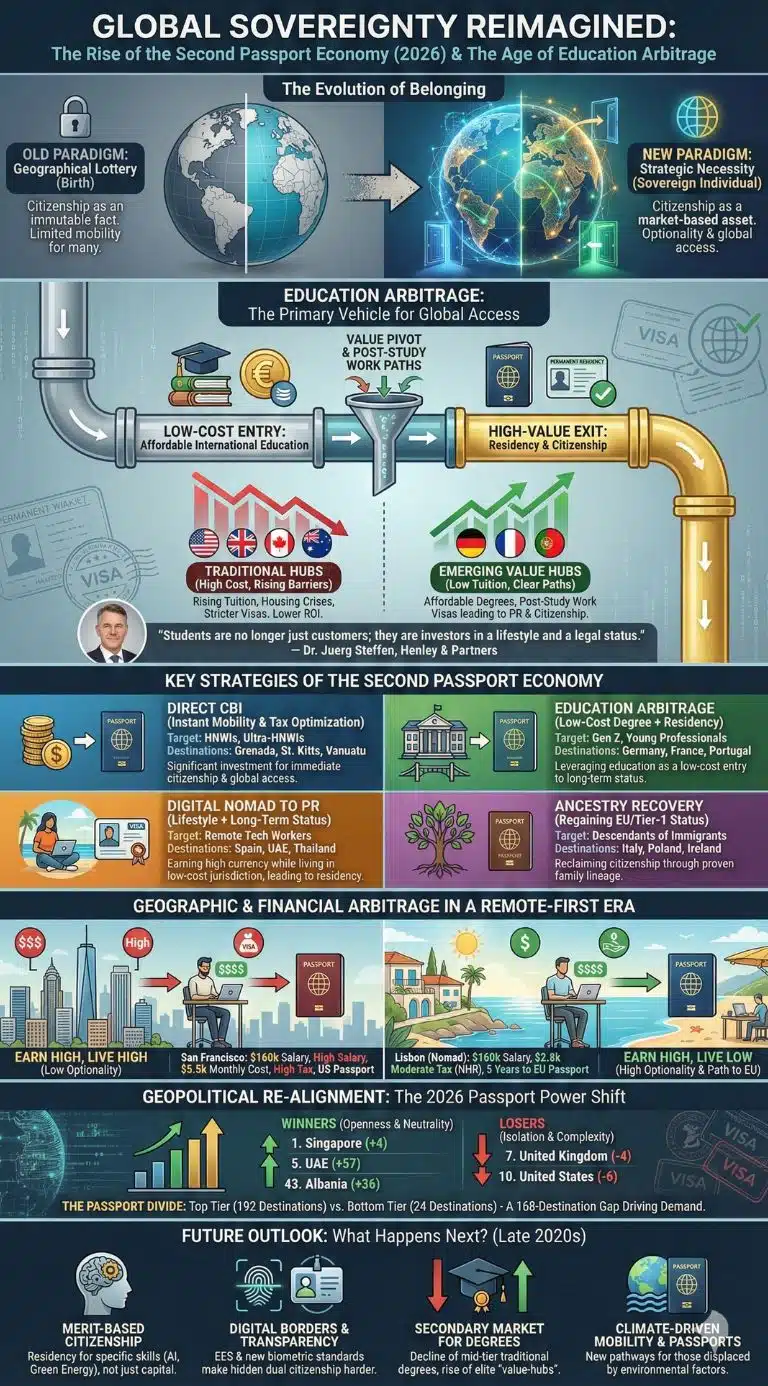

In 2026, the pursuit of a second passport has evolved from a luxury for the ultra-wealthy into a strategic necessity for the “sovereign individual.” Driven by remote work and the rising cost of traditional elite degrees, “Education Arbitrage” is now the primary vehicle for securing global access.

The concept of citizenship was once an immutable fact of birth—a “geographical lottery” that determined one’s life path. However, as we move through 2026, the global landscape has shifted toward a market-based model of national belonging. The “Second Passport Economy” is no longer just about tax havens or luxury travel; it is about “optionality.” In a post-remote world, the traditional ties between where one works, where one learns, and where one holds citizenship have severed.

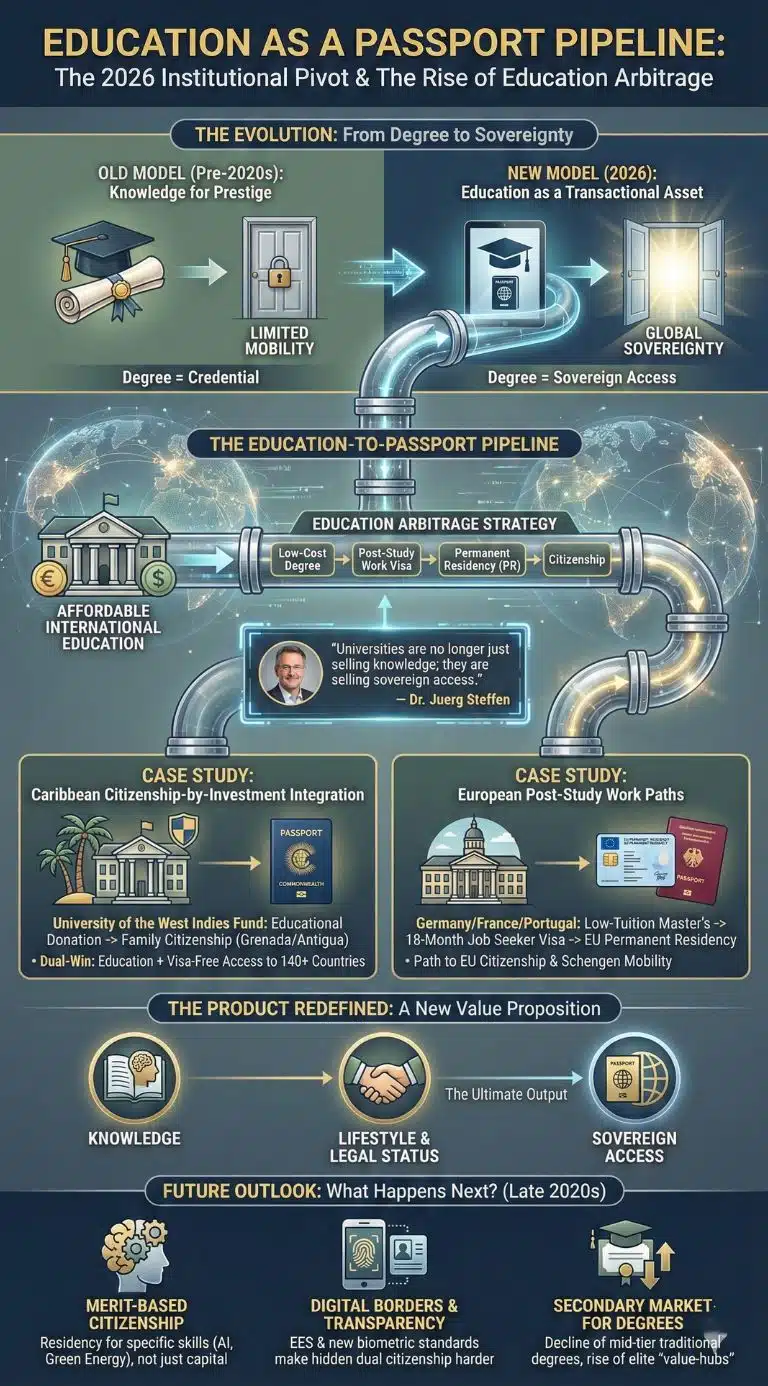

This decoupling has birthed a new phenomenon: Education Arbitrage. This is the strategic practice of leveraging international education not merely for a degree, but as a low-cost entry point into high-value residency and citizenship. As the “Big Four” education hubs—the US, UK, Canada, and Australia—face rising tuition and housing crises, students are pivoting toward nations that offer a “education-to-passport” pipeline, turning learning into a transactional asset for long-term global mobility.

The Strategic Evolution of the Second Passport Economy

The Second Passport Economy has transformed into a sophisticated landscape where global mobility is managed as a strategic asset. In today’s climate, a second citizenship is no longer just a luxury; it serves as a critical “Plan B” insurance policy to mitigate risks from domestic political instability and economic volatility. This pragmatic shift is driving a value pivot in international education, where students are increasingly bypassing prestigious, high-cost institutions in favor of countries like Germany and France that offer low tuition and clear residency pathways. The momentum is further accelerated by the remote work revolution, allowing individuals to practice geographical arbitrage—earning in high-value currencies like USD or EUR while residing in lower-cost jurisdictions through digital nomad visas. As this ecosystem matures, an institutional shift is occurring as universities and Citizenship by Investment (CBI) programs merge to attract global capital.

Beyond these financial and educational drivers, the market is expanding into environmental resilience, with “climate insurance” becoming a primary motivator for families relocating from ecologically vulnerable regions to more stable, resilient jurisdictions. We are also witnessing a transition from passive real-estate-based models toward innovation-led residency, where nations reward entrepreneurs and tech talent who provide active economic value rather than just capital. Ultimately, these factors are contributing to a broader geopolitical recalibration and a “Post-Western” era of mobility; while traditional powerhouses like the UK and US face administrative backlogs and declining relative power, Asian and Middle Eastern nations are surging ahead by negotiating superior visa-free access and offering streamlined, tech-integrated pathways to citizenship.

“What we are really witnessing is the unbundling of citizenship,” observes Saugata Bhattacharya, a senior corporate executive, global traveller, and long-time reader of passport and mobility theory. “In a post-remote world, education has become the softest, most politically acceptable gateway into a second life abroad. Unlike investment visas, it carries moral legitimacy, and countries can sell opportunity without appearing to sell sovereignty.”

The Transition from Mobility to Sovereignty: Why the Passport Map is Changing

For decades, global mobility was defined by the “strength” of one’s birth passport. If you held a German or Japanese passport, the world was open; if you held a Nigerian or Indian one, it was closed. By 2026, this hierarchy is being challenged by the rise of “purchased sovereignty.” High-net-worth individuals (HNWIs) and high-skilled remote professionals are no longer content with the luck of the draw.3

The data for 2026 shows a massive surge in CBI and Residency by Investment (RBI) applications. People are diversifying their “citizenship portfolio” much like they diversify a stock portfolio.4 This is a direct response to a world where borders can close overnight—as seen during the mid-2020s health and geopolitical crises.

| Passport Strategy | Primary Goal | Target Demographic | Common Destinations |

| Direct CBI | Instant mobility & tax optimization | HNWIs, Ultra-HNWIs | Grenada, St. Kitts, Vanuatu |

| Education Arbitrage | Low-cost degree + Residency | Gen Z, Young Professionals | Germany, France, Portugal |

| Digital Nomad to PR | Lifestyle + Long-term status | Remote Tech Workers | Spain, UAE, Thailand |

| Ancestry Recovery | Regaining EU/Tier-1 status | Descendants of immigrants | Italy, Poland, Ireland |

Education Arbitrage: The Death of Educational Loyalty

The most significant shift in the 2026 mobility market is Education Arbitrage. For years, international students flocked to the US and UK despite astronomical costs, believing the “prestige” of the degree would eventually pay for itself. However, the 2026 reality is different. With US tuition often exceeding $60,000 per year and UK maintenance requirements rising, students are performing a cold-blooded cost-benefit analysis.

“Education Arbitrage” involves identifying jurisdictions where the cost of education is low, but the “output value” (the strength of the residency or passport) is high. For instance, a Master’s degree in Germany may cost near zero in tuition but provides an 18-month post-study work visa that leads directly to EU permanent residency. In contrast, the UK’s 2026 “Student Levy” and tightening of dependent visas have made it a “high-cost, high-risk” destination.

“Students are no longer just customers of education; they are investors in a lifestyle and a legal status. If the UK or Canada doesn’t offer a clear, affordable path to staying, the ‘customer’ simply moves their capital to France or the UAE.” — Dr. Juerg Steffen, CEO of Henley & Partners.

Geographic and Financial Arbitrage in the Remote-First Era

The “Second Passport Economy” is fueled by the realization that in a remote-first world, your income and your location do not have to be in the same tax bracket. Remote workers are practicing Geographic Arbitrage: earning a Silicon Valley or London salary while living in a jurisdiction like Portugal, Costa Rica, or Bali.

In 2026, this has matured into a legal strategy.5 Professionals are not just “visiting” these countries; they are using “Golden Visas” and “Nomad Paths” to lock in long-term rights. They are betting that the flexibility of their work will eventually allow them to swap their high-tax, low-mobility original citizenship for a more favorable secondary one.

Comparative Analysis: Cost of Living vs. Salary Potential (2026 Projections)

| City of Residence | Average Remote Salary (USD) | Monthly Cost of Living | Path to Citizenship | Tax Efficiency |

| San Francisco | $160,000 | $5,500 | Original (US) | Low (High Tax) |

| Lisbon (Nomad) | $160,000 | $2,800 | 5 Years to EU | Moderate (NHR 2.0) |

| Dubai (Golden) | $160,000 | $3,500 | 10 Year Visa/Merit | High (Zero Tax) |

| Bangkok (LTR) | $160,000 | $1,800 | 10 Year Residency | Moderate |

The Institutional Pivot: Education as a Passport Pipeline

Higher education institutions have caught on to this trend. In 2026, many universities in the Caribbean and Europe have begun marketing their programs as “citizenship-adjacent.”

For example, the University of the West Indies fund allows families to gain Grenadian or Antiguan citizenship through a specific educational donation.6 This creates a “dual-win”: the student gets an education, and the family gets a Commonwealth passport that offers visa-free access to over 140 countries, including the Schengen Area and the UK.

This represents a fundamental change in the “product” being sold by universities. They are no longer just selling knowledge; they are selling sovereign access.

Geopolitical Re-Alignment: The Passport Power Shift

The 2026 Henley Passport Index reveals a startling decline in the relative power of Western passports. While the US and UK once dominated the top spot, they have been overtaken by a “New Guard” of nations that prioritize diplomatic openness and neutral business environments.

Winners vs. Losers: Global Passport Mobility 2026

| Country | 2026 Rank | Change from 2016 | Reason for Shift |

| UAE | 5th | +57 Places | Aggressive visa liberalization & neutrality. |

| Singapore | 1st | +4 Places | Global financial hub status & tech integration. |

| United Kingdom | 7th | -4 Places | Post-Brexit visa complexities & student levies. |

| United States | 10th | -6 Places | Increased isolationist policies & border friction. |

| Albania | 43rd | +36 Places | Rapid EU integration & Balkan stability. |

The “Passport Divide” is widening.7 In 2026, the average traveler from a top-ranked nation can access 192 destinations visa-free, while those at the bottom can access only 24.8 This 168-destination gap is the primary driver of the Second Passport Economy. For a business owner in an “emerging market,” buying a second passport isn’t a vanity project—it is the only way to attend a global conference or manage international assets without months of visa bureaucracy.

Expert Perspectives: The Ethics of Global Arbitrage

The rise of this economy is not without controversy. Analysts are divided on whether this trend democratizes opportunity or merely deepens global inequality.

- The Pro-Market View: Proponents argue that “Citizenship by Investment” allows small, resource-poor nations (like those in the Caribbean) to attract foreign direct investment that builds hospitals, schools, and infrastructure.9 They see education arbitrage as a way for talent to flow to where it is most valued, bypassing outdated immigration quotas.

- The Skeptical View: Critics, including many EU regulators, argue that citizenship should not be a “commodity.” They worry that the “Second Passport Economy” allows the wealthy to bypass security checks and creates “security backdoors” into major economies. Furthermore, they argue that “Education Arbitrage” creates a brain drain from developing nations, where the brightest students use their education solely as an exit strategy.

- The Neutral Reality: Most experts agree that the trend is irreversible. As long as there is a massive disparity in the “power” of different passports, there will be a market to bridge that gap.

Future Outlook: What Happens Next?

As we look toward the late 2020s, several milestones will define the next phase of the Second Passport Economy:

- The Rise of “Merit-Based” Citizenship: Expect more countries to follow the UAE’s lead, offering long-term residency not just for money, but for specific skills in AI, green energy, and biotechnology.

- Digital Borders & Biometrics: By 2027, the EU’s Entry/Exit System (EES) and the US’s new 2026 biometric standards will make “hidden” dual citizenship harder to maintain. Transparency will be the new currency.

- The “Secondary Market” for Degrees: As “Education Arbitrage” peaks, we may see a decline in the value of mid-tier degrees in the US/UK, while elite “value-hubs” in Germany and the Netherlands see record application volumes.

- Climate-Driven Mobility: We are likely to see the first “Climate Passports,” where citizenship or residency is granted to those displaced by environmental factors, potentially funded by the very CBI programs that currently cater to the wealthy.

The post-remote world has turned the “home” into a choice rather than a fate. Whether through the lecture halls of Berlin or the real estate markets of St. Kitts, the “Second Passport Economy” is the new frontier of global freedom.

Final Thoughts

The Second Passport Economy has evolved into a sophisticated framework of strategic asset management, where a secondary nationality serves as a vital “Plan B” against political and economic instability. This shift is characterized by a significant Value Pivot, as global citizens—particularly students—increasingly prioritize practical residency pathways in countries like France and Germany over traditional institutional prestige. This trend is further accelerated by the rise of remote work, enabling a lifestyle of “geographic arbitrage” where individuals earn in high-value currencies while securing long-term legal status in lower-cost jurisdictions. As institutional boundaries blur, universities are now integrating directly with Citizenship by Investment (CBI) programs, reflecting a broader geopolitical recalibration where the traditional dominance of Western passports is being challenged by the rising mobility and diplomatic reach of Asian and Middle Eastern nations.