According to projections from Juniper Research, global mobile point-of-sale (mPOS) transactions are set to grow from $2.7 trillion in 2025 to an estimated $4.9 trillion by 2030. This significant increase underscores the rapid transformation occurring in the retail, payment, and technology landscapes across both developed and emerging economies.

The rise of mPOS is being fueled by a shift away from fixed point-of-sale (POS) systems traditionally found at checkout counters in physical stores, toward more flexible, mobile-driven solutions. As retailers adapt to new customer expectations and payment behaviors, mPOS is emerging as a preferred tool for digital transaction management in diverse sectors such as retail, hospitality, transportation, and microenterprise.

Understanding mPOS and Its Global Appeal

Mobile point-of-sale (mPOS) refers to a handheld or portable payment solution—typically a smartphone or tablet paired with a card reader or software platform—that allows merchants to process credit or debit card payments on the go. Unlike fixed POS terminals that are stationary and often require significant infrastructure, mPOS devices offer mobility, cost-efficiency, and ease of deployment.

This form of payment processing has gained popularity due to its ability to support a wide range of business models, including pop-up shops, food trucks, street vendors, independent contractors, and even small retailers. The portability of mPOS makes it ideal for environments where traditional setups may be too costly or impractical.

Why the Shift from Fixed POS to mPOS Is Accelerating

The global shift from fixed POS terminals to mPOS systems is being driven by multiple market forces. Retail environments are evolving rapidly, with businesses placing greater emphasis on customer convenience, fast service, and omnichannel integration. Traditional checkout counters are no longer the only place where transactions occur—customers now expect service anywhere within a store or even outside it.

Retailers are adopting mPOS to support line-busting during peak hours, enable sales from anywhere on the shop floor, and facilitate real-time product lookups or digital receipts. The flexibility of mobile systems allows staff to better engage with customers while streamlining operations. Additionally, lower upfront hardware costs and cloud-based software models make mPOS a viable option for businesses of all sizes.

Comparing mPOS and Soft POS: Why Dedicated Hardware Still Matters

While both mPOS and Soft POS are gaining ground in the digital payments space, Juniper Research emphasizes the continued strength of mPOS due to its hardware advantages.

Soft POS refers to payment systems where a standard smartphone or tablet—without any additional card reader—is used as the terminal for accepting contactless payments. The key benefit of Soft POS is its minimal cost and frictionless deployment, making it attractive for individual entrepreneurs and very small businesses, especially in urban settings with digital infrastructure.

However, mPOS remains more resilient in structured retail and hospitality environments where consistent performance, battery life, security, and durability are essential. Industries like full-service restaurants, department stores, and travel providers still require specialized hardware that integrates smoothly with other systems such as printers, inventory software, and loyalty platforms.

Where Soft POS excels in low-volume, flexible transactions, mPOS leads in high-frequency settings that require dependable hardware, support, and integrations.

Emerging Markets Are Becoming the Epicenter of mPOS Expansion

One of the most significant takeaways from the forecast is the role of emerging markets—especially in Africa—in driving future mPOS growth. In regions where banking penetration has historically been low and cash is still the dominant payment method, mPOS offers a gateway to modern financial services and formal commerce.

Africa is experiencing a mobile-first financial revolution, with many consumers and small businesses skipping over traditional banking systems entirely and jumping straight into mobile wallets and digital payments. The affordability of mobile phones and increasing access to 4G and 5G networks are creating an environment ripe for widespread mPOS adoption.

For small business owners, mPOS provides a first opportunity to accept card and mobile payments, expanding their customer base and increasing revenue potential. Governments and fintech startups across the continent are also investing heavily in financial inclusion, deploying mPOS terminals in both urban markets and rural communities where physical bank branches are absent.

Card Acceptance and Digital Payments Are Expanding Rapidly

In addition to technology advancements, rising card acceptance infrastructure is another crucial factor propelling mPOS adoption. Payment networks, banks, and fintech companies are working together to increase the availability of card processing capabilities in previously underserved areas.

As more merchants adopt card readers and consumers gain access to debit and credit cards, mPOS becomes an increasingly valuable tool for bridging the gap between cash-based economies and digital commerce. Financial regulators in emerging economies are also supporting this growth by encouraging interoperability, reducing transaction fees, and fostering open banking initiatives.

This trend is particularly visible in regions like Sub-Saharan Africa, South Asia, and Latin America, where millions of small vendors are beginning to digitize their operations with help from low-cost mPOS solutions.

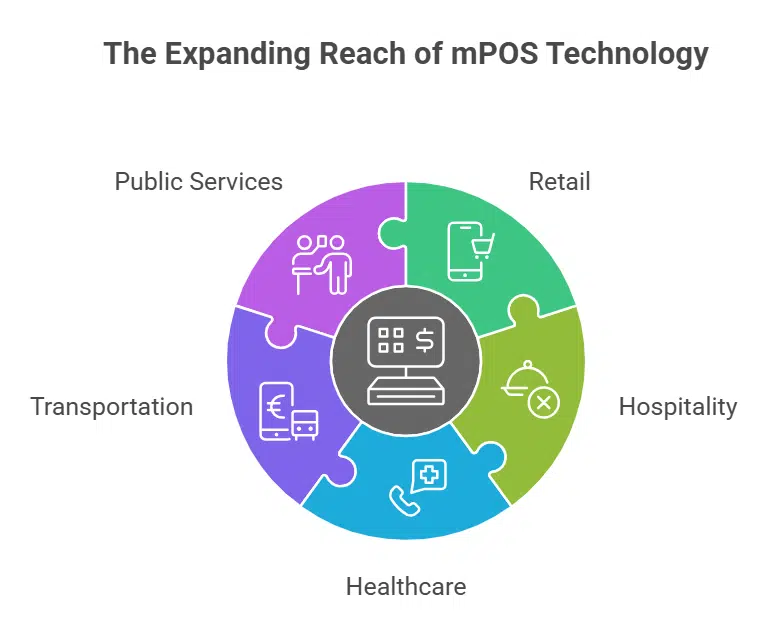

mPOS Adoption Is Rising Across Industries

Beyond emerging markets, mPOS technology is seeing broader adoption across a variety of industries and sectors. In retail, businesses use mPOS for in-aisle transactions, pop-up events, and curbside checkouts. In hospitality, restaurants, cafes, and hotels utilize mPOS for tableside ordering, contactless payments, and room service billing.

Healthcare providers are also using mPOS to facilitate patient payments at the point of care, while transportation companies—such as taxis and delivery services—employ mobile systems to collect fares on the move.

Even public services and local governments are adopting mPOS to streamline tax collections, licensing, and ticket sales. The pandemic further accelerated this trend by prompting many institutions to reduce physical contact and adopt digital tools for hygiene and convenience.

Global Economic Factors Supporting mPOS Growth

Increased demand for contactless payment options, the rapid digital transformation of the financial sector, and rising e-commerce integration are all contributing to the growth of the mPOS market. Economic recovery in post-pandemic environments has created an appetite for cost-effective and scalable payment systems, particularly among SMEs that were hit hardest during global lockdowns.

Governments, too, are incentivizing digital adoption by offering subsidies, technical support, or regulatory frameworks that encourage businesses to digitize. As economies modernize and cash usage declines, mobile-based payment infrastructure becomes foundational to long-term financial stability and consumer inclusion.

Looking Ahead: A $4.9 Trillion mPOS Economy by 2030

With the mobile point-of-sale transaction market expected to nearly double from $2.7 trillion in 2025 to $4.9 trillion in 2030, the next five years will be critical in shaping how businesses worldwide accept and process payments.

The strongest areas of opportunity lie in:

-

Financial inclusion efforts across Africa and South Asia

-

Retail transformation and omnichannel strategies in mature markets

-

Soft infrastructure development, including telecom and broadband connectivity

-

Integration of mPOS with broader fintech services, such as BNPL (Buy Now, Pay Later), QR-based payments, and mobile wallets

Mobile POS is no longer a fringe technology—it is becoming a core component of how the world conducts business. Its ability to combine affordability, scalability, and technological integration positions it at the forefront of the next generation of payment solutions.