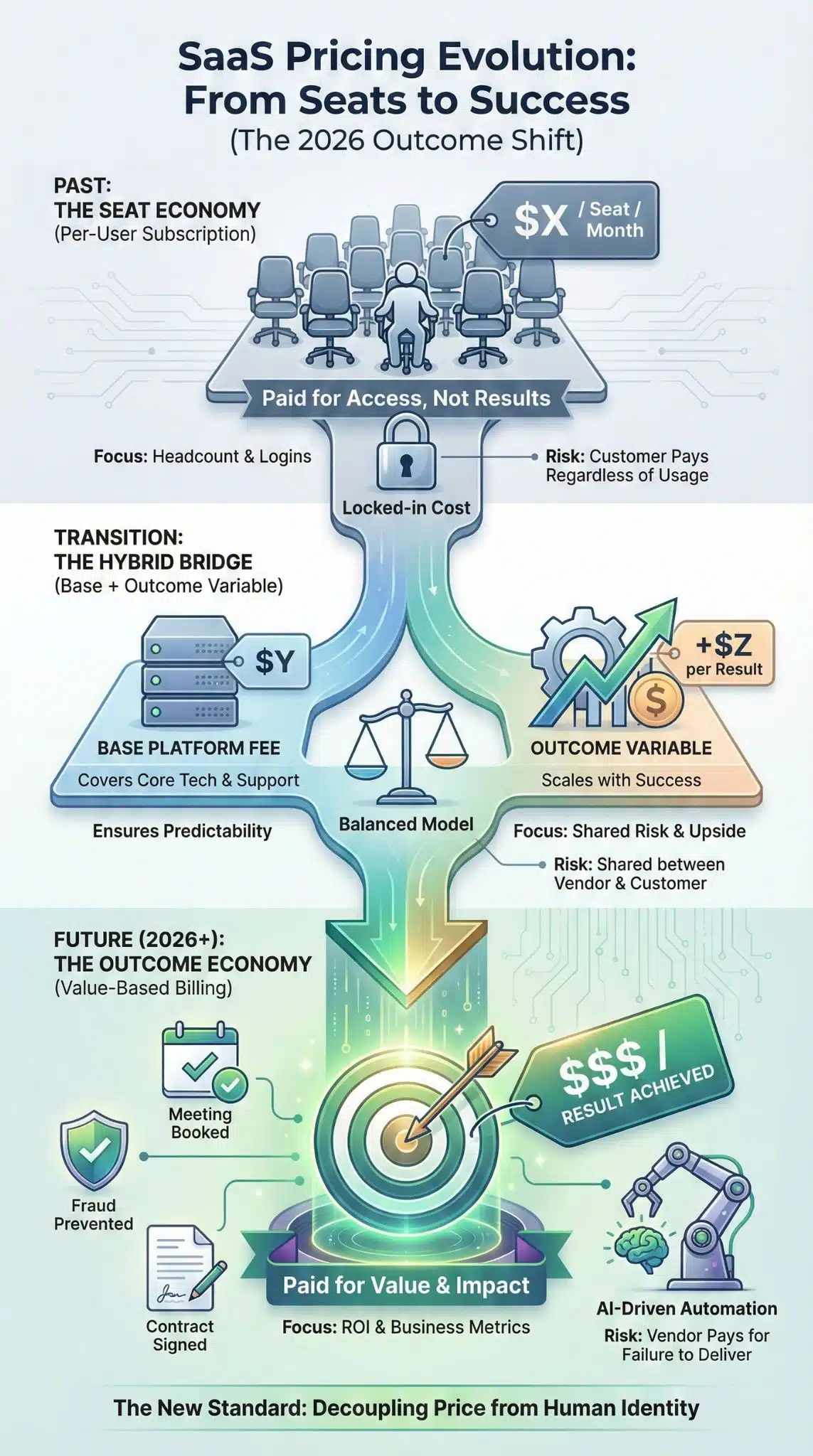

For decades, the “per-seat” license was the heartbeat of the software industry. It was simple, predictable, and easy to sell. But as we settle into 2026, that pulse is fading. The rise of autonomous AI agents, tightening IT budgets, and a fierce demand for ROI have rendered the traditional seat-based model obsolete for many sectors.

If an AI agent can do the work of five humans, why should a company pay for just one “seat”? Conversely, if a software tool doesn’t deliver tangible results, why should a client pay a fixed subscription fee at all?

This year marks the definitive tipping point where SaaS Pricing Models in 2026 pivot aggressively toward outcome-based billing. We are moving from an economy of access to an economy of results. This guide explores how this shift is happening, why it’s inevitable, and how SaaS leaders can navigate the transition without breaking their revenue engines.

The Death of the Seat: Why 2026 is Different

The “per-user, per-month” model had a good run. It worked perfectly when software was a productivity tool—a hammer that a human worker picked up to drive a nail. You charged for the hammer.

However, in 2026, software is no longer just the hammer; it is the carpenter.

The AI Agent Disruption

The primary driver of this shift is the proliferation of agentic AI. When a company deploys an AI SDR (Sales Development Representative) that autonomously finds leads, drafts emails, and books meetings, “user” seats become irrelevant.

If a SaaS platform charges $50/seat, but a single AI “user” generates $50,000 in pipeline value, the vendor is drastically underpricing their value. Conversely, if the AI agent fails to book any meetings, the customer feels cheated even by the low $50 fee.

SaaS Pricing Models in 2026 must align with the work done, not the login credentials created. We are seeing a massive correction where vendors are decoupling price from human identity.

The “Shelfware” Fatigue

By late 2025, CIOs reached a breaking point with “shelfware”—subscriptions that are paid for but rarely used. In a tight economic climate, paying for 100 seats when only 40 employees use the tool daily is a fast track to churn.

Outcome-based billing solves this friction instantly. It acts as a promise: “We only win when you win.” This psychological shift is powerful. It turns procurement from a battle over costs into a partnership discussion about shared revenue and efficiency goals.

Comparison: Per-Seat vs. Outcome-Based Models

| Feature | Per-Seat Model (Traditional) | Outcome-Based Model (2026 Standard) |

| Primary Metric | Number of human logins/licenses. | Business result achieved (e.g., lead booked). |

| Risk Profile | Customer bears the risk (pays regardless of value). | Vendor bears the risk (paid only for success). |

| Scalability | Linear growth with headcount. | Exponential growth with business success. |

| Customer Sentiment | “Why am I paying for unused seats?” | “I’m happy to pay more because I made more.” |

| Churn Risk | High (easy to cut unused licenses). | Low (product is tied to revenue/KPIs). |

What is Outcome-Based Billing?

Outcome-based billing is a pricing strategy where the customer is charged based on a specific, measurable value metric that represents success. It is not “usage-based” pricing (like paying for storage or API calls), though the two are often confused.

Usage measures input (e.g., gigabytes stored, emails sent).

Outcome measures output (e.g., fraud prevented, candidate hired, tax return filed).

Defining the “North Star” Metric

For this model to work, the “outcome” must be the “North Star” metric for the customer—the one number that matters most to their business.

- For a Recruiting Platform: It’s not “resumes viewed” (usage); it’s “qualified candidate interviewed” (outcome).

- For a Cybersecurity Tool: It’s not “scans run” (usage); it’s “threats neutralized” (outcome).

- For an EdTech Platform: It’s not “hours of video watched” (usage); it’s “certification passed” (outcome).

In 2026, the companies winning market share are those that have successfully identified and operationalized these metrics.

Real-World Examples in 2026

We are seeing major players adopt this successfully:

- Salesforce Agentforce: Instead of just charging for Service Cloud licenses, they introduced pricing around $2 per conversation handled. If the AI resolves the issue without human intervention, the customer pays. This aligns the cost directly with the labor savings.

- Intercom: Their Fin AI agent charges per “resolution.” If the bot talks to a customer but eventually has to pass them to a human, the customer often doesn’t pay the full outcome fee. This builds massive trust.

- LegalTech AI: Platforms reviewing contracts now charge a base fee plus a fee per “risk flagged and accepted,” rather than a flat monthly subscription.

Examples of Outcome Metrics by Industry

| Industry | Traditional Metric | 2026 Outcome Metric |

| Customer Support | Per Agent / Month | Per Automated Resolution |

| Marketing / AdTech | Per Contact / Email Sent | Per Qualified Lead / Meeting Booked |

| FinTech / Payments | Monthly Subscription | % of Transaction Volume / Fraud Saved |

| Cybersecurity | Per Device / Server | Per Threat Automatically Remediated |

| Healthcare SaaS | Per Doctor Seat | Per Patient Outcome / Claim Processed |

The Rise of Hybrid Pricing Models

While the concept of paying only for outcomes is attractive, it terrifies CFOs and investors who rely on Predictable Recurring Revenue (ARR). Pure outcome-based pricing can be volatile. If a customer has a slow month, the vendor’s revenue crashes.

To solve this, the dominant trend in SaaS Pricing Models in 2026 is the Hybrid Model.

Balancing Predictability with Performance

The Hybrid Model combines a stable platform fee with a variable outcome-based component.

The Formula:

Total Price = (Base Platform Fee) + (Outcome Volume × Price Per Outcome)

- Base Platform Fee: Covers the vendor’s fixed costs (hosting, support, R&D). It ensures that even if usage drops, the account remains profitable. It essentially pays for “access” to the technology.

- Outcome Variable: Captures the upside. As the customer succeeds and uses the tool to generate value, the vendor’s revenue scales up.

The Role of Usage-Based Components

Some companies add a third layer: usage gates. For example, a video editing AI might charge a monthly subscription (Base), plus a fee for rendering hours (Usage), plus a premium fee for “Auto-Viral Shorts Created” (Outcome).

This “layer cake” approach allows vendors to cater to different segments. Enterprise clients might negotiate a higher base fee for a lower per-outcome rate to cap their exposure, while startups might prefer a low base fee with higher outcome costs to manage cash flow.

Hybrid Model Structure

| Component | Purpose for Vendor | Benefit for Customer |

| Platform Fee | Ensures baseline ARR and covers COGS. | Grants access to core features and support. |

| Outcome Fee | Uncapped revenue upside; aligns with value. | Costs scale only when value is received. |

| Implementation Fee | Covers onboarding costs; validates commitment. | Ensures dedicated setup for faster ROI. |

Challenges in Implementing Outcome-Based Pricing

Despite the clear benefits, shifting to outcome-based billing is technologically and operationally difficult. It requires a complete re-architecture of how a SaaS company measures, bills, and recognizes revenue.

The Attribution Nightmare

The single hardest problem in outcome-based pricing is attribution.

If a sales platform claims it “booked a meeting,” how does it prove the software did the work? What if the sales rep sent an email, the marketing team ran an ad, and the AI agent sent a LinkedIn message? Who gets credit for the meeting?

Disputes over attribution can destroy customer relationships.

- The Solution: Clear, contractual definitions of “success events.”

- Example: “A meeting is credited to the AI Agent if the prospect books via the Agent’s unique link within 7 days of interaction.”

Without strict “black and white” rules, customers will constantly ask for refunds or credits, arguing that the software didn’t actually cause the result.

Revenue Recognition & Finance Pushback

ASC 606 (revenue recognition standards) makes variable consideration tricky. Finance teams hate uncertainty. In a subscription model, they know exactly how much cash is coming in next month. In an outcome model, revenue is a forecast, not a guarantee.

This makes raising capital harder. Investors in 2026 are learning to evaluate “Quality of Revenue” differently, looking at “Net Revenue Retention” (NRR) more than simple ARR. A company with high outcome-based revenue might be viewed as riskier than a flat-fee subscription business, even if it grows faster.

The “Gaming the System” Risk

When you price based on outcomes, customers (and employees) will optimize for that metric, sometimes to the detriment of actual value.

- Scenario: A customer support AI is priced per “resolution.”

- Risk: The AI might aggressively close tickets as “resolved” even if the customer isn’t happy, just to trigger the billing event.

- Correction: Companies must pair outcome metrics with quality guardrails (e.g., “Resolution” only counts if the customer does not re-open the ticket within 24 hours).

Challenges & Solutions Table

| Challenge | Description | Strategic Solution |

| Attribution | Proving the software caused the result. | strict “attribution windows” and unique tracking links in contracts. |

| Revenue Volatility | Unpredictable monthly income. | Implement hybrid pricing (Base + Outcome) to smooth cash flow. |

| Gaming Metrics | Artificial inflation of success metrics. | Add “quality gates” (e.g., CSAT score > 4/5) to billable events. |

| Customer Budgeting | Procurement hates variable bills. | Offer “Outcome Buckets” (pre-purchasing 1,000 outcomes at a discount). |

Strategic Steps to Shift Pricing Models

For SaaS founders and product leaders looking to adapt to SaaS Pricing Models in 2026, a “rip and replace” strategy is dangerous. You cannot simply wake up one day and switch your entire customer base from subscriptions to outcome billing.

Identifying Value Metrics

The first step is data discovery. You must analyze your existing customer usage data to find the correlation between usage and value.

Ask yourself: What is the exact moment my customer gets a dopamine hit of success?

- Is it when they hit “Publish”?

- Is it when a payment clears?

- Is it when a bug is fixed?

Once identified, start displaying this metric in the customer’s dashboard before you charge for it. Show them: “You saved $4,000 this month using our tool.” This primes them for the shift.

The Grandfathering Strategy for Legacy Customers

Existing customers will revolt if you suddenly change their pricing structure, especially if it leads to a price increase.

- The 2026 Playbook: Keep legacy customers on their current plan for 12-18 months (Grandfathering), but launch all new AI features exclusively on the new outcome-based tier.

- This creates a natural incentive to switch. “You can keep your old plan, but if you want the new Autonomous Agent features, you need to move to the Outcome Plan.”

Designing the “Meter”

You need a robust billing infrastructure. Traditional subscription management tools (like older versions of Stripe or Recurly) were built for flat fees. In 2026, the tech stack requires metering engines (like Metronome or Orb) that can ingest millions of events in real-time, aggregate them, apply complex pricing logic, and generate an invoice.

Final Thoughts

The transition to SaaS Pricing Models in 2026 is more than just a change in how we invoice; it is a fundamental realignment of incentives. The “Outcome-Based Billing” movement forces vendors to be honest. You can no longer hide behind a 12-month contract and deliver poor performance. You have to earn your revenue every single day.

While the challenges of attribution and revenue predictability are real, the upside is undeniable. Companies that align their pricing with their customers’ success are building unshakeable moats. They aren’t just vendors; they are partners in profit.

As AI continues to commoditize code and interface, the only thing left to sell is the result. If you are confident your product works, outcome-based pricing is the ultimate way to prove it.