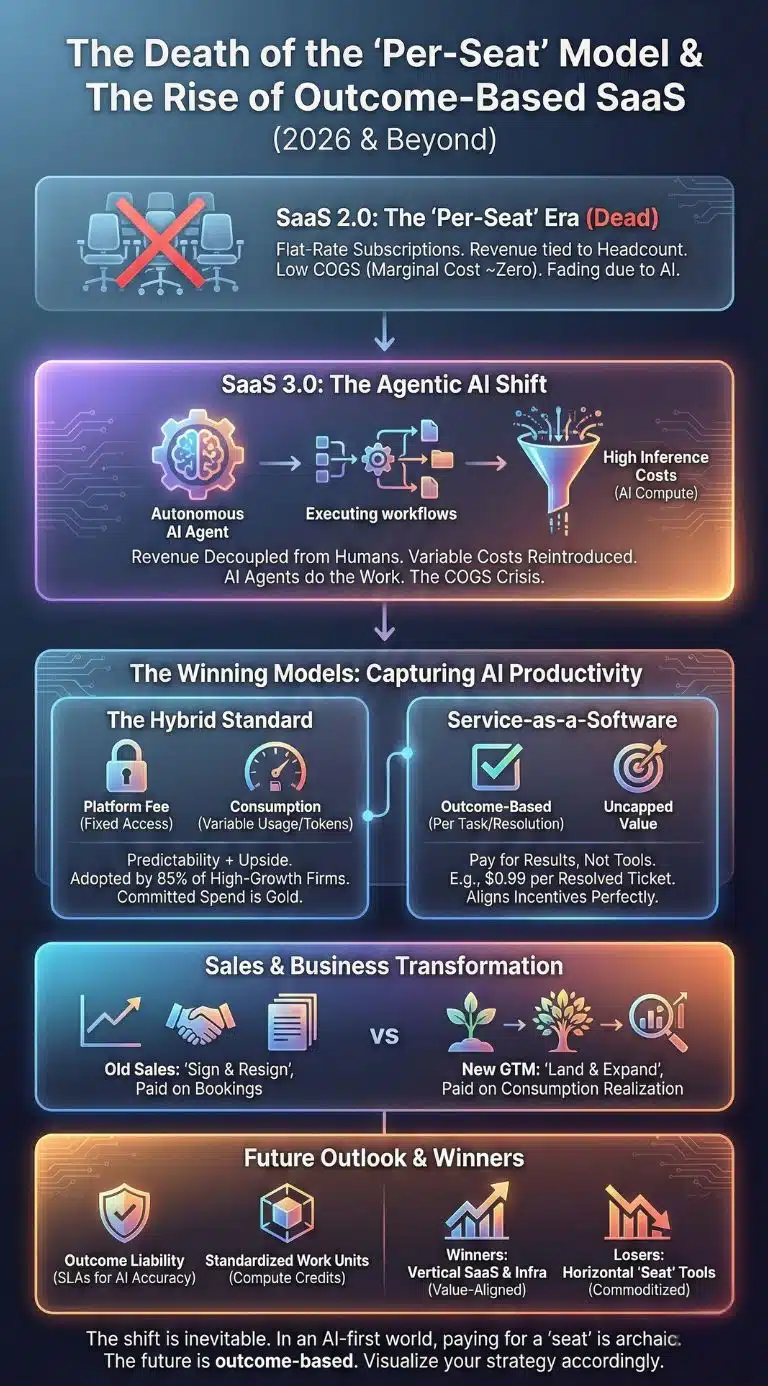

The “per-seat” subscription model—the golden goose of the last decade—is effectively dead. As of early 2026, the unit of value in software has shifted from “access” to “outcome.” With AI agents now executing autonomous workflows, the traditional link between headcount and software revenue has broken. Companies clinging to SaaS 2.0 flat-rate models are seeing margins eroded by soaring inference costs, while those embracing SaaS 3.0’s usage-based and hybrid structures are capturing the upside of the AI productivity boom.

Key Takeaways

- The Decoupling of Revenue and Headcount: In the SaaS 3.0 era, software revenue no longer correlates with how many humans log in, but with how much work the AI performs.

- The COGS Crisis: Generative AI has reintroduced variable costs to software. Heavy inference loads mean flat-rate subscriptions often result in negative gross margins for power users.

- Hybrid is the New Standard: Pure usage-based pricing (UBP) creates volatility; the winning model in 2026 is “Hybrid” (Platform Fee + Consumption), adopted by 85% of high-growth firms.

- Agentic Economics: We are moving toward “Service-as-a-Software,” where vendors charge for completed tasks (e.g., a resolved customer support ticket) rather than tool access.

- Sales Transformation: Go-to-Market (GTM) strategies are overhauling sales compensation, shifting from paying on “bookings” to paying on “consumption realization.”

Contextual Background: The Evolution to SaaS 3.0

To understand the magnitude of the 2026 shift, we must look at the trajectory of software monetization. We are currently witnessing the most significant business model pivot since the move from on-premise CD-ROMs to the Cloud.

- SaaS 1.0 (The Cloud Shift, ~2000-2010): Companies like Salesforce pioneered the move from on-premise servers to the cloud. The innovation was delivery, not necessarily billing. The model was simple: move the license fee to a recurring monthly payment.

- SaaS 2.0 (The Subscription Boom, ~2011-2023): This era perfected the “Per User/Per Month” model. It was predictable, investors loved the Recurring Revenue (ARR), and because software had near-zero marginal costs, every new seat was pure profit.

- SaaS 3.0 (The Agentic Era, 2024-Present): Generative AI broke the SaaS 2.0 equation. AI models require expensive GPU compute for every interaction (inference). Furthermore, AI “Agents” began doing the work of humans. If one human with an AI agent can do the work of ten people, a seat-based model sees revenue contract by 90% just as the value delivered skyrockets. This necessitated a new economic framework: SaaS 3.0.

The Three Eras of SaaS Evolution

| Feature | SaaS 1.0 (Cloud) | SaaS 2.0 (Subscription) | SaaS 3.0 (Agentic/AI) |

| Core Value | Accessibility (Anywhere access) | Workflow & Collaboration | Autonomy & Outcomes |

| Primary Unit | License / Server | User Seat (Headcount) | Outcome / Token / Work Unit |

| Marginal Cost | Low | Near Zero | High (Compute/Inference) |

| Revenue Driver | System Replacement | Hiring more people | Increasing usage/intensity |

| Key Metric | TCV (Total Contract Value) | ARR (Annual Recurring Revenue) | NRR (Net Revenue Retention) |

| Sales Motion | Field Sales (Steak dinners) | Inside Sales / PLG | Consultative / Product-Led |

The AI COGS Crisis and Margin Compression

The most immediate catalyst for the shift to usage-based billing is not philosophical; it is mathematical. In the SaaS 2.0 world, the cost to serve one additional user was negligible—a few database entries and minimal bandwidth. In 2026, serving a power user of an AI-native platform involves heavy computational lifting.

Large Language Models (LLMs) and reasoning engines incur “inference costs” every time they run. A 2025 report by Mavvrik indicated that 84% of enterprises saw gross margin erosion of >6% due to unmetered AI infrastructure costs. When vendors bundle unlimited AI features into a flat subscription fee, they expose themselves to “adverse selection.” The customers who get the most value—those running thousands of complex prompts or agentic workflows—are often the ones dragging the vendor’s gross margins below the critical 70% threshold.

Analysis: The shift to usage-based pricing (UBP) is a defensive maneuver to protect margins. By passing the inference cost to the customer via token-based or outcome-based billing, vendors ensure that revenue scales in lockstep with their own costs.

Cost Structure Comparison (Traditional vs. AI-Native)

| Cost Component | Traditional SaaS (2.0) | AI-Native SaaS (3.0) | Impact on Margin |

| Compute | Stable (Database queries) | Volatile (GPU Inference) | Significant Drag |

| Storage | Linear Growth | Exponential (Vector DBs) | Moderate Drag |

| R&D | Code-based | Model Fine-tuning + Code | High Investment |

| Support | Human Heavy | AI Agent Heavy | Potential Savings |

| Target Gross Margin | 80% – 90% | 60% – 75% | Compressed |

The Rise of Agentic Workflows

The fundamental promise of AI in 2026 is no longer just “copilots” assisting humans; it is “agents” replacing tasks. This distinction is vital for billing. In a seat-based model, you monetize the human operating the software. But what happens when the software operates itself?

Consider a Customer Support platform:

- SaaS 2.0 Scenario: You charge $100/month per human support agent. If a company uses AI to reduce their staff from 50 to 5, your revenue drops from $5,000 to $500, even though your software is now doing 90% of the work.

- SaaS 3.0 Scenario: You charge $0.99 per “autonomous resolution.” If the AI resolves 10,000 tickets, your revenue is $9,900.

This is the “Service-as-a-Software” shift. Companies like Intercom, Zendesk, and emerging vertical AI players have pioneered this shift. The economy is moving from renting tools to buying outcomes.

The “Service-as-a-Software” Pricing Matrix

| Metric | “Copilot” Model (SaaS 2.5) | “Agent” Model (SaaS 3.0) |

| Pricing Trigger | Per User Seat + AI Add-on | Per Outcome / Task Completed |

| Value Prop | “Make your staff faster” | “Do the work for you” |

| Customer Risk | High (Paying for unused seats) | Low (Paying for results) |

| Vendor Upside | Capped by headcount | Uncapped (Scales with business volume) |

| Example | Microsoft Copilot ($30/user) | Intercom Fin ($0.99/resolution) |

The Hybrid Compromise (Predictability vs. Upside)

While pure usage-based pricing (like Snowflake or AWS) aligns costs perfectly, it creates friction with enterprise procurement teams who dislike variable bills. A CFO cannot budget for “we’ll see how much we use.”

This tension has birthed the “Hybrid Model,” which dominates the 2026 landscape. According to the 2025 Pricing Trends Report by Maxio, companies utilizing hybrid models (Platform Fee + Usage) outperformed pure models with a 21% median growth rate.

How the Hybrid Model Works:

- Platform Fee: A fixed recurring fee (e.g., $20,000/year) that covers core access, data hosting, and security. This satisfies the vendor’s need for baseline ARR and the customer’s need for budget predictability.

- Consumption/Overage: A variable component for AI usage (e.g., tokens, generated videos, autonomous credits). This captures the upside as the customer scales.

This “Committed Spend” model—where customers pre-buy a block of usage credits—has become the gold standard. It allows vendors to recognize revenue upfront while allowing customers to consume at their own pace.

The Transformation of Sales and Customer Success

The shift to SaaS 3.0 requires a complete overhaul of the Go-To-Market (GTM) engine. The days of the “sign and resign” sales culture are fading.

The Death of the “Hunter” Sales Rep?

In SaaS 2.0, the goal was to sign the big contract and walk away. In SaaS 3.0, the initial contract is often small to lower barriers to entry (“Land”). The real revenue comes from “farming”—getting the customer to use the product more (“Expand”).

- Sales Compensation: Is moving away from paying 100% on the initial booking. Instead, commissions are often “dripped” or tied to “consumption realization” milestones.

- Customer Success (CS): Is no longer a support function; it is a revenue function. If a CS manager helps a client optimize their AI workflow, usage goes up, and revenue increases. CS teams in 2026 are increasingly carrying quotas tied to Net Revenue Retention (NRR).

Expert Perspective:

“In 2026, the best sales pitch isn’t a slide deck; it’s a low-friction pilot. You don’t sell the promise of value; you let the customer experience the outcome, and the billing naturally follows the value curve.” — Synthesized from 2025 OpenView & Bessemer Insights.

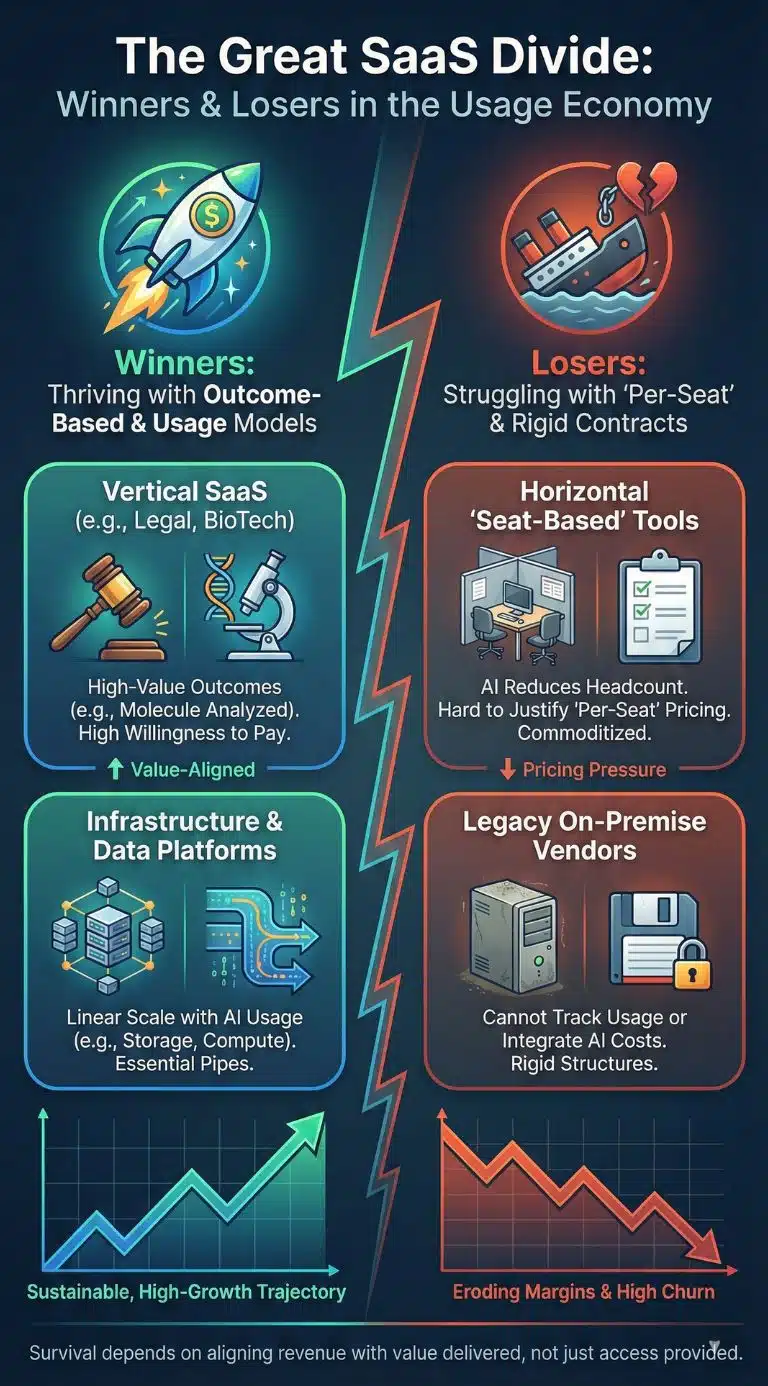

Winners vs. Losers in the Usage Economy

Not every company survives this transition. The usage-based model ruthlessly exposes “shelfware”—software that is bought but not used. In SaaS 2.0, vendors loved it when customers bought 100 seats but only used 50. In SaaS 3.0, if a customer isn’t using the tool, the bill is zero.

Winners and Losers of the SaaS 3.0 Shift

| Category | Status | Why? |

| Vertical SaaS (e.g., Legal, BioTech) | Winner | Can charge for high-value outcomes (e.g., “Contract Drafted” or “Molecule Analyzed”). High willingness to pay. |

| Infrastructure & Data Platforms | Winner | As AI usage explodes, the underlying data pipes and storage (Snowflake, Datadog) see usage scale linearly. |

| Horizontal “Seat-Based” Tools | Loser | Hard to justify per-seat pricing when AI reduces headcount. Highly commoditized (e.g., basic CRM, Project Mgmt). |

| Legacy On-Premise Vendors | Loser | Cannot easily track usage or integrate AI inference costs into rigid contract structures. |

Data & Visualization: The 2026 Landscape

To illustrate the market state, we look at the aggregated data defining the current year.

Key Statistics: The State of SaaS Billing (2026)

- 85% of SaaS companies have adopted some form of Usage-Based Pricing (UBP). (Source: Modall/Metronome Context)

- $85,521: The average monthly AI spend for mid-market enterprises, a 36% increase from 2024. (Source: CloudZero/Bessemer Context)

- 125%: The average Net Revenue Retention (NRR) for companies with Usage-Based models, compared to ~110% for pure subscription models.

- 60%: Percentage of horizontal productivity apps predicted to pivot or be acquired due to pricing pressure by late 2026.

- 5-7%: Average annual churn rate for healthy SaaS 3.0 companies, driven lower by value-aligned pricing.

Future Outlook: What Comes Next?

As we look toward the second half of 2026 and into 2027, three major trends will define the next phase of SaaS 3.0.

1. Outcome-Based Liability

If vendors charge for outcomes (e.g., “Code Written” or “Diagnosis Made”), they may soon face liability for bad outcomes (e.g., “Security Vulnerability Introduced”). Contracts will evolve to include “Service Level Agreements (SLAs) for Intelligence,” defining not just uptime, but the accuracy rate of the AI agents.

2. The “Work Unit” Standardization

Just as cloud computing standardized the “vCPU” and “GB of RAM,” the AI industry will likely coalesce around a standard unit of work—perhaps the “Task Unit” or “Compute Credit”—to allow easier comparison between different AI vendors.

3. Voice-First B2B Interfaces

With multimodal AI becoming cheaper, the “seat” will further dissolve as users interact with software via voice while driving or walking, removing the need for a visual UI “login” altogether. This reinforces the need for billing based on interaction, not visual interface access.

Final Thought

SaaS 3.0 is not just a pricing tweak; it is a fundamental restructuring of the business relationship between vendor and buyer. It aligns incentives purer than any model before it: The vendor only gets paid if the customer gets value.

While the transition is painful—requiring new billing infrastructure, new sales incentives, and uncomfortable margin analysis—it is inevitable. In an AI-first world, paying for a “seat” is as archaic as paying for long-distance calls by the minute. The future is outcome-based, and for the companies that navigate this shift, the upside is limitless.