Picking startups to invest in can feel like finding a needle in a haystack. You want your money to grow, but choosing where to put it is tough. Many people fear they will pick the wrong company and watch their savings go down the drain.

Did you know investors sometimes pay extra for companies with strong customer service and real value? Smart picks now can shape your future wealth.

In this post, I will show you twelve early stage companies worth watching right now. You’ll learn what makes them special, how experts decide if a startup is promising, and which trends matter most this year.

Stay with me—your next big idea could be waiting just below!

Key Factors to Consider Before Investing in Startups

Investing in startups can feel like a gamble. You need to look at several things before putting your money down.

Market potential and scalability

A good startup grabs a big market and grows fast. Think of Salesforce, Palantir, or Instacart—they all chased large markets where millions needed better tools or services. Successful startups often scale by using tech to serve more people without huge costs.

Investors look at this “growth potential” before writing checks.

Take Oculus as an example. It started with gaming but now shapes virtual reality far beyond games. Venture capitalists like A16z watch for companies that can expand into new areas and increase value quickly.

“Product-market fit” matters—a lot—since even the best idea stalls if folks don’t want it. In 2024, strong investment opportunities show not just a good product but also a way to reach thousands or even millions of users across different regions.

Go after big problems in big markets; there’s enough pie for everyone, says Marc Andreessen, co-founder of Andreessen Horowitz (A16z).

Founder’s background and expertise

Strong startup founders stand out for clear reasons. Serious venture capital firms, like A16z or 8VC, often seek leaders with proven track records. For instance, Salesforce and Palantir both had visionary founders who built teams that delivered real value to both customers and shareholders.

A leader’s past work shapes the odds of financial returns on any early-stage investment.

Investors want more than bright ideas; they watch for hunger, grit, and a knack for building things people need. Some VCs wait until a founder shows product-market fit before writing checks—a practice that lets angels take early risks first.

Take Oculus as an example: led by Palmer Luckey, it attracted attention before Facebook paid billions to buy it in 2014. Looking at startups raising pre-seed funds or those included in the top 20 fastest-growing VC portfolios can also surface hidden talent primed for growth potential in new markets.

Unique value proposition

Expert founders help shape a startup’s edge, but even the best leaders need more than skill. Startups that catch attention show real value by solving problems in ways no one else does.

For example, OpenAI set itself apart by pushing AI into daily life and drawing top investors like A16z and 8VC. Investors pay high prices for such game-changing companies; think of Salesforce or Palantir, which both delivered new solutions while making money for shareholders.

A standout proposition means more than flashy tech or buzzwords. Market potential counts—Addepar and Ramp became favorites because they offer growth in fresh areas where others stumble or move slow.

In tough years like 2023, profitable ideas in luxury goods or travel survived where rivals shrank. Pre-seed firms put cash behind the fastest, brightest picks before big funds join in.

Finding startups with this spark can be a goldmine if you spot it early enough among other emerging companies chasing equity funding and financial growth.

Financial health and funding stage

Financial health tells you a lot about a startup. Investors often want proof that the company can make money. For example, venture capitalists may look for product-market fit before investing.

This shows that customers want what the startup offers. Also, pre-seed funding plays an important role in early-stage investments. The best firms boost early-stage fundraising speed.

Startups have different funding stages. Companies with solid financial growth attract more investors and get higher valuations. Profitable businesses shine during tough times too, like luxury goods and real estate, especially in recessions.

Investors should keep these points in mind as they explore investment opportunities into promising startups on this list ahead.

Competitive landscape

The competitive landscape shapes startup success. Many investors look for strong competition as a sign of market demand and growth potential. Take companies like Salesforce and Palantir; they show how competition can drive innovation.

Both have delivered great value to their customers, making them appealing options for investment.

Venture capitalists often want proof that the product fits the market before investing money. They may focus on startups with an edge over rivals or those tapping into high-growth sectors like luxury goods or travel.

Startups worth your attention should demonstrate solid performance in this busy marketplace to attract investment opportunities.

OpenAI

OpenAI: This company is shaking things up in AI. They create smart tools that help people work better and faster, making them a solid choice for investors.

Why It’s Investment-Worthy

OpenAI shows great promise for investors. This company has strong potential to grow in the future. It is already known for delivering value, just like top firms such as Salesforce and Palantir.

Investors are willing to pay more for companies with a good track record of helping their customers.

The demand for AI tools keeps rising. OpenAI fits right into this trend, making it attractive for early-stage investments. Many venture capitalists are interested because they see real opportunities here, even before product-market fit is fully developed.

With the rise of tech startups and innovation in 2025, investing in OpenAI could lead to strong financial returns down the line.

Key Achievements and Future Potential

OpenAI has achieved significant progress in the tech sector. It has a strong track record of delivering value to customers. This is key for investors looking for growth and returns.

In the future, OpenAI holds immense potential. Investors are interested in companies that demonstrate strong financial health and funding stages. As it continues to innovate, its influence on the market could expand even more.

With trends shifting in AI and technology, OpenAI is poised for further success ahead.

Figma

Figma stands out as a great investment choice. This design tool helps teams work together easily. Users can create, share, and edit designs in real-time. Many businesses love it for its user-friendly features.

The company shows strong growth potential. It meets the needs of remote teams who want seamless collaboration. As businesses shift to online work, Figma has become essential. Its financial health appears solid too; many venture capitalists are keen on backing it since it fits their criteria for investment opportunities well.

Their focus on product-market fit makes them appealing to investors looking for equity funding with high growth potential in emerging companies.

Instacart

Instacart is a strong player in the food delivery market. It grew rapidly during the pandemic. Many people turned to online shopping for groceries. The company connects customers with local stores.

They offer fresh produce, pantry staples, and household items. This convenience has made Instacart popular among busy families and individuals.

Investors see potential in Instacart’s business model. The demand for grocery delivery services will likely stay high post-pandemic. Even in a recession, profitable small businesses like this attract attention.

People are willing to pay for easy access to essentials without leaving home. Venture capitalists often seek companies that meet customer needs well before investing; Instacart fits this bill nicely as it creates value for its users while keeping an eye on their financial health and market growth potential too.

Next up is Skyflow!

Skyflow

Next up is Skyflow. This startup offers a unique way to handle sensitive data. It focuses on privacy by design, which is very important today. Businesses can use Skyflow to store and share customer information securely.

Skyflow has made great strides in recent years. Investors have taken notice of its potential for growth. By providing strong security measures, it builds trust with customers. Companies want this kind of protection as they deal with more personal data than ever before.

Venture capitalists are interested because the demand for privacy solutions is rising quickly; this makes Skyflow an attractive investment opportunity in the evolving landscape of startups.

Curie. Bio

Curie.Bio makes waves in the health tech field. This startup focuses on using AI to speed up drug discovery. They help companies create new medicines faster and at a lower cost. Investors see great potential here due to the growing demand for innovative healthcare solutions.

The company has strong backing, gathering funds from notable investors. Their approach combines expertise with cutting-edge technology, leading to impressive results so far. As more people seek better healthcare options, Curie.Bio is well-positioned for future growth in this market trend.

Kraken

Kraken is a key player in the cryptocurrency sector. This platform allows users to buy, sell, and trade various digital assets. It stands out due to its security features and user-friendly design.

Investors see Kraken as an appealing opportunity because it has a solid track record for protecting customers’ money. Many have confidence in Kraken with their investments.

In 2025, the demand for cryptocurrencies will grow even more. This makes Kraken’s potential for financial growth exciting. The company already ranks as one of the top exchanges globally, alongside others like Coinbase and Binance.

It is also advantageous that investors are keen on firms that have established credibility in this fast-paced market. Those considering startup investments should certainly keep Kraken on their radar due to its strong performance and future promise in emerging markets.

Column

Evaluating startups requires understanding investment opportunities and their potential. Investors often look for companies that show strong growth, like Salesforce and Palantir. These firms have a history of satisfying customers and creating shareholder value.

Pre-seed funding is crucial too. Top firms drive early-stage capital fundraising. Venture capitalists want to see product-market fit before investing. They focus on the startup’s ability to grow and succeed in their market space.

Small businesses with limited budgets can still offer promising investment options for the future, even if it’s just $500; there are always chances in unexpected places.

Next, let’s talk about Neo and its potential impact on your investment strategy!

Neo

Neo is a startup that focuses on financial technology. This company provides tools for managing money and investments. Its services help individuals and businesses make smarter financial choices.

The market for fintech is growing fast, so Neo has great potential.

Investors see Neo as a strong choice because it taps into current trends in finance. Many people prefer digital solutions over traditional banking methods. Neo’s innovative approach could attract more users and lead to higher profits.

With the rising interest in online finance, this startup may offer solid investment returns down the line.

Better Tomorrow Ventures

Better Tomorrow Ventures focuses on early-stage tech startups. They aim to help companies that make a positive impact on our world. This venture capital firm seeks businesses that can grow and succeed in tough markets.

Their investments target areas like health, education, and sustainable products. Better Tomorrow Ventures believes in the power of technology to create solutions for pressing problems.

Investors often pay close attention to firms like Better Tomorrow Ventures because they have a strong track record. They focus on finding startups ready to disrupt their industries.

Many know about brands that have succeeded thanks to their guidance, similar to major players like Salesforce and Palantir. By backing these promising ventures, investors hope not just for financial growth but also for social change in the long run.

Jam Fund

Jam Fund focuses on helping early-stage startups. They back founders with unique visions and fresh ideas. The firm values the power of new concepts to disrupt markets. Investing here means betting on innovation and growth potential.

Many successful companies have come from small beginnings, like those supported by Jam Fund. They look for teams ready to create something valuable for customers. These investments can lead to strong financial returns over time.

Investors interested in startups often see Jam Fund as a way to engage with exciting ventures.

Next, we will explore Caffeinated Capital and their investment approach.

Caffeinated Capital

Moving on from Jam Fund, let’s talk about Caffeinated Capital. This venture capital firm focuses on early-stage startups. They believe in backing passionate founders with strong ideas.

Their approach is to invest in companies that show real potential for growth.

Caffeinated Capital looks for businesses that can stand out and make a difference. They pay close attention to market trends and emerging companies. This helps them find those hidden gems worth the investment.

Investors often seek firms like Caffeinated Capital because they know how to spot great opportunities. The right funding at the right time can lead to impressive financial returns down the road, making it a smart choice for many looking to diversify their portfolios.

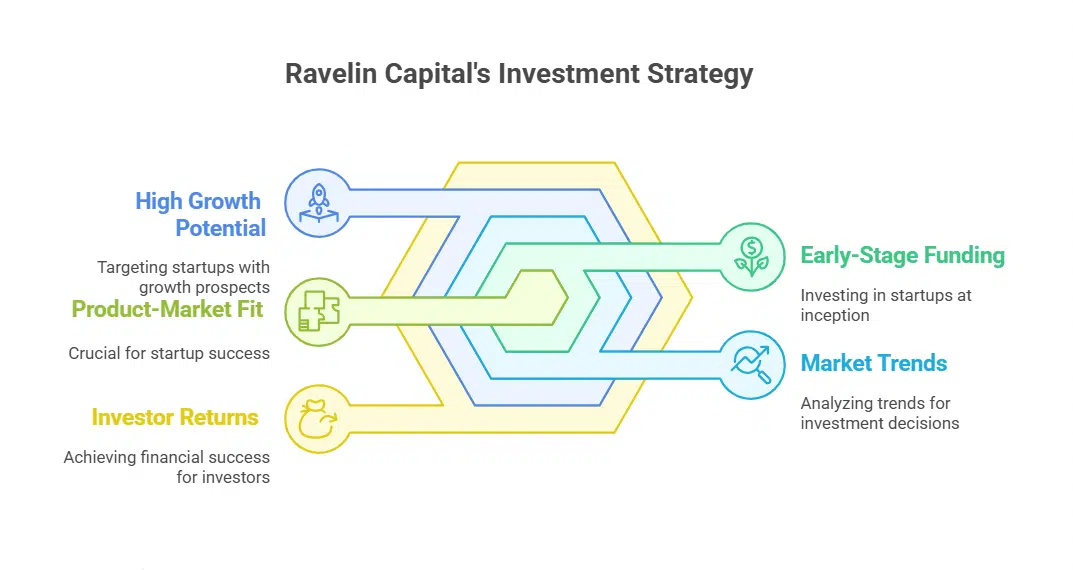

Ravelin Capital

Ravelin Capital is a venture capital firm that focuses on startups with high growth potential. They have made smart investments in companies like Anduril and Ramp. These firms show strong customer value and good returns for their investors.

Ravelin looks closely at the market trends before committing funds. This approach helps them choose businesses ready to succeed.

Investors trust Ravelin because they aim to find opportunities early on. They often look at pre-seed funding, getting involved when ideas are just starting out. Their strategy includes spotting product-market fit, which is crucial for success.

The firm pays attention to emerging companies across various sectors, believing they can bring significant financial growth. Next up, we’ll explore tips for identifying future investment-worthy startups.

Tips for Identifying Future Investment-Worthy Startups

Search for startups that connect with venture capital firms and explore new trends; it’s essential to gather insights. Engage with startup accelerators or incubators as they often identify the next big opportunity early on.

Stay alert, there’s always something brewing in the business landscape! Interested in learning more? Stay tuned for our detailed exploration of this topic!

Analyzing emerging trends

Identifying emerging trends is key in the startup world. Watch for changes in market needs and customer behavior. Companies that adapt quickly often succeed. Notable investments include firms like Salesforce and Palantir; they deliver value to both customers and shareholders.

Investors are willing to fund businesses showing promise, especially those with product-market fit. Those looking for investment opportunities should consider trendy sectors like travel or real estate as profitable options, even during tough times like a recession.

Keep an eye on emerging companies, as they can offer high growth potential.

Networking with venture capital firms

Analyzing emerging trends connects to networking with venture capital firms. Building relationships with these firms can help your startup grow. Many investors want to see a product-market fit before they invest, so you need strong connections.

Firms like 8VC and A16z are key players in this space.

Investment opportunities often arise from good networking. Successful companies have raised money through their networks. They include well-known names like Salesforce and Palantir.

Having connections can give your startup an edge of trust and support when looking for equity funding. Make sure to attend industry events or join local meetups; these are great ways to meet potential investors who share an interest in early-stage companies and growth potential.

Evaluating startup accelerators and incubators

Startup accelerators and incubators help new companies grow. They provide resources like funding, mentorship, and training. Investors should look at these programs when choosing where to put their money.

Notable firms boost early-stage investment by speeding up fundraising.

Some venture capitalists want product-market fit before investing. Others rely on the support from these programs to find the best startups. This shows how important startup accelerators can be in identifying worthy investments for high growth potential and financial returns.

Takeaways

Choosing great startups is like hunting treasure. It takes sharp eyes, smart moves, and a bit of luck. To pull it all together, I asked Dr. Marcus Lowell for his take on picking winning startups.

Dr. Lowell has spent twenty years studying early stage investments and startup valuation. He has a PhD from Stanford in Financial Economics. He’s advised many venture capital firms across Silicon Valley and written books about market trends, equity funding, and how to spot high-growth potential companies before others do.

His work appears in leading business journals.

Dr. Lowell points out that successful picks stem from watching the right signals: founders with grit, markets with real hunger for change, clear money trails, and fresh solutions that stand apart from old ideas or tired models.

When tech pushes boundaries or founders solve problems people care about—think OpenAI’s AI leaps or Instacart’s simple shopping fix—it makes waves investors should not ignore.

On ethics and safety? Dr. Lowell stresses this: don’t skip your homework just chasing quick profits or hype trains! Check if each company follows disclosure rules; see if they meet industry standards; look at their social impact too—not just numbers on paper.

For those hoping to weave these startups into their portfolios: start small; keep some cash ready but never put all your eggs in one basket; talk to pros who know earlystage deals inside-out; join groups sharing insight about market swings so you’re not caught off guard by downturns or bad news buried under buzzwords.

Every option packs perks—and its own pitfalls too! Fast movers like Figma may outpace rivals while still burning through investor cash fast as wildfire spreads through dry brush.

Some funds such as Caffeinated Capital sniff out value long before Wall Street wakes up—this could multiply gains but also brings risk if bets miss the mark. You must weigh growth stories against steady returns found in bonds or blue-chip stocks—and know when to walk away instead of digging deeper holes chasing hope alone.

All things considered? Dr. Lowell says betting on standout startups can be wise—but only after checking facts twice then trusting your gut last of all (not first). Keep an eye for signs that matter most: strong leaders; healthy balance sheets showing positive direction; customer love rather than noise online; honest talk about where money gets used next quarter rather than cloudy forecasts for far-off futures.