Money mistakes can sneak up on anyone. Have you ever felt like your paycheck disappears faster than you can earn it? Or wondered why saving for the future feels so out of reach? You’re not alone—poor financial habits hold many people back from reaching their goals.

Here’s a fact: skipping key steps like budgeting, tracking expenses, or building an emergency fund can lead to mounting debt and long-term stress. These are just some of the most common financial mistakes to avoid if you want to protect your hard-earned money.

This guide will walk you through 20 frequent errors and offer simple strategies to fix them. Ready to take control of your finances? Keep reading!

Key Strategies to Avoid Financial Mistakes

Managing money wisely prevents financial stress and builds a secure future. Follow these strategies to avoid common errors and protect your finances.

- Create a clear budget and stick to it. Skipping this step often leads to overspending or missed bills. Use budgeting apps for easy tracking.

- Track all expenses, even small ones. Small purchases, like daily coffees, add up quickly over months or years.

- Build an emergency fund equal to three to six months of expenses. This provides a safety net during job loss or medical emergencies.

- Contribute consistently to retirement savings accounts like 401(k) or IRA plans. Compound interest works best with early and steady investments.

- Pay off high-interest credit card debt first using the debt avalanche method or snowball strategy. Avoid carrying balances as interest piles up fast.

- Refrain from making only minimum payments on credit cards, as it keeps debts growing longer than needed.

- Limit luxury spending and prioritize needs over wants to improve financial stability in tough times.

- Buy pre-owned cars instead of brand-new vehicles that lose value (depreciate) quickly after purchase.

- Start investing early and diversify your portfolio with stocks, bonds, or mutual funds based on risk tolerance.

- Get life insurance to protect loved ones if something unexpected happens, especially if you have dependents.

- Review health insurance coverage regularly to ensure proper protection against rising healthcare costs like medical expenses or prescriptions.

- Avoid lifestyle inflation by maintaining the same standard of living when income increases instead of overspending on luxuries.

- Cancel unnecessary subscriptions or memberships that drain money monthly without offering real value anymore.

Budgeting Errors to Watch Out For

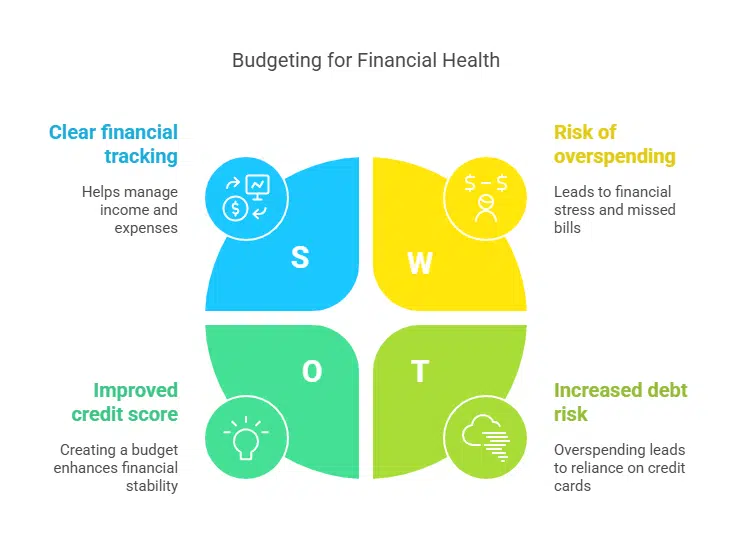

Creating a budget is only part of the process—sticking to it is where many fail. Small mistakes can lead to big financial stress, so staying alert matters.

Skipping Budget Creation

Skipping a budget often leads to financial stress. Without one, it’s easy to overspend or miss important bills. A clear financial plan helps track income and expenses. Budgeting apps can simplify this process by tracking spending in real time.

Failing to create a budget risks long-term damage to your credit score and savings. Overspending may force reliance on high-interest credit cards, increasing debt over time. Direct deposit allocation into separate accounts for savings or necessities ensures better control of funds.

Ignoring Expense Tracking

Failing to track expenses creates financial chaos. Small daily costs, like coffee or snacks, add up quickly without notice. This leads to unintentional overspending and missed savings opportunities.

Budgeting apps help monitor spending and spot problem areas. Ignoring this simple step fosters instability in your financial future.

Expenses can get out of hand when not recorded regularly. Over-reliance on credit cards worsens the issue by masking real financial strain. A clear log prevents surprises at month’s end and improves money management skills over time.

Saving and Emergency Fund Oversights

Building savings without a plan can leave you unprepared for surprise expenses. A strong emergency fund offers stability when life takes an unexpected turn.

Overlooking Emergency Savings

Ignoring emergency savings can jeopardize financial stability. Experts recommend setting aside three months’ worth of living expenses in an emergency fund. Yet, the U.S. personal savings rate was just 3.6% as of April 2024—far below suggested levels.

Without this safeguard, unexpected costs like medical bills or home repairs may require reliance on high-interest credit cards or personal loans.

Direct deposit into a separate savings account makes this process easier. Even small monthly contributions grow over time through consistency and compound interest. Skipping this step increases financial stress and affects long-term goals like retirement planning or efficiently paying off student loans.

Contributing Insufficiently to Retirement Funds

Failing to save enough for retirement puts future financial stability at risk. Experts suggest saving 15% of your income yearly in tax-advantaged accounts like a 401(k) or IRA. These accounts grow over time through compound interest, making early contributions more valuable than later ones.

Early withdrawals before age 59 come with a costly 10% penalty. This reduces the amount you’ll have when it’s most needed. Skipping proper retirement contributions today may leave you relying solely on Social Security, which often isn’t enough to cover basic living expenses post-retirement.

Common Debt Management Mistakes

Debt can feel overwhelming, especially without a clear plan. Small errors in how you handle debt may cost more than expected over time.

Using High-Interest Credit as Main Spending

High-interest credit cards can drain your money fast. With an average interest rate of 24.62% (as of June 2024), relying on them for everyday expenses adds up quickly. If you only pay the minimum each month, you fall deeper into debt while damaging your financial security.

Switch to cash or debit cards whenever possible. Pay off balances in full monthly to avoid steep credit card interest charges. Your wallet and credit score will thank you later!

Making Minimum Only Payments

Paying only the minimum on credit cards can lead to major problems. Interest rates pile up fast, making your total debt much larger over time. For example, a $5,000 balance with an 18% interest rate could take over 20 years to pay off if you stick to minimum payments—and cost thousands in added interest.

This habit also hurts financial stability. It keeps credit card debt high and raises your credit utilization ratio. A high ratio lowers your credit score, which impacts future loans or home-buying plans.

Focus on paying more than the minimum to reduce both debt and long-term stress.

Avoiding Poor Spending Decisions

Spending wisely can protect your financial future. Small, careless choices today might lead to big regrets later.

Excessive Spending on Luxuries

Buying unnecessary luxuries drains your financial security. Emotional decisions often lead to impulsive purchases, like the latest gadgets or designer items. These spendings add up fast and cut into savings or retirement funds.

Lifestyle inflation happens when higher income tempts you to overspend instead of saving.

For example, upgrading phones yearly costs thousands over time without adding much value. Redirecting that money into a retirement account or emergency fund builds long-term stability.

Always prioritize financial discipline and understand needs versus wants before spending on non-essential items.

Opting for New Cars Over Pre-owned

New cars lose value fast. In fact, they depreciate by 20-30% in their first year alone. Financing a new car means paying interest on this loss. This makes it an expensive choice compared to pre-owned vehicles.

Trade-ins also bring financial harm. Constantly upgrading to newer models reduces equity and increases debt. Pre-owned cars often offer better value without the steep depreciation or high monthly costs tied to financing new ones.

Investment Strategy Missteps

Starting investments too late or without a plan can harm your future financial security. A solid strategy helps you grow wealth and reduce risks over time.

Delaying Investment Start

Delaying investments wastes valuable time to grow your money. Starting early boosts gains with compound interest. For example, investing $200 a month at age 25 could grow to over $500,000 by age 65, assuming a 7% annual return.

Waiting until age 35 reduces that total to about $240,000—less than half.

Early investments make long-term financial goals easier to reach. Procrastination forces higher monthly contributions later in life just to catch up. Use retirement accounts like IRAs or employer-sponsored plans now for tax benefits and steady growth toward financial security.

Overlooking Investment Diversification

Failing to diversify investments can lead to big losses. Relying on a single stock or sector increases risk. A balanced portfolio with stocks, bonds, and short-term investments spreads this risk.

Diversification ensures that if one investment fails, others can offset the loss.

Proper asset allocation balances returns and protects against market declines. For example, younger investors might take more risks in stocks, while older ones may prefer stable bonds.

Ignoring diversification means missing out on growth while risking financial stability.

Insurance and Financial Safeguards Neglected

Skipping insurance can leave your money and future at risk. Protecting yourself with the right coverage helps avoid serious financial losses.

Not Securing Life Insurance

Failing to secure life insurance leaves loved ones vulnerable. Without it, dependents may face financial stress from unpaid home loans, debts, or daily expenses. A proper policy ensures that your family has funds for essential needs if you pass away unexpectedly.

Many underestimate how much coverage they need. This mistake can cause insufficient payouts that don’t cover costs like college tuition or medical bills. Choosing the right amount of life insurance through a trusted insurance company protects your family’s financial future.

Misjudging Health Insurance Requirements

Choosing the wrong health insurance can lead to high out-of-pocket costs. About 48% of insured people still struggle with affordability issues, showing how important proper coverage is.

A plan might seem cheaper upfront but could lack key benefits like low co-pays or access to specialists.

Ignoring deductibles and network limits adds financial stress during emergencies. Some skip necessary treatments because their plan doesn’t cover enough, risking both health and expenses.

Assess your needs carefully—include doctor visits, prescriptions, or potential surgeries—to avoid gaps in care.

Effects of Lifestyle Cost Creep

Lifestyle cost creep sneaks up when your earnings grow, but so do your expenses. Spending more without a plan can strain your financial stability over time.

Expanding Expenses Beyond Income

Spending more than you earn creates financial stress and instability. This often happens with lifestyle creep—gradually upgrading habits like dining out or buying high-end gadgets as income grows.

Savings and investments decrease while reliance on credit cards increases, leading to high-interest debt.

Small decisions add up quickly. For example, adding multiple streaming subscriptions might seem affordable but can total $100+ monthly. Paired with increased housing or car payments, this leaves little room for saving toward long-term financial goals like retirement accounts or an emergency fund.

Committing to Excessive Subscriptions and Payments

Unused subscriptions drain your wallet. Monthly charges for streaming services, gym memberships, or apps can add up fast. For example, spending $10 on five unused subscriptions means wasting $600 a year.

These small costs eat into your financial security over time.

Review all recurring payments regularly. Cancel what you don’t use or need. Many budgeting apps help track these expenses and alert you to unnecessary charges. Staying proactive keeps lifestyle cost creep in check and protects your hard-earned money.

Takeaways

Money mistakes can damage your future. Learning to spot and fix them builds financial security. Financial educator Jane Morales agrees.

Jane has over 20 years of experience in personal finance management. She holds an MBA in finance and authored “Smart Money Choices.” Her work focuses on improving money habits for long-term success.

Jane praises this guide’s practical tips. “It simplifies complex decisions,” she says, “and helps avoid costly errors.” Key strategies like budgeting tools or starting retirement accounts early build wealth steadily.

She stresses the importance of clear advice for safety and transparency. Reliable plans follow credit laws and promote ethical practices such as honest loan terms and secure saving methods.

To apply these steps daily, Jane suggests setting reminders for savings goals or automating bill payments through apps like Mint or YNAB. Small actions help maintain good habits over time.

As great as this advice is, some may find it basic if they’re already financially savvy. But its strength lies in being user-friendly—ideal for beginners working toward stability.

Jane recommends using trusted resources alongside this guide to enhance learning further: “Pairing it with credible sources makes a strong foundation.”

This approach leads you toward consistent improvement while avoiding big pitfalls that harm your wallet!