Payment fraud can be a significant threat to your business, impacting both your bottom line and customer trust. As you navigate the delicate balance between security and user experience, it’s crucial to adopt strategies that protect your revenue while keeping conversions high.

In this article, you’ll discover effective methods to prevent payment fraud without alienating your customers. You’ll learn how to carry out robust security measures, leverage technology, and maintain a seamless checkout process. By the end, you’ll have the tools to safeguard your business and enhance customer satisfaction simultaneously.

Why This Matters: Preventing Fraud While Preserving Conversion

Combating payment fraud matters significantly. Protecting your revenue without compromising conversions involves a strategic approach.

Operational and Commercial Impact

Preventing fraud directly affects your bottom line. Studies show that fraud can lead to losses of $3.5 million annually for an average business. Balancing prevention tactics with an efficient operation ensures sustainability and trust.

Smarter Systems Over More Rules

Smarter systems work better than just piling up rules. Machine learning algorithms can analyze transaction patterns. They often adapt to new threats, which allows for better decision-making. This enhances security while minimizing friction for genuine customers.

Payments Ecosystem Context

The payments ecosystem is complex. Understanding various payment methods and their risk profiles contributes to effective fraud prevention. Knowing which methods align with your target market can turn potential threats into manageable risks, keeping conversions high.

Know the Threat Landscape Before Preventing Fraud

To effectively prevent fraud, grasping the evolving threat world is crucial. Criminals continuously shift tactics, targeting various transaction methods to exploit vulnerabilities.

Common Payment-Fraud Vectors

Common vectors encompass:

- Stolen card credentials

- Fake identities

- Compromised accounts

- Fraudulent chargebacks

Attackers often exploit weak authentication methods, unsecured networks, and manual processing. These points require vigilance to mitigate risks.

How Attacks Evolve

Attacks evolve by adopting advanced technologies and social engineering tactics. For instance, business email compromise schemes are replacing older scams. Such adaptations demand continuous monitoring and quick responses to maintain security. Are your strategies updated to counter these evolving threats?

Principles for Preventing Fraud Without Hurting Conversions

Implementing effective strategies can help prevent fraud while keeping conversions high. Focus on three key principles.

Detect Early in the Flow

Use fraud detection tools that analyze transactions in real time. Machine learning and behavior analytics can help identify anomalies such as unusual spending patterns or mismatched billing addresses. Early detection lowers fraud risks.

Minimize False Positives

Advanced fraud prevention systems use adaptive risk scoring and device fingerprinting to identify potential threats. Risk-based authentication can apply “step-up” verification to suspicious transactions, allowing legitimate customers to complete purchases without unnecessary friction. Payment providers including Antom, Stripe, PayPal, Worldpay, and Adyen, apply sophisticated algorithms that analyze user behavior and transaction patterns in real time. Overly strict rules that block too many users should be avoided, as they can cause frustration and reduce sales.

Protect Sensitive Data

Employ secure protocols like HTTPS and encryption. Ensure compliance with PCI standards and carry out tokenization to safeguard payment information. Use multifactor authentication selectively for higher-risk transactions. Regular security audits help maintain protection levels.

| Principle | Key Actions |

|---|---|

| Detect Early in the Flow | Real-time analysis, machine learning, behavior analytics |

| Minimize False Positives | Adaptive risk scoring, device fingerprinting, step-up verification |

| Protect Sensitive Data | HTTPS, encryption, PCI compliance, multifactor authentication |

AI and Automation for Preventing Fraud with Less Friction

AI and automation play a key role in preventing fraud without disrupting customer experiences. You can leverage these technologies to streamline transactions and improve accuracy.

What Modern Models Weigh

Modern models assess transaction patterns and behaviors to detect anomalies, drawing on extensive data from past payments to improve accuracy. Machine learning algorithms can help filter out most false positives while ensuring that legitimate transactions proceed without unnecessary delays.

How Automation Reduces Friction

Automation speeds up decision-making processes significantly. You might see a reduction in delays that often occur with manual reviews. Automated systems continually evaluate transaction approval rates, fine-tune authentication methods, and payment flows.

| Feature | Manual Review | Automated Systems |

|---|---|---|

| Speed of Decision Making | Slower | Faster |

| Cost Associated | Higher | Lower |

| Error Rate | Usually higher | Typically lower |

| Effect on Customer Experience | Can create friction | Enhances smoothness |

You can achieve better conversion rates by implementing automated systems.

Integrate Controls into Your Payment Stack

Integrating controls into your payment stack is critical for preventing fraud while keeping conversion rates intact. Utilizing the right technologies can protect revenue and enhance customer experiences.

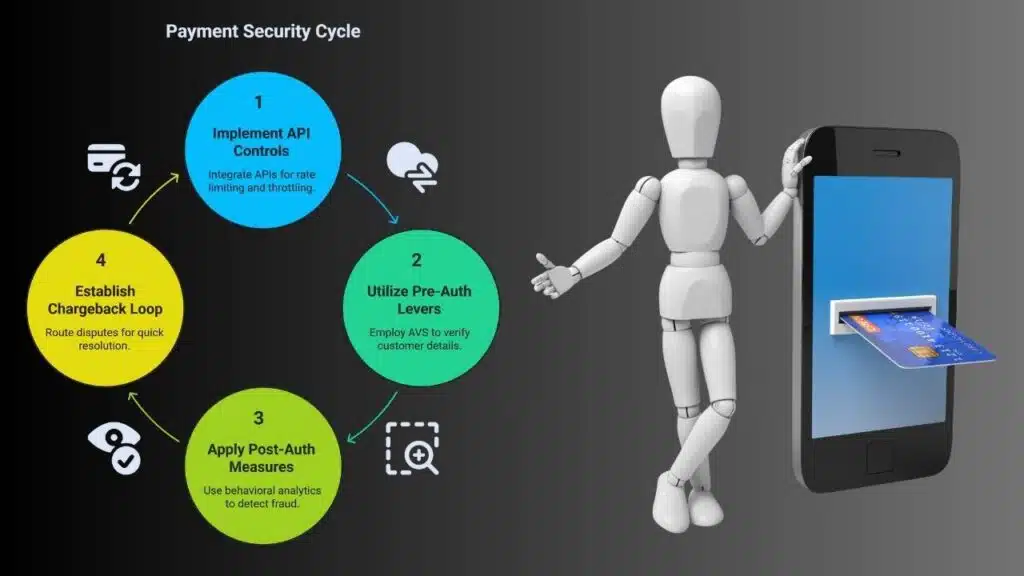

API-Based Architecture

Implement APIs that incorporate rate limiting and throttling features. These tools guard against attacks like carding or card cracking. Custom alerts and velocity rules—enabled by APIs—allow you to respond dynamically within existing systems.

Pre- and Post-Auth Levers

Use pre-authorization options, such as Address Verification Services (AVS). These verify customer details before approval, which decreases fraudulent transactions. Post-authorization measures also play a role. They employ behavioral analytics to identify suspicious activities after a transaction, enabling timely interventions.

Chargeback Response Loop

Establish a chargeback prevention system that routes disputes from issuers to merchants. This routing happens in near real-time and allows for quick resolution of disputes. A proactive approach can stop unnecessary chargebacks and protect profit margins. Adjusting this process leads to fewer false positives in payment processing.

Compliance, Education, and KPIs for Preventing Fraud While Preserving UX

Payment fraud prevention relies on compliance, education, and effective KPIs. Each component contributes to a secure yet friendly user experience.

Regulatory Readiness

Ensure your fraud prevention systems comply with PCI-DSS and PSD2 regulations to establish a solid foundation.

Team Awareness

Keep your payment and customer service teams updated on common fraud types and emerging threats through regular training.

Measure the Right Outcomes

Focus on KPIs that effectively balance fraud reduction and conversion rates to enhance your strategies.

| KPI | Description |

|---|---|

| Fraud Losses | Total amount lost to fraudulent transactions. |

| False Positives | Several legitimate transactions flagged as fraud. |

| Conversion Rate | Percentage of successful transactions. |

| Decline Rate | Rate of legitimate transactions not completed. |

Sector-Specific Nuances That Shape Conversion-Friendly Controls

Understanding sector-specific nuances helps craft controls that maintain conversion rates while preventing fraud. Different industries require unique strategies to balance security with customer experience effectively.

| Sector | Key Focus |

|---|---|

| E-commerce | Optimize strong customer authentication (SCA) to enhance security and streamline checkouts. |

| Travel and Mobility | Authenticate users dynamically to facilitate smooth transactions for time-sensitive purchases. |

| Subscriptions | Monitor customer behavior trends to flag anomalies while ensuring uninterrupted recurring payments. |

| Government Payments | Ensure compliance and accessibility through configurable authentication systems and real-time monitoring. |

| B2B Marketplaces | Implement tailored fraud prevention policies to detect complex schemes without blocking genuine transactions. |

Takeaways

Implementing advanced authentication strategies across various sectors—such as e-commerce, travel, subscriptions, government payments, and B2B marketplaces—enhances security while ensuring a seamless customer experience. By leveraging dynamic risk assessment, real-time monitoring, and tailored policies, businesses can effectively combat fraud, maintain compliance, and foster long-term customer loyalty.