The era of signing a ten-year lease based on a gut feeling is officially over. As we move into 2026, the retail landscape has shifted from a “growth at all costs” mindset to one of rigorous profitability and data-backed decision-making. For agile brands, Retail Market Validation Strategies have become the primary defense against bankruptcy and the most effective offense for expansion.

Entering a new market—whether it’s the bustling streets of New York, the heritage-rich neighborhoods of London, or the luxury corridors of Dubai—carries immense risk. But what if you could compress that risk into a single month? A 30-day “sprint” allows brands to test logistics, gauge brand sentiment, and capture real-world footfall data without the suffocating commitment of a long-term contract.

This guide explores ten specific pop-up formats designed not just to sell product, but to validate the viability of a new city before you plant your flag permanently.

Key Takeaways

-

30 Days is the Sweet Spot: Long enough to get reliable data, short enough to limit financial exposure.

-

Match Format to City: Use “Glass Pods” for Dubai visibility, “Shop-in-Shops” for UK trust, and “Mobile Vans” for US targeting.

-

Measure ROO, Not Just ROI: Validate logistics, email lists, and dwell time before worrying about net profit.

-

Experience First: In the validation phase, creating a memory is more valuable than selling a unit.

-

Don’t Sell Sales, Sell Data: If you break even on costs but gain 2,000 active local email subscribers, the pop-up was a massive profit.

-

Test the “Why,” not just the “What”: Use heat maps to understand why people didn’t buy (e.g., bad fitting room experience) vs. just knowing they didn’t buy.

The “Validation Economy”: Why 30 Days?

In 2026, a pop-up store is no longer just a marketing stunt; it is a laboratory. The “30-Day Rule” is based on the retail lunar cycle: four weeks is the minimum viable time to capture a full pay cycle, observe foot traffic patterns across different days/times, and gather enough data to make a statistically significant projection for a permanent location.

The Shift in Objectives:

-

Old Way (2020-2024): Pop-ups were for clearing old stock or generating PR buzz.

-

New Way (2026): Pop-ups are for Retail Market Validation. The goal is to answer: Does this specific neighborhood actually care about my brand?

If you can’t generate organic traction in 30 days, a 5-year lease won’t save you.

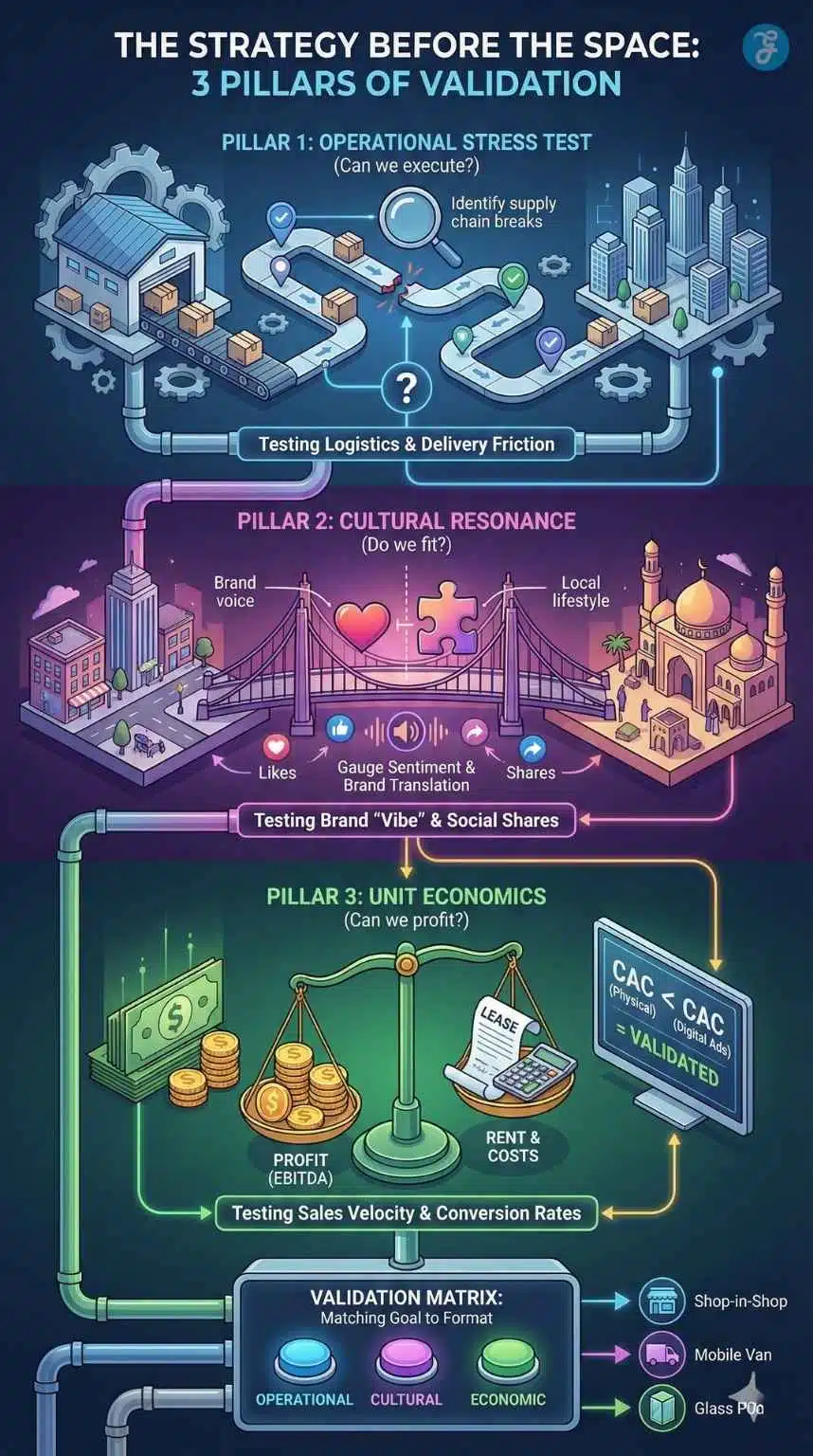

The Strategy Before the Space: 3 Pillars of Validation

Before you choose a glass pod in Dubai or a mobile van in Austin, you must define your “Validation Variable.” A common mistake in 2026 is picking a cool format that tests the wrong metric.

To validate a city effectively, you must isolate exactly one of the following three pillars. Your choice here dictates which pop-up format you should select in the next section.

Pillar 1: Operational Stress Test (Can we execute?)

This is purely logistical. You are testing if your supply chain can handle the friction of a new border or city.

-

The Question: Can we get stock from our warehouse to a customer’s door in London within 24 hours without the margin being eaten by tariffs or traffic?

-

The Goal: Identify supply chain breaks before they become permanent headaches.

Pillar 2: Cultural Resonance (Do we fit?)

This is about “Brand Translation.” A bestseller in New York might be a flop in Tokyo or Dubai due to sizing, color preferences, or cultural values.

-

The Question: Does our brand voice, imagery, and product mix align with the local lifestyle?

-

The Goal: Gauge sentiment. Are people confused by your product, or are they delighted?

Pillar 3: Unit Economics (Can we profit?)

This validates the financial model. It strips away the hype to look at the raw numbers of rent vs. revenue.

-

The Question: Is the Customer Acquisition Cost (CAC) via a physical store lower than our digital ad spend in this region?

-

The Goal: Prove that a permanent lease will yield a healthy EBITDA.

Validation Matrix: Matching Your Goal to the Format

Use this matrix to guide your choice of format in the next section:

| If your Primary Goal is… | You are testing… | Focus on these Formats (Below) |

| Operational Stress Test | Logistics, Staffing, Last-Mile Delivery | The Shop-in-Shop, The “Phygital” Showroom |

| Cultural Resonance | Brand “Vibe,” Social Shares, Footfall | The Museum Installation, The Mobile Van, The “Blind” Concept |

| Unit Economics | Sales Velocity, Conversion Rates, AOV | The In-Line Mall Sprint, The Glass Pod |

10 Pop-Up Formats That Validate a New City

We have categorized these formats by their primary function: Speed, Experience, or Deep Engagement.

Category A: The “Low-Friction” Formats (Speed & Efficiency)

These formats are designed for rapid deployment. They answer the question: Is there a basic demand?

1. The Shop-in-Shop (The “Parasite” Model)

-

Concept: Renting a dedicated corner, shelf, or “concession” within a larger, established retailer that already serves your target demographic.

-

Best For: UK (London) and USA (NYC). Think Selfridges or a curated boutique in SoHo.

-

Why It Works: You “borrow” the host’s credibility. If you are a sustainable denim brand, launching inside a popular eco-conscious multi-brand store validates whether their existing customers will switch to you.

-

2026 Twist: “Smart Concessions” where your shelf is equipped with independent traffic counters to measure how many people stopped vs. how many bought.

2. The In-Line Mall “Sprint”

-

Concept: Taking over a vacant “in-line” unit (a standard store between anchor tenants) in a major shopping mall for exactly one month.

-

Best For: Dubai (Dubai Mall, Mall of the Emirates) and the USA (Westfield centers).

-

Why It Works: This is the only format that accurately mimics the P&L (Profit & Loss) of a permanent store. It tests whether you can survive the “mall ecosystem” of high rent and high competition.

-

Validation Signal: If your sales per square foot match the mall average in month one, you are ready for a lease.

3. The Mobile Boutique (The “Vantage” Van)

-

Concept: A custom-outfitted truck or luxury van that moves to a new neighborhood every 5-7 days.

-

Best For: USA (Los Angeles, Austin, Miami).

-

Why It Works: In sprawling US cities, location is everything. A van allows you to A/B test neighborhoods. Does your brand perform better in Silver Lake or Venice Beach? The van gives you the answer before you sign a lease.

Category B: The “Experiential” Formats (Brand Salience)

These formats prioritize “Mental Availability” over immediate sales. They answer: Is my brand interesting enough to stop traffic?

4. The “Museum-Style” Installation

-

Concept: A space dedicated to art, storytelling, and sensory experiences with little to no physical product for sale.

-

Best For: London (Shoreditch) and Dubai (Alserkal Avenue).

-

Why It Works: It tests “Viral Potential.” In 2026, if your store isn’t being shared on TikTok or Instagram, it doesn’t exist. High social mentions during this pop-up validate that your brand has cultural relevance in the city.

5. The “Phygital” Showroom (Zero Inventory)

-

Concept: A minimalist showroom where customers can touch and try products, but all purchases are made via QR code for home delivery.

-

Best For: Tech Hubs (San Francisco, London, Dubai Design District).

-

Why It Works: It validates your Logistics & E-commerce infrastructure. Can you actually deliver to a Dubai postcode within 24 hours? This format exposes supply chain cracks without the risk of holding $50k of stock in a temporary backroom.

6. The “Live-Stream” Studio

-

Concept: A glass-walled store designed primarily as a broadcasting set for influencers and live-stream shopping hosts.

-

Best For: Dubai and London.

-

Why It Works: It tests the “Halo Effect.” Does a physical presence in London boost your online sales in the UK? This format often generates more revenue online during the 30 days than in-store.

7. The “Blind” Concept Store

-

Concept: A store with no external signage or branding—just a vibe, a color, or a cryptic symbol.

-

Best For: USA (New York, LA).

-

Why It Works: It tests “Organic Pull.” If people are curious enough to walk in without a logo slapping them in the face, your brand aesthetic is strong enough to survive.

Category C: The “Community” Formats (Deep Engagement)

These formats focus on depth of connection. They answer: Will these people become loyalists?

8. The Modular “Glass Pod”

-

Concept: A pre-fabricated, high-end, standalone glass cube dropped into a high-traffic outdoor area.

-

Best For: Dubai (JBR Beach, City Walk).

-

Why It Works: Dubai’s retail is increasingly outdoor during cooler months. This format offers high visibility and “stopping power” in tourist-heavy zones. It’s modular, so if the location fails in week 1, you can literally pick it up and move it.

9. The Collaborative “Cross-Pollination” Pop-Up

-

Concept: Co-renting a space with a non-competing brand that shares your values (e.g., a luxury sneaker brand popping up inside a specialty coffee roastery).

-

Best For: London (Soho) and the USA (Portland, Seattle).

-

Why It Works: It validates Lifestyle Alignment. It helps you identify exactly which “tribe” your customer belongs to in a new city.

10. The VIP “Speakeasy” Suite

-

Concept: An invite-only retail suite hosted in a luxury hotel room or private members’ club.

-

Best For: Dubai (Palm Jumeirah) and London (Mayfair).

-

Why It Works: Essential for luxury brands. It tests the appetite of High-Net-Worth Individuals (HNWIs) in a controlled, exclusive environment. High conversion rates here validate a potential flagship opening.

Regional Strategy: USA vs. UK vs. Dubai

A cookie-cutter approach will fail. Here is how to tailor your 30-day validation strategy for 2026:

| Feature | USA Strategy | UK Strategy | Dubai Strategy |

| Consumer Focus | Convenience & Community. Americans value ease of access and local neighborhood vibes. | Heritage & Story. Brits connect with brands that have a narrative, wit, or ethical stance. | Experience & Service. Dubai shoppers expect VIP treatment, late hours, and “Instagrammability.” |

| Top Location | Neighborhood High Streets (e.g., Abbot Kinney in LA, Williamsburg in NYC). | Historic Districts (e.g., Covent Garden, Shoreditch, Carnaby Street). | Mega Malls & Beachfronts (e.g., Dubai Mall, JBR, Blue Waters). |

| Key Validation Metric | Repeat Visits. Did they come back twice in 30 days? | Dwell Time. Did they stay to chat and learn the story? | Average Transaction Value (ATV). Did they buy the premium collection? |

| 2026 Trend | Hyper-Local Events. Hosting run clubs or morning yoga at the pop-up. | Circular Retail. Offering repairs or resale alongside new products. | Night-Time Economy. Pop-ups that stay open until midnight or 1 AM. |

The Validation Scorecard: Measuring What Matters

In 2026, “Sales” is a vanity metric during the validation phase. You need actionable intelligence. Use this scorecard to evaluate your 30-day sprint.

1. The “ROO” (Return on Objectives)

Instead of ROI, focus on ROO. Did you meet the objective of collecting 500 local email addresses? Did you distribute 1,000 samples?

-

Target: >25% Email Capture Rate (1 in 4 visitors leaves data).

2. Dwell Time Analysis

Using heat-mapping sensors (like those from retail tech providers), measure how long people stay.

-

Benchmark: 12+ minutes indicates high brand engagement. Under 3 minutes suggests a mismatch between product and location.

3. The “Phygital” Conversion Rate

Track how many customers scanned a QR code in-store and completed the purchase after leaving.

-

Why it matters: This validates that your physical presence drives digital behavior, a key justification for long-term rent.

4. Cost of Customer Acquisition (CAC)

Compare the CAC of the pop-up (Total Cost / New Customers Acquired) vs. your digital ads.

-

Win: If Pop-Up CAC is lower than your Facebook/Instagram Ad CAC, the city is validated.

The Tech Stack: Measuring the Invisible

In 2026, you cannot validate a market with a clipboard and a pen. You need a “Validation Tech Stack” that captures data passively while customers shop. Here is the essential setup for a 30-day sprint:

-

Footfall Sensors (e.g., Dor, RetailNext): These peel-and-stick sensors go above the door. They tell you exactly how many people walked past vs. how many walked in.

The Insight: High traffic outside but low entry? Your window display is failing.

-

“Phygital” POS (e.g., Shopify POS Go): Don’t use a clunky cash register. Use mobile handheld terminals that allow staff to capture email addresses and tag customer preferences (e.g., “Customer liked the fit but hated the price”) directly in the transaction log.

-

Heat Mapping Cameras: These distinct cameras show you the “Hot Zones” (where people stand) and “Cold Zones” (where no one goes).

The Insight: If your hero product is in a Cold Zone, you aren’t testing the product; you’re testing a bad layout.

-

QR Code “Endless Aisle”: For the Glass Pod or Showroom formats, place QR codes next to every single item. Even if they don’t buy, a “Scan” counts as a vote of interest.

The 4-Week Pre-Launch Checklist

You have 30 days to succeed, which means you cannot spend the first week fixing the Wi-Fi. Here is the “Sprint” preparation timeline:

| Timeline | Action Item | Critical Detail |

| Week -4 | Permits & WiFi | Apply for temporary signage permits and order a 5G commercial router (don’t rely on the mall’s public WiFi). |

| Week -3 | Staff “Bootcamp” | Hire staff who are “Brand Storytellers,” not just cashiers. Train them on your Data Goals (e.g., “Get 10 emails a day”). |

| Week -2 | The “Micro-Influencer” Invite | DM 50 local micro-influencers (5k-50k followers), inviting them to an exclusive “Preview Hour” before you open. |

| Week -1 | Soft Launch | Open the doors quietly for 2 days to test your POS, heat maps, and inventory flow before the official marketing blast. |

3 Mistakes That Kill Validation (Anti-Patterns)

We have seen hundreds of brands fail at this. Here is what not to do during your 30-day validation:

1. The “Clearance” Trap

-

The Mistake: Using the pop-up to sell off last season’s dead stock at 50% off.

-

The Consequence: You will validate that people in this city like cheap stuff, not that they like your brand. You get false positive data.

-

The Fix: Launch with 80% full-price hero products and only 20% exclusives.

2. The “Staffing” Cheap-Out

-

The Mistake: Hiring a temp agency worker who doesn’t care about your brand.

-

The Consequence: The customer asks, “Is this sustainable cotton?” and the staff says, “I don’t know.” You lose the sale and the trust.

-

The Fix: Send your best manager from HQ to lead the pop-up. They are the carriers of your culture.

3. The “Ghost” Exit

-

The Mistake: Closing the doors on Day 30 and disappearing.

-

The Consequence: You wasted all the momentum.

-

The Fix: On Day 25, place a sign in the window: “We’re moving online! Scan here for free shipping to [City Name] forever.” Transition the physical relationship to a digital one immediately.

Frequently Asked Questions (FAQs)

1. How much does a 30-day validation pop-up cost in 2026?

Costs vary wildly by region and format. A “Shop-in-Shop” in London might cost £5,000–£10,000, while a standalone Glass Pod in a prime Dubai location could run upwards of $30,000–$50,000, including fit-out. The goal is to keep the “build” modular so it can be reused.

2. Can I really judge a market in just 30 days?

Yes, if you focus on leading indicators (footfall, dwell time, email capture) rather than lagging indicators (profit). 30 days gives you four full weekends and a complete pay cycle, which is sufficient to spot demand patterns.

3. Do I need a local business license for a 30-day pop-up?

Almost always. In Dubai, you need a DED (Department of Economic Development) permit for promotions. In the UK and the USA, you often need temporary use permits. However, “Shop-in-Shop” formats (Format #1) often bypass this as you trade under the host’s license.

4. What is the biggest mistake brands make with validation pop-ups?

Treating it like a clearance sale. If you fill the store with discounted old stock, you are validating bargain hunters, not your actual premium customers. You must test with your core, full-price product to get accurate data.

5. How do I staff a pop-up for just one month?

In 2026, “Gig-Retail” platforms have surged. Apps like Storefront or local staffing agencies specialize in providing trained, temporary retail staff who know the local culture. Alternatively, send your best manager from HQ to ensure the brand ethos is perfectly represented.

Final Thought

The difference between a gamble and a strategy is data. By utilizing these Retail Market Validation Strategies, brands can treat new cities like software updates: release a beta version (the pop-up), test for bugs (logistics/demand), and only launch the full version (permanent store) when the code is stable.

In 2026, the brands that win aren’t the ones with the deepest pockets—they are the ones with the smartest tests.