A surprise bill or broken machine can stall your business when you need cash the most. Bluevine can fund a small business loan in minutes with same-day cash at rates as low as 6.2%.

We show eight top short-term business loans, from lines of credit and cash advances to invoice factoring, and share a loan application checklist to boost your working capital. Keep reading.

Key Takeaways

- Bluevine funds up to $250,000 same day. Lines of credit start at 6.2% and term loans start at 7.8% APR. You need a 625 credit score. Bluevine uses Coastal Community Bank, Member FDIC, for deposits.

- OnDeck offers term loans up to $250,000 at 29.9% APR. It uses an OnDeck Score to speed checks. Apply by noon for same-day funding. You need a 625 credit score, $100,000 in annual revenue, and one year in business.

- Fundbox and FundThrough turn invoices into cash fast. Fundbox offers up to $150,000 at a 4.66% draw rate with next-day funding (two months in business, 600 credit score). FundThrough advances 100% of invoices in 24 hours with rates from 2.75% (30 days) to 8.25% (61+ days) and up to 90 days repayment (three months in business).

- SBA disaster loans lend up to $2,000,000 at rates up to 4%. They cover payroll, inventory, rent, and repairs in declared disaster areas. No minimum credit score applies. Funds arrive in a few weeks and can repay over decades.

- Lendio and QuickBridge simplify the search and funding process. Lendio compares term loans ($5,000–$2 million at 6% + APR), lines of credit ($1,000–$500,000 at 8%–60%), and cash advances ($5,000–$1 million at 18% +). Funds can arrive in 24 hours. QuickBridge needs a 600 credit score, $250,000 revenue, and six months in business and funds up to $500,000 after a ten-minute online form.

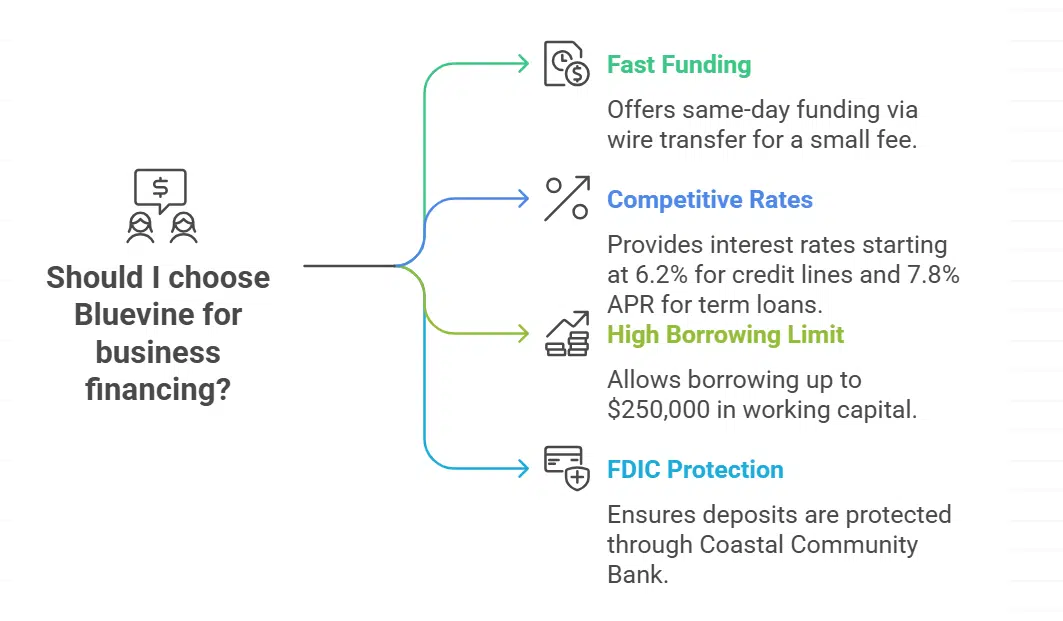

Why is Bluevine the Best Choice for Quick Access to Funds?

Bluevine funds accounts the same day, via wire transfer for a small fee. It answers credit applications in minutes and offers interest rates starting at 6.2% for a business line of credit, or 7.8% APR on term loans, cutting costs on merchant cash advances.

Lenders ask for a credit score of at least 625, and you can borrow up to $250,000 in working capital. Small business owners in Nevada, North Dakota, South Dakota, and U.S. territories cannot apply, but most others get fast approval for short-term business loans.

Bluevine handles banking through Coastal Community Bank, Member FDIC, so deposits stay protected. It adds monthly payments on certain credit lines to match your business cash flow.

This fintech shines among online lenders by delivering funds swiftly and keeping loan repayment terms clear, helping you cover expenses and meet invoices on time.

What Makes OnDeck Ideal for Short-Term Loans?

OnDeck backs short-term business loans and emergency business loans with easy tools. The lender uses the OnDeck Score to check credit history fast. This system taps accounts receivable and working capital info.

Applicants see same-day funding if they finish the loan application process by noon. Borrowers can take a lump sum up to $250,000. Rates start at 29.9 percent APR.

Clients need a credit score of at least 625 and $100,000 in annual revenue. Approval also needs one year in business. OnDeck reports payments to credit bureaus and gives repeat clients rate cuts.

It spells out loan repayment terms and factor rates clearly. Owners can add a business line of credit or choose a term loan for cash flow.

How Can Fundbox Help New or Young Businesses?

Fundbox moves fast for small business loans, with next-day funding on draws. It approves firms as young as two months, with a 600 credit score minimum. You link to QuickBooks or Xero, you tap into unpaid invoices for working capital.

The business line of credit starts at a 4.66 percent draw rate.

Borrowing can reach $150,000 via this invoice factoring model. The line requires short repayment terms, so cash flows clear though fees run relatively high. This setup beats bank delays and gives startups a solid shot at growth.

Why Choose Balboa Capital for Equipment Financing?

Balboa Capital funds equipment fast. Approval happens in hours and brings same-day financing. Loans reach up to $500,000. The service asks for a 620 credit score and $100,000 in annual revenue.

Businesses need a year of operation. Customers praise the quick pace, fair APR and flexible loan repayment terms. This boost to working capital frees up other assets.

A loan calculator on its site shows monthly costs, and a credit report review stays simple. Online financier platforms cut out long waits. Dedicated advisors handle calls or live chat.

These steps shave hours off a typical process. Equipment financing kicks in after a few clicks, thanks to clear fees and straight talk.

What Are SBA Disaster Loans and Who Qualifies?

SBA disaster loans fill gaps after storms, fires, or other declared emergencies. The Small Business Administration lends up to $2,000,000 at interest rates for working capital up to 4 percent.

Businesses use them for payroll, inventory, rents, and repairs to restore operations fast. These emergency business loans run longer than most short-term business loans, with repayment terms that can span decades.

Access requires a location inside a federally declared disaster area. No minimum credit score stands in your way. You submit an online application, fill in losses, and wait. After approval, funds arrive in a few weeks.

This path pairs low-cost funding with simple loan qualification requirements, easing strain on business cash flow.

How Does Lendio Help Compare Multiple Loan Options?

Lendio acts like a one-stop shop for short-term business loans. Term loans span $5,000 to $2 million, with APRs starting at 6%. Lines of credit cover $1,000 to $500,000, rates run 8% to 60%.

Cash advances go from $5,000 to $1 million, APRs sit at 18% and up. You compare interest rates, loan terms, and repayment length in one view.

The loan application process sends your info to online lenders. Results pop up as a side by side table, easy to read. You spot APR, factor rates, and repayment terms at a glance. Filters match your credit score, time in business, and annual revenue needs.

You score cash in as fast as 24 hours, for working capital or a new project.

Why Is QuickBridge Known for a Simple Application Process?

QuickBridge cuts through red tape with an online loan application process that takes just ten minutes. A simple API ties credit scores and revenue figures in seconds. Applicants need a 600 credit score and at least $250,000 in annual revenue to qualify.

Businesses must operate six months before they can seek up to $500,000. Digital lenders offer daily or weekly repayment terms and factor rates beginning at 1.11x.

Funders deliver unsecured loans and business line of credit to boost working capital. Borrowers can choose terms up to 16 months. This fast approval loan fits short-term and emergency business loans.

How Does FundThrough Support Cash Flow with Invoice Factoring?

FundThrough turns invoices into cash fast. You can get up to 100% of each invoice. Factor rates start at 2.75% for 30 days. They rise to 3.75% at 45 days, 5.5% at 60 days, or 8.25% beyond 61 days.

Repayment spans up to 90 days. Applicants face no credit score requirement. Three months in business suffices.

Funding can hit your account in 24 hours. You skip a long loan application process. That jumpstarts your working capital and business cash flow. Invoice factoring acts as accounts receivable financing.

Business owners link files with accounting software. Managers view factor rates, short-term business loans, and small business loans on one screen. Teams dodge debt traps, like stacking credit card balances.

How Do You Choose the Right Short-Term Business Loan?

Choosing the right loan can boost your business cash flow fast. Use clear steps before you sign.

- Compare interest rates and APR. Use a loan calculator to see total cost.

- Review loan repayment terms. Note if you pay weekly, daily or monthly with terms from three to 24 months.

- Assess loan amounts and fees. Match the max to your working capital and watch origination fees and factor rates.

- Evaluate application speed and ease. QuickBridge can fund in 24 hours with a simple form.

- Verify qualification criteria, including time in business, revenue, credit score, state rules and guarantee needs.

- Investigate lender transparency and customer ratings. Seek clear fee disclosures and honest reviews.

- Consider financing tools like invoice factoring, equipment financing, merchant cash advances, business credit cards and SBA Express Loans.

What Are the Pros and Cons of Short-Term Capital Loans?

Short term capital loans deliver fast cash and tight repayment.

| Pros | Cons |

|---|---|

|

|

Takeaways

Eight lenders can rescue your cash flow. Each tool fits a need, from term loans to equipment financing. You can grab funds in hours or plan for stormy days. Invoice factoring works like a fuel boost when bills pile up.

An SBA disaster loan may land in weeks with low APR. Picking a route can feel wild at first. Use this guide, weigh rates, track repayment terms, choose the path that keeps you moving.

FAQs on Short-Term Capital Loans to Cover Business Emergencies

1. What are the best short-term business loans for emergencies?

When cash runs dry, you need fast help. Try invoice factoring, merchant cash advances, or a business line of credit. You can also grab working capital loans, SBA Express loans, or gear financing.

2. How do interest rates and APR work on these loans?

Interest rates can be fixed or variable, they shape your cost. APR, the annual percentage rate, adds fees to the rate. Factor rates are unique to invoice factoring, they hint at total cost. Simple interest deals can save you some cash.

3. What are typical loan terms and repayment terms?

Term loans sit on a set schedule, with fixed loan repayment terms. Revolving credit lets you pay off debts, then borrow again. Secured loans need collateral, unsecured loans do not. Keep tabs on loan terms to dodge defaulting.

4. Do I need a strong credit score and time in business to qualify?

Lenders eye your credit score, often a FICO score above 600. They check your time in business, usually at least one year. They want steady annual revenue, too. Startup funding may face tougher loan qualification requirements.

5. How fast can I get business cash flow from these loans?

Online lenders often offer fast approval loans in 24 hours or less. A bank loan takes weeks, maybe months. As an alternative, crowdfunding platforms may fill the gap. Flexible funding can feel like a lifeline in a pinch.

6. What loan options exist beyond bank loans?

You can tap personal loans or a home equity line of credit. SBA disaster loans or certified development companies can step in after a storm. Asset-based lending or collateral-free loans can help. Business credit cards and gear financing also fit many cases.