Many users ask how to use torrid credit card on app when they face problems with mobile payments. The app works with comenity bank and performs an additional security check to protect your details.

We show you ways to pay bills, review loyalty points, and grab app-only deals while you shop for leggings. Read on.

Key Takeaways

- The Torrid App uses Comenity Bank for extra security.

- You can download the app from the App Store or Play Store.

- Logging in needs your Torrid Credit Card account details and a quick check via d.comenity.net.

- The app lets you make one-time and automatic payments, view rewards, and grab special deals.

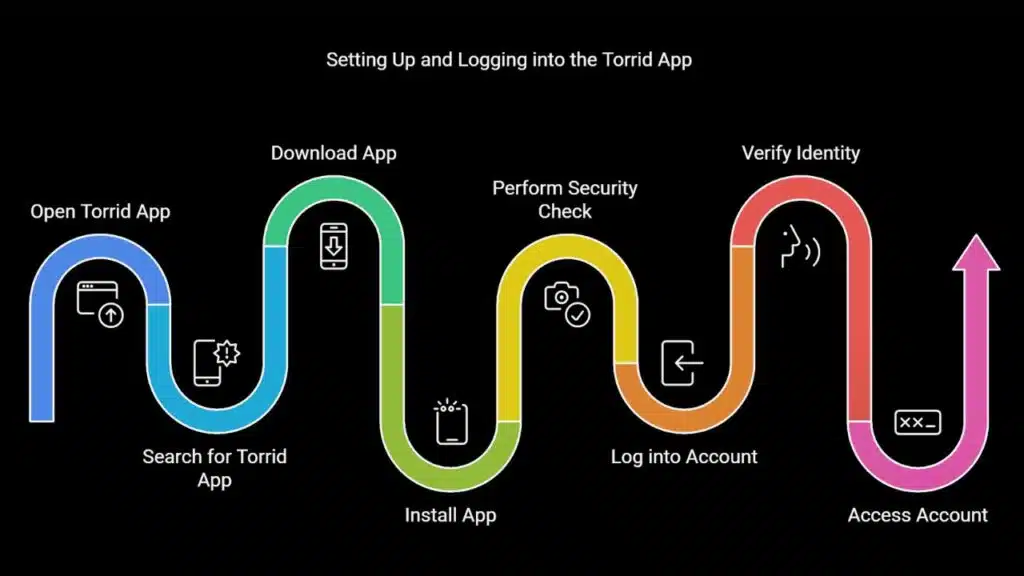

Setting Up the Torrid App

Open the Torrid App on your phone and follow simple steps like a quick stroll in the park. Sign in to your Torrid Credit Card account and pass a fast additional security check through Comenity Bank at d.comenity.net to get your financial services rolling.

Downloading and installing the app

Torrid app lets you use your Torrid Credit Card on your phone. It makes simple tasks safe and quick.

- Use your smartphone to access the App Store or Play Store.

- Type “Torrid” into the search bar to find the app.

- Tap download and start the process immediately.

- Wait as the app installs on your device.

- Watch for pop-up messages that show an additional security check.

- Check d.comenity.net for more safety details.

- Enter your Torrid Credit Card login info when prompted.

- Accept the steps that show you the way to finish the setup.

- Comenity Bank backs these financial services with strong support.

Next, explore managing payments with the app.

Logging into your Torrid Credit Card account

The app installation is complete. Next, log into your account to use your torrid credit card features.

- Open the app and tap the login option.

- Type your username linked to your account.

- Enter your password in the provided field.

- Confirm your details to start the authentication process.

- Answer an additional security check that pops up.

- Follow prompts from d.comenity.net to verify your identity.

- Wait for a secure connection with comenity bank to load your account.

Managing Payments Through the App

Make a quick single transfer or set up recurring ones to pay your Torrid Credit Card from the app. Comenity Bank backs these moves with an additional security check, and more smart tips await as you continue reading.

Making one-time payments

Torrid Credit Card users can pay their bills with a single tap. The process stays simple and secure.

- Launch the Torrid app on your phone and tap the payment option.

- Sign in with your Torrid Credit Card details provided by Comenity Bank.

- Enter the amount you want to pay in one go.

- Check for an additional security check that keeps your data safe.

- Tap the submit button to finish your one-time payment.

Next, explore how to set up automatic payments.

Setting up automatic payments

Set automatic payments fast. This process runs smooth and simple.

- Open the app and tap the payment menu.

- Tap the auto-pay setup option.

- Pick your pay date that best fits your budget.

- Choose the amount for each payment.

- Add your Comenity Bank details when asked.

- Confirm settings to start automatic payments.

How to Pay Your Torrid Credit Card Online

Pay your Torrid credit card online fast. This guide helps you get it done.

- Open the Torrid mobile app to check your card details.

- Log in with your account credentials to view your balance.

- Tap the payment option for one-time payment.

- Enter the amount you want to pay in the field provided.

- Press the submit button to send your payment online.

- Watch the screen update with your new balance and reward points.

- Tap the deals spot to grab app-only offers and discounts.

Explore how to track rewards and points next.

Tracking Rewards and Points

The app shows your earned bonus credits on a handy dashboard. Tap a button to check for updates and see how close you stand to a new treat.

Viewing loyalty points

The Torrid credit card app lets you view loyalty points easily. Check your rewards quickly in the mobile app.

- Tap the Rewards icon to display your points total.

- See your points shown in large, clear numbers.

- Watch how your points update in real time.

- View a graph that shows your points growth over time.

- Get tips on how to earn more rewards directly in the app.

- Find a list of rewards available for your points.

Redeeming rewards directly from the app

Redeeming rewards is simple on the app. The process works fast and gives clear choices.

- Open the mobile app from your phone screen.

- Tap the Rewards icon to see available offers.

- Check your point total that appears in real time.

- Pick a reward from the list that fits your needs.

- Verify details on the screen and tap to confirm.

- Get a message that your reward has been activated.

Exclusive App Features

The app gives you exclusive in-app offers and price cuts that boost your budget. You can view your purchase record in clear, quick steps to track spending details.

Accessing app-only deals and discounts

Deals on this app help you save money. Extra rewards come with each special offer.

- Tap the deals icon on your home screen to view discounts.

- Swipe to find offers made for Torrid Credit Card users.

- Check extra rewards in the special section for savings.

- Scan a QR code to claim a discount instantly.

- Watch for flash deals that appear every week.

- Shop with your credit card and use a one-click redemption.

- Earn bonus points when you take advantage of these deals.

Monitoring transaction history

After checking app-only deals, you can view transactions with ease. The app shows clear details of each payment.

- Tap the transaction screen to see your record list.

- Scan each entry for the date, amount, and merchant name.

- Check status markers to know if payments are cleared or pending.

- Sort the list by date so you see the latest actions first.

- Search for keywords to quickly locate a particular transaction.

Takeaways

Enjoy the app’s new features. Manage payments with quick taps. Track rewards and points on your device. Experience smooth credit card control today.

For more detailed instructions on making online payments, visit our guide on how to pay your Torrid Credit Card online.

FAQs

1. How do I add my Torrid credit card on the mobile application?

You open the mobile app and navigate to payment settings. Next, you enter your credit instrument details. This step plays out like following a short map to a small treasure. You tap, type, and the card is on board.

2. How do I check my balance when I use the Torrid credit card through the app?

The mobile app shows a clear balance view. You tap the balance section and see recent spendings, alerts, and a neat summary. It works like carrying a mini bank in your pocket, simple and quick.

3. What support options does the mobile application offer for using my Torrid credit card?

The mobile app provides quick tips and a guide section. At times, you can start an in-app conversation with a helper. This is like having a friendly mechanic when your engine hesitates. It simplifies the process, making each step clear.

4. What should I do if the mobile app does not accept my Torrid credit card?

First, try restarting the mobile application or rechecking your card data. Sometimes the system stumbles, much like a hiccup in everyday life. A short pause and a re-entry of details often fix the glitch. This way, your payment tool gets back on track.