Hey there, are you tired of guessing where to put your money in real estate? Many folks just like you worry about picking the wrong spot, losing cash, or missing out on big gains.

Here’s a cool fact to chew on: investors in 2025 are gearing up to spend more on both new and old properties, showing a real hunger for growth. Now, imagine having a clear map to guide you.

Our blog, “10 Most Profitable Property Investment Strategies In 2025,” lays out simple, smart paths to boost your rental income and grow your wealth. Stick with us; we’ve got tips on everything from flipping houses to tapping into emerging markets.

Ready for a win? Keep reading!

Key Takeaways

- Look into the Buy and Hold Strategy for 2025 to grow wealth with steady rental income over time.

- Try Short-Term Rentals for vacation spots in 2025 using platforms like Airbnb to earn quick cash.

- Invest in Sustainable Properties in 2025 for tax benefits and higher property values with green features.

- Consider Real Estate Investment Trusts (REITs) in 2025 for easy, low-risk real estate gains without owning property.

- Explore Emerging Markets in the Midwest and Inter-mountain West in 2025 for affordable, high-growth real estate deals.

Buy and Hold Strategy

Dig into the Buy and Hold Strategy, folks, and see why it’s a solid pick for real estate investment in 2025. This approach means you snag a property, keep it for the long haul, and watch its value climb over time.

Think of it like planting a seed and waiting for a mighty oak to grow. With increased spending on properties and a growth mindset among investors, as seen in recent trends, this method shines for building steady rental income.

It’s a path to passive income that many real estate investors swear by, especially with market volatility pushing for portfolio diversification.

Now, let’s chat about how this ties into today’s real estate market trends. Using AI-driven property analyses, you can spot high-yield opportunities in residential properties or even emerging markets.

Plus, renovations and geographical expansion, which are hot right now, can boost your rental business. Imagine fixing up an old house and seeing renters line up. By spreading your bets across different real estate classes, you lower investment risk.

So, grab a property, hold tight, and let time work its magic for financial freedom.

Short-Term Rentals for Vacation Properties

Moving on from the steady pace of the Buy and Hold Strategy, let’s switch gears to a faster way to earn with real estate. Short-term rentals for vacation properties are a hot trend in real estate investing right now.

They can bring in quick cash, especially if you pick a spot travelers love. Think beach houses or cozy cabins near ski slopes. With platforms like Airbnb and Vrbo, listing your place is a snap.

Plus, virtual reality property tours are now standard for first showings, so guests can check out your spot without stepping foot inside.

This approach fits well with real estate market trends, as more folks crave quick getaways. You can boost rental income by targeting peak seasons, like summer or holidays. Just keep an eye on local rules for short-term stays.

Also, consider adding perks, like fast Wi-Fi or a cool vibe, to stand out. With rising demand for climate-friendly spots, toss in some energy-efficient features to draw eco-aware travelers.

This can lift your property value and keep those bookings rolling in!

Investing in Sustainable and Green Properties

Hey there, let’s talk about investing in eco-friendly properties. It’s a wise choice with the rising demand for energy-efficient homes, thanks to incentives for sustainable building.

Getting in early with green features can increase property values and secure attractive tax benefits. Think solar panels or rainwater systems; they’re like sowing seeds for a greater return in the future.

Now, prioritizing climate resilience is essential to avoid financial setbacks. With climate change influencing real estate patterns, sustainable homes are a secure option. They hold up well against weather challenges and attract buyers who value environmental responsibility.

So, explore this opportunity, and see your real estate investment flourish while creating a positive social impact with affordable housing solutions.

Real Estate Investment Trusts (REITs)

Let’s chat about Real Estate Investment Trusts, or REITs, a super way to dip your toes into real estate without buying a whole building. Think of REITs as a big pot of money, pooled from lots of folks like you and me, used to buy properties.

You get a slice of the action, earning rental income or profits without the headache of fixing leaky pipes. Plus, many REITs trade on stock exchanges, so buying in is as easy as grabbing shares online.

Dig this cool fact, partnerships between investment firms and banks or REITs help cut down on risks in commercial real estate. They team up with insurers too, making sure bumps in the road don’t wipe out your cash.

So, if you’re eyeing real estate opportunities with less stress, REITs could be your ticket to steady gains in 2025.

Flipping Properties for Quick Profits

Hey there, readers, got a knack for a fast buck in real estate? Flipping properties for quick profits might just be your game. This strategy means you buy a house, fix it up fast, and sell it for more money.

It’s like turning a rough stone into a shiny gem in no time. But, watch out, it takes a sharp eye to spot the right fixer-upper at a low price.

Dig into AI-driven property analyses to stay ahead. These tools crank up competition and push property prices higher, so you gotta move quick. Pair that with hyper-targeted marketing to find motivated sellers ready to let go cheap.

Think of it as fishing with the best bait; you snag the big catch before anyone else even casts a line. Stick to this, and flipping in 2025 could pad your wallet with some serious rental income potential or straight-up cash from a sale.

Mixed-Use Property Investments

Mixed-use property investments are gaining steam, folks, especially in secondary and tertiary markets. Think of these as spaces that mix residential, commercial, and recreational spots all in one.

They’re like a tasty stew, blending different flavors to create something special for everyone. This setup pushes urban decentralization and supports a live-work-play vibe that many crave today.

It’s a smart way to draw renters and buyers who want it all close by.

Imagine a building with apartments upstairs, shops below, and a park nearby. These mixed-use developments are hot near healthcare and education hubs, where demand often outstrips supply.

By jumping into this real estate trend, you tap into undersupplied markets and boost your rental income. Plus, they offer a neat path to portfolio diversification in the ever-shifting commercial real estate scene.

Leveraging Data-Driven Platforms for Market Analysis

Dig into the power of data-driven platforms for real estate investment, folks. These tools use AI and machine learning to give predictive insights for smarter choices. They help spot trends in the real estate market, like finding motivated sellers fast.

Imagine cutting through the noise to snag high-yield opportunities before anyone else does. That’s the edge you get with big data and predictive analytics.

Now, let’s be real, this tech does amp up competition in emerging markets. Everyone’s racing to use these platforms for better property valuations. Still, staying ahead means acting on data insights quick as a flash.

So, gear up to make sharp moves with these tools in your corner. Let’s roll into investing in emerging real estate markets next.

Investing in Emerging Real Estate Markets

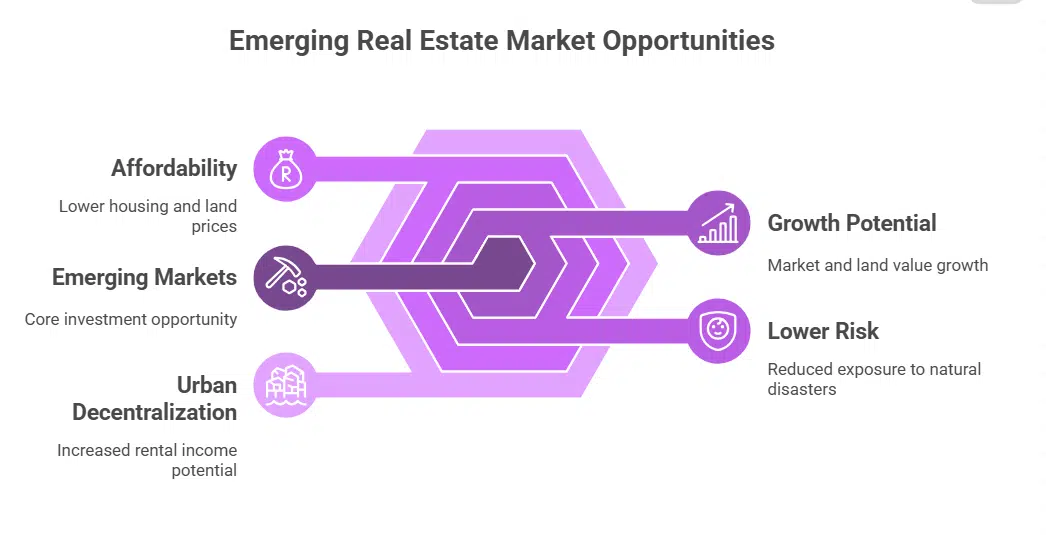

Moving from data-driven platforms, let’s shift our focus to a hot trend in real estate investment, exploring emerging real estate markets. These areas are like hidden gems waiting to be found, often overlooked but packed with potential for growth.

In 2025, the spotlight is on second-tier markets in the Midwest and inter-mountain West. Why? They’re showing solid market growth and land values, plus they’re away from high-risk zones like hurricane-prone Southeast or wildfire-prone Northwest.

If you’re a risk-tolerant investor or a first-time buyer, this could be your chance to jump in.

Now, let me paint a picture for you. Think of these emerging markets as the new frontier in real estate opportunities. They offer affordable housing options and lower land prices compared to big cities.

You can snag a deal on residential properties or even commercial real estate in these spots. Plus, with urban decentralization on the rise, more folks are moving to these areas, boosting rental income potential.

Stick around as we chat about tapping into this trend for your portfolio diversification.

Commercial Real Estate for Hybrid Workspaces

Shifting gears from emerging real estate markets, let’s chat about a hot trend in property investment, commercial real estate for hybrid workspaces. This is all about spaces that bend and flex with the times, especially since hybrid work models are now a big deal.

Folks split their time between home and office, and companies crave spots that can adapt to this mix. Think of it as a chameleon of a building, changing to fit the need.

Demand for flexible spaces is soaring due to these hybrid setups, and shared workspaces are popping up everywhere, fueled by remote work trends. Providers like WeWork are in a tight race, battling it out to offer the best spots for businesses.

Investing in commercial real estate for such spaces can bring solid rental income, as firms hunt for shared workspaces that save on cost but still feel like a pro hub. Stick with this trend, and you might just hit a gold mine in real estate opportunities.

Building Multi-Family Residential Units

Hey there, folks, let’s chat about building multi-family residential units, a solid path in real estate investment for 2025. With housing costs soaring, the demand for affordable shared living spaces is spiking fast.

You can meet this need by developing apartment complexes or townhomes, offering a steady stream of rental income. It’s like planting a money tree that keeps growing with every tenant.

Dig into this strategy, and you’ll see it aligns with social impact investing too. Focus on affordable housing, and you’re not just earning cash; you’re helping communities thrive with stable places to live.

Plus, diversification across these properties, like mixing duplexes and larger buildings, brings stability to your portfolio. So, jump into this real estate trend, and watch your finances grow stronger!

Exploring Niche Markets Like Senior Housing

Exploring niche markets, like senior housing, can be a treasure trove for real estate investment in 2025. Consider this, folks, our aging population needs secure, comfortable places to reside, especially close to healthcare hubs.

Targeting underserved markets in these locations isn’t just a wise move; it’s a chance to create a meaningful impact. Plus, with social impact investing picking up momentum, you’re not just pursuing gains but also contributing to society by backing affordable housing solutions for seniors.

Engaging with this trend positions you at the forefront of real estate opportunities. Imagine investing near medical centers where demand is strong. It’s like sowing a seed in rich soil, seeing both your portfolio and community flourish.

Many investors are now embracing a forward-thinking approach, directing more funds into properties that fulfill a need. So, let’s move forward and examine how property management software can improve your efficiency in the next section.

Utilizing Property Management Software for Efficiency

Hey there, readers, let’s chat about making property management a breeze with the right tools. Using software like Innago and Appfolio can save you tons of time. These platforms handle tricky tasks, like tenant screening and tracking security deposits.

Plus, they send out rent reminders, so you don’t have to nag anyone. It’s like having a trusty sidekick for your real estate investment journey.

Stick with me on this. Many of these tools offer free trials and tiered pricing to fit your budget. Imagine cutting down on stress while managing rental income and expenses. With property management software, you stay on top of everything, almost like magic.

So, dive right in and see how these systems boost efficiency in your real estate game.

Tax Incentives and Benefits for Strategic Investments

Savvy investors, let’s chat about a sweet perk in real estate investment, tax incentives. These little gems can save you big bucks if you play your cards right. Think of them as a reward for smart moves, especially when you focus on energy-efficient properties.

Early adoption of green features often boosts property values, and, get this, it can snag you some nice tax breaks too. So, going eco-friendly isn’t just good for the planet; it pads your wallet as well.

Keep an eye on potential tax changes, though, since they can shake up your plans. Rising property prices don’t always mean bigger profits if tax burdens creep up. Stay sharp and chat with a pro to max out those benefits for your real estate investments.

Curious about another hot trend? Let’s jump into partnering with real estate crowdfunding platforms next.

Partnering with Real Estate Crowdfunding Platforms

Hey there, folks, let’s chat about a cool way to jump into real estate investment. Partnering with real estate crowdfunding platforms is like joining a team to buy a big pizza, where everyone chips in a little cash.

You don’t need a huge bank account to start. These platforms let everyday investors pool money for big projects, like shiny new buildings or data centers. It’s a smart path to grow your rental income without buying a whole property yourself.

Dig into this with me; it gets even better. Many crowdfunding setups work with investment firms and banks to lower risks, much like having a safety net. Plus, some even team up with insurance companies for solid risk management.

So, you can toss your hat into real estate opportunities, from digital infrastructure like cell towers to commercial real estate, and feel a bit safer. Stick around to see how this fits into emerging markets!

Diversifying Portfolios with International Properties

Moving from crowdfunding platforms, let’s explore a broader horizon with international properties. Adding global real estate to your mix can be a game-changer for portfolio diversification.

It’s like spreading your bets across different games, not just one table. By investing in residential, commercial, industrial, and mixed-use properties abroad, you dodge the risks of market volatility in a single country.

Think of it as planting seeds in various gardens. Secondary and tertiary markets, often overlooked, hold big growth potential for real estate opportunities. You could snag a deal on emerging markets, boosting your rental income while dodging high interest rates at home.

So, cast your net wider, and watch how international real estate trends spice up your investment game!

Smart Home Integration to Boost Property Value

Hey there, folks, let’s talk about a popular trend in real estate investment. Smart home tech is gaining traction, and it’s a guaranteed way to increase your property value in 2025.

Imagine owning a place where lights, thermostats, and even door locks operate with a simple voice command or app tap. This isn’t just impressive; it’s what buyers are looking for now, especially with the growing demand for eco-friendly properties equipped with innovative solutions.

Now, see this as a double benefit. By installing these devices, you’re not just simplifying life; you’re also investing in energy-efficient properties that cut down on bills. Plus, with AI and machine learning integrated, managing your residential properties becomes effortless.

It’s like having an assistant who anticipates problems before they arise. So, embrace this intelligent trend and watch your rental income soar!

Risk Management Strategies for Long-Term Profitability

Let’s chat about keeping your real estate investments safe for the long haul. Risk management in property deals isn’t just a fancy term, folks; it’s your safety net. Think of it as wearing a helmet while biking down a steep hill.

One smart move is focusing on climate resilience. Storms, floods, and other disasters can wipe out your profits if you’re not ready. So, pick properties in areas less prone to nature’s wrath.

Also, team up with banks and insurers to guard against commercial real estate risks. These partnerships can save you from big financial hits. Isn’t that a relief to know?

Now, ponder this angle for a sec. Investing in digital infrastructure, like data centers and cell towers, can be a game-changer. These assets often dodge the usual ups and downs of the real estate market.

They’re in high demand as our world gets more connected. Plus, working with Real Estate Investment Trusts, or REITs, adds another layer of protection. They spread out the risks by pooling money from many investors.

This way, if one property flops, your whole rental income doesn’t tank. Stick with these strategies, and watch how they shield your hard-earned cash.

Takeaways

Hey there, folks, we’ve just walked through some killer property investment ideas for 2025. Got a favorite yet? I bet you’re itching to jump into real estate trends like sustainable homes or emerging markets.

So, go ahead, pick a strategy, and make your money work harder than a busy bee. Stick with these tips, and watch your rental income grow!

FAQs on Most Profitable Property Investment Strategies

1. What’s the big deal with real estate investment in 2025?

Well, my friend, real estate trends are shifting fast, and the real estate market trends point to hot opportunities like energy-efficient properties and mixed-use developments. If you’re looking to grow your rental income, now’s the time to jump in with both feet. Keep an eye on emerging markets, too, as they’re ripe for picking.

2. How can I mix up my portfolio with property investments?

Diversification is the name of the game, folks. Try real estate diversification by tossing in some residential properties alongside commercial real estate, maybe even dabble in workforce housing or co-living spaces to spread the risk.

3. Are data centers a smart bet for 2025?

Oh, absolutely, with digital infrastructure booming, data centers and server farms are like gold mines waiting to be tapped. They’re tied to cloud services, and the demand ain’t slowing down anytime soon. Plus, predictive analytics and machine learning can help you spot the best spots to get invested.

4. What’s this buzz about climate resilience in property deals?

Hey, let’s chat about playing it smart with climate resilience. Properties built to withstand wild weather are becoming a top pick in real estate opportunities, especially as urban decentralization pushes folks to new areas. It’s like building a fortress while banking on long-term gains, even with property taxes or capital gains taxes in the mix.

5. Can hybrid work change how I invest in real estate?

You bet it can. Hybrid work is shaking up the need for shared workspaces and walkable retail space, so investing in mixed-use developments near these hubs could be a premium move for steady lease terms.

6. How do I get started with social impact investing in property?

Listen up, if you wanna make a difference while making a buck, social impact investing in affordable housing is your ticket. Look into private equity real estate or peer-to-peer lending to fund these projects, and use property management software to keep things smooth. It’s like hitting two birds with one stone, helping communities and padding your wallet.