Ever feel overwhelmed by digital payment apps and new fintech tools?

You’re definitely not alone.

Many of us want better ways to send money internationally, catch fraud before it hits, or manage our small business finances without drowning in paperwork. But figuring out which tech actually works can feel like solving a puzzle with half the pieces missing.

Here’s the exciting part: According to a 2025 report by Viola Group, Israeli fintech companies raised $565 million and now employ an average of 830 people. Together, seven of Israel’s top 15 private tech companies are fintechs, and they’re solving real problems for millions of users worldwide.

This article walks you through 12 standout Israeli startups transforming everything from cross-border payments to AI-powered fraud detection. You’ll discover how each company uses artificial intelligence and smart automation to make your financial life simpler and safer.

Ready to see what innovation looks like?

Key Takeaways

- Israeli fintech startups now support over 5 million users globally, with companies like Payoneer integrated into 2,000+ marketplaces and Riskified analyzing over a billion transactions.

- According to Viola Group’s 2025 report, today’s Israeli fintech companies have raised $565 million on average and employ 830 people, showing massive growth from just eight years ago.

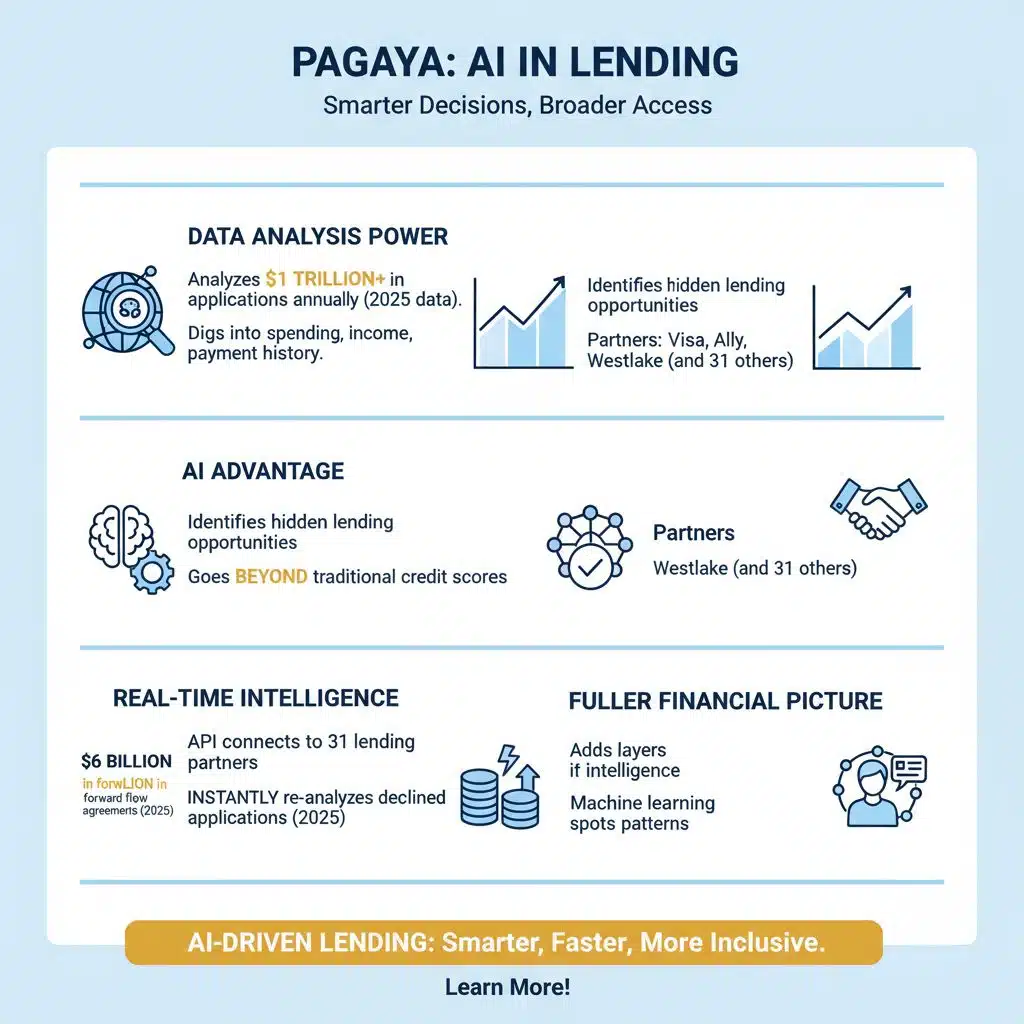

- AI-powered platforms like Pagaya process $1 trillion in loan applications annually and help partners approve customers who fall outside traditional credit score limits.

- Automation tools from HoneyBook and Justt save small businesses multiple hours weekly by handling client communications, chargeback disputes, and payment workflows automatically.

- Companies like ThetaRay and Riskified use machine learning to detect financial crimes and fraud 2-3 times better than competitors, protecting both banks and online shoppers.

How Does Pagaya Use AI in Investment Solutions?

Pagaya harnesses artificial intelligence to analyze mountains of data.

This helps banks and credit unions make smarter lending decisions. The company’s AI models dig into spending habits, income trends, payment histories, and even subtle market shifts to find strong lending opportunities that traditional credit scores might overlook.

According to a June 2025 presentation at Morgan Stanley, Pagaya’s platform now processes $1 trillion in applications every year. That massive data flow gives the AI an edge that most competitors simply can’t match. Partners like Visa, Ally, and Westlake use this tech to offer loans and credit cards to customers who might not fit the old approval boxes.

Pagaya connects directly to 31 lending partners through a simple API. When someone applies for a loan and gets declined, the system instantly re-analyzes that application using hundreds of alternative data points. In 2025, the company secured forward flow agreements totaling up to $6 billion, showing that institutional investors trust the AI’s ability to spot good borrowers.

This isn’t about replacing credit scores entirely. It’s about adding layers of intelligence that paint a fuller picture of each person’s financial health. Machine learning catches patterns a human analyst would miss, and it does so in real time.

What Makes Pagaya’s AI Network Different?

The secret sauce is volume and feedback loops.

Every application the system reviews teaches it something new. Pagaya reported turning a $21 million net loss in Q1 2024 into an $8 million profit by Q1 2025, proving the model actually works. The company now works with 135 institutional investors who provide the capital for approved loans.

By focusing on shorter-duration loans with FICO scores above 600, Pagaya targets borrowers who are likely to repay quickly. This strategy minimizes defaults and speeds up capital turnover, making the whole system more efficient for everyone involved.

How Does Payoneer Simplify Global Payments?

Payoneer launched in 2005 and now serves over 5 million users worldwide.

The platform gives you local bank details in major currencies like USD, EUR, GBP, and more. So if you’re a freelancer in Mumbai getting paid by a client in London, you can receive that payment as if you had a UK bank account. No confusing wire transfers or sky-high currency conversion fees.

According to a 2025 review, Payoneer integrates directly with over 2,000 marketplaces and platforms, including Amazon, Upwork, Fiverr, and Airbnb. This means if you sell products online or work as a contractor, you can connect your Payoneer account once and get paid seamlessly from all these channels.

The real magic happens with multi-currency accounts. You can hold balances in 70 different currencies and withdraw funds when the exchange rate works in your favor. For small businesses managing international invoices, this flexibility cuts through red tape that usually slows down cross-border commerce.

How Does Payoneer Handle Currency Conversions?

The platform handles conversions at competitive rates.

You don’t need to set up accounts in multiple countries or deal with different banks in each region. Payoneer provides virtual account numbers that act like local bank details, so your clients can pay you using their familiar payment methods.

In April 2025, Payoneer acquired Easylink Payment Co., a Chinese payment provider, expanding its reach even further. The company now operates in 190+ countries and supports payments in territories that other platforms often skip.

Whether you’re paying overseas suppliers or collecting earnings from global marketplaces, Payoneer turns what used to be a week-long headache into a same-day solution.

How Does Riskified Prevent Fraud in E-Commerce?

Riskified uses AI to fight fraud at scale.

The company’s platform checks every online order for red flags, catching fake buyers before they can complete fraudulent purchases. According to their own testing, Riskified detects fraud 2-3 times better than competitors in head-to-head comparisons.

Founded in 2013 and now publicly traded on the NYSE, Riskified operates from offices in New York and Tel Aviv. The platform draws insights from over a billion historical transactions across its global merchant network. This massive dataset helps the AI spot patterns that would be invisible to a small team of fraud analysts.

When a shopper hits the checkout button, Riskified’s system analyzes hundreds of data points in milliseconds. It looks at device information, browsing behavior, purchase history, and connections between accounts. According to a March 2025 announcement, the company launched Adaptive Checkout, which approves more legitimate transactions while reducing false declines. One customer, TickPick, approved an additional $3 million in incremental revenue that otherwise would have been blocked.

How Do Merchants Benefit From Riskified?

Online stores using Riskified see fewer chargebacks and lost revenue from scams.

The platform offers a chargeback guarantee, meaning Riskified takes on the financial risk when it approves an order. This lets retailers focus on marketing and customer experience instead of chasing down fraud claims or dealing with mountains of paperwork.

In 2024, Riskified was named to CNBC’s World’s Top Fintech Companies list. The company reported achieving full-year positive adjusted EBITDA and now serves many of the world’s biggest online brands.

According to a June 2025 survey of 130+ ecommerce professionals, 85% of merchants struggle to balance customer experience with fraud prevention. Riskified’s AI solves this by making instant decisions that don’t slow down the checkout process.

AI-Powered Transaction Monitoring

AI tools now catch suspicious money moves in real time.

Financial institutions no longer rely on gut feelings or outdated rules-based systems. Machine learning scans millions of transactions per day, flagging patterns that signal money laundering, fraud, or other financial crimes.

What Advanced AI Techniques Does ThetaRay Use?

ThetaRay, founded in 2013 in Hod HaSharon, uses proprietary machine learning algorithms to scan massive financial datasets in seconds.

The platform sorts through millions of banking transactions, picking up hidden patterns that link to money laundering or terrorist financing. According to TechCrunch, ThetaRay raised $57 million in 2023 specifically to expand its AI tools for fighting financial crime.

Unlike traditional systems that rely on rigid rules, ThetaRay’s Cognitive AI dynamically learns from data. It detects what the company calls “unknown unknowns,” which are threats that don’t fit pre-programmed patterns. This technology adapts as criminal tactics evolve, so it stays ahead of bad actors who constantly change their methods.

Major banks like Santander and fintech companies like Payoneer use ThetaRay to monitor cross-border payments. The system factors in dozens of risk indicators to give compliance teams a clear picture of suspicious activities without drowning them in false alarms.

How Does ThetaRay Detect Suspicious Transactions?

The system watches for activities that look out of place.

It learns normal patterns in payment flows and sounds the alarm when something odd happens, like unusual transaction amounts, unexpected destinations, or connections between accounts that shouldn’t be linked. According to the company, this approach cuts down false positives dramatically, so compliance teams can focus on real threats.

ThetaRay’s platform works 24/7 and integrates with existing banking systems through APIs. Financial institutions praise it because it works fast and stays up-to-date with global anti-money laundering regulations. By automating reviews, the software slashes manual work and helps banks avoid costly regulatory penalties.

The platform also provides real-time insights into customer behaviors and transaction trends, helping institutions proactively identify risks before they become major problems.

How Does HoneyBook Streamline Small Business Operations?

HoneyBook combines financial software and automation into one platform built specifically for independent businesses.

According to a February 2025 study, 70% of HoneyBook AI users report greater confidence in decision-making. The platform saves them multiple hours each week by automating tasks like follow-up emails, invoicing, and project tracking.

Small businesses across the United States and Israel use HoneyBook to handle everything from client communications to payment collection. The AI drafts personalized emails based on your past messages, so responses sound like you wrote them. One user, photographer Mecca Gamble, says she saves 6 to 10 hours per week using the platform’s AI tools.

HoneyBook leverages data from $18 billion in transactions and 25 million client interactions to power its recommendations. The system identifies high-value leads automatically, helps you create proposals that match what similar businesses have found successful, and even designs follow-up sequences for clients who haven’t accepted your offers yet.

What Can HoneyBook’s AI Actually Do?

The platform handles three major areas: lead management, project execution, and financial tracking.

For leads, AI suggests which inquiries are most likely to convert and alerts you when someone important reaches out. For projects, it generates meeting recaps and keeps everything organized with automated summaries. For finances, it lets clients pick their own payment plans and integrates with Google Pay and Apple Pay for seamless mobile checkout.

According to HoneyBook’s 2025 data, entrepreneurs using AI through the platform book twice as many projects and generate 94% higher gross payment volume compared to those who skip the automation features. On average, users reclaim up to three hours per week from repetitive admin tasks.

How Does Justt Automate Chargeback Mitigation?

Justt, founded in 2020 in Tel Aviv, makes fighting chargebacks feel effortless.

The platform automatically collects transaction details, gathers evidence that supports the merchant’s case, and submits clear, customized responses to credit card issuers. According to the company, preparing a chargeback case manually takes 20 to 50 minutes of an analyst’s time. Justt does it instantly.

In December 2024, Justt closed a $30 million Series C funding round, bringing total funding to $100 million. The company nearly doubled the chargeback volume it managed in 2024 compared to the previous year, and it projects doubling revenue again in both 2025 and 2026.

The AI doesn’t use templates. Instead, it creates dynamic arguments tailored to each specific dispute, analyzing factors like the industry, payment service provider, reason code, and available data. The system connects to over 500 data points from PSPs, third-party sources, and your own records, then weighs all that information to build the strongest possible case.

What Makes Justt’s Approach Different?

Most chargeback tools rely on pre-written templates.

Justt uses machine learning to run continuous A/B tests in the background, learning which arguments work best for different scenarios. According to a June 2025 announcement, the company launched Dispute Optimization, which predicts the likelihood of winning each case and recommends whether to fight, ignore, or accept based on ROI.

The platform integrates with over 40 major payment processors, including Stripe, PayPal, and American Express. Merchants can view and manage all chargeback data in one central dashboard instead of logging into multiple PSP accounts.

One customer, digital marketplace Eneba, reported that their win rate keeps growing over time as the AI learns from each new case. Justt opened offices in New York and London in 2024 to serve growing demand in North America and Europe.

How Does BondIT Optimize Fixed-Income Portfolios?

BondIT Global, based in Herzliyya since 2012, takes bond investing to the next level with machine learning.

The platform helps portfolio managers build and adjust bond portfolios quickly. It crunches massive sets of financial data to find patterns that a human analyst might miss, making investment decisions both faster and smarter.

Institutional clients use BondIT’s AI tools to craft strategies backed by hard data instead of hunches. The system searches for opportunities in the fixed-income market, spots risks before they become problems, and provides clear reporting dashboards that don’t require an advanced math degree to understand.

With backing from investors including Startupbootcamp Fintech London, BondIT blends AI-driven risk analysis with user-friendly interfaces. Portfolio managers can tweak their bond holdings almost as easily as checking a weather app, giving them the agility to respond quickly when market conditions shift.

How Does Blue dot VATBox Transform VAT Recovery and Compliance?

Blue dot VATBox, founded in Tel Aviv in 2012, automates value-added tax recovery for companies with global operations.

The platform scans through mountains of invoices and receipts, checking each one for missed tax credits like a detective on a mission. This automation means finance teams don’t have to manually review data or worry about keeping up with constantly changing tax rules from authorities like the IRS.

Supported by Talent Resources Ventures and 14 other investors, Blue dot VATBox stands out among Israeli fintech companies for saving money and cutting errors that come with manual work. The system automatically adapts to new regulations in different countries, so businesses can claim back the taxes they’re entitled to without spending hours researching compliance requirements.

Whether you’re processing healthcare payments across borders or handling taxpayer records at scale, the platform handles the complexity. It gives your team full visibility over expenses and catches recoverable VAT that would otherwise slip through the cracks.

How Does Gaviti Simplify Accounts Receivable Collection?

Gaviti, started in Tel Aviv in 2017 and funded by Moneta VC and seven other investors, makes collecting payments far less stressful.

The platform sends automated reminders to customers at optimal times, helping companies reduce their days sales outstanding. According to the company, improved cash flow means fewer worries about late payments and more time to focus on actual work instead of chasing down invoices.

Many fintech companies struggle to get clients to pay on time. Gaviti turns this challenge into a smooth, automated process. Businesses set up payment plans through an easy-to-use dashboard, and the software tracks every step of accounts receivable collection so nothing falls through the cracks.

The system eliminates the need for sticky notes or endless spreadsheets. It knows when to send follow-ups, which customers need extra attention, and how to phrase reminders for maximum effectiveness. Everything works together like gears in a well-oiled machine, giving you better cash management without the heavy lifting.

How Does Earnix Provide Real-Time Insurance and Banking Solutions?

Earnix, founded in 2001 and headquartered in Ramat Gan, delivers financial software that helps banks and insurers act instantly.

The platform lets financial institutions set prices, launch new products, and offer personalized banking solutions in real time. According to the company, customers see changes reflected immediately rather than waiting days or weeks for systems to update.

With investors like JVP and backing from four other partners, Earnix keeps pushing the boundaries of real-time fintech tools. Banks use these solutions to meet customer needs quickly while boosting profits. The technology handles most of the heavy lifting, so staff can focus on customers instead of wrestling with technical issues.

According to Earnix’s 2024 Industry Report surveying 431 global insurance executives, 74% of insurers still rely on outdated legacy technology for critical processes. Earnix’s SaaS platform solves this by adding an intelligent layer to existing tech stacks, connecting pricing, rating, and underwriting into one shared system.

What Makes Earnix’s Platform Unique?

The platform combines predictive, generative, and agentic AI to power decisions across the full cycle of underwriting, pricing, and personalization.

Insurers can monitor deployed rates and adapt pricing strategies instantly based on market performance. One customer, Link4, reported that using Earnix helped them become a leader in the third-party liability and automotive markets by reacting to market changes faster than competitors.

The system integrates with existing infrastructure through APIs and can be deployed quickly without disrupting current operations. This flexibility is especially valuable for institutions that need to modernize without a complete system overhaul.

How Does OurCrowd Pioneer Equity Crowdfunding Platforms?

OurCrowd makes startup investing accessible to people beyond just wealthy venture capitalists.

The platform, launched in Jerusalem in February 2013, vets companies first by checking their backgrounds and real potential. This careful screening helps investors spot promising opportunities in sectors like fintech and payment solutions.

According to Wikipedia, OurCrowd has over 200,000 registered members and has received commitments exceeding $2 billion as of November 2022. The platform has had over 60 exits, including stock market listings like Beyond Meat, Lemonade, and Innoviz, plus high-profile acquisitions such as Microsoft’s purchase of CyberX.

OurCrowd brings together a large network of accredited investors, giving them direct access to deals once reserved for major players. Members can invest in individual companies with minimums starting at $10,000, or put $50,000 into OurCrowd funds that provide broader diversification across multiple startups.

How Does OurCrowd Select Companies?

The investment team reviews about 3,000 companies annually and selects only 1-2% for the platform.

Every company listed goes through strict due diligence before members see the opportunity. This careful curation process has helped build trust between the fintech ecosystem and both new and experienced investors looking for smart ways to grow their money.

Pitchbook has rated OurCrowd “Israel’s most active VC fund” for ten consecutive years. The platform operates offices in the US, UK, Canada, Australia, Spain, Singapore, Brazil, and the UAE, making it a truly global investment network.

How Does Finaro Support Payment Services for Online Merchants?

Finaro, based in Herzliya Pituah and founded in 2007, acts as both a merchant acquiring bank and payment service provider.

The platform helps online merchants process card payments quickly and safely. According to the company, Finaro’s system handles transactions for e-commerce shops using secure channels that protect each customer’s payment details.

With $655 million raised from Shift4 and other investors, Finaro brings extra trust to every transaction. The platform supports multiple currencies, so merchants can sell worldwide without headaches over conversions or payment delays. This makes international commerce feel as easy as selling to someone next door.

What Security Does Finaro Provide?

Security sits at the core of everything Finaro does.

The technology stops fraudsters before they can cause trouble, giving merchants peace of mind. Fast payment approvals mean less waiting around for businesses eager to grow their sales.

For fintech companies needing solid support with payments, Finaro offers tools that keep business flowing day and night while lowering risks for everyone involved. The platform integrates with existing e-commerce systems, making it straightforward to start accepting payments from customers around the world.

Takeaways

Israeli fintech companies are reshaping digital banking at lightning speed.

From AI-powered payment systems to fraud detection tools, these 12 startups set a global benchmark for innovation. Their software helps banks make smarter decisions, small businesses work more efficiently, and regular people manage money with less stress.

With ideas constantly flowing from Tel Aviv and beyond, one thing is crystal clear: the financial technology wave shows no signs of slowing down. Keep watching this space, because these companies never stand still!

FAQs on Israeli Fintech Companies

1. What makes Israeli fintech companies stand out in the financial technology world?

Israeli fintech companies stand out by applying deep expertise in cybersecurity and data analytics, often gained in elite military tech units, to solve complex financial problems. Companies like Rapyd use this know-how to build global payment solutions, making them leaders in the financial technology space.

2. How do these fintech companies help regular taxpayers and businesses?

They build user-friendly financial software that automates complex tasks for businesses. For instance, Melio helps small businesses pay their bills digitally, while Tipalti automates the entire accounts payable process, saving companies significant time and reducing errors.

3. What types of services do Israeli fintech firms offer?

They offer a wide range of financial services, including global payment solutions from companies like Payoneer, AI-driven lending platforms like Pagaya, and automated invoice processing tools from Tipalti.

4. Why are investment opportunities in Israeli fintech so attractive?

Investment opportunities are attractive due to a track record of success and high growth, with the Israeli fintech ecosystem raising billions in capital annually. Investors are drawn to companies with proven technology that solves real-world problems for global financial institutions, creating strong potential for high returns.