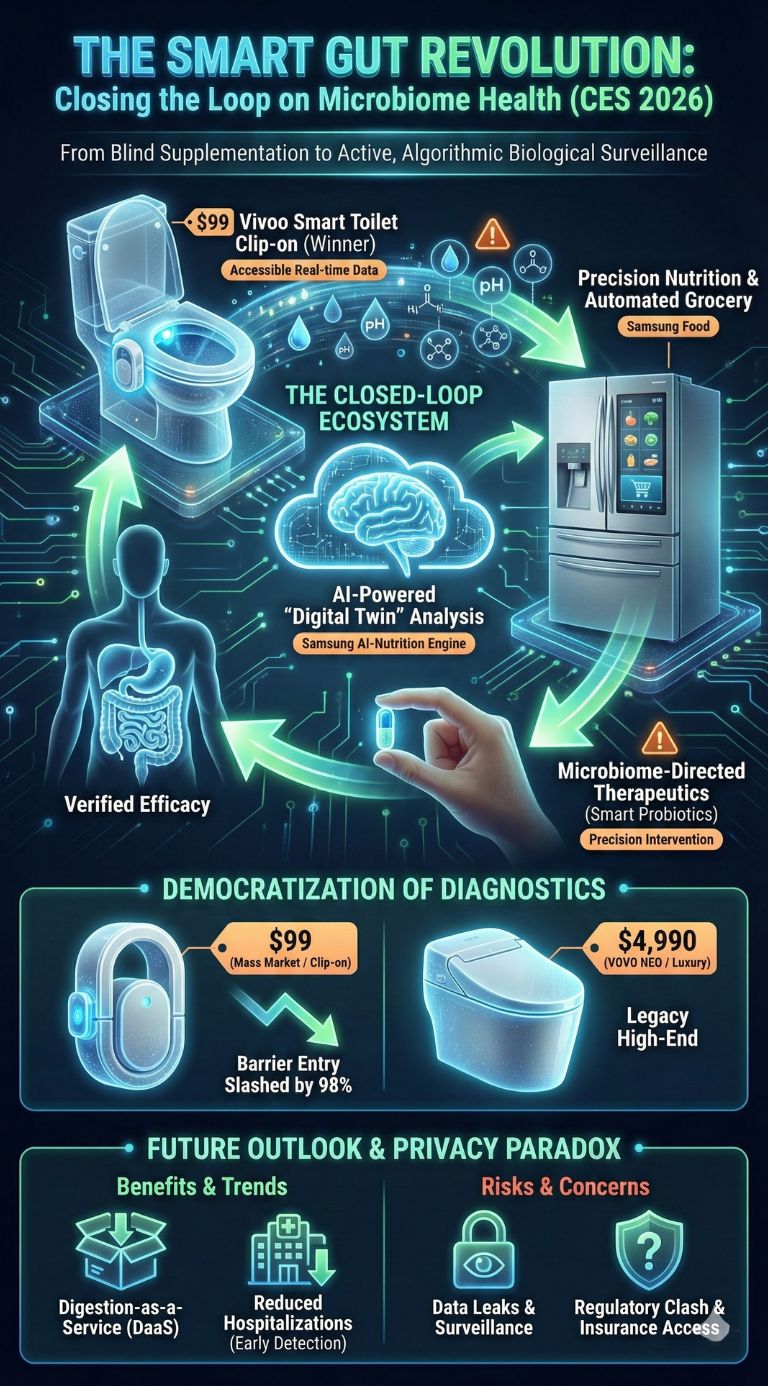

The era of “blind” supplementation is dead. At CES 2026, the gut health narrative shifted aggressively from passive pill-popping to active, algorithmic biological surveillance. The breakout stars weren’t just new bacterial strains, but the ecosystem of hardware—specifically the $99 Vivoo Smart Toilet clip-on and Samsung’s AI-nutrition engine—that finally closes the feedback loop on microbiome health. This convergence transforms the $60 billion probiotic market from a “faith-based” industry into a precision medicine powerhouse. For the first time, consumers can affordably verify if their supplements are working in real-time, signaling a massive disruption for legacy CPG brands that rely on vague wellness claims.

From Yogurt to Bio-Hacking: How We Got Here

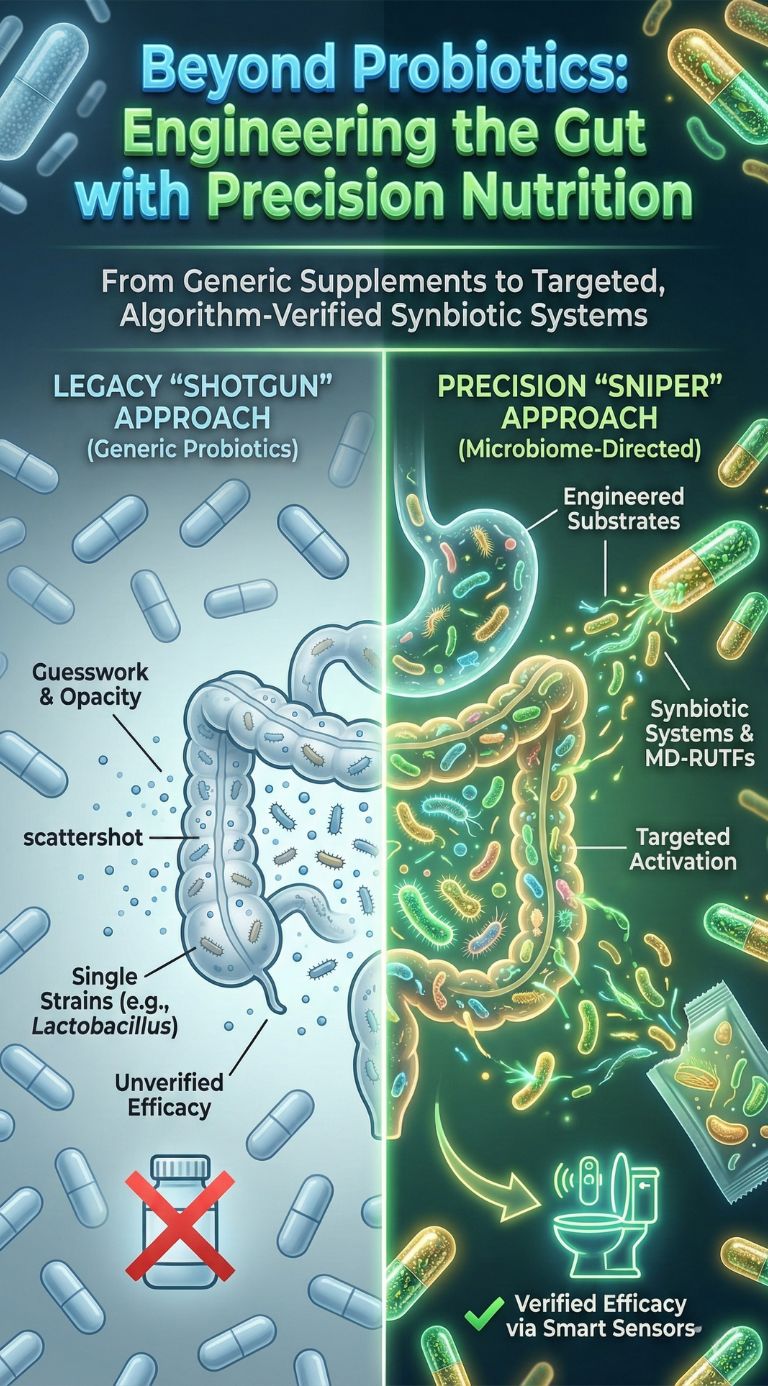

For decades, the “gut health” industry thrived on opacity. Consumers spent billions on probiotics, fermented foods, and prebiotics with zero visibility into their actual efficacy. While clinical science linked the microbiome to everything from mental health to immunity, consumer technology was stuck at the “input” stage (eating yogurt) without measuring the “output.”

The precursor to this moment was the “quantified self” movement (Fitbit, Apple Watch), which tracked external metrics like steps and heart rate. CES 2026 marks the arrival of “quantified biology”—cheap, non-invasive sensors that monitor internal biomarkers. We have moved from the “Open Loop” era (take a pill, hope for the best) to the “Closed Loop” era, where a smart toilet tells your smart fridge to adjust your grocery order based on yesterday’s digestion.

Core Analysis: The Anatomy of the “Smart Gut” Revolution

The “Smart Probiotic” winning CES isn’t a single capsule; it is the infrastructure of verification. The revolution is built on three pillars: affordable monitoring, AI interpretation, and precision intervention.

1. The Democratization of Diagnostics (The “Smart Toilet” War)

The biggest news at CES 2026 was the pricing war in biometric monitoring. While companies like VOVO showcased the high-end NEO Smart Toilet ($4,990), the real disruptor was Vivoo. By launching a $99 clip-on optical sensor, they slashed the barrier to entry for gut analysis by 98%. This device turns any standard toilet into a urinalysis lab, tracking hydration, pH, and ketones instantly.

- Why it matters: High-tech health was previously the domain of the wealthy. Vivoo’s price point pushes “urine data” into the mass market, creating a massive dataset that will likely train the next generation of AI health models.

Table 1: The Smart Toilet Hardware Landscape (CES 2026 Comparison)

| Feature | Vivoo Smart Toilet (Winner) | VOVO NEO Smart Toilet | Withings U-Scan (Legacy) |

| Price Point | $99 (Clip-on) | $4,990 (Full Unit) | ~$500 (Cartridge system) |

| Installation | Universal Clip-on (DIY) | Full Plumbing Install | In-bowl Pebble |

| Primary Data | Hydration, pH, Ketones | Vital Signs, Waste Analytics | Hormones, Nutrition |

| Target Audience | Mass Market / Fitness | Luxury / Elderly Care | Early Adopters |

| Maintenance | 1,000+ tests/battery | Integrated System | Monthly Cartridge Swap |

2. The “Digital Twin” of Digestion

Hardware gathers the data, but AI makes it actionable. Samsung’s “End-to-End Wellness” reveal was pivotal because it integrated “Samsung Food” with “Samsung Health.” Instead of a static calorie counter, their AI now acts as a predictive biological agent.

- The Shift: If your smart toilet detects high acidity or dehydration, the AI doesn’t just log a graph. It communicates with your smart fridge to suggest specific “microbiome-directed” recipes (e.g., high-fiber therapeutic foods) for your next meal. This automation of willpower removes the cognitive load from healthy eating.

Table 2: Evolution of Health Apps

| Era | Passive Apps (Pre-2025) | Active AI Agents (2026+) |

| Role | Data Logger (User inputs food) | Predictive Coach (AI suggests food) |

| Connection | Siloed (App stands alone) | Ecosystem (Toilet talks to Fridge) |

| Action | “You ate 2,000 calories.” | “Your pH is low; eat this specifically.” |

| Customization | Generic “One size fits all” | Hyper-personalized to real-time biomarkers |

3. Microbiome-Directed Therapeutics (The New “Probiotic”)

The content of the “Smart Probiotic” itself is changing. The Gates Foundation’s showcase of MD-RUTFs (Microbiome-Directed Ready-to-Use Therapeutic Foods) highlighted a shift from generic bacteria to specific substrates that feed good bacteria.

- Analysis: Consumer brands are adopting this “precision nutrition” approach. Instead of selling a generic Lactobacillus pill, companies are moving toward “synbiotic” systems—foods engineered to activate specific gut pathways, verified by the smart sensors mentioned above.

4. The Privacy Paradox: Surveillance of Excretion

The explosion of “Smart Gut” tech raises unprecedented privacy concerns. Biometric data from waste is uniquely identifying. The VOVO NEO, for instance, includes “Jindo the Dog” AI monitoring for elderly safety. While useful for fall detection, it normalizes cameras and sensors in the most private room of the home.

- The Risk: If insurance companies gain access to this data (e.g., verifying if a diabetic is actually following their diet via urine analysis), it could lead to “lifestyle discrimination” in coverage.

Table 3: The Privacy Trade-Off

| Benefit | Risk |

| Early Disease Detection: Spotting kidney issues or dehydration days before symptoms. | Data Leaks: Waste data is highly sensitive and embarrassing if hacked. |

| Elderly Safety: “Passive monitoring” replaces invasive check-ins. | Surveillance State: Normalization of sensors in bathrooms. |

| Lower Insurance Premiums: Rewards for proven healthy biomarkers. | Coverage Denial: Penalties for detecting alcohol/sugar markers. |

Expert Perspectives: Hype vs. Reality

Differing viewpoints emerged from the CES floor, highlighting the tension between innovation and practicality.

- The Proponents: Dr. Miray Tayfun (Founder of Vivoo) argues that hydration and gut health are the “low-hanging fruit” of preventative medicine. “We flush away valuable health data five times a day,” she noted. Proponents believe that making this data visible will reduce hospitalizations for dehydration and UTIs by 30% over the next decade.

- The Skeptics: Medical critics caution that “more data isn’t always better.” There is a risk of “the worried well” obsessing over minor fluctuations in urine pH that have no clinical significance. Furthermore, critics point out that while the hardware is cheap ($99), the subscription models (often $3-$10/month) create a permanent “health tax” on consumers.

Future Outlook: The “Prescription Kitchen”

The “Smart Probiotic” victory at CES 2026 is a leading indicator for three major trends over the next 24 months:

- The Rise of “Digestion-as-a-Service” (DaaS):

Expect supplement companies to bundle their pills with cheap monitoring hardware. You won’t just buy a probiotic; you’ll subscribe to a “Gut Optimization Kit” that includes the pills, the smart toilet sensor, and the app. - Regulatory Clash:

The FDA will face pressure to regulate “Wellness AIs.” If an app tells a user to change their diet based on a urine sensor and the user gets sick, who is liable? The line between “wellness advice” and “medical prescription” is blurring. - Toilet-to-Grocery Automation:

By 2028, the integration will be seamless. Your toilet will detect a deficiency, and your Amazon Fresh or Instacart order will automatically update with the corrective foods, approved by your AI health agent.

Bottom Line: The “Smart Probiotic” of 2026 isn’t a pill—it’s a network. The winner is not the company selling the bacteria, but the company owning the data that proves the bacteria works.