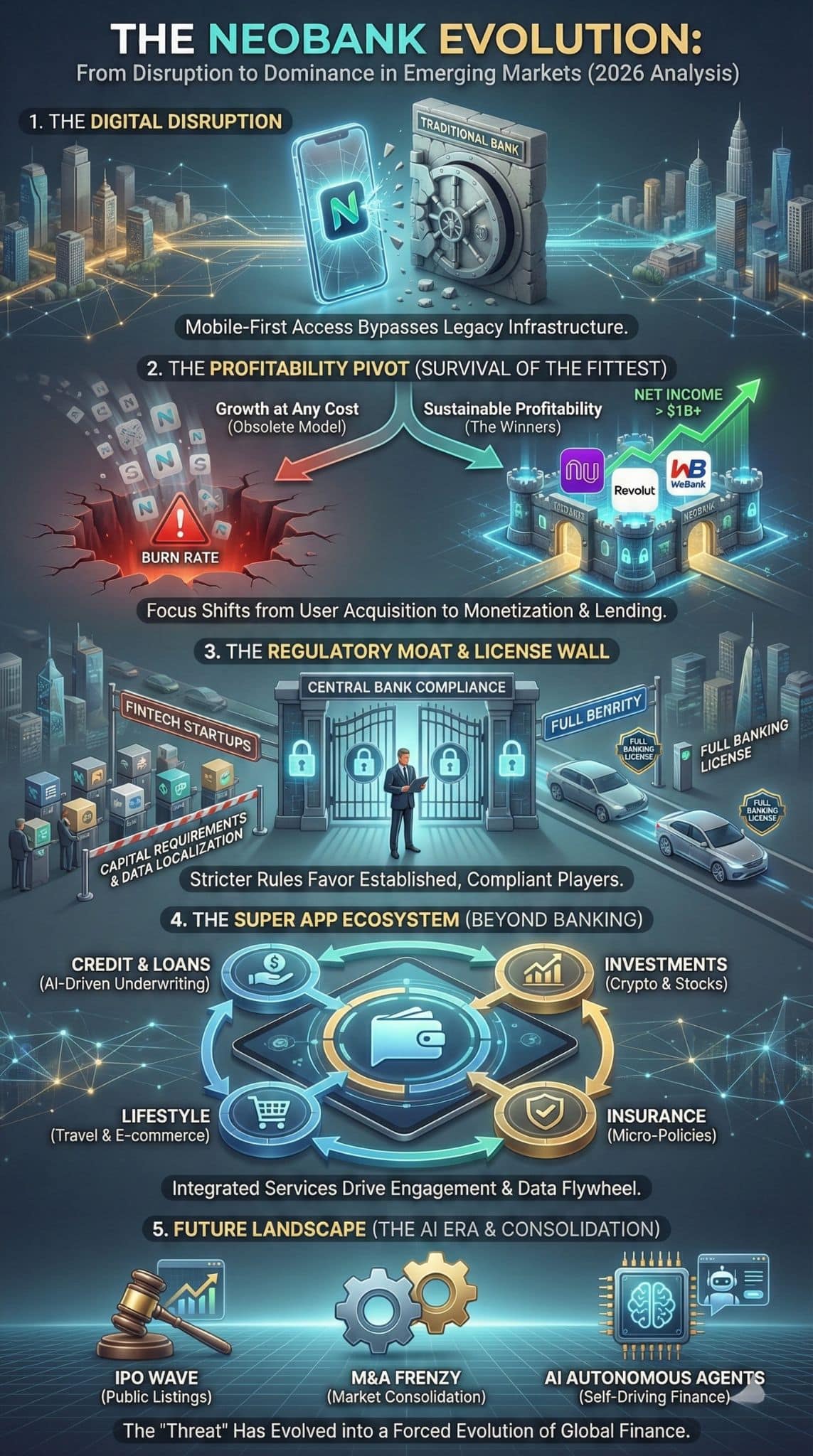

Why this matters right now: As of early 2026, the narrative has shifted. It is no longer about if neobanks can survive, but which few will dominate the global financial infrastructure. With Revolut recently dethroning Nubank as the world’s most valuable neobank (hitting a $75 billion valuation) and Nubank passing the 120 million customer mark, we have reached a tipping point.

The “growth at any cost” era is dead; the “profitability or perish” era has begun. For traditional banks in emerging markets, the threat is no longer theoretical—it is existential.

Key Takeaways

- Valuation Flip: In a symbolic shift, UK-based Revolut surpassed Brazil’s Nubank in valuation (~$75B vs.2 ~$72B) in late 2025, signaling global investor confidence in sustainable fintech models.

- Profitability is King: The vast majority of the world’s 400+ neobanks are still unprofitable. However, the top 5% (Nubank, Monzo, Revolut) have cracked the code, generating billions in net income.

- The “Barbell” Effect: The market is consolidating into a “barbell” shape—dominated by massive incumbents and massive neobanks, squeezing out mid-sized regional banks.

- Regulatory Moats: Obtaining banking licenses has become significantly harder in 2026 (e.g., US regulatory tightening), turning compliance into a major barrier to entry for new startups.

- Asia is the Next Battleground: While LATAM is maturing, Asia-Pacific is projected to grow at over 50% CAGR through 2031, becoming the fiercest arena for the neobank vs. incumbent war.

The Shift from “Unbanked” to “Neobanked”

A decade ago, the “unbanked” population in emerging markets was a humanitarian concern. Today, it is one of the most lucrative asset classes in fintech. The explosion of affordable smartphones and high-speed mobile data in regions like Latin America, Southeast Asia, and Africa created a digital highway that bypassed physical bank branches entirely.

By 2025, the script flipped. Traditional banks, burdened by legacy COBOL systems and expensive branch networks, could not serve low-income customers profitably. Neobanks, running on cloud-native stacks with near-zero marginal costs, could. What started as prepaid cards and simple wallets has evolved into full-service digital banking ecosystems offering credit, insurance, and investment products. We are now witnessing the maturity phase of this cycle, where the “disruptors” are becoming the new “establishment.”

The Profitability Pivot – Survival of the Fittest

The most significant trend of 2025-2026 is the bifurcation of the market. For years, Venture Capital subsidized free banking. That tap has run dry. Investors now demand unit economics that make sense.

The Winners: Nubank serves as the prime example. By successfully cross-selling credit cards and personal loans to its massive user base in Brazil, Mexico, and Colombia, it generated nearly $2 billion in net income in 2024. Similarly, Revolut’s diversified revenue stream (subscriptions, crypto, forex, business accounts) propelled it to profitability.

The Losers: In contrast, hundreds of “me-too” neobanks that relied solely on interchange fees are shutting down or being acquired. Chime, despite high revenue, struggled with profitability longer than its peers due to a lack of lending depth. The lesson for 2026 is clear: You cannot survive on payments alone; you must become a lender.

The Neobank Leaderboard (Early 2026 Data)

| Neobank | HQ Location | Valuation (Est.) | User Base | Profitable? | Key Markets |

| Revolut | UK | ~$75 Billion | 65M+ | Yes | Europe, Global Expansion |

| Nubank | Brazil | ~$72 Billion | 123M+ | Yes | Brazil, Mexico, Colombia |

| WeBank | China | ~$32 Billion | 360M+ | Yes | China |

| Chime | USA | ~$25 Billion | 22M+ | No (Near) | USA |

| Monzo | UK | ~$5.9 Billion | 10M+ | Yes | UK, USA (Targeting) |

Financial Inclusion as a Business Model

In developed markets like the US or UK, neobanks are often a secondary account for discretionary spending. In emerging markets, they are the primary (and often only) bank account. This distinction is crucial.

In regions like Southeast Asia and Latin America, neobanks aren’t just competing on “better UX”; they are competing on access.

- Credit Scoring the “Invisible”: Traditional banks rely on credit bureau history. Neobanks use alternative data (mobile top-up history, utility payments, geolocation) to underwrite loans for the credit-invisible.

- Cost Structure Advantage: A traditional bank in the Philippines might spend $20-$50 to onboard a customer via a branch. A digital player like Tonik or GCash can do it for under $5. This allows them to serve customers with balances as low as $10 profitably—a segment traditional banks actively ignore.

The Incumbent Empire Strikes Back

It would be a mistake to count traditional banks out. In 2025, we saw a wave of aggressive counter-moves from incumbents, creating a “Hybrid” defense.

- The “Flanker” Brand Strategy: Big banks are launching their own digital-only brands to capture youth demographics without cannibalizing their main brand. (e.g., Mashreq Neo in UAE, Mox by Standard Chartered).

- Acquisition Sprees: Rather than build, incumbents are buying. We are seeing a consolidation phase where traditional banks acquire struggling fintechs to absorb their tech stacks and talent.

- The Trust Factor: In times of economic uncertainty (like the inflation spikes of 2024), customers often flee back to “too big to fail” institutions for their primary savings, while using neobanks for daily spending. This “deposit flight” to safety is the incumbents’ biggest hedge.

Regulatory Headwinds & The License Wall

The “Wild West” days of fintech regulation are over. In 2026, Central Banks are tightening the screws.

- The License Hurdle: Regulators in the US, UK, and EU are raising capital requirements and compliance standards. Monzo’s long road to a US charter and Bunq’s regulatory challenges highlight this friction.

- Data Sovereignty: Emerging markets are increasingly enforcing strict data localization laws (e.g., India, Indonesia), forcing global players like Revolut to build expensive local infrastructure rather than running everything from a central cloud.

- Operational Resilience: Following the massive CrowdStrike outage of 2024, regulators now view third-party tech reliance as a systemic risk. Neobanks, which rely heavily on varied API partners (BaaS), face higher scrutiny than vertically integrated traditional banks.

Regulatory Friction Points in 2026

| Regulatory Area | Impact on Neobanks | Impact on Traditional Banks |

| Capital Requirements | High: Forces fundraising dilution or slows lending. | Low: Already capitalized; easy compliance. |

| Data Localization | High: Disrupts “build once, deploy everywhere” model. | Medium: Expensive but they have local infrastructure. |

| Digital Fraud (APP Scams) | High: rapid onboarding often lets in fraudsters; fines increasing. | Medium: Slower onboarding acts as a friction filter. |

The “Super App” Endgame

The ultimate goal for neobanks in emerging markets is to become a “Super App”—a WeChat-like ecosystem where users chat, shop, book travel, and bank.

- Beyond Banking: Revolut is launching eSIMs and travel bookings. Nubank is selling insurance and marketplace products.

- The Data Flywheel: The more a user does in the app, the better the credit model becomes, lowering default rates and increasing profitability.

- Crypto & Investments: By 2026, integration of crypto wallets is standard. Neobanks have become the primary on-ramp for digital assets in emerging economies, a feature traditional banks are still hesitant to touch due to compliance fear.

Expert Perspectives

To balance the enthusiasm, we must look at the risks.

- The Bull Case: Maria Fernandez, Senior Fintech Analyst at LATAM Insights: “The incumbents in Latin America and Africa are too slow. They are trying to digitize a typewriter. Neobanks are natives. By the time traditional banks catch up, the generation Z and Alpha will be locked into the Nubank or Revolut ecosystem.”

- The Bear Case: James Thorne, Banking Strategist at CityFinance: “We are seeing a ‘re-bundling’ of finance. Customers are tired of having 10 different apps. Traditional banks that offer a decent app plus the safety of a branch network are winning back older millennials who now have mortgages and complex needs. Neobanks struggle to capture the ‘primary salary account’—which is where the real money is.”

Future Outlook: What Happens Next?

As we look toward the remainder of 2026 and into 2027, three predictions stand out:

- The IPO Wave: Expect major IPOs from players like Chime, Revolut (potential dual listing), and other regional giants. These public listings will force even more transparency and profitability discipline.

- M&A Frenzy: The mid-market neobanks (those with 1-5 million users) will disappear. They will be bought by incumbents or merged into larger neobank conglomerates to achieve scale.

- AI-Driven Autonomous Banking: The next frontier is not just a banking app, but a banking agent. Generative AI will move from customer support chatbots to autonomous financial managers that switch your savings to higher interest rates or refinance your debt automatically.

Final Words

The rise of neobanks in emerging markets is not just a threat to traditional banking; it is a forced evolution.8 The “threat” has already materialized—traditional banks have lost the monopoly on the customer interface. The future belongs to whoever can most efficiently use data to solve the customer’s financial stress, regardless of whether they have a 100-year-old brand or a colorful app icon.