You file an auto insurance claim. You send photos, medical bills, and forms. Then the insurer stays silent. The adjuster gives you the runaround. It feels like banging your head on a wall.

You may face bad faith insurance.

Under Florida law, insurers must pay valid claims fairly and on time. If they misrepresent policy terms or delay payment, they break the insurance contract. This guide shows you how to spot bad faith tactics, keep clear records, file a complaint with the Department of Insurance, and seek punitive damages.

Keep reading.

Key Takeaways

- Spot bad faith. Jake mailed his bills on June 10, but his insurer stalled 45 days. He lost wages and faced late fees.

- Keep full records. Log each call, email, form, photo, and bill in one file.

- File with the Florida Department of Insurance. Under Fla. Stat. 624.155, attach your policy copy and your call/bill logs.

- Send a final demand letter. Mail it by certified mail, quote your coverage, and give 15–60 days to pay.

- Sue if needed. Hire a lawyer to seek compensatory and punitive damages for breach of contract.

Recognizing Bad Faith Insurance Practices

An insurance adjuster might stall your vehicle coverage claim for weeks, testing your patience and stretching contractual obligations. They often hide behind policy fine print to justify a claim denial with half-baked reasons.

Unreasonable delays in claim processing

Jake broke his leg in a grocery store fall. He sent his medical bills to his insurer on June 10. The insurance adjuster stalled his auto insurance file for 45 days. That delay left him with late fees and lost wages.

He faced a cascade of unpaid debts due to wrongful delay in claim payment.

Some insurance companies drag out investigations, then ask for the same forms each week. These delayed investigations add stress, cost time, and raise medical bills. Such tactics show bad faith insurance.

Policyholders hear crickets when they call. Insurance deadlines slip past 30 days under many state laws. File a complaint with your Department of Insurance or the insurance commissioner.

Denial of valid claims without justification

Your auto insurance company may deny a personal injury claim without proof or a fair check. A driver hit by an uninsured motorist sent $12,000 in medical bills under his policy. The carrier refused to pay a valid claim despite clear coverage.

That denial of valid claims without justification can breach the covenant of good faith and fair dealing and trigger punitive damages or a breach of contract suit.

Your life insurance firm might dismiss a $500,000 death benefit claim even after you submit a death certificate, beneficiary form, and medical records. ERISA and state insurance fraud statutes grant you solid legal rights.

An insurance adjuster must investigate every part of your file. You can file a complaint with your state Department of Insurance or hire an insurance lawyer to fight back.

Misrepresentation of policy terms

Insurers twist policy language and stretch terms. Many call a valid request “outside coverage.” I asked the adjuster, “Why won’t you pay?” He pointed to a hidden exclusion.

Such misrepresentation of policy terms marks clear bad faith insurance.

Clients see a sudden claim denial and wonder where the wording changed. Agents skip crucial information about policy exclusions. That breach of contractual obligations breaks the implied covenant of good faith and fair dealing.

A life insurance policy or auto insurance plan should not feel like a maze.

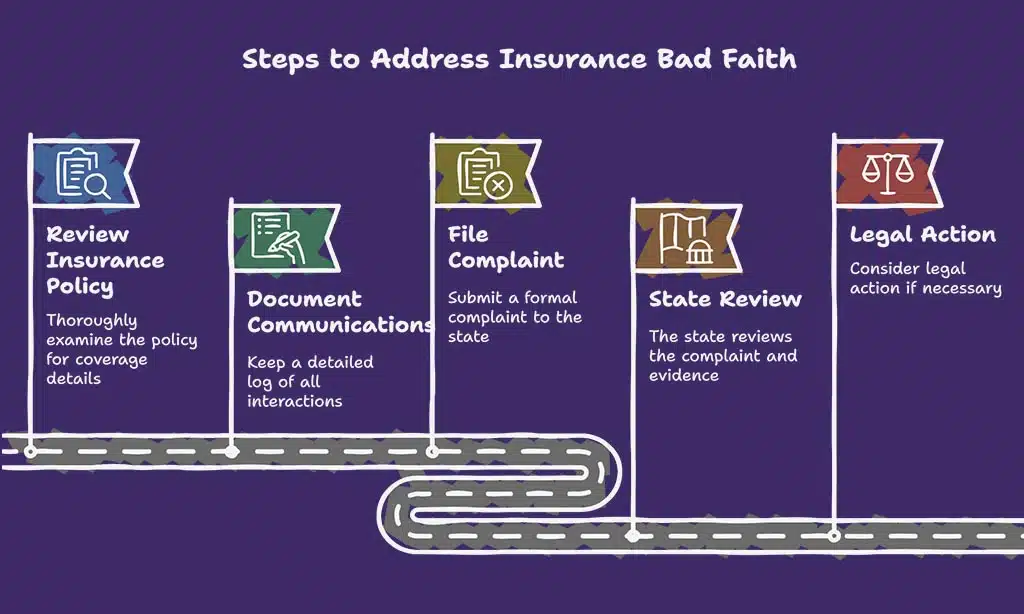

Steps to Take if You Suspect Bad Faith

Grab your insurance contract, mark every deadline, and stash all denial notices, forms, and call logs in one file. Fire off a crisp grievance to the State Insurance Commissioner, and get set to push back if they stall.

Review your insurance policy thoroughly

Roll out your insurance contract and read each page carefully. Tackle every clause like a detective on a stakeout, marking coverage limits, exclusions and claim denial triggers. Ask your state’s Department of Insurance or a consumer protection lawyer to clear up any odd language.

Listing dates, adjuster notes and payment caps helps you spot insurance fraud or a breach of contract. Armed with this knowledge, you protect your legal rights in a dispute with your insurance company.

Document all communications and claim denials

Keep a claim log of every call, email or letter. Jot dates, names and length of each call. Write down what adjusters say on those calls. Scan photos, bills and receipts and add them to your log.

Ask for a supervisor review after each claim denial. Send copies of your logs and records to the state Insurance Commissioner and to an insurance lawyer. This proof can back a bad faith insurance or breach of contract lawsuit.

File a complaint with your state’s Department of Insurance

Call your state’s Department of Insurance or fill its online form. Under Florida Statute 624.155, the office enforces fair claim handling. Describe each claim denial by your insurance company.

Attach policy copies, emails and notes. This step kicks off a formal review.

State insurance commissioner staff will examine your file. They can spot insurance fraud or breach of contract. They may order the insurer to pay valid claims or punitive damages. You keep your legal rights intact.

This process shields policyholders across auto insurance, health insurance and life insurance plans.

Filing a Bad Faith Insurance Claim

You mail a demand letter, file a complaint form before the statute of limitations and gather a folder of documents to push your insurer to pay—keep reading.

Send a final demand letter to your insurer

Draft a final demand letter after you log every call, text, and email with your claims adjuster. Cite the date of your auto insurance claim denial or your health insurance refusal.

Quote the exact policy language in your insurance contract. Give your insurer 15 to 60 days to pay covered costs. Warn of legal action for breach of contract or possible punitive damages.

Mail the letter by certified mail and get a return receipt. Keep the copy and that receipt in your records. Use this proof to file a bad faith insurance claim or a complaint with your state’s Department of Insurance.

A consumer protection lawyer can use your demand to push for fair value.

Initiate a bad faith lawsuit if necessary

Check the insurer’s reply after 60 days. Assess if they fix the breach of the insurance contract or pay damages. Initiate a bad faith insurance lawsuit if they deny valid claims or delay payment.

Hire a consumer protection lawyer or litigation and appeals lawyer to start the case. Seek compensatory damages for economic loss, interest, attorneys’ fees, and personal injuries.

Ask the court for punitive damages when you spot fraud or misrepresentation of policy language.

Recruit all claim denials, demand letters, and your insurance policy to build proof. Present your case under state laws before the statute of limitations runs out. Win a judgment that forces the insurance company to honor contractual obligations.

When to Consult an Attorney

If your insurance company drags out your claim past the time limit or shrugs off your final demand letter, call a lawyer to fight for punishment pay—read on.

Benefits of legal representation in bad faith cases

Legal help can force an insurer to share hidden evidence. A Florida bad faith insurance attorney digs through files and policy logs. They team with insurance adjusters to spot false statements.

They review claim denial letters for breach of contract. A lawyer sends a final demand letter and files a bad faith lawsuit. They seek punitive damages when the insurance company hides facts.

This step shields your legal rights under auto insurance, health insurance, or life insurance.

An attorney knows state laws and the statute of limitations. They fight insurance fraud and stop threatening statements. They speed up valid claims in a first party claim. They gather documents, witness notes, and medical records.

These steps force the insurer to honor contractual obligations. You get clear legal advice and sidestep court mistakes.

Takeaways

Your fight matters. Log every call with an insurance adjuster and note each promise or stall. Call their bluff with a clear demand letter. File a complaint with the Department of Insurance if they dodge you again.

Tap an insurance lawyer when they twist your policy terms. Stand firm, you can win and claim the damages you deserve.

FAQs on Insurance Company Acts in Bad Faith

1. What is bad faith insurance?

Bad faith insurance is when an insurer denies a valid claim, twists policy words, or misses deadlines. It breaks the insurance contract. It can hurt your health insurance, life insurance, business insurance, or liability insurance, and cut your legal rights.

2. How do I spot bad faith tactics?

Look for claim denial without a valid reason, low settlement offers that ignore comprehensive coverage, or threatening statements from insurance adjusters. If the company ducks questions, that is a red flag. That shows misrepresentation of law.

3. What steps do I take if I face wrongful claim denial?

Read your insurance contract. Write a demand letter, state facts clearly. Send it by mail or email, keep a copy. You can file a complaint with your state insurance commissioner.

4. When should I seek legal advice?

Call a consumer protection lawyer or a litigation and appeals lawyer if the insurer ignores your demand or fights to dodge a fair settlement. A lawyer can spot insurance fraud or bad faith insurance, and help you seek punitive damages.

5. What damages can I get for bad faith insurance?

You can ask for your claim amount, punitive damages, and attorney’s fees. You can seek interest and costs under state laws or california law, if it fits. You might join class actions for similar bad faith tactics.