Smartphones have become an indispensable part of our daily lives, serving as our primary means of communication, work, entertainment, and banking.

With the rising cost of smartphones, protecting them from accidental damage, theft, and hardware failures has never been more important. This is where mobile insurance plans in India come into play, providing financial security against unforeseen mishaps.

If you’re wondering whether a mobile insurance plan is worth investing in, consider this: Repairing a high-end smartphone screen can cost anywhere from ₹5,000 to ₹25,000, and in case of theft, replacing the device can burn a hole in your pocket.

Having a mobile insurance plan ensures that you can repair or replace your phone without bearing the full financial burden. Additionally, with more consumers relying on online banking and digital transactions, losing a phone can lead to financial and data security risks, making insurance a must-have in 2025.

Why is mobile insurance essential in 2025?

In 2025, mobile devices will become more than just communication tools—they are essential for work, entertainment, banking, and daily life. With increasing smartphone prices, advanced features, and rising security threats, protecting your device is more important than ever.

Mobile insurance plans in India offer peace of mind by covering accidental damage, theft, and technical malfunctions, ensuring you’re not left with costly repairs or replacements. But why exactly is mobile insurance essential in 2025? Let’s explore the key reasons.

Rising Smartphone Costs

With flagship models like iPhones and Samsung Galaxy devices now costing over ₹1 lakh, repairing or replacing them without insurance can be financially burdensome. High-end smartphones come with sophisticated hardware, making even minor repairs expensive.

Increasing Cases of Accidental Damage and Theft

Reports suggest that smartphone thefts in India have increased, especially in metropolitan areas. Moreover, accidental drops, water damage, and hardware malfunctions are common issues. A recent survey indicated that over 35% of smartphone users have faced accidental damage at least once in their phone’s lifespan.

High Repair Costs

Authorized repair centers charge a hefty amount for replacing damaged screens, motherboards, and other critical components. Third-party repair centers may be cheaper but often void the warranty and use low-quality parts.

Extended Warranty and Added Protection

Most manufacturer warranties cover only hardware defects, leaving users vulnerable to accidental damage or liquid spills. A mobile insurance plan fills this gap effectively. Some plans also offer cashless repairs, meaning you won’t have to pay out of pocket.

How to Choose the Best Mobile Insurance Plans in India?

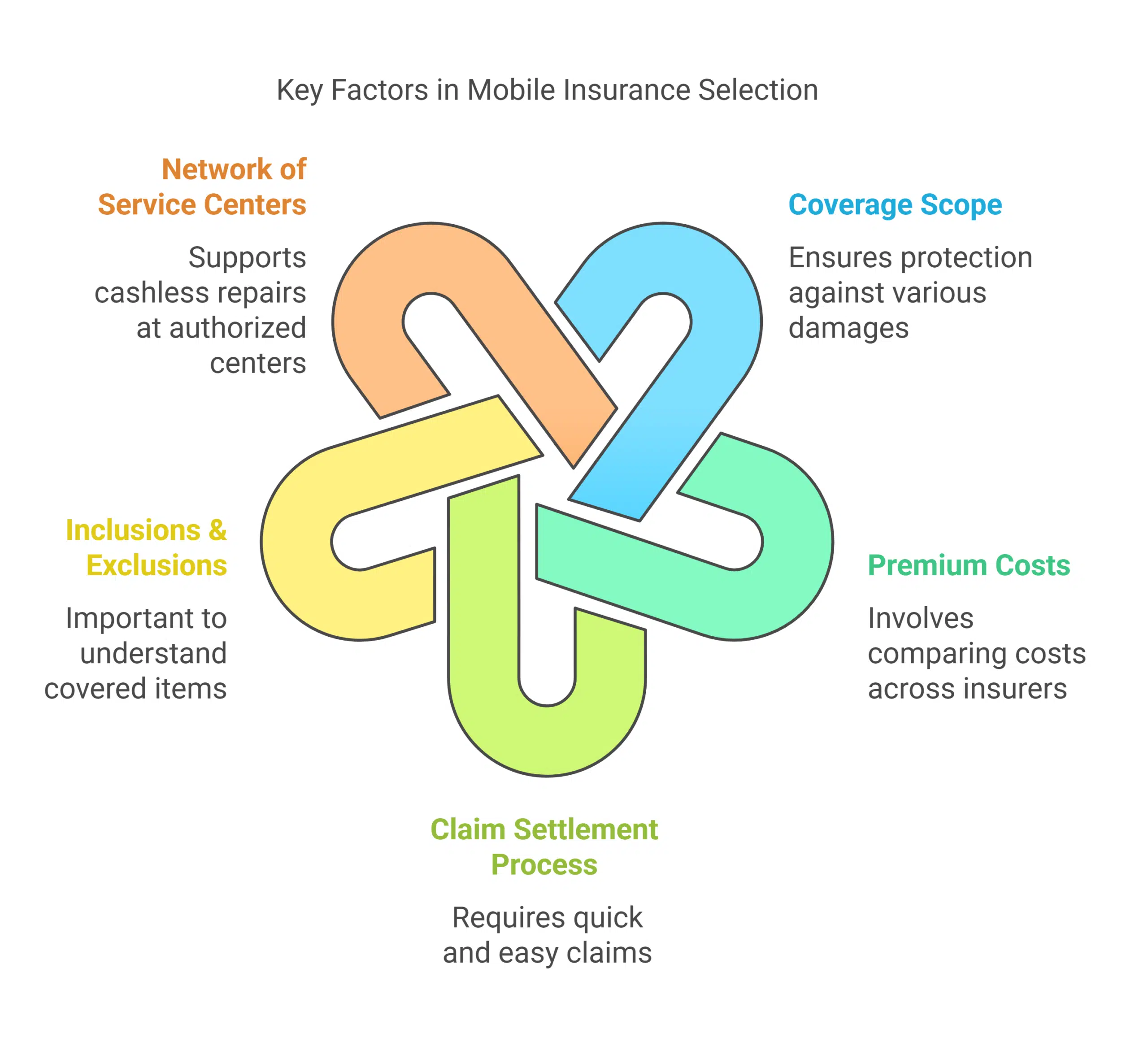

Selecting the right mobile insurance plan in India requires careful evaluation. Here are key factors to consider:

- Coverage Scope: Ensure the plan covers accidental damage, theft, and liquid damage.

- Premium Costs: Compare different insurers based on the cost of premiums.

- Claim Settlement Process: A quick and hassle-free claim process is crucial.

- Inclusions & Exclusions: Read the fine print to know what’s covered.

- Network of Service Centers: Opt for plans that support cashless repair at authorized service centers.

Top 5 Mobile Insurance Plans in India for 2025

Choosing the right mobile insurance plan can be overwhelming, given the numerous options available in the market. Whether you are looking for extensive coverage, budget-friendly options, or theft protection, understanding the best mobile insurance plans in India is essential. In this section, we review the top 5 insurance plans that offer maximum value for smartphone users in 2025.

1. Digit Mobile Insurance Plan: Best for Comprehensive Coverage

Digit is one of the most popular mobile insurance providers in India, known for its wide coverage and quick claim settlement. Their plan covers not just screen damage but also accidental and liquid damage, making it an excellent option for smartphone users looking for all-around protection. The claim process is hassle-free, allowing users to conduct self-inspections via their app, ensuring faster settlements.

Key Features:

| Feature | Details |

| Coverage | Accidental damage, liquid damage, screen damage |

| Premium Cost | Starting from ₹209 |

| Claim Process | Quick online claim settlement with self-inspection via app |

| Pros | Affordable, covers new and old devices, worldwide protection |

| Cons | Doesn’t cover theft or burglary |

2. Bajaj Finserv Mobile Screen Insurance—Best Budget-Friendly Plan

If you’re looking for an affordable insurance plan that provides basic coverage, Bajaj Finserv’s Mobile Screen Insurance is a great choice. It primarily covers screen damage due to accidents or liquid spills, making it ideal for users who frequently drop their phones.

However, it does not offer theft or loss protection, so users should evaluate their risk factors before opting for this plan.

Key Features:

| Feature | Details |

| Coverage | Accidental and liquid screen damage |

| Premium Cost | ₹1,212 annually |

| Claim Process | Allows two claims per year |

| Pros | Budget-friendly, includes mechanical breakdowns |

| Cons | Covers only screen-related issues |

3. ICICI Lombard Mobile Protection Plan—Best for Quick Claim Settlement

ICICI Lombard’s mobile protection plan is a great option for users looking for fast claim settlements. The policy covers accidental screen damage, making it useful for those with flagship devices. The only downside is that it applies only to devices less than one year old.

Key Features:

| Feature | Details |

| Coverage | One-time accidental screen damage for phones < 1 year old |

| Premium Cost | Available upon inquiry |

| Claim Process | 48-hour mandatory claim reporting |

| Pros | Reputable insurer, fast settlement |

| Cons | Covers only screen damage |

4. OneAssist Mobile Protection Plan—Best for Theft and Loss Protection

OneAssist is known for its extensive protection plans, which cover theft, accidental, and liquid damage. The plan is slightly more expensive than others but offers complete peace of mind, especially for users with high-value devices.

Key Features:

| Feature | Details |

| Coverage | Theft, accidental, and liquid damage |

| Premium Cost | Varies based on device value |

| Claim Process | Free pick-up and drop for repairs |

| Pros | Theft protection, cashless repair |

| Cons | Higher premiums |

5. Samsung Care+ [Best for Premium Smartphones]

Samsung Care+ is an exclusive insurance plan designed for Samsung device users. It offers extended protection beyond the standard warranty and covers accidental and liquid damage. If you own a premium Samsung phone, this plan ensures repairs are done by certified professionals using genuine parts.

Key Features:

| Feature | Details |

| Coverage | Accidental and liquid damage, mechanical breakdowns |

| Premium Cost | Based on the Samsung device model |

| Claim Process | Certified Samsung expert repair |

| Pros | Extended warranty, expert service |

| Cons | Limited to Samsung devices |

Takeaways

Investing in a mobile insurance plans in India is a smart decision, ensuring peace of mind against unexpected smartphone damages or losses.

Whether you own a budget-friendly device or a premium smartphone, choosing the right plan can save you thousands in repair or replacement costs.

Compare your options and choose a plan that best suits your needs to keep your device safe and protected in 2025.