Real World Assets (RWA) tokenization in 2026 is no longer a niche idea for crypto natives. It is becoming a practical way to represent ownership, claims, and cash flows from traditional assets on blockchains, with clearer compliance rails and more credible institutional participation than earlier cycles.

This guide explains what RWAs are, why 2026 matters, how tokenization works in the real world, and how to evaluate opportunities without getting lost in hype.

What Real World Assets (RWAs) Mean In Crypto

RWAs are financial or physical assets that exist offchain but get represented onchain through tokens. The token acts like a digital wrapper around legal rights, such as a claim on interest payments, a right to redeem, or fractional ownership in an asset or vehicle.

The important point is simple. A token is not the asset by itself. The token is a transport layer for rights that must be defined, enforceable, and operationally supported.

A Plain-English Definition

RWA tokenization is the process of turning real-world ownership or payment rights into a blockchain-based token. The token can then move, settle, and integrate with software in ways traditional assets often cannot.

If the legal structure is weak, the token is just a label. If the legal structure is strong, the token becomes a new interface for holding, transferring, and using real-world value.

Common RWA Categories You Will See In 2026

RWAs cover a wide range of assets, but a few categories dominate most conversations and products:

- Government debt and cash equivalents (treasuries, money market exposure)

- Credit (private credit, receivables, trade finance)

- Real estate (equity or debt claims)

- Commodities (often gold, sometimes other vaulted goods)

- Fund interests (tokenized shares of funds or structured vehicles)

These categories grow at different speeds. Some work well because they fit existing investor demand and compliance needs. Others move slower because they rely on local law, complex underwriting, or verification.

RWA Tokenization Vs Stablecoins

Stablecoins usually aim to track a currency. They optimize for payments, settlement, and dollar access.

RWAs aim to bring yield, collateral variety, and structured exposure onchain. In practice, stablecoins often serve as the “cash leg,” while RWAs serve as the “investment leg.”

Why 2026 Feels Like A Tipping Point

RWA tokenization has existed for years, yet 2026 stands out because the market is shifting from experiments to repeatable infrastructure. Projects are starting to look less like one-off launches and more like production systems with standard roles, reporting, and compliance.

This does not mean the risks disappear. It means more teams are finally building around the hard parts instead of ignoring them.

Institutions Found A First Product That Fits

Institutions tend to adopt technology when it reduces friction in a controlled way. Tokenized cash management and short-duration yield products fit that profile because they resemble tools institutions already understand.

This wedge matters because it creates habit. Once an organization has custody, compliance, and reporting integrated for one tokenized product, adding new products becomes easier.

Market Plumbing Got Better

Earlier tokenization attempts struggled with custody, transfer restrictions, settlement mechanics, and investor onboarding. In 2026, the ecosystem has more specialized vendors and clearer patterns.

You can now find purpose-built infrastructure for identity, compliance gating, attestations, and administration. That does not guarantee safety, but it reduces the number of unknowns.

Regulation Is No Longer A Side Quest

RWA products often live close to securities, funds, and regulated payment rails. That means teams cannot treat compliance as a marketing checkbox.

In 2026, the best projects design around jurisdiction, investor eligibility, disclosures, and redemption rules from day one. That discipline separates real adoption from temporary hype.

How RWA Tokenization Works In Practice

Most RWA systems follow a similar blueprint, even if they differ in details. Understanding the blueprint helps you judge whether a project is truly asset-backed or just using the language.

The Core Components Of A Tokenized RWA

A credible tokenized asset stack usually includes:

- An asset or portfolio with defined cash flows or ownership rights

- A legal structure that issues the claim (often a fund, trust, or special purpose vehicle)

- A token contract that represents the claim and enforces transfer rules

- Custody or safekeeping for the underlying asset or records

- Administration, reporting, and audit or attestation processes

- A redemption process that connects token holders to offchain settlement

Each layer matters. Weakness in any one layer can break the promise of “tokenized ownership.”

The Truth Stack Framework

It helps to think in three layers of truth:

- Onchain truth includes token supply, transfer history, and smart contract logic

- Offchain truth includes custody statements, bank records, and administrator reports

- Legal truth includes contracts defining ownership, redemption, and priority in disputes

A strong system aligns all three. A weak system talks only about onchain truth while staying vague about legal truth and offchain truth.

Redemption And Settlement Paths

Many investors care less about trading and more about redemption. Redemption is where “asset-backed” becomes real.

A sound RWA product explains who can redeem, how long it takes, what fees apply, and what happens under stress. It also explains what settlement rail it uses, such as bank transfers or stablecoin settlement where permitted.

The 2026 RWA Landscape

Real World Assets (RWA) tokenization in 2026 is expanding across multiple asset classes, but growth is uneven. The winners tend to share one trait. They deliver a clear, regulated claim with simple reporting and a realistic liquidity story.

Where Growth Concentrates

Several segments stand out because they match investor demand:

- Tokenized short-duration yield products that resemble familiar cash management tools

- Tokenized fund interests that streamline subscriptions, redemptions, and recordkeeping

- Private credit structures that package yield, underwriting, and servicing into a repeatable product

Real estate and trade finance still attract attention, but they often face tougher verification and legal complexity. That complexity is not fatal, but it slows scaling.

Who Builds The Ecosystem

The RWA stack often includes:

- Issuers and asset managers who source assets and define products

- Tokenization platforms that provide issuance tooling and compliance controls

- Custodians and administrators who handle safekeeping and reporting

- Auditors or attestation providers who support trust

- Market venues and liquidity partners who enable trading or transfers

- DeFi protocols that integrate RWAs as collateral where compliance allows

In 2026, you can judge maturity by whether these roles exist and whether they are named, accountable, and contractually defined.

Public Blockchains Vs Permissioned Environments

Public chains offer openness, composability, and broad distribution. Permissioned environments offer stronger access control, easier compliance, and comfort for regulated participants.

Many real deployments use a hybrid approach. They keep strict compliance at the asset layer while allowing selected integrations at the application layer.

Top RWA Use Cases In 2026

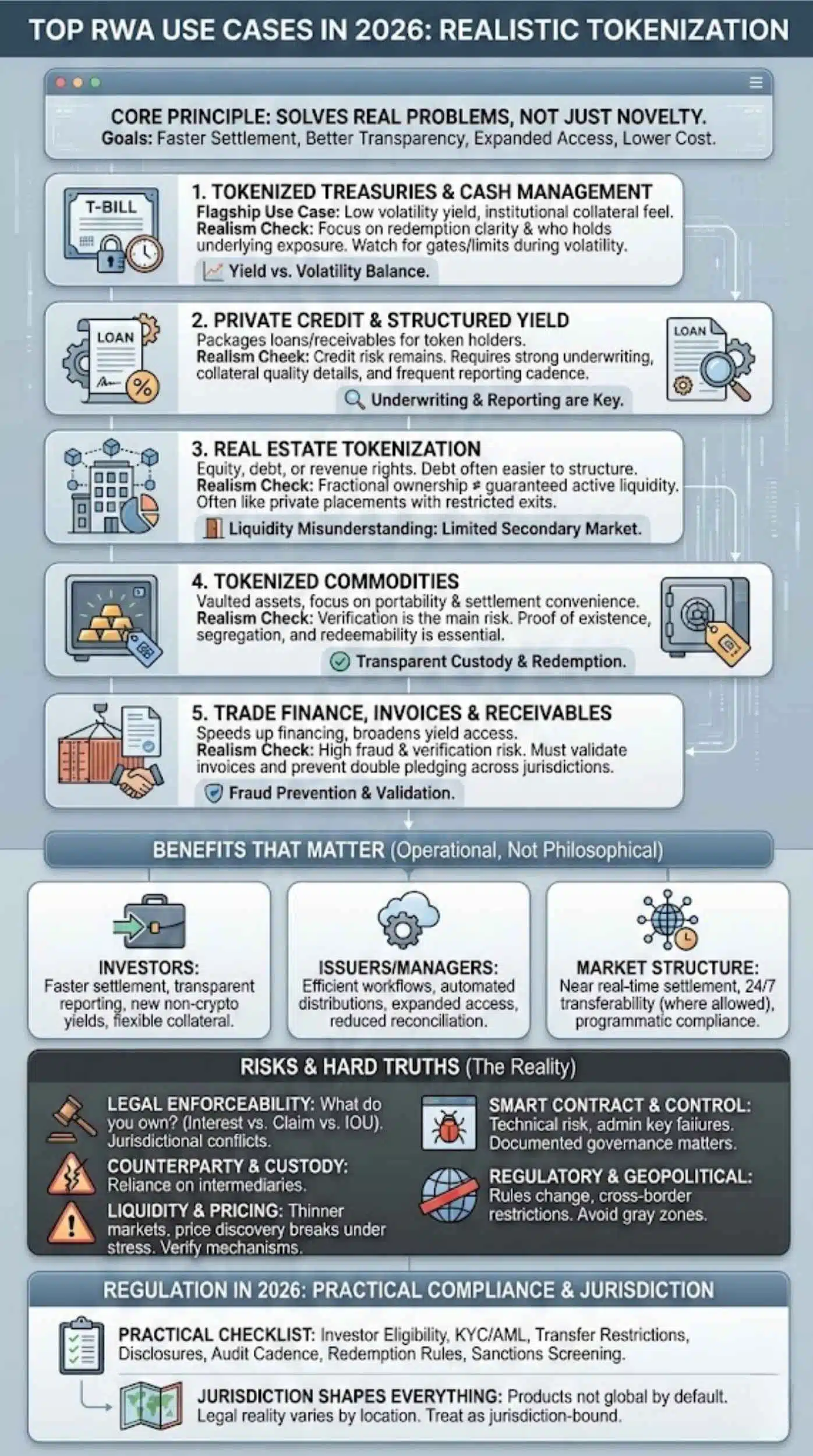

RWAs work best when tokenization solves a real problem, not when it only adds novelty. The strongest use cases reduce settlement time, improve transparency, expand access where allowed, or lower operational cost.

Tokenized Treasuries And Cash Management

Tokenized treasury exposure has become a flagship RWA use case because it delivers something crypto markets consistently want: relatively low volatility yield. It can also serve as institutional collateral that feels closer to traditional finance risk models.

Still, “treasury-backed” is not a single thing. Products may differ in duration, structure, fees, redemption timing, and who bears operational risk.

If you are evaluating one, focus on redemption clarity and who holds the underlying exposure. Also check whether the product has any gates, limits, or discretionary controls during volatility.

Private Credit And Structured Yield

Tokenized private credit typically packages loans or receivables into a structure that pays yield to token holders. This can work well when underwriting is strong and reporting is frequent.

The challenge is that credit risk does not disappear because a token exists. In fact, tokenization can hide credit risk if marketing focuses on APY while minimizing details about defaults, recoveries, and servicing.

A credible credit product explains underwriting criteria, collateral quality, servicing responsibilities, and what happens when borrowers miss payments. It also provides a reporting cadence that matches the underlying loan performance.

Real Estate Tokenization

Real estate tokenization can represent equity ownership, debt claims, or revenue rights. Debt is often easier to structure because cash flows are defined, while equity introduces governance complexity.

Liquidity is the biggest misunderstanding here. Fractional ownership does not guarantee an active secondary market. Many real estate tokens behave like private placements with restricted transfers and limited exit windows.

A strong real estate tokenization model emphasizes legal enforceability, investor rights, and realistic redemption or sale paths. It does not promise instant liquidity.

Tokenized Commodities

Tokenized commodities, especially vaulted assets, can work when custody and redemption are transparent. The main value is portability and settlement convenience.

The key risk is verification. Investors need clear proof that the asset exists, stays segregated, and remains redeemable under defined conditions.

Trade Finance, Invoices, And Receivables

Receivables tokenization can speed up financing for businesses and broaden access to yield for investors. It can also reduce reconciliation friction across counterparties.

This category also carries fraud and verification risk. The project must prove it can validate invoices, prevent double pledging, and enforce repayment across jurisdictions.

Benefits That Matter To Real Users

Tokenization needs practical advantages to earn long-term adoption. In 2026, the benefits that resonate tend to be operational, not philosophical.

Benefits For Investors

Investors may gain:

- Faster settlement and simpler portfolio movement

- More transparent exposure and reporting than many private products

- New yield sources that do not rely on crypto-native volatility

- More flexible collateral options in compliant environments

These benefits only hold when the product is well-structured. A token can also introduce new risks, which is why due diligence matters.

Benefits For Issuers And Asset Managers

Issuers can benefit from:

- More efficient issuance workflows and recordkeeping

- Better automation for distributions, coupons, and corporate actions

- Expanded distribution to eligible investors through digital rails

- Reduced reconciliation costs across service providers

Tokenization can also improve auditability, since onchain movement creates a shared ledger of transfers.

Benefits For Market Structure

A mature RWA market can support:

- Near real-time settlement

- 24/7 transferability where rules allow

- Programmatic compliance and access control

- Integration with software-driven finance systems

These changes can reduce delays and operational overhead, even if the underlying asset remains traditional.

Risks And Hard Truths

Real World Assets (RWA) tokenization in 2026 still carries meaningful risks. Some are familiar, like credit and liquidity risk. Others are unique, like smart contract controls and legal mismatch between token behavior and real-world enforceability.

Legal Enforceability Risk

Token holders must understand what they legally own. Some tokens represent a beneficial interest in a vehicle. Others represent a contractual claim. Others only represent an IOU.

You should ask what happens during disputes, insolvency, and jurisdictional conflicts. If the answers are vague, treat the token as higher risk.

Counterparty And Custody Risk

RWAs rely on intermediaries, even when they use blockchains. Someone must custody assets, manage records, service loans, or administer funds.

A project can be “onchain” and still fail because a custodian, administrator, or issuer fails. The best systems name counterparties clearly and explain how they manage operational risk.

Liquidity And Pricing Risk

Many RWAs trade in thinner markets than crypto-native assets. Price discovery can break during stress, especially if NAV updates lag and redemptions slow.

If a product claims liquidity, verify the mechanism. Look for market makers, transfer venues, and redemption windows. If those details are missing, assume liquidity is limited.

Smart Contract And Control Risk

Smart contracts can reduce manual friction, yet they also introduce technical risk. Upgrade keys, admin controls, and permissioning logic can create central points of failure.

You should understand who can pause transfers, change rules, or upgrade contracts. Strong governance and documented controls matter more than marketing claims.

Regulatory And Geopolitical Risk

RWA frameworks depend on law and policy. Rules can change, and cross-border structures can face sudden restrictions.

If a product relies on regulatory gray zones, treat it as fragile. If it operates under clear licensing and disclosure expectations, it has a better chance of surviving volatility.

Regulation In 2026

RWA tokenization sits at the intersection of securities, payments, identity, and consumer protection. That reality shapes how products launch, who can access them, and what reporting they must provide.

A Practical Compliance Checklist

A serious RWA product typically addresses:

- Investor eligibility and onboarding requirements

- KYC and AML processes

- Transfer restrictions and whitelisting logic

- Disclosure documents and risk statements

- Audit or attestation cadence

- Redemption rules and settlement rails

- Sanctions screening where applicable

If a project avoids these topics, it is not necessarily illegal, but it is likely not designed for scale.

Why Jurisdiction Shapes Everything

Two products can look similar onchain but differ entirely in legal reality based on where they issue, who can buy, and which rules apply.

For readers and investors, the takeaway is practical. Do not treat RWAs as global by default. Treat them as jurisdiction-bound products that may or may not be portable.

The Infrastructure Stack Powering RWAs

RWA systems need more than a token contract. They need identity, compliance, reporting, and real-world integration.

Token Standards And Compliance Controls

Modern RWA tokens often include:

- Whitelisting and permissioned transfers

- Role-based controls for administrators and transfer agents

- Hooks for corporate actions like distributions and redemptions

- Clear handling of lost keys, disputes, and forced transfers where legally required

These controls can feel “less decentralized,” but they often make the product legally viable.

Identity And Permissioning

Many RWA products need to restrict who can hold the token. They may also need to prove investor status without exposing sensitive data publicly.

In 2026, you will see more systems that combine onchain permissions with privacy-preserving identity claims. The goal is to keep compliance strong while limiting unnecessary data exposure.

Oracles, Attestations, And Reporting

RWAs depend on offchain facts like NAV, reserves, and loan performance. Oracles and reporting pipelines bring those facts onchain or make them visible to token holders.

The best projects define what gets reported, how often, and who verifies it. They also explain what happens if reporting fails or data conflicts.

Interoperability And Settlement

Interoperability tools can move tokens across chains or integrate them with applications. Settlement tools connect onchain transfers with offchain cash movement.

These systems work best when they define finality clearly. If something goes wrong, the project needs a documented process for dispute resolution and error handling.

How To Evaluate An RWA Project Before You Touch It

A token can look polished and still be fragile. Evaluation requires a mix of legal thinking, credit thinking, and technical thinking.

The Due Diligence Questions That Matter Most

Ask these questions and do not accept vague answers:

- What exactly does the token represent legally

- Who issues the token, and where is the issuer domiciled

- Who holds or administers the underlying asset

- How does redemption work, and how long does it take

- What reporting exists for reserves, NAV, or performance

- Who services the asset, especially for credit products

- What happens in insolvency, and where disputes get resolved

- What fees exist across the stack, including hidden layers

When a team answers clearly, you can model the risk. When a team dodges, you cannot.

Common Red Flags In 2026

Watch out for:

- Claims of “backed” without naming structure and counterparties

- No credible audit or attestation cadence

- Unclear redemption, or redemption that depends on discretion

- Promised liquidity without market structure details

- Admin keys that can change rules without guardrails

- Marketing that focuses on yield while avoiding risk language

If you see multiple red flags at once, move on. There will be better options.

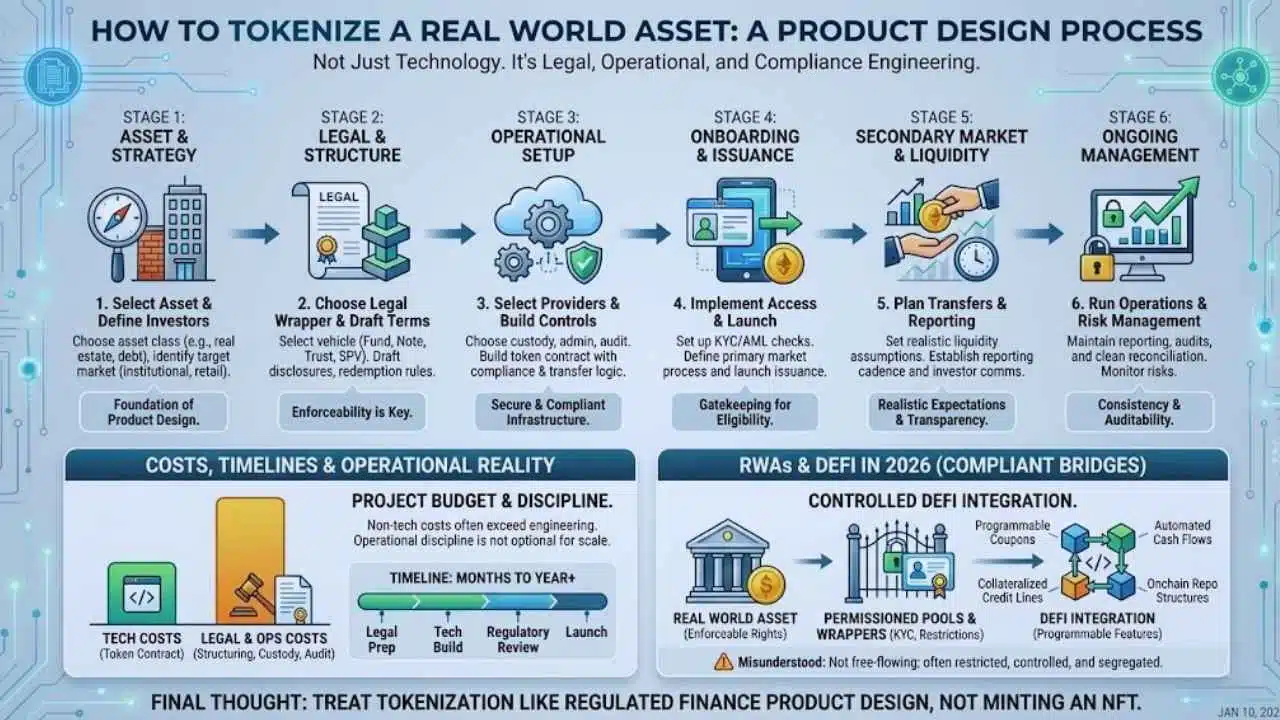

How To Tokenize A Real World Asset

Tokenization is not a single technical step. It is a product design process that blends legal structuring, operations, compliance, and distribution.

A Step-By-Step Tokenization Workflow

Most issuers follow a path like this:

- Select the asset and define the target investor base

- Choose the legal wrapper, such as a fund share, note, trust, or SPV claim

- Draft disclosures, terms, and redemption rules

- Select custody, administration, and reporting providers

- Build the token contract with compliance and transfer controls

- Implement onboarding, eligibility checks, and access management

- Launch issuance and define primary market processes

- Plan secondary transfers with realistic liquidity assumptions

- Set reporting cadence and investor communications

- Run ongoing operations, audits, and risk management

The best issuers treat tokenization like launching a regulated financial product. They do not treat it like minting an NFT.

Costs, Timelines, And Operational Reality

Legal work, administration, custody, audits, and integration often cost more than the token contract. Teams that budget only for engineering usually end up cutting corners where it hurts most.

Operational discipline is also not optional. Tokenized products need consistent reporting and clean reconciliation. If the project cannot do that, it cannot scale.

RWAs And DeFi In 2026

DeFi integration is one of the biggest narratives around RWAs. It can also be one of the most misunderstood.

What Compliant DeFi Looks Like

In many jurisdictions, RWA-backed products cannot flow freely into fully permissionless pools. Instead, you often see:

- Permissioned pools with verified participants

- Segregated collateral frameworks

- Wrappers that enforce eligibility and transfer restrictions

- Controlled redemption and settlement processes

This may feel less open than early DeFi ideals, but it can create a workable bridge between institutions and onchain systems.

New Building Blocks Enabled By RWAs

As RWAs mature, they can enable:

- Programmable coupons and automated cash flow distribution

- Collateralized credit lines backed by offchain exposure

- Onchain repo-like structures with defined settlement rules

- Collateral baskets that diversify beyond crypto-native assets

These systems can improve capital efficiency, but only if the underlying rights are enforceable and transparent.

The Outlook From 2026 To 2028

Adoption will likely grow, but not in a straight line. The market will learn through product successes and failures, especially in credit and liquidity.

What Likely Scales Next

Expect continued expansion in:

- Tokenized cash management and short-duration yield products

- Tokenized fund shares used for operational efficiency

- More structured credit products with clearer reporting norms

- Better distribution channels for eligible investors

As standards improve, more firms will treat tokenization as an operational upgrade rather than an experiment.

What Could Slow Things Down

Several events could slow momentum:

- Regulatory crackdowns on weak structures

- A major default cycle exposing poor underwriting

- Custody failures or mismanagement of reserves

- Liquidity events that reveal mismatched redemption promises

The strongest platforms will plan for stress. They will publish clear processes for redemptions, reporting disruptions, and dispute resolution.

Takeaways

Real World Assets (RWA) tokenization in 2026 is turning blockchains into practical financial rails, but only for products that respect legal reality and operational discipline. The biggest winners will not be the loudest. They will be the ones with clear structures, credible counterparties, and repeatable reporting.

If you want to engage with RWAs, start with clarity. Verify what the token represents, how redemption works, who holds the underlying exposure, and how risk gets managed when markets turn. When those answers are strong, tokenization can offer real improvements in settlement, transparency, and access within the rules that govern finance.