Car accidents can be scary and confusing. After the crash, many drivers feel lost about what to do next or how to deal with their motor insurance. The process might seem tricky, but it doesn’t have to be.

Did you know filing your claim quickly can save time? Insurance companies expect details like a police report, photos of damage, and your policy number right away. If you’re unsure how it works, don’t worry! This guide will break down everything step by step so you can handle your car insurance claim with ease.

Keep reading—you’re in the right place!

Key Takeaways

- Act fast after an accident. Call the police if needed, take photos, and collect details like names and insurance info.

- File your claim within 24 hours. Include documents like the police report, photos of damage, and your insurance policy number.

- Insurers often process claims in 30 to 45 days. Send all papers quickly to avoid delays.

- Common claim denial reasons include unpaid premiums, late filing, or missing coverage for specific damages.

- If denied, appeal by gathering proof, checking your policy terms, and writing an appeal letter with all evidence attached.

Steps to Take Immediately After an Accident

Accidents can feel chaotic, but quick actions matter. Stay calm, act responsibly, and handle the situation step by step.

Stop and secure the scene

Pull over to a safe spot if possible. Turn on your hazard lights to warn other drivers.

Check yourself and others for injuries first. Call for an ambulance if needed. Stay calm, and avoid arguing with anyone at the accident scene.

Contact the authorities

Call the police if someone is hurt or there’s major vehicle damage. This helps create an official police report, which is key for your insurance claim. For small fender-benders without injuries, you can skip calling but still document everything well.

Stay calm and provide clear details to officers. Answer their questions honestly. Avoid saying anything that admits fault at the scene. If witnesses are present, ask them to stay nearby until police arrive; their statements might help later with accident liability.

Document the accident

Accidents can be stressful and chaotic. Staying calm helps you gather the right information.

- Take clear photos of the accident scene. Include traffic signs, vehicle damage, skid marks, or debris on the road.

- Use your phone or a notebook to write down what happened. Add details like time, weather, and location of the crash.

- Get names and contact info from all involved drivers, passengers, and witnesses. Ask for their phone numbers and email addresses too.

- Exchange insurance details with the other driver. This includes policy number, insurance company name, and personal details like address or license plate number.

- Snap pictures of both cars’ license plates, driver’s licenses, and registration documents for quick reference later.

- Save any proof of injury if applicable—like visible bruises or cuts caused by the accident.

- Keep notes on conversations with police officers at the scene for your records.

- Call your insurer to notify about the incident within 24 hours after collecting everything you need.

These steps help protect your car insurance claim!

Exchange information with involved parties

Share details with everyone involved in the crash. Get names, phone numbers, and addresses. Ask for driver’s licenses and car insurance policy numbers. Note the license plates of all vehicles.

Take pictures or write down damage to cars or property. If there are witnesses, ask them for their statements and contact info too. This helps your insurance company handle claims faster.

When to File a Motor Insurance Claim

You should file a motor insurance claim if your car is damaged or someone is hurt—keep reading to learn what else matters.

In cases of physical injury

Seek medical help right away after an accident. Even small injuries, like bruises or headaches, can signal bigger problems. Personal injury claims often cover medical bills, so don’t delay getting care.

File a personal injury claim with your auto insurer if you live in a no-fault insurance state. States like Florida require this, and rates won’t increase for no-fault crashes there.

Keep doctor reports, X-rays, and receipts for proof of expenses. These documents are key to getting what you deserve from your auto insurance policy.

In cases of vehicle damage

File a claim if your car has collision damage. This applies only if you have collision coverage in your insurance policy. For example, hitting another car or crashing into a pole qualifies.

Non-collision issues like theft, vandalism, or weather damage need comprehensive insurance to cover repair costs.

Take photos of the vehicle’s condition at the accident scene. These prove the extent of damage for insurers and claims adjusters. Save receipts for towing or rental cars too—some policies include these expenses under coverage terms like rental car expenses and collision coverage.

Documents Required for Filing a Claim

Gathering the right papers, like reports and photos, is key to a smooth claim process—find out what you need next!

Accident report or police report

File a police report for any serious accident or injury. It helps show what happened and who might be at fault. Include details like the location, time, weather, and road conditions.

Officers will note statements from drivers and witnesses.

The report is key for your car insurance claim. Insurance companies use it to check liability coverage and damage claims. Without it, your claim could face delays or denial. Always ask for a copy of the report as proof for your insurer.

Insurance policy details

Provide your policy number when filing your car insurance claim. It helps the insurance company locate your records quickly. Share clear accident details, like date, time, and location.

Mention who was involved and any damage caused.

Keep a copy of your vehicle insurance document handy. This shows what type of coverage you have, like liability or collision coverage. If unsure about specifics, ask your insurance agent for help with the claim process.

Photos of the damage

Take clear photos of your car’s damage right away. Get pictures from all angles to show the full extent. Snap close-ups of scratches, dents, or broken parts. Include shots of the entire accident scene too.

Capture traffic signs, tire marks, and anything else relevant.

Make sure your images have good lighting. Blurry or dark photos won’t help much in a claim process. Use your phone camera if you don’t have another option handy. These pictures will back up your side when talking to an insurance company or adjuster later on.

Identification and registration documents

Provide a copy of your driver’s license. Keep it current and clear to avoid delays. Share your vehicle registration details, including the plate number.

Have proof of ownership handy. This could be your car title or lease agreement. These papers confirm you legally own or operate the vehicle involved in the accident.

How to File Your Motor Insurance Claim

Filing a car insurance claim can feel tricky, but it doesn’t have to be. Start by acting fast and giving your insurer all needed info for a smooth process!

Notify your insurance company promptly

Call your insurance company right away. Do this by phone, online, or through their mobile app. Provide your policy number and personal details. Explain the car accident briefly but clearly.

Share key facts like the date, time, place, and who was involved.

Quick reporting speeds up the car insurance claim process. It also helps avoid delays in getting compensation for vehicle damage or injury bills. Some insurers may send an insurance adjuster to assess damages sooner with early notice!

Submit the required documents

Gather all documents quickly to avoid delays. Provide a police report, photos of the car damage, and your insurance policy numbers. Include proof of identity, like a driver’s license or car registration.

Insurance adjusters may ask for repair estimates from a body shop or other details during the process. Send paperwork as soon as possible to keep things moving smoothly with your claim settlement.

Cooperate with the insurer’s investigation

Provide honest answers to the insurance company. Speak clearly about what happened during the car accident. Share all details like photos, police reports, and witness statements.

The insurance adjuster will look at the damage and review your documents. They may ask questions about repair costs or medical expenses. Respond quickly to help speed up the claim process.

Understanding the Claim Review Process

The claim review is like a waiting game, where insurers check details, timelines, and facts—keep reading to know what happens next!

Claim processing timeline

Claims usually take 30 to 45 days to process. Complex cases, like accidents with severe injuries or unclear liability, may need more time. Insurance companies move faster if you send all required documents quickly.

After you file a car insurance claim, an adjuster reviews it. They check evidence like the police report and photos of damage. Their job is to confirm what happened and decide payment details for repair costs or personal injury protection.

Stay in touch with your insurance company during this period for updates on progress.

How insurers assess claims

Insurers check every detail of your car insurance claim. They send an insurance adjuster to inspect the vehicle damage and review repair costs. Photos from the accident scene, witness statements, and the police report play a big role in this process.

Adjusters also calculate if your car is a total loss or can be repaired.

The insurance company reviews your policy coverage next. Things like liability coverage or comprehensive insurance decide how much they’ll pay you. Medical expenses for personal injuries are considered too, based on bills and proof provided.

This step helps them settle the right amount fast while avoiding errors in payouts.

Receiving Compensation and Repairs

Get your payout, fix your car, and hit the road again—here’s how it happens.

Reviewing the settlement offer

Check the settlement offer carefully. Make sure it covers all repair costs, medical expenses, and other losses. Look for errors in the claim amount or policy details.

Ask questions if something looks off. If the payout seems low, request an explanation from your insurance company or agent. You can negotiate, so don’t settle too fast!

Following up on vehicle repairs

Call the repair shop often to check on your car repairs. Ask for updates about parts and progress. If delays happen, request a clear reason and timeline.

Review the repair estimates before work begins. Confirm that costs match the settlement offer from your insurance company. Ensure all agreed repairs are part of the plan.

What to Do if Your Claim is Denied

Don’t panic; learn why it was denied and fight back with the right proof.

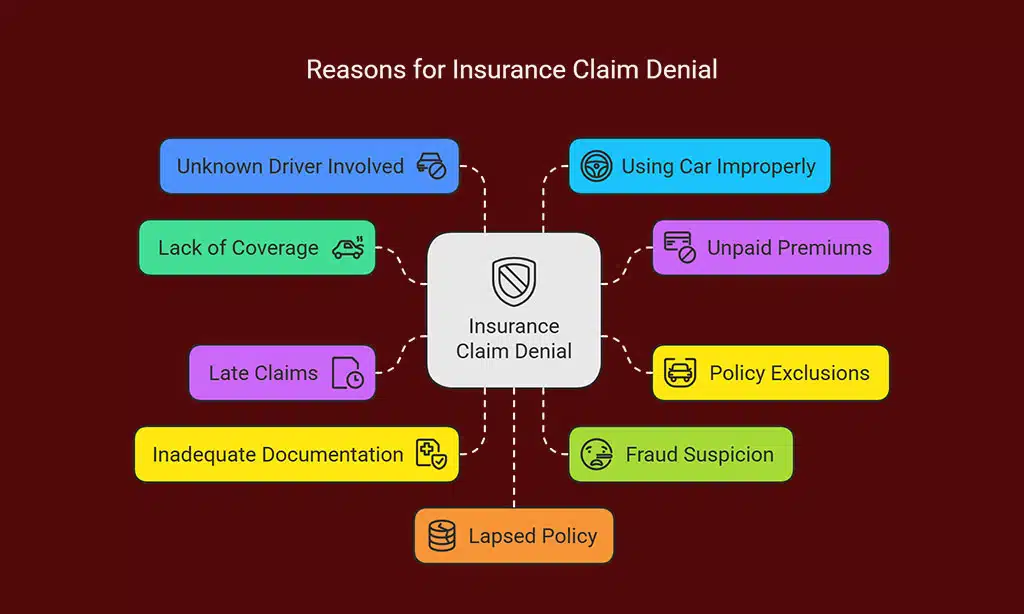

Common reasons for claim denial

Insurance claims can be denied for several reasons. It’s essential to understand these so you can avoid them.

- Lack of coverage

Your insurance might not cover certain damages. For instance, liability insurance won’t pay for your car repairs. - Unpaid premiums

If you missed payments, the policy may not be active. Always pay on time to keep coverage. - Policy exclusions

Some policies exclude specific events like floods or drivers without licenses. Check your insurance details carefully. - Late claims

Filing a claim long after the accident can lead to denial. Insurers often need claims filed within a set timeframe. - Inadequate documentation

Missing reports, photos, or proof of damage can hurt your case. Always submit all needed papers quickly. - Fraud suspicion

Exaggerated or false claims raise red flags. Insurance companies investigate suspicious accidents closely. - Unknown driver involved

If someone not listed on your policy caused the crash, the insurer could reject it. Update your policy if others drive your car often. - Using a car improperly

Driving outside policy terms, like for commercial work with personal coverage, voids claims in many cases. - Lapsed policy

Once expired, it no longer protects you or pays for damages after an auto accident occurs. - Violation of traffic laws

Breaking signs or rules during an accident reduces chances of approval as insurers see it as negligence that increases risk levels too high to accept responsibility for losses fully covered previously under normal circumstances!

Steps to appeal a denial

Sometimes, your car insurance claim might be denied. Don’t panic. You can appeal it by following these steps:

- Read the denial letter carefully. Check why the insurer refused your claim. Look for terms like “policy coverage” or “exclusions.”

- Gather all evidence again. Include photos of the car damage, accident scene, police report, and repair estimates.

- Check your insurance policy details. Confirm if your coverage includes the type of damage or accident.

- Write an appeal letter to the company. Explain why you believe they should approve the claim. Attach all documents and proof.

- Contact an attorney specializing in auto insurance claims if needed. They know how to handle claim settlement disputes.

- File a complaint with state regulators if necessary. The insurance commissioner’s office may step in and help review issues.

Use these steps promptly for better chances of success!

Takeaways

Filing a motor insurance claim can feel overwhelming, but it doesn’t have to be. Stay calm, follow the steps, and keep your documents ready. Your insurance company is there to help you through the process.

Know your policy, ask questions, and don’t rush decisions. A little patience can lead to fair compensation and peace of mind!

FAQs

1. What should I do first after a car accident?

Start by checking for injuries and calling emergency services if needed. Document the accident scene, take photos of vehicle damage, note traffic signs, and gather witness statements. File a police report as soon as possible.

2. How do I start my car insurance claim process?

Contact your insurance provider or agent immediately. Provide your policy number and details about the accident timeline. They will guide you on filing a claim form and may send an insurance adjuster to assess the damage.

3. What types of damages does collision coverage handle?

Collision coverage pays for repair costs or replacement if your car is damaged in an accident involving another vehicle or object, like a tree or pole.

4. Can I get reimbursed for medical expenses after an accident?

Yes, personal injury protection (PIP) can cover medical bills related to injuries from the crash. Liability coverage might also help with costs if you’re found at fault for someone else’s injuries.

5. What happens if my car is declared a total loss?

If repairs cost more than the car’s value due to depreciation, it’s considered a total loss. Your insurer will offer settlement based on its market value before the crash.

6. Will uninsured motorist coverage protect me against drivers without insurance?

Uninsured motorist coverage helps pay for damages caused by uninsured drivers or underinsured motorists who can’t fully cover repair estimates or medical expenses from accidents they cause.