The world of NFTs and Crypto Collectibles is revolutionizing how we think about ownership, art, gaming, and investing. Whether you’re an artist, a collector, or someone exploring the world of digital assets, it’s essential to understand the must-know terms of NFTs and Crypto Collectibles.

This terminology forms the foundation for navigating this emerging ecosystem and ensures you can confidently engage with the technology and market dynamics.

In this guide, we’ll break down the must-know terms in the world of NFTs, explain how they relate to crypto collectibles, and explore the implications for creators, collectors, and investors alike.

Whether you are getting started or already involved in NFTs, understanding these terms is crucial to understanding the value, risks, and potential rewards of participating in the digital asset space.

Introduction to NFTs and Crypto Collectibles

Before diving into the specific terms, it’s essential to first understand the core concepts. NFTs (non-fungible tokens) and crypto collectibles are fundamentally reshaping industries such as art, gaming, and entertainment. These terms are essential in comprehending the technologies and markets at play.

What Are NFTs?

NFTs are digital assets that represent ownership or proof of authenticity of a unique item. The uniqueness of an NFT comes from its association with the blockchain—a decentralized ledger that guarantees the token’s verifiability and immutability. Unlike cryptocurrencies like Bitcoin or Ethereum, NFTs are non-fungible, meaning each one is unique and cannot be exchanged on a one-to-one basis.

The value of NFTs lies in their rarity, scarcity, and authenticity. For example, digital artwork, virtual collectibles, music, and even tweets can be tokenized as NFTs, allowing creators to monetize their work in ways that were not possible before.

Understanding Crypto Collectibles

Crypto collectibles are a category of NFTs, specifically referring to unique digital items collected in a way similar to physical collectibles such as trading cards, rare figurines, or artwork. These digital assets are often used in gaming or digital art, where rarity and exclusivity play a significant role in their value.

Crypto collectibles can include:

- Virtual pets or characters used in games.

- Digital trading cards representing real or fictional characters.

- In-game assets such as skins, weapons, or virtual land.

Why NFTs and Crypto Collectibles Matter Today

NFTs and crypto collectibles have rapidly gained traction for several reasons:

- Democratizing Art and Creativity: Artists can monetize their digital works directly by selling NFTs without the need for intermediaries like galleries or auction houses.

- Changing Digital Ownership: NFTs provide a new way to prove ownership of digital assets, offering a solution to the problem of infinite duplication in the digital realm.

- New Investment Opportunities: Collectors can buy and sell digital assets, creating a new marketplace for both traditional and digital investors.

Key NFT and Crypto Collectible Terms You Should Know

The must-know terms of NFTs and Crypto Collectibles include several technical and conceptual phrases that are crucial to understanding the NFT landscape. Here’s a detailed breakdown of these terms:

1. NFT (Non-Fungible Token)

- Definition and Characteristics: An NFT is a digital token representing ownership of a unique item. NFTs are powered by blockchain technology, which secures the ownership and transaction history of these assets. Unlike cryptocurrencies, NFTs cannot be exchanged for other tokens on a one-to-one basis because each one is unique.

- How NFTs Differ from Cryptocurrencies: Cryptocurrencies like Bitcoin or Ethereum are fungible, meaning one Bitcoin is the same as another. NFTs, on the other hand, are non-fungible. For example, one piece of digital art represented by an NFT is different from another, just as a unique piece of physical art is different from another.

Comparison Between NFTs and Cryptocurrencies

| Feature | NFTs (Non-Fungible Tokens) | Cryptocurrencies |

| Fungibility | Unique, non-interchangeable | Fungible, interchangeable |

| Use Case | Art, collectibles, digital assets | Currency, digital transactions |

| Ownership Proof | Blockchain-based ownership record | Blockchain-based ownership record |

| Examples | Digital art, virtual land, music | Bitcoin, Ethereum |

2. Blockchain Technology

- Role in NFTs and Crypto Collectibles: Blockchain is the foundational technology behind NFTs and crypto collectibles. It is a decentralized and transparent ledger that records every transaction involving NFTs, ensuring the authenticity and ownership of each token. The blockchain acts as the secure, immutable database that verifies each NFT’s provenance and history.

- How Blockchain Ensures Ownership and Authenticity: Each NFT is stored on the blockchain, which maintains a record of the NFT’s creation, transactions, and current ownership. This record cannot be altered, ensuring that the digital asset remains verifiably authentic.

Popular Blockchain Networks for NFTs

| Blockchain Network | Key Features | Popular NFT Marketplaces |

| Ethereum | Most widely used, supports ERC-721 & ERC-1155 standards | OpenSea, Rarible, SuperRare |

| Flow | Optimized for NFTs and collectibles, low transaction costs | NBA Top Shot, VIV3 |

| Binance Smart Chain | Fast, low fees, compatible with Ethereum’s ecosystem | BakerySwap, TreasureLand |

3. Smart Contracts

- How Smart Contracts Function in NFTs: Smart contracts are self-executing contracts where the terms of the agreement are directly written into code. When you purchase or sell an NFT, a smart contract automatically executes the transaction based on pre-defined conditions. For example, a smart contract might ensure that an artist receives a royalty every time their artwork is resold.

- Benefits and Risks of Using Smart Contracts in Collectibles<span style=”font-weight: 400;”>: The primary benefit of smart contracts is automation, which reduces the need for intermediaries, lowers transaction costs, and speeds up the process. However, they are also susceptible to errors in the code, which can lead to vulnerabilities or exploitation.

4. Minting

- What is Minting in the NFT World?: Minting is the process of converting a digital file (such as a piece of artwork or music) into an NFT and registering it on the blockchain. Once an NFT is minted, it is available for sale or trade on various platforms.

- Steps Involved in Minting an NFT:

- Step 1: Choose a marketplace like OpenSea or Rarible.

- Step 2: Upload your digital file (art, video, etc.).

- Step 3: Pay the minting fee (gas fee) to create the NFT.

- Step 4: The NFT is created and listed for sale or auction.

- Minting creates a unique digital token on the blockchain that is forever tied to the file, guaranteeing its ownership.

Minting Process

| Step | Action | Details |

| 1. Choose a Marketplace | Select a platform (e.g., OpenSea, Rarible) | Research and choose based on fees, audience |

| 2. Upload Digital File | Add your digital artwork, video, etc. | Formats may vary (JPG, PNG, MP4, etc.) |

| 3. Pay Minting Fee | Pay the gas fee required to mint your NFT | Fees depend on blockchain congestion |

| 4. List for Sale | Set the price and make your NFT available | Auctions or fixed prices |

5. Gas Fees

- Understanding Gas Fees in Blockchain Transactions: Gas fees are transaction fees that are required to perform any operation on the blockchain, such as minting or transferring an NFT. These fees are paid to the network miners or validators who process and confirm the transaction.

- How Gas Fees Impact NFT Creation and Trading: Gas fees fluctuate based on blockchain network congestion. When demand for network usage is high (such as during a popular NFT release), gas fees can increase dramatically. This makes it expensive for creators, especially smaller ones, to mint NFTs.

Gas Fee Impact on NFT Transactions

| Action | Low Network Activity | High Network Activity |

| Minting an NFT | Low fee (e.g., $5) | High fee (e.g., $100) |

| Buying an NFT | Low fee (e.g., $2) | High fee (e.g., $50) |

| Selling an NFT | Low fee (e.g., $2) | High fee (e.g., $50) |

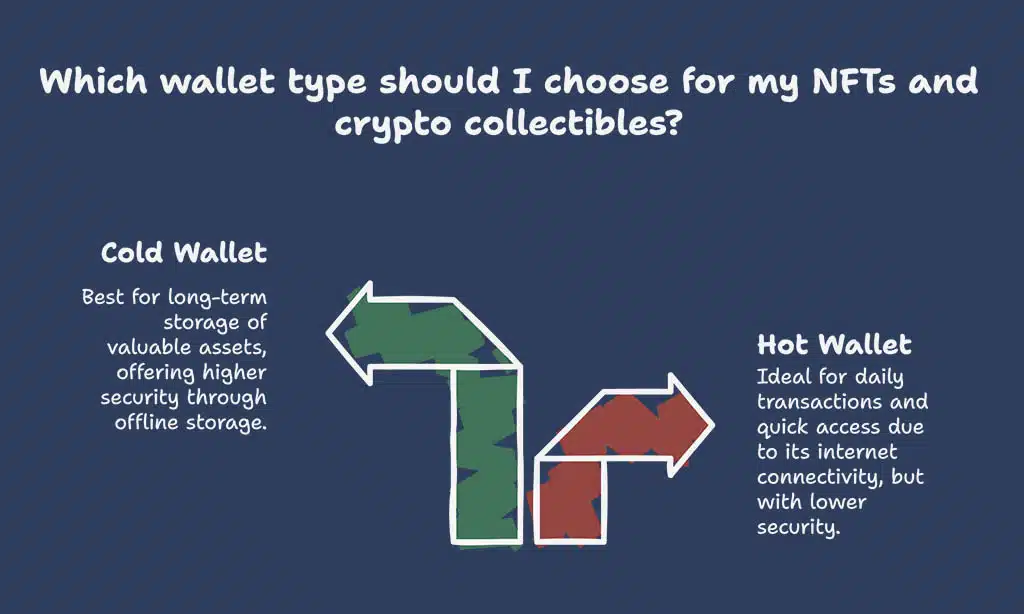

6. Wallets for NFTs and Crypto Collectibles

- What Types of Wallets Are Used?: Digital wallets are essential for securely storing NFTs and cryptocurrencies. There are two main types of wallets:

- Hot Wallets: Connected to the internet, making them easier to use but more vulnerable to hacks.

- Cold Wallets: Offline wallets offering greater security, ideal for long-term storage of high-value NFTs.

Wallet Types and Features

| Wallet Type | Connectivity | Security Level | Best Use Case |

| Hot Wallet | Internet-connected | Lower security | Daily transactions, quick access |

| Cold Wallet | Offline storage | Higher security | Long-term NFT storage, valuable assets |

7. Royalties

- Definition and Importance of Royalties in NFTs: One of the most innovative aspects of NFTs is the ability for creators to receive royalties every time their NFT is resold. A royalty is a percentage of the resale price that is paid to the original creator. This feature ensures that artists can continue to profit from their work long after the initial sale.

- How Royalties Work in NFT Transactions: When a digital artwork is sold as an NFT, the smart contract associated with the token can be programmed to automatically transfer a set percentage of the sale price to the artist. This is one of the key benefits of NFTs over traditional art sales, where the original artist typically receives no compensation after the artwork is sold to a new owner.

- Setting Royalties: Many NFT marketplaces, such as OpenSea, allow creators to set the royalty percentage when they mint their NFT. These royalties typically range between 5% and 10%, though this varies depending on the platform.

Example of NFT Royalties and Earnings

| NFT Sale | Original Sale Price | Resale Price | Creator’s Royalty (10%) | Creator’s Earnings from Resale |

| 1st Sale | $500 | – | – | – |

| 2nd Sale | – | $1,000 | $100 | $100 |

8. Decentralized Marketplaces

- What Are Decentralized Marketplaces?: Decentralized NFT marketplaces are platforms that allow users to buy and sell NFTs without an intermediary or central authority. These marketplaces are built on blockchain technology, which ensures transparency and security by removing the need for a middleman.

- Examples of Popular Decentralized Marketplaces: Some well-known decentralized NFT marketplaces include OpenSea, Rarible, and Foundation. These platforms allow users to mint, buy, and sell NFTs without relying on centralized control, offering greater flexibility and lower fees than traditional marketplaces.

- Advantages of Decentralization: By decentralizing the marketplace, the power remains in the hands of creators and buyers. These platforms are often community-driven, offering artists and collectors a more direct way to engage with the NFT ecosystem. Additionally, transactions on decentralized platforms are recorded on the blockchain, providing verifiable ownership and transaction history.

Comparison of Decentralized Marketplaces

| Marketplace | Blockchain | Key Features | Popular NFT Types |

| OpenSea | Ethereum | Largest NFT marketplace, wide variety of assets | Art, collectibles, music, virtual land |

| Rarible | Ethereum | Community-governed, creator-focused | Art, video clips, digital fashion |

| Foundation | Ethereum | Artist invite-only, curated platform | Art, digital illustrations, animations |

9. Virtual Worlds and Metaverses

- What Are Virtual Worlds and Metaverses?: A metaverse is an immersive, often decentralized, virtual world where users can interact with each other and digital assets, including NFTs. These virtual spaces are a place for gamers, creators, and collectors to socialize, create, and trade NFTs as part of a larger ecosystem.

- Popular Metaverses Featuring NFTs: Virtual worlds like Decentraland, The Sandbox, and Somnium Space are platforms where users can own virtual land, digital art, or wearables. These metaverses allow users to create, buy, and sell NFTs within their environments. These virtual worlds combine gaming, digital art, and real estate, creating a new dimension for NFT interaction.

- The Role of NFTs in Virtual Worlds: NFTs in the metaverse can represent virtual land, avatars, buildings, and other assets within these online environments. Just as real estate in the physical world holds value, digital real estate within metaverses can be traded or leased to others.

Popular Metaverses and NFT Integration

| Metaverse | Key Features | Notable NFT Usage |

| Decentraland | Virtual land ownership, immersive environments | Digital art, virtual properties |

| The Sandbox | Play-to-earn games, land ownership | Virtual clothing, avatars, in-game items |

| Somnium Space | Open-world VR metaverse, land buying | VR spaces, digital art, wearables |

10. Token Standards (ERC-721 and ERC-1155)

- What Are Token Standards?: Token standards are a set of rules that define how NFTs are created, traded, and managed on the blockchain. In the NFT space, the two most popular token standards are ERC-721 and ERC-1155, both of which are based on the Ethereum blockchain.

- ERC-721 vs. ERC-1155:

- ERC-721: The first standard for NFTs, ERC-721 ensures that each token is unique and cannot be replaced with another. It is the most common standard for individual, non-fungible tokens, such as collectible art or digital collectibles.

- ERC-1155: This standard supports both fungible and non-fungible tokens. It allows for more efficient transactions by enabling a single contract to manage multiple types of assets. ERC-1155 is used in games and projects that require the trading of multiple NFTs, such as virtual goods or in-game assets.

- Advantages of ERC-1155 over ERC-721: While ERC-721 is ideal for single, unique items, ERC-1155 offers a more flexible and efficient solution for projects that involve collections of assets. For example, in gaming, where players may own multiple copies of items like swords or shields, ERC-1155 allows all these items to be managed under one contract, reducing the transaction costs and improving scalability.

Key Differences Between ERC-721 and ERC-1155

| Feature | ERC-721 | ERC-1155 |

| Fungibility | Non-fungible (unique tokens) | Can handle both fungible and non-fungible |

| Transaction Efficiency | Less efficient for multiple assets | More efficient for batch transactions |

| Use Case | Digital art, collectibles | Gaming, in-game assets, collectibles |

| Standard for | Most popular NFT collections | Larger collections, gaming ecosystems |

How NFTs and Crypto Collectibles Are Changing the Digital World?

The must-know terms of NFTs and crypto collectibles are more than just jargon—they are driving a fundamental shift in the way we interact with digital assets. The impact of NFTs extends beyond art and collectibles into various sectors such as gaming, entertainment, and finance.

Impact on the Art World

NFTs have given digital artists an unprecedented opportunity to monetize their work directly. Before NFTs, it was difficult for digital art to be sold with guaranteed provenance. Now, through NFTs, artists can sell their work directly to collectors, ensuring that their creations are recognized as valuable assets.

One famous example is Beeple’s “Everydays: The First 5000 Days”, which sold for $69 million at Christie’s in March 2021. This sale made Beeple one of the highest-paid living artists, showcasing the power of NFTs to transform the art world.

Revolutionizing Digital Collectibles and Gaming

NFTs are also making waves in the gaming industry. In games like Axie Infinity or Decentraland, players can own, trade, and sell virtual items such as characters, land, or weapons. This creates a new economy where players can earn real-world value through their gaming activities.

How NFTs Are Empowering Creators and Artists

NFTs provide creators with a direct channel to their audience, bypassing traditional gatekeepers like galleries or agents. With smart contracts, artists can also ensure they receive royalties every time their work is resold, empowering them to maintain a continuous income stream.

Risks and Considerations in the NFT Space

While NFTs present exciting opportunities, they also come with risks. Being aware of these risks and understanding the must-know terms of NFTs and crypto collectibles is key to navigating the space responsibly.

Potential Scams and Fraud in NFT Marketplaces

As the NFT market is largely unregulated, there are risks of scams and fraud. Fake listings, phishing attacks, and fraudulent creators are common in the space. It’s crucial to verify the legitimacy of platforms and creators before engaging in any transactions.

Environmental Concerns Around NFTs

NFTs often rely on blockchain networks like Ethereum, which require significant computational power to process transactions. This has led to concerns about the environmental impact of NFTs, as the energy consumption of blockchain networks can be substantial.

Regulatory Challenges for NFTs and Crypto Collectibles

The regulatory landscape for NFTs is still in its infancy. Governments are beginning to explore ways to regulate NFTs and ensure that intellectual property laws are respected, while also addressing issues like taxation and anti-money laundering.

Wrap Up: Embracing the Future of NFTs and Crypto Collectibles

The must-know terms of NFTs and crypto collectibles are integral to understanding the burgeoning world of digital assets.

As NFTs continue to grow in popularity and adoption, staying informed about these key concepts is crucial for anyone involved in the space—whether as a creator, collector, or investor.

The future of NFTs and crypto collectibles is exciting and full of possibilities. By mastering the essential terminology and keeping up with emerging trends, you’ll be well-equipped to navigate this rapidly evolving landscape.