Investing in the stock market can be a rewarding way to grow your wealth, but it comes with its fair share of risks. Without a solid risk management plan, even the most promising investments can lead to significant losses.

In this article, we’ll explore 12 Risk Management Strategies for Stock Market Success to help you navigate market volatility, protect your investments, and achieve your financial goals.

Understanding the Basics of Risk Management in the Stock Market

What is Risk Management in Investing?

Risk management in investing refers to the strategies and techniques used to minimize potential losses while maximizing potential returns. It involves understanding the risks associated with different investments and taking proactive measures to mitigate them. Effective risk management allows investors to make informed decisions and achieve long-term success.

By creating a structured framework to handle uncertainty, risk management becomes a key driver for consistent performance in the stock market.

Key Types of Risks in Stock Market Investments

- Market Risk: The possibility of losing money due to fluctuations in stock prices, often influenced by economic conditions.

- Credit Risk: The risk of a company defaulting on its obligations, particularly relevant for bond investors.

- Liquidity Risk: Challenges in selling an asset without significantly affecting its price, especially in less liquid markets.

- Systematic Risk: Risks inherent to the market, such as economic downturns or geopolitical events, that cannot be eliminated through diversification.

- Unsystematic Risk: Risks specific to a particular company or industry, such as poor management decisions or regulatory changes.

| Type of Risk | Description | Example |

| Market Risk | Fluctuations in stock prices | Losses during a market crash |

| Credit Risk | Default on financial obligations | A bond issuer failing to pay interest |

| Liquidity Risk | Difficulty in selling an asset | Selling a low-volume stock at a discounted price |

| Systematic Risk | Economy-wide issues | Recession impacting the overall market |

| Unsystematic Risk | Specific to a company or industry | Losses due to poor management in a tech company |

Why Risk Management is Crucial for Every Investor

Neglecting risk management can lead to poor decision-making and significant financial losses. A structured approach helps investors:

- Protect their capital against unexpected downturns.

- Maintain emotional discipline during volatile market phases.

- Adapt to changing market conditions with a clear plan.

12 Proven Risk Management Strategies for Stock Market Success

1. Diversify Your Investment Portfolio

Diversification involves spreading your investments across various asset classes, sectors, and geographies to reduce risk. By holding a mix of stocks, bonds, and other assets, you can minimize the impact of a poor-performing investment on your overall portfolio. For example, pairing tech stocks with defensive sectors like utilities or healthcare can balance volatility.

| Asset Class | Examples | Risk Level |

| Equities | Technology, Healthcare | High |

| Fixed Income | Government Bonds, ETFs | Low-Medium |

| Commodities | Gold, Oil | Medium |

| Real Estate | REITs, Commercial Property | Medium-High |

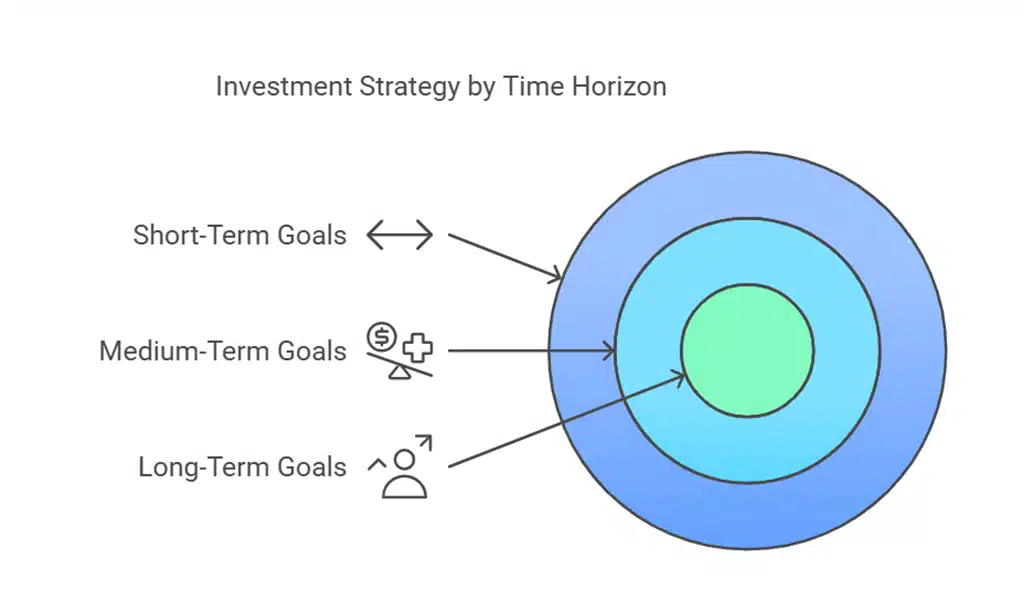

2. Set Clear Investment Goals

Define your short-term and long-term financial objectives before investing. Clear goals help you determine your risk tolerance and guide your investment choices. For instance, saving for retirement might involve low-risk, long-term investments, while short-term goals like a home purchase may require a more conservative approach.

| Goal Type | Time Horizon | Recommended Investments |

| Short-Term (1-3 yrs) | Low | Money Market Funds, Treasury Bonds |

| Medium-Term (3-7 yrs) | Medium | Balanced Funds, Dividend Stocks |

| Long-Term (>7 yrs) | High | Equity Funds, Growth Stocks |

3. Invest Only What You Can Afford to Lose

Never risk money you can’t afford to lose. Establish an emergency fund and ensure your essential expenses are covered before entering the stock market. This safeguards your financial stability and reduces the pressure to liquidate investments prematurely during market downturns.

| Risk Budget | Example Scenarios |

| Emergency Fund | 6-12 months of living expenses |

| Discretionary Investments | Savings beyond essential needs |

4. Regularly Review and Rebalance Your Portfolio

Market conditions change, and so should your portfolio. Regularly reviewing and rebalancing ensures your investments align with your financial goals and risk tolerance. For example, if a stock sector has grown disproportionately, rebalancing reallocates funds to maintain your desired risk level.

| Frequency | Suggested Actions |

| Quarterly or Annually | Assess portfolio weightings |

| After Market Events | Adjust for significant movements |

5. Use Stop-Loss and Limit Orders

Stop-loss and limit orders are essential tools to protect your investments:

- Stop-Loss Order: Automatically sell a stock when its price falls to a specified level, protecting against large losses.

- Limit Order: Buy or sell a stock at a predetermined price, ensuring control over entry and exit points. These tools are especially valuable during volatile markets.

| Order Type | Functionality | Example |

| Stop-Loss Order | Prevents further losses | Sell a stock if it drops below $100 |

| Limit Order | Sets a fixed price for transactions | Buy a stock only if it’s priced at $120 or lower |

6. Research Before Every Investment Decision

Thorough research is non-negotiable. Analyze:

- Fundamentals: Financial health, management, and growth prospects of the company.

- Technical Indicators: Price patterns and market trends. Use credible sources like financial news platforms, annual reports, and industry analyses. For instance, reviewing the quarterly earnings reports of companies can provide insight into future performance.

| Research Method | Focus Area | Example Tools |

| Fundamental Analysis | Financial health and valuation | Company Annual Reports, Yahoo Finance |

| Technical Analysis | Price trends and patterns | TradingView, StockCharts |

| Market Sentiment | Public opinion on stocks | Google Trends, Social Media Platforms |

7. Avoid Emotional Decision-Making

Emotions like fear and greed can lead to impulsive decisions. Develop a disciplined investment approach by:

- Sticking to your strategy.

- Ignoring short-term market noise.

- Practicing patience. A study by Dalbar Inc. revealed that emotional investing often results in lower returns than the overall market.

8. Consider Dollar-Cost Averaging (DCA)

Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of market conditions. This strategy reduces the impact of market volatility and ensures consistent investing. For instance, investing $500 monthly in an index fund spreads risk over time.

| Scenario | Advantages |

| Rising Markets | Buy fewer shares but gain value |

| Falling Markets | Accumulate more shares at low cost |

9. Leverage Hedging Strategies

Hedging involves using financial instruments like options, futures, or exchange-traded funds (ETFs) to offset potential losses. For example:

- Buy put options to protect against a decline in stock prices.

- Invest in inverse ETFs to hedge against market downturns. Hedging is particularly useful during periods of economic uncertainty.

| Hedging Tool | Use Case |

| Put Options | Protect individual stock positions |

| Inverse ETFs | Hedge against broader market risks |

| Futures Contracts | Lock in prices for commodities |

10. Monitor Macro-Economic Trends

Stay informed about macro-economic factors like:

- Interest rates.

- Inflation.

- Geopolitical events. Understanding these trends helps you anticipate market movements and adjust your strategy. For example, rising interest rates often lead to declining stock prices in rate-sensitive sectors like real estate.

11. Educate Yourself Continuously

The stock market evolves, and so should your knowledge. Regularly update yourself with:

- Investment books.

- Online courses.

- Expert webinars. Continuous learning equips you with the tools to make smarter investment decisions.

| Resource | Description |

| “The Intelligent Investor” by Benjamin Graham | Classic book on value investing |

| Coursera/EdX | Courses on stock market fundamentals |

12. Seek Professional Advice When Needed

A financial advisor can provide personalized guidance tailored to your financial goals and risk tolerance. They can help you develop a comprehensive investment plan and stay on track. For example, working with a certified financial planner (CFP) ensures access to expert insights for complex portfolios.

Interactive and Practical Elements to Enhance Risk Management

Sample Portfolio Diversification by Asset Class

| Asset Class | Suggested Allocation (%) | Risk Level |

| Equities | 40-60% | High |

| Bonds | 20-40% | Medium |

| Real Estate | 10-20% | Medium-High |

| Cash/Cash Equivalents | 5-15% | Low |

Checklist: Are You Managing Your Risks Effectively?

- Do you diversify your investments across different asset classes?

- Are your investment decisions based on research?

- Do you regularly review and rebalance your portfolio?

- Have you set clear stop-loss and limit orders?

- Are you continuously educating yourself about the market?

Takeaway

Risk management is the cornerstone of stock market success. By implementing these 12 Risk Management Strategies for Stock Market Success, you can safeguard your investments, make informed decisions, and achieve your financial objectives. Remember, the key to success lies in discipline, education, and proactive planning.

Take control of your financial future today by applying these strategies to your investment journey!