Buying your first home is an exciting milestone — but navigating the mortgage process can feel overwhelming. From understanding credit requirements to saving for a down payment, there are countless details that can make or break your loan approval. The good news? A few smart strategies can significantly improve your chances of getting approved and even save you thousands over time.

In this guide, we’ll walk you through 13 essential mortgage tips for first-time homebuyers to help you secure the best deal, boost your approval odds, and confidently step into your dream home.

Check and Improve Your Credit Score

Pull your free credit report online, run your FICO score through a simulator tool, then slash revolving debt and pay bills on time to boost your rating—read on for more tips!

How can I check my credit score for free?

Sites like AnnualCreditReport.com let you get one free credit report a year from Experian, TransUnion, and Equifax. You can also view a free FICO score on many bank or credit card websites.

Scan your credit report for wrong balances, late payments, or unfamiliar accounts. File a dispute with each consumer reporting agency to correct mistakes. Sign up for credit monitoring to track your credit score and spot any new activity.

What steps improve my credit score quickly?

Pay off credit cards in full each month to cut down balances fast. Low balances help your credit score and shrink your credit utilization ratio. Set up automatic bill payments to keep your payment history spotless.

Dispute any errors on your credit report to fix mistakes quickly. Ask to become an authorized user on a responsible person’s account for a fast boost. Try a credit-builder loan to add positive entries to your credit history.

Save for a Down Payment and Closing Costs

Use a budget calculator and a mobile app to stash cash for your down payment and closing costs—keep reading for more tips.

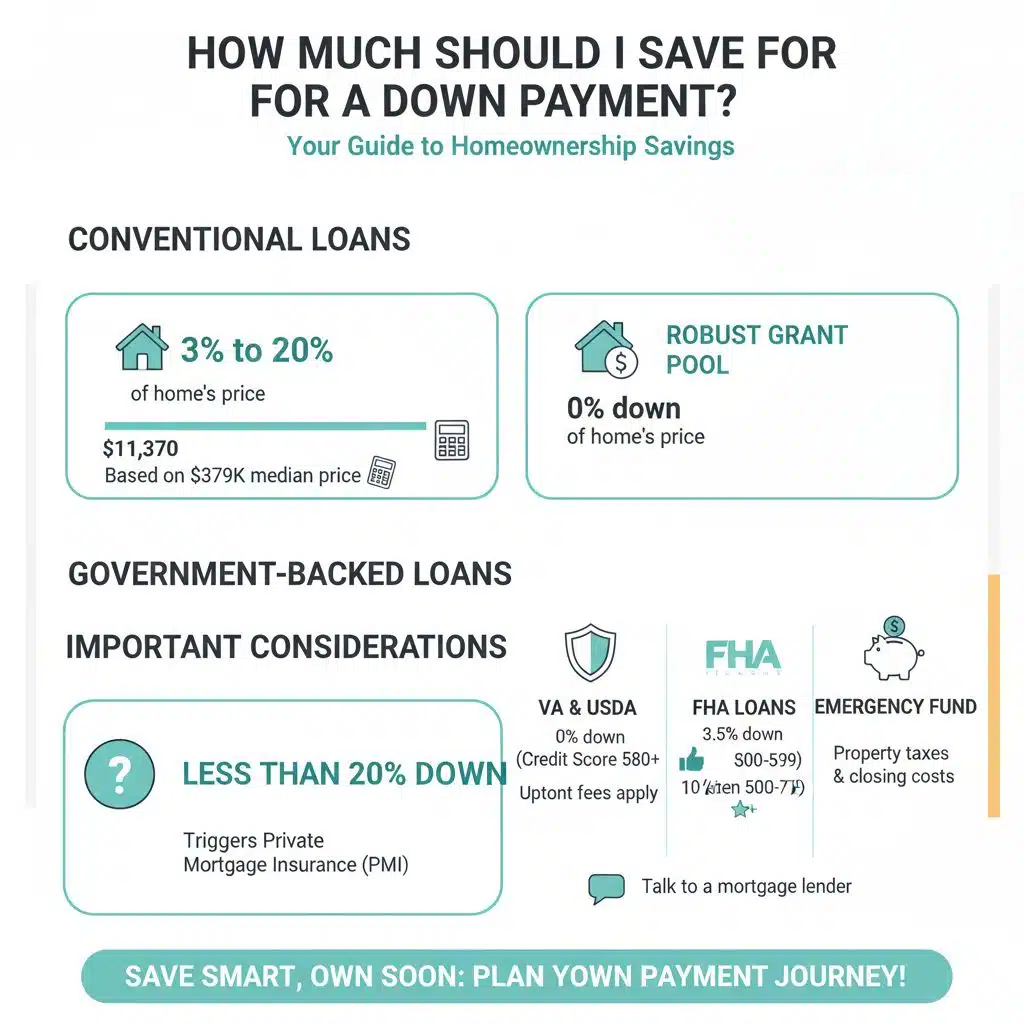

How much should I save for a down payment?

Lenders usually ask buyers to save 3% to 20% of a home’s price for a conventional loan. At a $379,000 median price, that means $11,370 to $75,800. A mortgage calculator can show how each percentage affects monthly payments.

Setting aside an emergency fund helps you cover property taxes and closing costs.

Some VA and USDA loans let you close with zero down, but you may pay upfront funding or guarantee fees instead. FHA loans ask for 3.5% down if your credit score hits 580 or more, or 10% down with a score between 500 and 579.

Putting less than 20% down on a conventional loan triggers private mortgage insurance. Talk to a mortgage lender to compare rates and fees before you make any offers.

What are typical closing costs for first-time buyers?

Closing costs run about 3% to 6% of your home loan. On a $300,000 purchase, you might pay $9,000 to $18,000. You face loan start fees, valuation reports, ownership coverage, legal fees, home checks, and escrow account charges.

Fannie Mae HomePath can offer credits toward these fees. You can ask the seller to cover part of your costs with concessions. Talk with your mortgage lender or real estate agent to spot these saving options.

Determine How Much You Can Afford

Use a mortgage estimator, your credit file and statements of account to spot a price point your wallet can handle—read on so you can secure your ideal loan.

How do I calculate my mortgage affordability?

Start by adding your gross monthly income figures. Multiply that sum by 0.28 to set your maximum housing payment. List every monthly debt to keep your debt-to-income ratio below 36 percent.

Include property taxes and home insurance in your calculations. Feed these numbers into an online home affordability calculator or mortgage calculator tool.

Set aside cash for repairs, maintenance, and utility bills. Adjust your down payment to view how different amounts change principal and interest costs. Visit Fannie Mae’s MyHome calculator or your preferred lender’s web portal for side-by-side comparisons.

Check varied interest rate scenarios to see their effect on your total monthly payment. Stay realistic about closing costs, private mortgage insurance fees, and potential loan application charges.

Research First-Time Homebuyer Programs

Visit HUD’s site to review FHA Section 203(b) purchase loans and Section 203(k) rehab loans. Then weigh Veterans Affairs mortgages against USDA Rural Development loans as you read on.

What first-time homebuyer programs are available?

Fannie Mae HomePath gives a 3% closing cost credit to buyers of foreclosed homes. HUD (Department of Housing and Urban Development) Good Neighbor Next Door sells homes at large discounts to teachers, firefighters, and police officers.

The Mortgage Credit Certificate lets buyers claim a tax credit on a share of mortgage interest. Many state and local programs offer grants and down payment help. Some nonprofit groups run homebuyer classes and grant aid for closing costs.

FHA (Federal Housing Administration) loans let buyers put down as little as 3.5% of the home price. VA (Veterans Affairs) loans let veterans skip a down payment and avoid private mortgage insurance.

Ask mortgage lenders for a preapproval letter and an annual percentage rate quote. Compare conventional, fixed-rate, and adjustable-rate mortgage options. Select the housing finance option that fits your budget.

How do I qualify for these programs?

You clear hurdles like finishing a homebuyer education class, handing over proof of income, and boosting your credit score. You stack documents: credit report, W-2s, bank statements, and tax returns.

You meet income limits or prove first-time buyer status. Some schemes only serve teachers or first responders. VA loans need extra veteran papers, FHA loans allow lower scores.

Lenders scan your debt-to-income ratio next. They often ask for a minimum 620 score for FHA and 640 for conventional loans. You send preapproval requests to your mortgage broker, then you get a preapproval letter.

You inch closer to a closing disclosure with every form signed.

Compare Mortgage Lenders

Treat each lender like a shop, compare loan rate, mortgage insurance, points, and fees on the closing disclosure. Use your credit report and preapproval letter to spot low percentages and avoid surprise charges.

What should I look for when comparing mortgage lenders?

Pick lenders with low interest rates, and compare origination fees side by side. Ask for closing costs and sample closing disclosures up front. Weigh discount points against long term savings.

Note lender-specific requirements for private mortgage insurance. Check customer service ratings, local experience and branch accessibility.

Talk about the preapproval process, and ask for required documentation like credit reports, W-2s, tax returns and bank statements. Find out typical turnaround times. Ask if they offer FHA loans, VA loans or first-time homebuyer assistance programs.

Use an existing bank relationship to negotiate better terms. Request a preapproval letter before house hunting. Get details on home appraisal fees, title insurance and early repayment penalties.

How do interest rates and fees vary among lenders?

Lenders set interest rates based on loan type and borrower profile. A fixed-rate home loan may carry a 4.5% rate. A floating-rate home loan can start as low as 3.8%, but rates can rise later.

High credit scores can cut rates by half a point. Government-backed home loans sometimes include lower initial rates, but they require loan insurance.

Financial institutions often charge $1,000 to $3,000 in origination or processing fees. Online platforms and mortgage calculator tools may list lower fee amounts. Total closing costs can differ by $2,000 to $5,000 across lenders.

Shopping multiple quotes helps you spot savings. Comparing mortgage loan offers can save you thousands.

Get Preapproved for a Mortgage

Gather your credit history, W-2 forms and account records fast. Lenders use these docs, plus your debt-to-income ratio, to issue a preapproval notice, so you know your government-backed or standard mortgage budget.

What is mortgage preapproval and why is it important?

Mortgage preapproval is a formal check by a lender. Lenders look at your credit report, pay stubs, W-2s, bank statements, tax returns, and assets. It sets a clear loan amount, so you can focus your house hunt.

You gain credibility and more power to negotiate with sellers.

You get a preapproval letter to show sellers. Hot markets make buyers with that letter stand out. You may skip holds, strike deals fast, and beat competing offers. The process can help you dodge a last minute denial or closing delay.

How do I get preapproved for a mortgage?

Gather tax returns, bank statements, W-2s, pay stubs, and proof of employment verification, then send them to your chosen lender along with a credit report. Complete the formal application and let the lender review your debts, income ratio, and credit history.

The lender issues a preapproval letter, showing your homebuying budget and estimated interest rate.

Make no big purchases or open new lines of credit while you wait. A sudden debt can raise your interest rate or void your approval. Flash that preapproval letter like a VIP pass, and sellers will see you as a serious buyer.

Understand Loan Options and Interest Rates

Choosing a loan can feel tough, but you can pick a plan with a steady interest rate or one that shifts over time, and you can explore FHA or VA options. Review your credit report, check for private mortgage insurance fees, then show your lender a preapproval letter to lock in your best rate.

What are common mortgage loan types for first-time buyers?

Conventional loans come from private lenders. Buyers need at least a 620 credit score. They can put down just 3 percent. FHA loans come via the Federal Housing Administration. This choice needs private mortgage insurance, or PMI.

Down payments range from 3.5 to 10 percent.

Applicants scoring 500 or more qualify. USDA loans serve low income families in rural zones. Borrowers skip any deposit. Rates can dip to one percent. VA loans target veterans and active duty troops.

These plans need no money down. Lenders use loose credit and debt standards. Home shoppers use a mortgage calculator tool.

How do fixed and variable interest rates differ?

Many first-time homebuyers choose a fixed-rate mortgage to lock in one interest rate for 30 or 15 years. A 30-year loan yields lower monthly bills but costs more in total interest over time.

A 15-year option forces higher monthly payments but cuts total interest paid. Loans like these give stable bills and clear forecasts.

Some buyers opt for variable-rate mortgage loans. These loans tie your interest rate to market moves. Start rates sit low for 5 or 7 years. Lenders can hike rates, pushing your payments up.

Shifting costs can test your budget over time.

Avoid Making Major Financial Changes Before Approval

Tweaking your credit report or shifting cash in your checking ledger can spook a lender at the last minute. Lenders want steady paychecks and neat 1040 forms, so wait on new loans or credit lines until you hold that preapproval letter.

What financial actions can hurt my mortgage approval?

New loan applications and big purchases can sink your approval. Lenders recheck your credit record before closing, so opening a new card or applying for a car loan can shove your utilization over 30 percent and send alerts to underwriters.

A personal loan or any fresh debt may trigger a default flag or bump up your debt-to-income ratio. Do not close old cards either, since that move can drop your credit score just before you submit your preapproval notice.

Stable pay stubs and deposit records help lenders see a reliable income. Sudden job changes or gaps can scare underwriters more than a haunted house at Halloween. Keep paying each bill on time, keep debt below one-third of available credit, and resist the urge to buy new furniture with store credit.

This steady path shows strong finances and boosts your odds of mortgage approval.

Work with a Knowledgeable Real Estate Agent

Your real estate agent holds the key to top property listings, and they read the closing statement in a blink. They guide you through property appraisal steps while they compare interest rates with a loan calculator.

How do I find a reliable real estate agent?

Start by asking friends, family or your lender for referrals. They can name realtors they trust. Then ask each agent about their years of experience and familiarity with your target area.

You also want a licensed pro in good standing with the local real estate board. Check online reviews and testimonials for client satisfaction.

Use the multiple listing service to check each agent’s listing count. Compare real estate agents on home search sites and property listing platforms. Note how many homes they sold last year.

Inquire about negotiation tactics and how they keep clients in the loop. Pick an expert who has smooth communication skills and a solid track record.

Research the Neighborhoods You’re Interested In

Check local safety stats, size up land levies, peek at bus ride lengths on Google Maps, scout parks and bistros, run a value check with a property checker, then keep reading for insider tips.

What factors should I consider when researching neighborhoods?

Local school ratings help measure quality. Many score above 8 out of 10 on GreatSchools. A low crime rate feels like a welcome mat, most areas show fewer than 20 incidents per 1,000 residents.

Google Maps lets you time your commute, distance to work stays under 30 minutes on I-95. Public transit stops within a half mile ease rush hour stress.

Rising property values signal real estate market stability, home prices rose 5 percent last year in some towns. A plan for a new shopping center in 2025 promises more amenities; parks and healthcare centers sit within two miles of most listings.

Long bike trails, playgrounds and retail shops make weekends fun, lower property taxes can ease your budget. Highways, bus lines or train routes boost accessibility, cutting drive times by ten minutes.

Expect clear title reports, and factor in average property taxes of one percent of home value when you calculate closing costs.

Get a Professional Home Inspection

Hire a certified home inspector, so you spot hidden leaks and creaky floors. They use an appraisal report and a walk-through list, to reveal issues before closing.

Why is a home inspection necessary?

Buyers face hidden risks in a home. A home inspection reveals hidden defects and safety hazards. A trained home inspector uses tools like a humidity gauge and an infrared camera. The inspection report lists structural flaws and electrical hazards.

It creates peace of mind before you sign a mortgage contract.

Findings let you negotiate credits, repairs, or a lower price. You can add an inspection contingency to your agreement, protecting your deposit if major problems emerge. A failed inspection gives you a valid reason to walk away without losing your earnest money.

This step saves money and stress down the line.

What does a home inspection cover?

A home inspection checks all major systems and structures. Home inspectors act like health pros for the house, scanning each room. Roof checks include shingles, flashing, and gutter stability.

Foundation scans spot cracks or slab shifts. HVAC tests run the furnace, air conditioner, and ductwork. Plumbing trials open taps, inspect pipes, and watch for drips. Electrical checks flip breakers, test outlets, and verify wiring.

Mold sweeps and pest probes uncover hidden damage. Infrared cameras and moisture meters reveal sneaky leaks. Appliance trials run the stove, fridge, dishwasher, and dryer. Inspectors note general upkeep, watching for wear on floors and walls.

Prepare for Closing Costs and Other Fees

Check the final statement for costs such as the deed check, home appraisal, and lender fees. Reserve cash for your down payment, trust account deposit, and recording fees to avoid a rush.

What closing costs should I expect?

Origination and lender fees run about 0.5 to 1 percent of your loan amount. You should set aside $300 to $700 each for appraisal and home inspection costs. Title insurance and attorney fees vary by state and lender.

You must prepay property taxes and homeowners insurance at closing. Recording fees and escrow account setup add more closing costs. Your closing disclosure will list mortgage rates, private mortgage insurance, and other charges line by line.

How can I budget for additional homebuying fees?

Open a high-yield savings account for closing costs and early repairs. Set up automatic deposits of $200 a month. Ask your real estate agent about seller concessions. Add room for utility deposits, moving expenses, and small repairs.

Use the Closing Disclosure to list each expected fee. List items like appraisal, title search, and property tax. Enter figures in a budget spreadsheet or finance app. Adjust your plan when charges change.

Invest in Homeowners Insurance

Buy a homeowners insurance plan that guards your walls and stuff, so you dodge big repair bills and liability claims. Shop quotes, study your closing disclosure, and top off your emergency fund before you sign.

Why do I need homeowners insurance?

Mortgage companies list homeowners insurance on your closing disclosure for FHA loans, VA loans, or conventional loans. The policy covers fire, theft, storm damage, and liability claims.

It keeps your lender’s collateral, the house, safe. It also offers you financial protection against disasters.

Skipping that coverage can leave you on the hook for huge bills. It puts your investment and mortgage at risk. Proof of a valid home insurance policy must arrive before closing. Add that cost to your closing costs and plan with your emergency fund.

How do I choose the right insurance policy?

Compare coverage limits, deductibles, and premium costs from multiple providers. Pick a plan that meets your budget and risk level. Add flood or earthquake coverage if your house sits in a high-risk zone.

Bundle homeowners insurance with auto policies, and save on your annual bill.

Check policy exclusions and limits to avoid surprise gaps. Ask about an umbrella policy for extra liability protection. Review deductibles and adjust them to balance cost and out-of-pocket needs.

Keep Copies of All Mortgage Documentation

Store your credit files, tax filings, income slips and account records in one secure folder. Scan your approval letter and closing summary, then sort them by date for fast access to rates, fees and insurance details without breaking a sweat.

What mortgage documents should I keep and organize?

Put your mortgage agreement, loan note, closing disclosure form, and settlement statement in a fireproof folder. Keep the deed and title insurance policy alongside these papers. Add your preapproval letter, private mortgage insurance papers, and property tax records too.

Label each document by date to skip future mix ups.

Track inspection reports, appraisal reports, and the homeowners insurance policy next. File escrow documents and all correspondence with your lender. Store proof of payments, bank statements, W-2s, tax returns, and your credit report.

Use a binder or cloud folder to hold every item safely.

Takeaways

These 13 tips guide first-time homebuyers through credit report review, down payment savings, lender research, and loan type choices. You can cut stress by tracking bank statements, W-2s, tax returns, and a preapproval letter.

A friendly real estate agent can show homes, set up a home inspection, and explain closing disclosure details. Save an emergency fund, buy homeowner insurance, and learn about property taxes before you sign.

Enjoy house hunting, armed with a strong credit score and clear budget, like a pro.

FAQs on Mortgage Tips for First-Time Homebuyers

1. What down payment do first-time homebuyers need?

Lenders often want at least 3% of the house price, and a bigger downpayment can lower your interest rate. If you put down less than 20%, you may pay private mortgage insurance, or PMI. Keep an emergency fund for home maintenance, closing costs, and property taxes.

2. What credit score do I need and what proof of income is required for a preapproval letter?

Aim for a credit score over 620, lenders will pull your credit report. You need stable income to earn a preapproval letter. Show earnings forms, income documents, and account records.

3. Should I pick a fixed-rate mortgage or adjustable-rate mortgage?

A fixed-rate mortgage locks in your interest rate, you pay the same each month. An adjustable-rate mortgage can start low, but rates rise later. You can refinance as a safety net. Compare federal housing administration loans, veteran loans, and conventional loans to see what fits.

4. Do I need a home inspection or a home appraisal before closing?

A home inspection finds hidden problems, it’s like a health check for your property. A home appraisal tells you the true market value. Both can save you money on closing costs. They help you set a fair house price.

5. What are closing costs and how does a closing disclosure help?

Closing costs cover fees for title work, homeowner insurance, and property taxes. Your closing disclosure gives a line by line list of these fees. You get it three days before you sign, so you avoid last minute surprises.

6. How can a real estate agent guide me in the homebuying process?

A real estate agent knows house hunting like the back of their hand, they steer you clear of lemon properties and point out great livability. They can link you to renovation loans or a line of credit for updates. They also help you find homeowner insurance, and point you to resources from the U.S. Department of Housing and Urban Development.