Lab-Grown Eel is shifting from a lab milestone to a market test in Japan just as wild eel pressure, traceability debates, and food-tech investment realities collide. If cultivated unagi proves scalable, it could stabilize a culturally vital food while rewriting how premium seafood is sourced by 2026 and beyond.

How We Got Here: Unagi’s Structural Supply Problem?

Eel is not simply a menu item in Japan. Unagi sits at the intersection of tradition, seasonal rituals, and premium dining economics. That cultural demand is resilient, which means any supply disruption shows up quickly in prices, procurement behavior, and the incentives that shape the upstream trade.

The deeper issue is that “eel farming” often depends on nature more than consumers realize. Many eel farms are not breeding eels end-to-end in captivity at commercial scale. Instead, they commonly rely on wild-caught juvenile “glass eels” that are raised in controlled systems. When wild recruitment drops, farms and traders compete for fewer juveniles, and the entire chain tightens.

That wild bottleneck helps explain why eel repeatedly appears in conservation and trade discussions. If the starting input is a scarce, high-value wild juvenile, the system becomes vulnerable to opaque sourcing, mislabeling, and illicit trade. It also becomes politically difficult to regulate because restrictions can hit livelihoods, restaurants, and national food culture all at once.

The conservation signal has been clear for years. Japanese eel is listed as Endangered on the IUCN Red List, with assessments describing major declines over a multi-decade timeframe. Environmental groups also document how Japan’s eel consumption has fallen sharply from early-2000s peaks, a market-level indicator that scarcity has already reshaped behavior even without a total collapse in demand.

Trade governance has struggled to keep up. Recent international debates show how hard it is to align countries on uniform eel controls, partly because enforcement is complex. Eels are hard to identify across species in trade channels, supply chains cross many borders, and legitimate aquaculture can blur with questionable upstream sourcing. That is why “lab-grown eel” matters. It does not just promise a new product. It promises a new supply chain architecture that can reduce dependence on wild inputs if the technology can deliver.

Here is the key backdrop in compact form.

| Pressure Point | What It Looks Like In Practice | Why It Creates An Opening For Lab-Grown Eel |

| Wild juvenile dependency | Farms often need wild-caught glass eels | Cultivation could bypass the wild bottleneck |

| Price volatility | Scarcity and imports drive uneven pricing | Stable production could smooth menus and procurement |

| Enforcement difficulty | Species identification and traceability remain contested | Cultivated eel can offer clearer chain-of-custody |

| Cultural stickiness | Demand is tied to tradition and ritual | Premium tradition foods can fund early-stage tech |

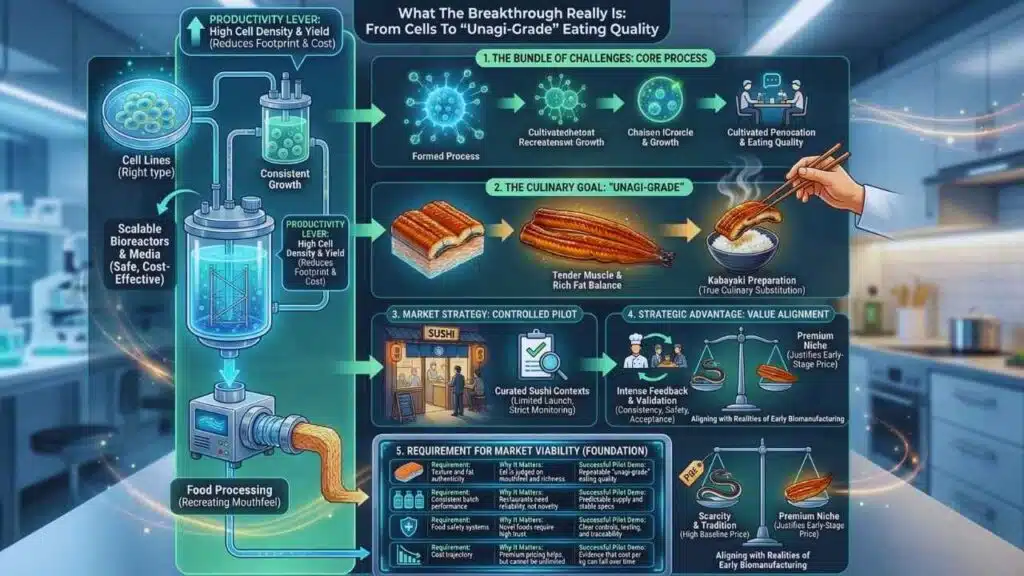

What The Breakthrough Really Is: From Cells To “Unagi-Grade” Eating Quality?

“Lab-Grown Eel” can sound like a single invention, but it is a bundle of challenges that have to be solved together. The product needs the right cell lines, consistent growth, safe and cost-effective media, scalable bioreactors, and food processing that can recreate eel’s characteristic mouthfeel. If any one of these layers fails at scale, the concept stays stuck at “impressive demo” rather than becoming a reliable supply source for restaurants.

The reason eel is a strategically interesting target is that it is both high value and technically demanding. Many cultivated seafood concepts begin with products that can tolerate looser texture constraints, such as minced or blended formats. Eel, by contrast, is prized for its balance of tender muscle and rich fat, especially in kabayaki preparations where glazing and grilling amplify texture and aroma. If cultivated eel can satisfy that sensory bar, it signals that cultivated seafood is moving beyond easy wins into true culinary substitution.

A major technical lever in cultivated foods is productivity, often described through cell density and yield. Higher cell density can mean more biomass per unit volume, which can reduce facility footprint, reduce batch time, and improve cost per kilogram. Some cultivated-eel developers have publicly emphasized unusually high cell density claims using organoid-based approaches. If those claims translate into stable, repeatable industrial outcomes, the cost curve could bend faster than earlier cultivated-meat projects that struggled with scale economics.

Still, it is important to interpret the “sushi market” narrative correctly. Early market entry does not mean supermarkets nationwide. It almost always means controlled launches: limited restaurants, limited menus, strict batch monitoring, and intense feedback loops. That is the normal path for any novel food category where regulators, consumers, and chefs need confidence. If Lab-Grown Eel begins showing up in curated sushi contexts, that is less a victory lap and more a structured pilot designed to validate consistency, safety systems, and dining acceptance.

The culinary strategy also carries a subtle advantage. Eel already has a high baseline price in many contexts, and diners are accustomed to paying for it as a premium treat. That helps cultivated eel because early-stage products rarely compete with commodity proteins. They compete with premium niches where supply is unstable and where a strong narrative can justify price.

This is the practical meaning of the breakthrough. It is not that eel has been “solved.” It is that developers are aiming at a category where tradition, scarcity, and value align with the realities of early-stage biomanufacturing.

| Requirement For Market Viability | Why It Matters Specifically For Eel | What A Successful Pilot Would Demonstrate |

| Texture and fat authenticity | Eel is judged on mouthfeel and richness | Repeatable “unagi-grade” eating quality |

| Consistent batch performance | Restaurants need reliability, not novelty | Predictable supply and stable specs |

| Food safety systems | Novel foods require high trust | Clear controls, testing, and traceability |

| Cost trajectory | Premium pricing helps, but cannot be unlimited | Evidence that cost per kg can fall over time |

Market Impact: Premium Seafood Economics Meets Japan’s Import Reality

Eel’s economics are shaped by three realities. First, Japan remains one of the most influential demand centers for eel as a cultural and culinary product. Second, supply is heavily connected to imports and cross-border trade. Third, the chain is exposed to shocks, from recruitment swings in juvenile eels to policy actions that change what can be traded and how easily.

This matters because cultivated eel is not just competing with “wild eel.” In most cases, it is competing with a hybrid market of farm-raised eel that still depends on wild juveniles. That distinction matters for sustainability messaging and for price stability. From a diner’s perspective, a restaurant may already sell “farm eel,” but the upstream sustainability and enforcement questions do not necessarily disappear.

If Lab-Grown Eel is commercialized, the first measurable market effect will likely be stabilization in the premium segment rather than a sudden collapse in conventional supply. Think of it as a new supply layer added at the top of the market. Over time, if production scales and costs fall, the substitution could spread into broader restaurant categories. But in the near term, the economic logic points to selective displacement.

There is also a strategic business pattern here that mirrors many food-tech launches. Start with premium foodservice because it supports higher prices, tighter quality control, and simpler distribution. Use those early placements to build brand trust and regulatory confidence. Then expand into processed formats and retail channels once scale economics improve. Eel is particularly well suited to this path because many consumers already see it as an occasional indulgence, not an everyday staple.

Investment conditions will influence how fast this unfolds. Cultivated meat and seafood have moved from the exuberant funding years into a more disciplined era. Industry analyses show funding has become tighter and more selective, with companies pushed to demonstrate scalable economics and credible go-to-market plans. This environment can slow the number of new entrants, but it can also accelerate consolidation around the few models that show real cost and regulatory progress.

From Japan’s perspective, cultivated eel also touches food security and economic security. Japan imports large amounts of food and feed, and supply fragility has become a bigger policy concern across Asia. A domestic or regionally anchored biomanufacturing supply chain for premium seafood fits into a broader narrative of resilient procurement. It also supports a tech-industrial agenda where Japan can lead on standards and high-quality production rather than competing on low-cost commodity volume.

A useful way to frame this is “where it bites first.”

| Market Segment | Near-Term Effect If Cultivated Eel Expands | What It Means For Conventional Eel |

| High-end sushi and kabayaki restaurants | Adds stable, premium supply option | Creates competitive pressure on provenance and consistency |

| Mid-tier restaurants | Limited at first due to price | Minimal immediate impact, but sets future benchmark |

| Retail and ready-to-eat | Later expansion once scale improves | Could reshape packaged “eel” category over time |

| Import channels | Slow shift if domestic cultivation rises | Reduces exposure to trade and currency swings |

Policy, Trust, And Labeling: The Real Bottleneck Is Governance

Even if the technology works, cultivated eel lives or dies on governance. Regulators must decide how it is reviewed for safety, how it is labeled, and how it is monitored once it is sold. Consumers and chefs must decide whether they trust it, and whether it fits cultural expectations of what eel should be.

Japan is in an active phase of policy development for cultivated foods, including cultivated meat and fish. That work matters because uncertainty is costly. Companies hesitate to build expensive production facilities without a predictable pathway. Restaurants hesitate to commit menu space without a clear compliance framework. Investors hesitate to fund scale-up without clarity on approval timelines and labeling rules.

Labeling is a particularly sensitive issue for eel because the market already faces concerns about origin, species, and traceability. Cultivated eel could become a trust-enhancing product if regulators create clear naming standards and auditing expectations. But it could also become a new confusion point if rules are vague and marketing gets ahead of standards.

There is also a global political overlay. In some markets, cultivated meat has sparked ideological pushback. Even where national food agencies create pathways, local or regional politics can introduce bans or restrictions. Japan has not followed that playbook to the same extent, but the lesson is relevant. Cultivated foods can become cultural symbols as much as products, especially when they touch tradition-heavy cuisines.

For Japan, the most strategic governance outcome is a clear, science-based approval and labeling regime that protects consumers and gives innovators a stable runway. If Japan moves early and clearly, it can become a reference market for cultivated seafood standards, similar to how certain jurisdictions become standard setters in other regulated categories.

This is also where neutrality matters. Critics of cultivated foods raise fair questions: energy use, supply chain emissions, long-term safety monitoring, and corporate concentration in food systems. Supporters counter with the conservation potential, improved traceability, and the ability to decouple premium seafood from fragile ecosystems. Both sides have a point, and the job of regulation is to turn those arguments into measurable requirements.

Here is the governance scoreboard that will shape outcomes.

| Governance Question | Why It Matters | What A Strong Answer Looks Like |

| Safety review pathway | Determines whether scale-up is investable | Clear dossier requirements and transparent timelines |

| Labeling rules | Drives consumer trust and avoids backlash | Plain naming, clear differentiation, no ambiguous claims |

| Post-market monitoring | Builds confidence for novel foods | Testing protocols, reporting, and recall readiness |

| Sustainability claims | Prevents greenwashing and protects credibility | Auditable metrics and honest boundaries of impact |

What Happens Next: The Milestones That Decide Whether This Becomes A New Seafood Category?

If Lab-Grown Eel is truly approaching broader sushi-market exposure, the next phase will be defined by milestones that are visible and testable. The most important milestones are not viral tastings. They are boring, operational signals that indicate a product is becoming a dependable category.

First, watch for regulatory clarity in Japan that translates into predictable approvals and labeling. This will be the switch that turns “interesting” into “buildable.” Second, watch for repeated restaurant service rather than one-off chef showcases. Repeated service proves batch consistency, distribution reliability, and customer acceptance. Third, watch for production scale announcements that include facility capacity, quality controls, and realistic cost trajectories.

Cost will remain the hardest variable. Early cultivated eel may be priced close to high-end restaurant eel, but long-term growth needs a falling cost curve. That requires media optimization, reliable high-density growth, and bioreactor designs that can run efficiently. It also requires financing structures that can support factories, which is difficult in a tighter investment climate. Partnerships with established food and biotech firms may become as important as the cell technology itself.

Conservation impact will be a slower story. Even if cultivated eel succeeds, it will not immediately erase illegal trade or wild harvest pressure. Those incentives can persist if conventional eel remains culturally preferred or if labeling systems remain weak. The more realistic conservation pathway is gradual substitution in premium demand combined with stronger traceability standards, which together reduce the profitability of questionable sourcing over time.

Here is a forward-looking scenario grid that stays grounded without pretending certainty.

| Scenario | What Drives It | Likely Outcome By 2027–2028 |

| Controlled premium success | Clear approval rules, strong chefs, stable quality | Cultivated eel becomes a high-end category with growing volumes |

| Slow adoption | Regulatory delay, consumer skepticism, high cost | Eel remains mostly conventional, cultivated stays niche |

| Rapid scale pivot | Major partnerships and cost breakthroughs | Cultivated eel expands into broader restaurant tiers and processed formats |

| Backlash and fragmentation | Political pushback or labeling controversy | Patchy availability and slowed investment, despite technical progress |

The most likely near-term reality is controlled growth. Expect limited launches, strong emphasis on transparency, and intense iteration on taste and consistency. If the product clears those hurdles, the next “big moment” will not be a headline. It will be when procurement managers and restaurant groups treat cultivated eel as a normal option with standard specs and steady supply.

Over the longer run, Lab-Grown Eel could serve as a template for other premium, ecologically sensitive seafood. If you can cultivate eel, you can plausibly cultivate other high-value species where wild inputs or ecosystem pressure create chronic instability. That is why this matters beyond unagi. It is a test case for whether biomanufacturing can support tradition-heavy foods without turning them into conservation liabilities.

Comparative Data Blocks For Quick Reference

| Why Eel Is A Strong Early Target | Why Eel Is Also A Hard Test |

| Premium pricing supports early economics | Texture and fat expectations are demanding |

| Scarcity makes stable supply valuable | Regulatory scrutiny will be intense |

| Sustainability narrative is intuitive | Risk of consumer backlash if labeling is unclear |

| Traceability value is high | Cost curve must fall for wider adoption |

| What Restaurants Want | What Regulators Want | What Consumers Want |

| Consistent taste and texture | Verified safety and controls | Clear labeling and honesty |

| Stable supply | Traceable manufacturing | “Is it real eel” clarity |

| Predictable pricing | Post-market monitoring | Taste that matches expectation |

| Near-Term Watchlist | Why It Matters |

| Japan’s formal guidance for cultivated foods | Determines speed of commercialization |

| Repeat restaurant placements | Validates reliability and acceptance |

| Transparent labeling standards | Reduces backlash and confusion |

| Credible cost disclosures | Signals whether scale is realistic |

| Partnerships with incumbents | Increases chance of real volume production |

Lab-Grown Eel is not just a clever alternative protein headline. It is a stress test for whether cultivated seafood can step into a culturally important, premium category where sustainability is contested and supply is structurally fragile. If Japan creates clear rules and early pilots prove reliable, cultivated unagi can become a stabilizing force in sushi and kabayaki markets. If regulation stalls or trust fractures, it will remain a niche novelty while the wild-dependent supply chain continues to absorb pressure and scrutiny.