payment prompt) and presents it dynamically, reducing the need to open individual apps at all.

The Green Shift: Sustainability as a Status Symbol

In 2026, “New” is out; “Certified Pre-Owned” is in. As the “Silicon Tax” drives flagship prices into the stratosphere, a massive secondary market has emerged, turning sustainability from a moral choice into a financial necessity.

-

The Refurbished Boom: The global market for refurbished smartphones is projected to hit record volumes in 2026, growing at a CAGR of nearly 8-10%. The stigma of buying used is gone.

-

The “Right to Repair” Reality: With strict EU regulations taking full effect, 2026 marks the death of the “glued-shut” phone. Manufacturers like Nokia (HMD Global) and even Apple have been forced to redesign internal chassis for easier battery swaps.

-

The New Battleground: Brands are no longer just fighting to sell you a new phone; they are fighting to sell you their refurbished phones. Apple’s “Certified Refurbished” store and Samsung’s “Re-Newed” program are now major revenue pillars, stealing market share from third-party marketplaces like Back Market.

Beyond the Big Two: The Satellite & Connectivity Frontier

While the city-dwellers fight over AI features, a quiet revolution is happening in the world’s dead zones. 2026 is the year Direct-to-Device (D2D) satellite connectivity moves from a “safety feature” to a daily utility.

-

The “Sky-Fi” War: With partnerships like T-Mobile/Starlink and Apple/Globalstar fully operational, 2026 smartphones are the first generation to offer reliable texting and basic data without cell towers.

-

The Untapped Markets: This tech is the key to unlocking the final 5% of the global population in remote regions of Latin America, Sub-Saharan Africa, and Maritime Southeast Asia.

-

Who Wins: This gives a massive edge to brands with deep carrier partnerships (like Samsung and Motorola) over budget Chinese brands that lack the specialized antennas and licensing deals required for satellite communication. In these remote frontiers, a phone that connects everywhere is worth far more than one with a slightly better camera.

Frequently Asked Questions (FAQs)

Who will be the #1 smartphone brand in 2026?

It is a statistical dead heat, but Apple is projected to narrowly edge out Samsung with approximately 19.4% of the global market share, largely driven by the premiumization trend and strong iPhone 17 cycles.

Why are smartphone prices increasing in 2026?

Prices are rising due to a global shortage of memory chips. Manufacturers are diverting production to High Bandwidth Memory (HBM) for AI servers (like those used by Nvidia), creating a scarcity of standard RAM for phones, driving up Bill-of-Materials (BoM) costs by 15-20%.

Is the budget smartphone market dying?

It is severely contracting. The sub-$150 phone category is becoming unprofitable for manufacturers to sustain due to rising component costs. Consumers in this bracket are being forced to buy refurbished older flagships or spend more on mid-range devices.

Will Huawei sell phones globally in 2026?

Huawei is expanding its footprint, but mostly in terms of AI infrastructure. While their phones are dominant in China, their global smartphone expansion remains limited due to the lack of Google Mobile Services (GMS), though they are seeing niche growth in parts of the Middle East and Russia.

What is the “Agentic AI” trend in 2026 smartphones?

Unlike previous AI that simply answered questions, Agentic AI in 2026 smartphones can perform multi-step tasks across different apps autonomously (e.g., “Plan a date night,” which involves checking calendars, booking a restaurant, and ordering a ride-share without user intervention).

Final Thought: The Great Filter

Smartphone Market Share 2026 will be remembered as the industry’s “Great Filter.” The era of endless growth and cheap devices is over. The market is maturing into a high-stakes poker game where only those with deep pockets (Apple, Samsung) or deep local moats (Huawei, Vivo) can afford to play. For the consumer, 2026 means paying more, but potentially getting a device that is far more intelligent—and durable—than ever before.