Renting out your property can feel like walking through a minefield. One wrong move, and you could face lost income, legal trouble, or endless headaches with tenants. Many new landlords jump in without knowing the Mistakes To Avoid When Renting Out Your Property.

Fair housing laws trip up too many owners. You can’t pick tenants based on personal bias—that’s illegal under the Civil Rights Act of 1968 and other anti-discrimination rules.

This post will show you how to dodge costly errors, from sloppy lease agreements to bad tenant screening. Stay sharp—your rental income depends on it.

Understanding Fair Housing Laws for Property Rentals

Ignoring fair housing laws can land landlords in legal trouble. The Fair Housing Act protects renters from discrimination based on race, religion, gender, and other factors. Asking the wrong questions during tenant screening, like family status inquiries, breaks these rules.

Property owners must follow anti-discrimination laws in ads and showings too. Phrases like “perfect for young professionals” could accidentally exclude protected groups. Using outdated lease agreements might also clash with current landlord-tenant laws, causing fines or lawsuits.

Keep leases clear and treat every applicant equally to stay compliant—and keep your rental income safe.

Effective Tenant Screening Strategies

Finding the right tenant can make or break your rental property business. A bad tenant means late payments, property damage, and legal headaches.

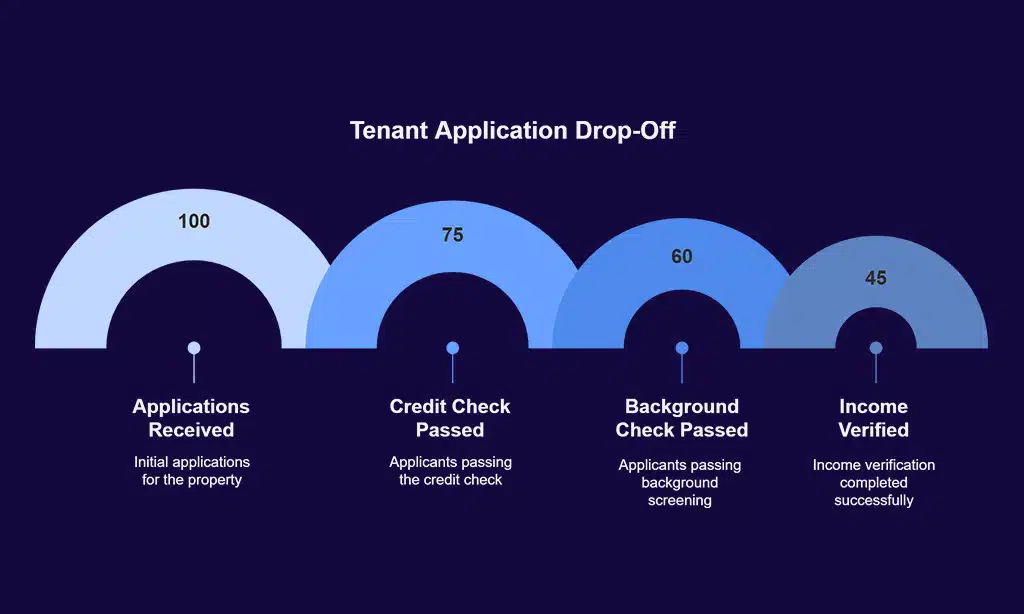

- Run a credit report to check financial responsibility. Look for a history of on-time payments and low debt levels. Avoid tenants with poor credit scores.

- Conduct background checks for criminal history. Use services like Zillow.com or a property management company to verify records. Skip applicants with a history of evictions or violent crimes.

- Verify income and employment. A good rule is monthly rent should be 30% or less of the tenant’s income. Ask for recent pay stubs or bank statements.

- Check rental references from past landlords. Ask about payment habits, property care, and lease violations. Avoid those with complaints of property damage or late rent.

- Avoid discriminatory questions under the Fair Housing Act. Stick to facts like income and rental history. Never ask about race, religion, or family status.

- Charge a security deposit to cover potential damages. Most states allow 1-2 months’ rent upfront. Clearly outline refund terms in the lease agreement.

- Meet applicants in person or through video calls. Watch for red flags like vague answers or unwillingness to provide documents. Trust your gut if something feels off.

- Use property management software to track applications. Tools like these help compare tenant details quickly and fairly. Keep records to avoid legal trouble later.

- Set clear screening criteria before listing the rental home. Apply rules equally to every applicant to stay compliant with the Fair Housing Act. No exceptions based on personal bias.

- Require renters insurance in the lease agreement. It protects both you and the tenant from liability in case of accidents or damage caused by negligence.

Crafting a Comprehensive Lease Agreement

A solid lease agreement is your first line of defense against tenant issues. Many landlords make the mistake of using outdated templates, which can leave loopholes or miss key clauses.

This leads to disputes over rent payments, property damage, or even evictions. Your rental agreement should clearly spell out rent due dates, late fees, and maintenance responsibilities.

Include terms about security deposits, pet policies, and subletting rules to avoid confusion later. The Fair Housing Act requires equal opportunity for all tenants, so avoid discriminatory language.

A well-written lease protects both you and the renter. It also makes enforcing rules easier if problems arise. Keep it simple but thorough—cover every possible scenario without turning it into a novel.

Managing Maintenance Costs for Rental Properties

Maintenance eats into profits if not handled right. Charge enough rent to cover repairs, upgrades, and emergencies—skimping leads to bigger bills later. Regular inspections catch small issues before they become costly disasters.

Property taxes and HOA fees add up fast. Budget for them alongside routine upkeep like HVAC servicing or plumbing checks. A property management company can help track expenses but expect fees around 10% of rental income.

Smart landlords save a portion of monthly cash flow for surprise fixes—broken water heaters don’t wait for payday.

Strategies for Marketing and Advertising Your Rental

Getting the word out about your rental property is key to finding good tenants fast. Poor marketing can leave your place sitting empty, costing you money.

- Take high-quality photos of your rental property. Bright, clear pictures show off its best features and attract more interest. Dark or blurry shots turn renters away.

- Write a detailed listing that highlights what makes your place special. Mention nearby schools, parks, or public transport. Skip vague phrases like “cozy” or “great location.” Be specific.

- Post your ad on popular rental websites like Zillow, Apartments.com, and Facebook Marketplace. More eyes on your listing means faster results.

- Set a competitive rent price by checking similar homes in your area. Charging too much scares off tenants. Too little hurts your cash flow.

- Respond quickly to inquiries from potential renters. Slow replies make them look elsewhere. A fast response keeps them interested.

- Use social media to spread the word. Share your listing in local groups or community pages. Friends and neighbors might know someone looking.

- Hold open houses or virtual tours for serious applicants. Letting them see the space in person builds trust and speeds up decisions.

- Avoid discriminatory language in ads to stay compliant with the Fair Housing Act. Stick to facts about the property, not the people you want living there.

- Offer incentives like a free first month’s rent or waived application fees if the market is slow. Small perks can make your place stand out.

- Keep your listing updated until the lease is signed. Mark it as “pending” once you have serious applicants to avoid confusion.

Enforcing Lease Terms Consistently

Enforcing lease terms keeps things fair for everyone. If you let one tenant slide on late rent, others may expect the same treatment. Stick to the rules in your lease agreement, like due dates and property care.

This avoids confusion and keeps tenants accountable.

Ignoring small issues can lead to bigger problems. A leaky faucet today might mean water damage tomorrow. Address repairs fast to keep the property safe and tenants happy. Clear communication helps prevent disputes.

Treat all renters the same to stay within fair housing laws.

Budgeting Strategies for Rental Vacancies

Rental vacancies hurt cash flow fast if you’re unprepared—plan ahead like you would expect bad weather during peak travel season (because vacancies happen). Set aside at least one month’s worth *of* mortgage payments plus HOA fees upfront—this covers gaps without panic-dipping into personal savings later on down road trips gone wrong financially speaking!

Track every dime spent fixing up empty units between leases too; small upgrades attract better-paying renters faster while keeping long-term repair bills low over time—think fresh paint instead *of* pricey remodels unless absolutely necessary due wear-and-tear damage left behind prior occupants moving out unexpectedly early sometimes happens despite solid tenant screening efforts beforehand…

Streamlining Rent Collection Processes

Getting rent on time keeps your rental property running smoothly. Late payments hurt cash flow and create headaches for landlords.

- Set clear payment terms in the lease agreement. Specify due dates, late fees, and accepted payment methods to avoid confusion. Include details like online transfers, checks, or property management apps.

- Use digital payment tools for faster transactions. Online platforms like Zelle or PayPal reduce delays, paper checks, and trips to the bank. Tenants appreciate the convenience, and you get paid quicker.

- Enforce late fees consistently. If rent is overdue, apply penalties as stated in the lease. This discourages bad habits while keeping cash flow steady.

- Automate reminders for rent deadlines. Send friendly texts or emails a few days before payment is due. This helps tenants stay on track without last-minute panic.

- Keep detailed records of all payments. Use spreadsheets or property management software to track deposits, late fees, and receipts. Organized bookkeeping avoids disputes during tax season.

- Offer incentives for early payments. Small discounts or perks encourage timely rent submission, reducing your stress during tight months.

- Avoid cash payments when possible. Checks or digital transfers leave clear paper trails, reducing risks of lost money or misunderstandings.

- Communicate clearly about financial hardships. If a tenant struggles, work on a short-term plan instead of ignoring missed payments. This builds trust and prevents bigger issues later.

- Review rent prices regularly. Compare local market rates to keep your income competitive. Adjusting prices yearly can cover rising costs like HOA fees or homeowners insurance.

Maintaining Effective Communication with Tenants

Good communication keeps tenants happy and prevents small issues from turning into big problems. Not being available when needed can lead to frustration, late rent payments, or even property damage.

Respond quickly to repair requests and check in regularly without being intrusive—balance is key.

Use clear methods like email, text, or a property management app for updates and emergencies. A simple monthly newsletter can remind tenants about rent due dates, maintenance tips, or policy changes.

Keep records of all conversations to avoid misunderstandings later. Staying professional but friendly builds trust and makes lease enforcement easier if problems arise.

Operating Your Rental Property as a Professional Business

Running a rental property like a business keeps things smooth. Many landlords slip up by not setting clear processes for tenant issues or maintenance. It’s easy to let bookkeeping slide, but falling behind creates financial chaos later, making it hard to track rental income and expenses.

A strong lease agreement prevents disputes down the road. Skipping thorough tenant screening invites headaches—like late payments or property damage. Charge rent that covers upkeep costs so the home stays in good shape without eating into profits.

Keeping communication open with tenants avoids frustration, especially if repairs pop up unexpectedly. Treating rentals as a professional venture means staying organized, responsive, and fair under housing laws to dodge legal trouble while keeping cash flow steady.

Takeaways

Renting out your property can be profitable, but mistakes can cost you time and money. Know the Fair Housing Act, screen tenants well, and use a solid lease agreement. Keep up with repairs, set clear rent rules, and stay on top of finances.

Good communication prevents problems before they start—treat it like a business to succeed. Ready to turn your rental into smooth income? Start today!

FAQs

1. What’s the biggest mistake landlords make with lease agreements?

Skipping details in the lease agreement can backfire. Always list rules, rent due dates, and penalties. A solid lease keeps both you and tenants safe.

2. Why is tenant screening important for rental property owners?

Bad tenants cost money. Screen them well—check credit, past rentals, and income. It beats dealing with evicted tenants later.

3. How do property taxes affect rental income?

They eat into profits. Know your local rates before buying an investment property. Factor them into your cash flow analysis.

4. Should I hire a property management company?

If juggling mortgage payments, HOA fees, and repairs feels like a circus, yes. They handle the dirty work, but they take a cut.

5. Can ignoring the Fair Housing Act get me in trouble?

Big time. Treat all applicants the same, no favorites. Breaking this law leads to fines, headaches, and sleepless nights.