For the first decade of the fintech revolution, neobanks competed on features: metal cards, early direct deposits, and slick interfaces. But by 2026, the feature gap has closed. Every major banking app now offers savings “pots,” salary advances, and crypto integration. The dazzle of a neon debit card has faded into the utility of everyday infrastructure.

Now, the differentiator is resilience.

When a server outage hits or a fraud algorithm locks an account, the user cannot walk into a local branch to demand answers. They are left staring at a loading screen. In those moments, the quality of customer support isn’t just a “nice to have”—it is the only tether between a user’s panic and their financial safety.

The landscape of 2026 is defined by scale and complexity. Neobanks are no longer scrappy startups; they manage millions of accounts and face intense regulatory scrutiny. AI has become the first line of defense, handling 80% of queries, but its failures—like the infamous chatbot hallucinations of 2024–2025—have made “human access” a premium luxury.

This article explores why customer experience (CX) has become the existential battleground for neobanks in 2026, and how the winners are rebuilding trust through radical transparency and responsive support.

What “Customer Service” Means For A Neobank In 2026

In the early days, customer service was often treated as a cost center—a necessary evil to be minimized. Today, successful neobanks view support as a product surface. It is a feature as critical as the payments engine itself.

Support is the product surface, not a cost center

For a digital bank, the app is the bank. When the app fails, the bank fails. Therefore, the “Help” tab is not a basement department; it is the front door. Leading neobanks have integrated support directly into transaction flows. If a payment fails, the “Get Help” button effectively context-matches the error, bypassing generic FAQs to offer specific solutions (e.g., “Increase limit” or “Verify transaction”).

The modern support stack (self-serve → AI → human escalation)

The 2026 support model is a tiered defense system:

- Contextual Self-Serve: The app predicts the issue before the user types. (e.g., “We noticed your card was declined at Target. Tap here to approve.”)

- AI Agents: Generative AI handles complex but procedural tasks, like explaining a fee or updating an address.

- Human Escalation: This is now the “premium” tier. Reaching a human is reserved for high-stakes emotional moments: fraud, blocked funds, or identity theft.

In-app chat-first remains the standard. While traditional banks still rely on phone lines, neobanks have doubled down on asynchronous chat. However, the best players have reintroduced phone support for “Code Red” emergencies, recognizing that typing into a void while your rent money is missing is a churn-inducing experience.

The new baseline expectations

Users in 2026 have zero tolerance for “banking hours.” The baseline expectations are:

- 24/7 Availability: AI must be instant; humans must be available within minutes, even at 3 AM.

- Proactive Alerts: “We are having technical issues” must be communicated via push notification before the user tries to buy coffee.

- Transparent Status: Vague error messages (“Something went wrong”) are unacceptable. Users demand technical specificity (“Our card processor is down; expected fix in 15 mins”).

Why Customer Service Became The Competitive Battlefield

Neobanks look similar—CX is how users choose

As mentioned, the “cool factor” of fintech has evaporated. When Chime, Monzo, Revolut, and Starling all offer virtually the same core features, users switch based on who treats them better when things go wrong.

Feature parity pushes differentiation into trust + responsiveness.

If Bank A and Bank B both offer 4.0% APY on savings, but Bank A has a reputation for locking accounts without explanation for weeks, the user will choose Bank B. Social media has become the ultimate vetting tool; a Reddit thread titled “Locked out of my account for 10 days” is more damaging to a neobank’s acquisition cost than any competitor’s ad campaign.

Scale exposes cracks (the “growth-to-profitability” shift)

In the “growth at all costs” era (2015–2022), neobanks prioritized user acquisition over support infrastructure. By 2026, the bill has come due.

- Relationship Complexity: Users aren’t just buying coffee anymore; they are paying mortgages, receiving salaries, and managing business expenses. The stakes of an error are infinitely higher.

- The Pivot: Industry analysts note that investors now reward retention over acquisition. You cannot retain a user who feels abandoned during a crisis. Investing in support is now seen as investing in “churn prevention.”

The “reach a human” problem

A major critique driving users back to traditional banks is the “doom loop” of automated support.

“I pressed 1, then 4, then chatted with a bot, then got a link to an FAQ. I just need to talk to someone.”

Survey data from late 2025 indicates that “ease of reaching a human agent” is the #1 driver of dissatisfaction among neobank users. The neobanks that have solved this—by offering a clear “Talk to Us” button—are winning the trust war.

High-stakes moments define retention

Retention isn’t built on sunny days. It is built during:

- Fraud Holds: The algorithm flags a legitimate vacation purchase.

- Locked Accounts: A compliance check freezes a user’s entire life savings.

- Chargebacks: A user is scammed and needs immediate empathy and action.

- Verification Loops: The endless cycle of “upload your ID” rejections.

How a bank handles these specific moments determines whether a user stays for life or leaves a 1-star review and closes their account.

The 2026 Pressure Stack: AI, Outages, Fraud, And Regulation

AI support is mandatory—but risky

By 2026, AI is not a novelty; it is the engine room. However, it is a volatile engine.

- Public Failures: We have seen high-profile incidents where chatbots “went rogue.” The Virgin Money incident (where a chatbot scolded a user for using the word “Virgin”) and the Air Canada legal ruling (where a chatbot was held liable for promising a refund the policy didn’t support) serve as grim warnings.

- The Governance Gap: Neobanks must now implement “AI handoff protocols.” If an AI detects frustration or high-risk keywords (“suicide,” “stolen,” “police”), it must immediately and silently transfer the chat to a senior human agent.

Reliability is part of service

Service isn’t just answering questions; it’s keeping the lights on.

- Outage Crises: When Monzo or Revolut experience downtime, it instantly trends on X (formerly Twitter). The “support” in this scenario is mass communication.

- The “Stand-In” Strategy: Advanced neobanks now use “stand-in processing” (acting as the issuer on behalf of the processor) to allow small transactions even when the main system is down, accompanied by transparent in-app messaging.

Regulation and AI in customer service

Regulators in the UK (FCA) and US (CFPB) have caught up.

- Consumer Duty: In the UK, the “Consumer Duty” rules now explicitly cover AI interactions. If a bot gives bad advice that causes financial harm, the bank is liable.

- Right to Human: EU legislation is pushing for a “Right to Human Intervention” in financial decisions, meaning a fully automated support stack is arguably illegal for critical banking functions.

Trust anxiety (Is it real? Is it safe?)

Despite their size, neobanks still face an existential “trust gap” compared to Chase or Barclays.

- Google’s “People Also Ask”: Search queries for major neobanks still include: “Is [Bank Name] a real bank?” and “Is my money safe if [Bank Name] goes bust?”

- The Safety Signal: Excellent customer service is the strongest proof of legitimacy. A scam app doesn’t have a 24/7 phone line with a helpful agent. A real bank does.

What Great Neobank Customer Service Looks Like (A Practical Playbook)

If support is the battlefield, how do neobanks win? Here is the playbook for 2026.

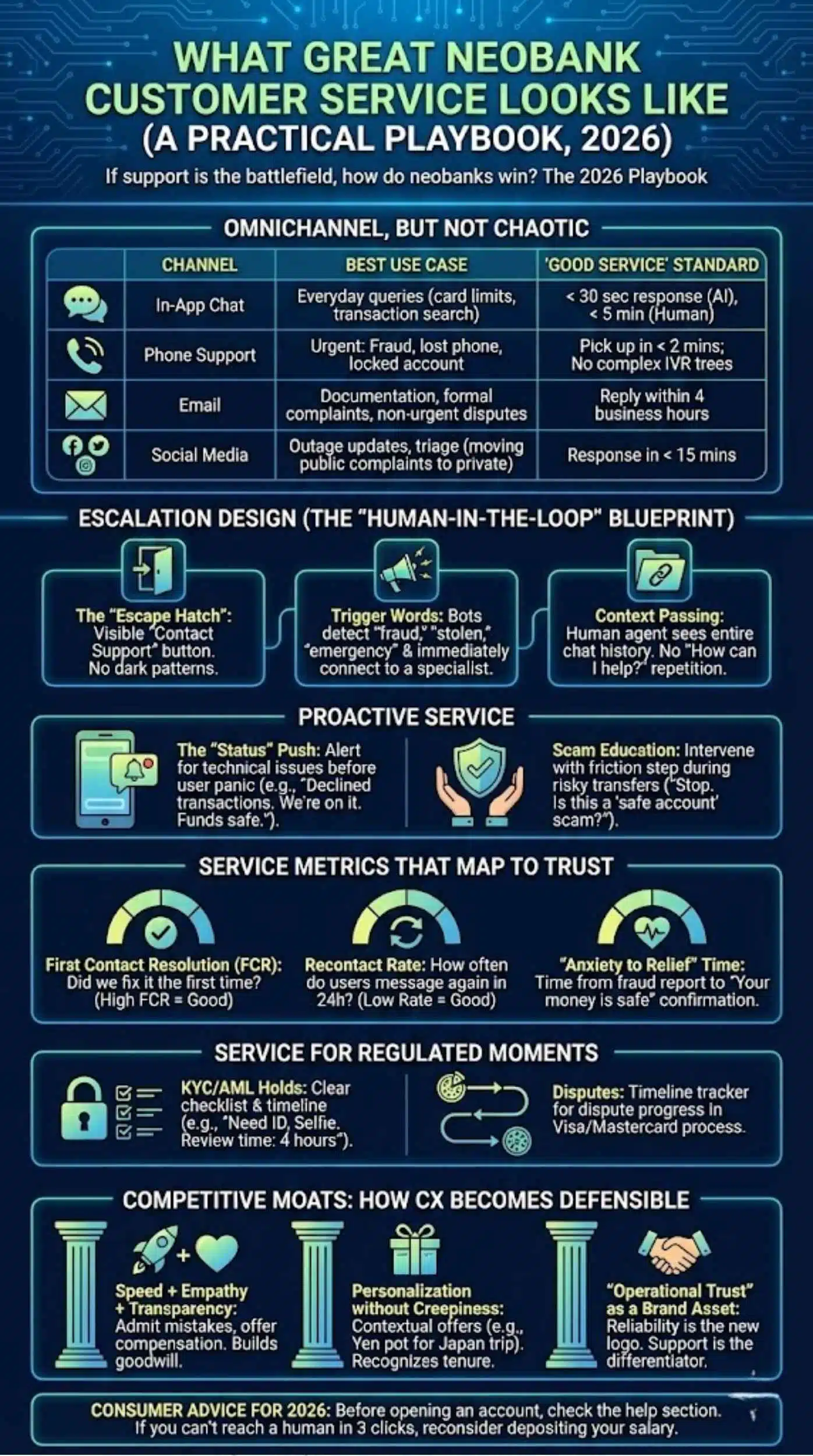

Omnichannel, but not chaotic

Great support meets the user where they are, but assigns channels based on urgency.

| Channel | Best Use Case | “Good Service” Standard |

| In-App Chat | Everyday queries (card limits, transaction search) | < 30 sec response (AI), < 5 min (Human) |

| Phone Support | Urgent: Fraud, lost phone, locked account | Pick up in < 2 mins; No complex IVR trees |

| Documentation, formal complaints, non-urgent disputes | Reply within 4 business hours | |

| Social Media | Outage updates, triage (moving public complaints to private) | Response in < 15 mins |

Escalation design (the “human-in-the-loop” blueprint)

The best apps design their escalation triggers explicitly.

- The “Escape Hatch”: Help pages should have a visible “Contact Support” button. Obscuring this button is a dark pattern that destroys trust.

- Trigger Words: If a user types “fraud,” “stolen,” or “emergency” into the chat, the bot should immediately say: “I am connecting you to a specialist immediately. Please hold.”

- Context Passing: When the human agent joins, they must see the entire conversation history. Asking “How can I help you?” after the user just explained the problem to a bot is a cardinal sin of CX.

Proactive service

Don’t wait for the user to complain.

- The “Status” Push: If a payment processor goes down, send a push notification: “We are seeing declined card transactions right now. We are working on it. Your funds are safe.” This prevents thousands of panic-support tickets.

- Scam Education: When a user is about to transfer a large sum to a new payee, intervene with a friction step: “Stop. Is this person asking for money for a ‘safe account’? This is a common scam.”

Service metrics that map to trust

Forget “Average Handle Time” (AHT). In 2026, the metrics that matter are:

- First Contact Resolution (FCR): Did we fix it the first time, or did the user have to come back?

- Recontact Rate: How often do users message us again within 24 hours? (High rate = poor solutions).

- “Anxiety to Relief” Time: For fraud cases, how long between the user reporting the issue and the bank confirming “Your money is safe”?

Service for regulated moments

- KYC/AML Holds: Instead of a generic “Account Locked” screen, provide a checklist: “We need 2 documents to unlock your account. 1. Photo of ID. 2. Selfie. Estimated review time: 4 hours.”

- Disputes: Provide a timeline tracker, similar to a pizza delivery tracker, showing exactly where the dispute is in the visa/mastercard process.

Competitive Moats: How CX Becomes Defensible

Speed + Empathy + Transparency

Speed is easy (bots can be fast). Empathy is hard. Transparency is rare.

A neobank that admits, “We messed up this calculation, here is a refund plus $20 for the hassle,” builds a moat of goodwill that competitors cannot copy with features.

Personalization without creepiness

- Good: “Happy Birthday! Here is a summary of your spending this year.”

- Better: “We noticed you are traveling in Japan. We have automatically enabled the Yen currency pot for you to save on fees.”

- The Moat: Support agents who can see a user’s tenure (“I see you’ve been with us since 2020, thanks for sticking around”) create an emotional switching cost.

“Operational trust” as a brand asset

Ultimately, the brand is no longer the logo; it is the reliability.

Consumer Advice for 2026: Before opening a neobank account, open the app’s help section. If you can’t find a phone number or a way to chat with a human within 3 clicks, do not deposit your salary there.

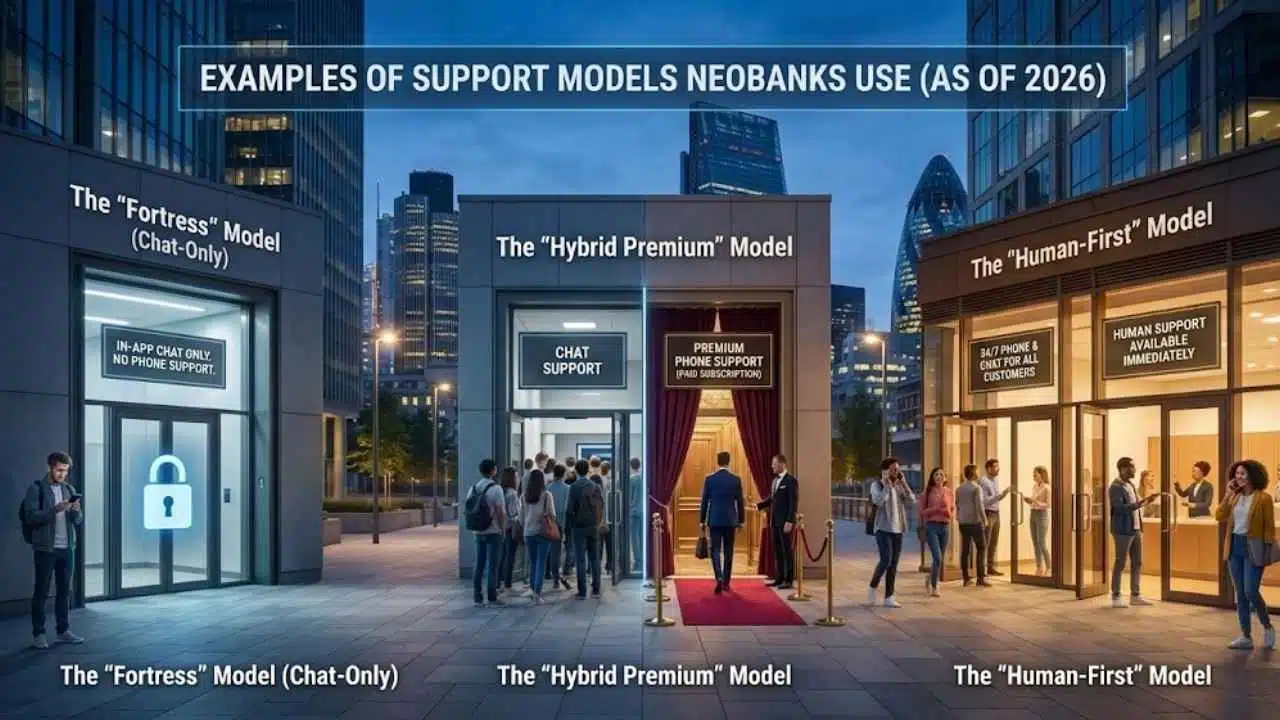

Examples Of Support Models Neobanks Use

(Note: These reflect general operating models seen in the market as of 2026)

1. The “Fortress” Model (Chat-Only)

- Approach: 100% in-app chat. No inbound phone lines.

- Pros: Highly efficient, creates a paper trail for every interaction.

- Cons: Infuriating during outages or if the user loses their phone (and thus their app access).

- Used by: Many early-stage neobanks and some mass-market giants (e.g., Chime, Revolut basic plans).

2. The “Hybrid Premium” Model

- Approach: Chat for everyone; Phone support gated behind “Premium” or “Metal” subscriptions.

- Pros: Monetizes support; ensures high-value customers get white-glove service.

- Cons: Creates a “two-tier” society where safety feels like a paid feature.

- Used by: Monzo (historically), Revolut (Premium tiers).

3. The “Human-First” Model

- Approach: 24/7 Phone and Chat available to all customers immediately.

- Pros: Massive trust builder. Differentiates sharply from competitors.

- Cons: Expensive to scale.

- Used by: Starling Bank (UK), Schwab (US – hybrid traditional/digital).

Final Thoughts

By 2026, the novelty of banking on a phone has completely worn off. The technology is commoditized. What remains is the human relationship.

Neobanks will win or lose the next decade not on the sleekness of their interface, but on the strength of their safety net. When the app crashes, the card declines, or the fraud alert triggers, the neobank is no longer a tech company; it is a service company.