You want a digital cash that stays close to one u.s. dollar. Crypto coins often crash or spike, like a wild ride. That can make cross-border payments slow and scary. Algorithmic stablecoins try to tame price swings with smart contracts on blockchain technology in decentralized finance.

Analysts say stablecoins could be a $4 trillion force by 2035. This post lists 10 key algo tokens you need to know. Each one shows how code mints or burns tokens to hold value. You will spot the perks and pitfalls of this digital currency.

Keep reading.

Key Takeaways

- Algorithmic stablecoins use code in smart contracts to mint or burn tokens and keep a $1 peg. Analysts expect them to grow to $4 trillion by 2035.

- TerraUSD (UST) lost its peg in May 2022, fell from $1 to $0.05 in two weeks, and erased $60 billion in value when its code failed to match supply with demand.

- Frax (FRAX) uses a hybrid model that holds partial reserves in USDC or treasury bills and adjusts supply by algorithm. Ampleforth (AMPL) uses daily rebases to change token balances.

- Regulators like the SEC and FinCEN moved after UST’s crash and now propose the Stable Act to oversee both fiat-backed and algorithmic stablecoins.

- Platforms such as MakerDAO’s DAI and Aave’s GHO mix collateral with algorithms to power fast, low-fee cross-border payments and lending on DeFi exchanges.

What Are Algorithmic Stablecoins?

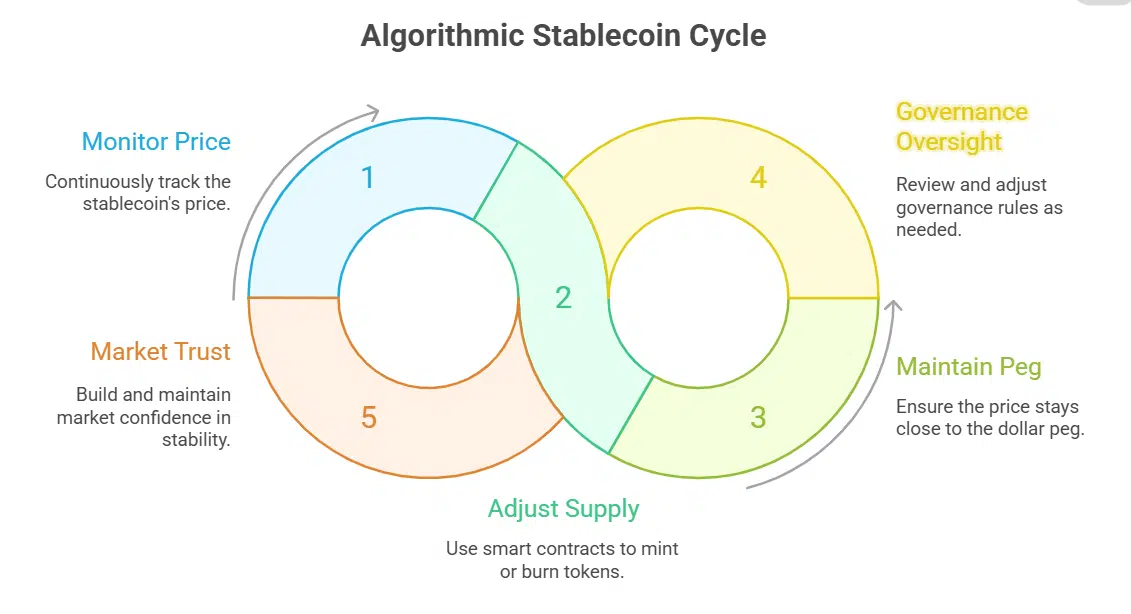

Algorithmic stablecoins use smart contracts within blockchain technology to adjust token supply. They chase a dollar peg for fiat assets without a cash reserve. Code triggers minting or burning tokens like a seesaw, when prices cross one dollar.

This setup cuts fees for cross-border payments and speeds up on chain transactions.

Frax (FRAX) shows this idea in action. The protocol splits supply moves through governance rules and algorithmic triggers. It holds small collateral and trusts market forces to keep price stable.

Tokens such as TerraUSD (UST) collapsed when code could not match supply with demand. That event rings a caution bell for many crypto assets in decentralized finance (DeFi).

Benefits of Algorithmic Stablecoins

These coins peg their value to the US dollar, using smart contracts to add or remove tokens in real time, like a thermostat controlling room temperature. They give a stable alternative to Bitcoin or Ether, which can swing wildly in value.

Smart token models like algorithmic stablecoins use code to control supply, not locked funds. This method cuts fees, so users save on cross-border payments, and they avoid hefty repurchase agreements or money market funds.

It works on blockchain technology, so apps on distributed ledgers can tap into these coins for fast, cheap trades.

Rising decentralized finance use drives strong demand for a reliable store of value. These tokens scale easily, since they do not require locked collateral in treasury bills or gold-backed assets.

Liquidity flows freely on decentralized exchanges, turning complex yield farming into child’s play. Users can earn interest, swap tokens, or send cash abroad without banking gatekeepers.

Risks and Challenges of Algorithmic Stablecoins

Algorithmic stablecoins lean on smart contracts, not bank vaults, to hold value. A slip in reserve management can trigger depegging, and prices can spiral. Regulators eye financial stability risks and probe for money laundering.

A trading platform may freeze orders if the coin strays too far from the dollar. Automated code faces tests when markets crash.

TerraUSD lost its peg in 2022 and dragged Luna to ruin, erasing $60 billion in value. That failure shook decentralized finance and sparked debates at the Commodity Futures Trading Commission and the European Central Bank.

Tether USDT and USD Coin stay closer to a dollar by keeping actual cash in reserves. Algorithmic coins used for cross-border payments in emerging markets face tight scrutiny. Will code alone tame crypto’s ups and downs?

TerraUSD (UST): A Cautionary Tale

TerraUSD (UST) stood out as an algorithmic stablecoin that aimed to hold one US dollar. The design used supply shifts and digital agreements on blockchain technology. It joined Luna in a decentralized autonomous organization that ran on programmable contracts.

The network supported cross-border payments and on-chain transactions. A single $150 million shift jolted its peg. An $84 million sale pushed UST down. Market value dipped from $1 to $0.05 in two weeks.

That crash burned $60 billion in value. Fans in DeFi saw a tough lesson on price stability and financial stability risks.

Many held UST as a medium of exchange in markets in crypto-assets. Some thought it could rival Tether USDT or USDC. Other traders praised fiat-backed stablecoins, stirring talk around the Stable Act and anti-money laundering rules.

Regulators like the Securities and Exchange Commission eyed the wreckage. Firms like Pax Dollar and BUSD looked safer. Banks and digital wallets reexamined their risk models. UST’s fall still echoes in DeFi chats.

It has become a cautionary tale.

Frax (FRAX): A Hybrid Stability Model

Frax runs on smart contracts in a blockchain network. The protocol mints and burns FRAX digital currency tokens to match demand. Users can swap FRAX for collateral, like USD Coin, at fixed rates.

It uses algorithmic stablecoin logic with reserve backing to hold the peg.

The hybrid design mixes code-based rules with real assets. Protocol taps fiat-backed stablecoins or treasury bills for collateral. Traders see fewer price swings on blockchain technology rails.

It fits in decentralized finance (defi) apps and smooths cross-border payments and on-chain transactions.

Ampleforth (AMPL): Elastic Supply Mechanism

AMPL sends supply into action whenever demand shifts. It uses supply rebasement to tweak token counts in wallets. Demand elasticity drives these shifts. Network nodes run smart contracts on Ethereum to rebase balances at 2 UTC every day.

The system targets price stability without fiat or crypto collateral. Users check transactions on block explorers like Etherscan and trade on Uniswap.

This model rides on blockchain technology to power algorithmic stablecoins in decentralized finance (DeFi). People add AMPL to their MetaMask wallets and study tokenomics for insights.

Traders tap it for cross-border payments and foreign exchange moves. Analysts call this elastic supply mechanism a fresh way to hunt stable value without reserves. Markets in crypto-assets (MICA) now list AMPL as a novel digital asset.

Balancer Smart Pool: Dynamic Algorithmic Adjustments

Balancer Smart Pool shifts asset weights inside a liquidity pool. This system tweaks token ratios to keep price stable. Code runs on Ethereum and uses smart contracts. Developers can change supply and demand in real time.

That feature makes the pool more flexible than fixed supply models. Liquidity providers mix tether USDT or USD Coin USDC as tokens. Pairs of stablecoins help power cross-border payments on blockchain technology.

Such design avoids reserve backing of collateralized stablecoins.

Algorithmic rules react to on-chain transactions and changing exchange rates. decentralized finance (DeFi) dapps tap this tool for better price stability. Builders write smart contracts against the Balancer protocol.

Governance token holders set key parameters. This approach cuts leverage spikes and lowers financial stability risks. Non custodial liquidity pools attract traders with less volatility.

Fei Protocol (FEI): Protocol-Controlled Value

FEI links directly to the protocol-controlled value vault and smart contracts. The protocol mints or burns tokens to match market demand. It holds digital assets in Ethereum to back each FEI.

This method keeps FEI close to one US dollar. It uses blockchain technology and algorithmic stablecoins logic.

The vault buys ether or other on-chain collateral. It cuts price swings and drops reliance on fiat-backed coins. Traders visit decentralized finance applications to swap FEI for USDT or USD Coin.

Users enjoy faster, low fee cross-border payments. It plays out like a tightrope act, shifting supply in real time.

Empty Set Dollar (ESD): An Early Algorithmic Experiment

Empty Set Dollar rose as one of the first algorithmic stablecoins in decentralized finance (defi). The protocol used smart contracts to mint and burn tokens, balancing supply and demand with no reserve backing.

Blockchains recorded all on-chain transactions, while a decentralized exchange carried out arbitrage. Traders followed moves with a block explorer and managed assets inside a wallet app.

The system lost its peg to a dollar under stress. Purely algorithmic rules led to wild swings in token value. This failure flagged major financial stability risks for digital assets in defi.

Developers noted that future models might blend algorithms with treasury bills or collateral.

OlympusDAO (OHM): Algorithmic Reserve Currency

OlympusDAO issues OHM as an algorithmic reserve currency. The team uses smart contracts on Ethereum’s blockchain technology, staking, bonding, and an oracle network to set supply.

They back OHM with reserves like DAI, USDC and USDT. It locks real digital assets in a treasury to boost long-term stability.

Stakers earn protocol fees from cross-border payments and decentralized finance (defi) trades. Investors snap up bonds to bulk up reserve backing. This mechanism tweaks supply instead of leaning on fiat-backed stablecoins, and curbs wild swings as the network grows.

Basis Cash (BAC): A Historical Perspective

Basis Cash ran on Ethereum, built on blockchain technology. The team coded smart contracts to adjust supply via rebasing. The protocol aimed to anchor to one dollar, like USDT and USDC.

It used no reserve backing. It looked like a pure decentralized algorithmic stablecoin. It faced wild price swings. It lost its peg within weeks, and the price fell below eighty cents.

Its run shows that simple algorithms risk failure in a storm. New projects now mix smart code with backing. They use fiat-backed and crypto-backed stablecoins to hold the peg. Some add rules for AML/CFT and work with monetary authorities.

Projects target cross-border payments and more decentralized finance cases. These moves guide future digital currencies.

DAI (MakerDAO): A Semi-Algorithmic Approach

DAI taps blockchain technology and smart contracts to hold its peg. It stays near $1 through crypto-backed collateral locked in vaults and supply tweaks by code. The protocol uses decentralized price feeds, so on-chain transactions keep rolling.

It lets traders move digital assets and make cross-border payments without a bank. Real world apps and DeFi platforms lean on this decentralized stablecoin every day.

MakerDAO voters adjust stability fees and add new collateral types. This semi-algorithmic model blends algorithmic stablecoins and collateralized stablecoins. It walks a tightrope between reserve backing and code rules to guard price stability.

It powers loans, yield farms, and payment rails across decentralized finance (DeFi). It ranks among the top stablecoins in the ecosystem.

GHO (Aave): The New Entrant in Algorithmic Stability

Aave released GHO as its new algorithmic stablecoin. It blends price stability algorithms with the protocol’s liquidity and security. Smart contracts mint GHO over collateral in Aave’s lending pools.

Users borrow it by staking ether or usd coin (usdc).

Aave secures GHO with crypto-backed collateral and on-chain transactions. That structure taps the power of decentralized finance (defi) while steering clear of fiat-backed stablecoins.

Traders can use GHO for cross-border payments or point-of-sale purchases. Liquidity pools act like digital cash drawers, storing underlying assets to support price stability. Developers aim to match or beat reserve backing in treasury bills, without depending on central banks or commercial paper.

Regulatory Concerns Surrounding Algorithmic Stablecoins

US regulators scramble to catch up with algorithmic stablecoins. Janet Yellen raised alarms in Feb 2022 after TerraUSD lost its peg. They warn that shaky code can spark financial stability risks and fuel illicit activity.

FinCEN now eyes more anti-money-laundering rules. Some lawmakers push for a Stable Act to fold both fiat-backed stablecoins and new code-driven coins into one rule set.

These protocols run on blockchain technology without a central bank cushion. Classic coins lean on Treasury bills as reserve backing. This gap stirs debate in Congress and at the EBA.

Crypto exchanges must beef up AML checks or face fines. Firms in DeFi fret that this rule haze could jam cross-border payments or stall lending markets.

The Role of Algorithmic Stablecoins in DeFi

Algorithmic stablecoins power many DeFi apps. They run via smart contracts on blockchain technology. These coins feed liquidity pools on decentralized exchanges. They capture about two thirds of stablecoin trades.

Digital assets flow through lending markets and yield farms. Stable tokens speed on-chain transactions and support cross-border payments. Projects like MakerDAO’s DAI or the Fei Protocol slot into Aave or an AMM platform.

They boost decentralized finance.

Future Outlook for Algorithmic Stablecoins

Analysts predict stablecoin supply could hit $4 trillion within a decade. That jump will reshape cross-border payments, remittances, and trade finance. Smart contracts on blockchain tech will cut costs and speed transfers.

Banks and digital wallets will handle on-chain transactions in seconds. Regulatory bodies like the european banking authority, the financial action task force and FinCEN will guard against illicit activity and financial stability risks.

The Stable Act may force new rules for fiat-backed and decentralized stablecoins.

Developers will build hybrid models that mix reserve backing, treasury bills, and gold. DeFi rigs will tap algorithmic rules for price stability. It may feel like riding a roller coaster.

Crypto exchanges and credit card firms will plug into these systems. Digital euro pilots may run on smart contracts. Bitcoin mining firms might join as validators. Pypl will test money transfer features on these rails.

Regulators must adapt fast as this digital asset class grows.

Takeaway

Algorithmic coins twist supply like a rubber band to chase $1. They use smart contracts on blockchain to mint or burn tokens. Failures showed how fragile code can be in wild markets.

Other designs like a dual-backed token and a dynamic pool proved more sturdy, earning fan clubs in DeFi. Keep an eye on this tech as it rewrites how we move digital money.