Car insurance can feel like a money pit. Many Australians pay steep premiums, leaving less cash for other needs. If you drive less or are on a tight budget, these costs can hurt even more.

Did you know switching policies could save hundreds of dollars each year? Some people pay over twice as much as they need to by sticking with the same insurer too long.

This guide will share simple tips to lower your car insurance in Australia. Save money without sacrificing coverage! Keep reading for easy ways to cut costs.

Comparing Car Insurance Rates in Australia

Transitioning from understanding why car insurance premiums can sometimes feel steep, it’s crucial to learn how to find better deals. Comparing rates is like shopping for the best fruit at the market. You need to weigh options, look for discounts, and read the fine print. Here’s how it stacks up:

| Step |

Description |

Key Benefit |

|---|---|---|

| 1 | Shop online for policies. | Online discounts can save you a fixed amount or even percentages off premiums. |

| 2 | Use comparison websites. | They make it simple to review multiple insurers quickly. |

| 3 | Check for Safe Driver Discounts. | Providers reward good drivers with lower rates or No Claims Bonuses. |

| 4 | Look for pay-as-you-drive options. | Ideal for those clocking low mileage, saving money if driving is limited. |

| 5 | Read the Product Disclosure Statement (PDS). | Ensures you know what you’re paying for and avoid unnecessary costs. |

| 6 | Consider combined policy discounts. | Bundling car and home insurance can lower total premiums. |

| 7 | Compare annual versus monthly premiums. | 48% of providers allow monthly payments, but annual can save more. |

No two people have the same needs, so finding the right balance is key. Use these steps to make smarter decisions without wasting time or money.

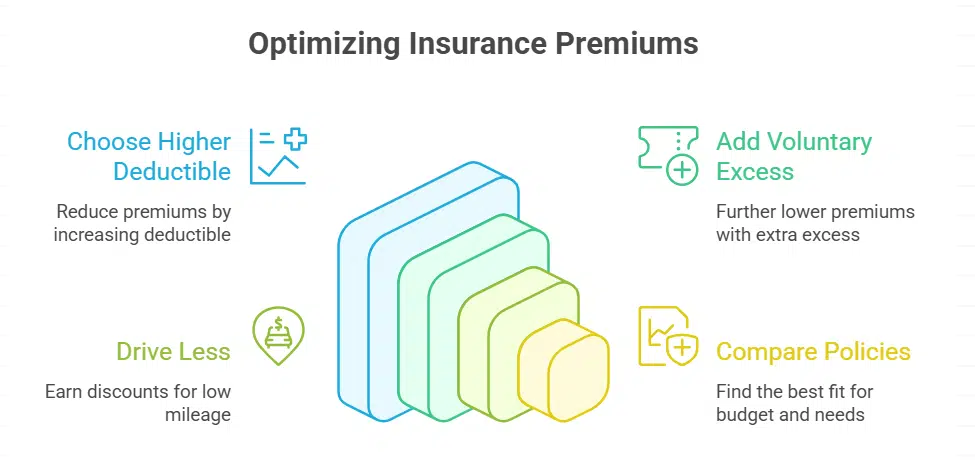

Opting for Higher Deductibles

Choosing a higher deductible can shrink your insurance premiums fast. Adding a voluntary excess on top of the standard amount brings even more savings. For drivers who don’t mind larger out-of-pocket costs, this is a smart move.

It works best if you’re confident about not making frequent claims.

Insurers often reward low-mileage drivers with extra discounts. So, be honest about your driving habits during the claims process. Compare policies carefully to find options that fit your budget and needs.

Keep in mind, raising deductibles might also avoid premium hikes after filing any claim at renewal time. Assess risks wisely before picking this route!

Choosing Annual Premium Payments

Opting for higher deductibles can save money, but how you pay matters too. Paying annually often costs less than monthly payments. Insurers may offer discounts for annual premium payments.

Monthly payment plans can include extra fees or interest. Avoid these added costs with a single yearly payment. It simplifies budgeting and reduces total expenses over the policy term.

Sustaining a Good Driving History

A clean driving record keeps car insurance costs down. Avoid accidents and traffic violations to stay eligible for discounts. Insurers often reward safe drivers with No Claims Bonuses.

These rewards grow every year without a claim but might stop increasing after several years.

Being cautious earns trust from insurance companies, lowering risk assessments. Let’s face it: fewer claims mean less stress and more savings over time. One slip-up can raise premiums, so play it safe on the roads!

Safe driving doesn’t just protect you; it protects your wallet too.

Restricting Policy Access to Fewer Drivers

Limiting drivers on your policy lowers risk. Fewer people driving means fewer chances for accidents. Insurers see this as less risky, which can reduce premiums.

Allowing only experienced and safe drivers helps, too. More permissions add more risk to insurance companies. Keep the list small, and choose carefully who gets access. This simple step keeps costs down while boosting security.

Combining Multiple Insurance Policies

Fewer drivers on your policy can save money, but combining insurance policies takes it a step further. Bundling car and home insurance with one insurer often earns discounts. Some companies, like GIO, provide deals when you pair both policies.

Managing multiple premiums becomes easier with combined coverage. Switching insurers? Mention your current provider for better savings offers. Discounts depend on the types of plans bundled, so check options carefully to maximize premium cuts while keeping good coverage.

Valuing Your Car at Market Rate

Bundling policies can save money, but so can valuing your car at market rate. Insuring for market value often lowers premiums compared to agreed value coverage. Market value reflects what your car is worth today, not a pre-set amount.

This option works well if cost-saving matters more than fixed payouts during claims. Always check the Product Disclosure Statement (PDS) closely to understand this coverage. It’s a smart choice for reducing premium costs while still keeping basic protection intact!

Securing Your Vehicle in Safe Locations

Parking your car in a garage can make a big difference. Insurers often reward safe vehicle storage with lower premiums. Keeping a car off the street reduces risks like theft or damage.

Adding safety features helps even more. Alarm systems and immobilizers discourage thieves. Some insurance companies offer discounts for these upgrades. A well-secured vehicle means fewer worries and potential savings.

Cutting Down on Car Usage

Driving less can lower your insurance premiums. Many insurers offer discounts for reduced mileage or pay-as-you-drive plans. These policies charge based on how much you drive, saving you money if you keep trips short or rare.

Safe driving habits also improve your record and reduce risks. Using secure parking areas can encourage less frequent car use too. Insurers reward low-risk behaviors with cost savings, so every mile skipped could mean more cash in your pocket.

Selecting Essential Extras for Car Insurance

Adding extras to your car insurance can be helpful. But, it’s smart to choose only what you truly need to save money.

- Roadside assistance can ease worries about getting stuck. It often covers towing or jump-starting your car.

- Rental car coverage is handy if your car gets damaged. This pays for a temporary ride while yours gets fixed.

- Windscreen protection saves trouble after cracks or chips. Some policies may not include this by default but adding it avoids high repair costs.

- Gap insurance helps if you owe more than your car’s current value after an accident. It covers the difference and stops debt headaches.

- Uninsured driver coverage protects you if hit by someone without insurance. This saves you from legal battles and extra losses.

- Fire and theft cover adds security against unexpected damage or loss of property due to a fire or break-in.

- Personal belongings coverage protects items like laptops in the car that could get stolen during an incident.

- Accident forgiveness ensures rates won’t increase after small mishaps on the road, which can prevent future premium hikes.

- Comprehensive add-ons shield against non-collision damage like hailstorms, floods, or vandalism that may impact repair expenses.

- Liability booster increases limits for third-party harm protection, giving peace of mind in major accidents with costly claims.

- Choosing benefits like no-claims bonuses reduces premiums over time, rewarding cautious driving habits.

Evaluating Car Models for Insurance Affordability

Evaluating your car model’s impact on insurance costs can save you a small fortune. Some cars naturally attract lower premiums. Others can leave your wallet gasping for air. To make smarter choices, here’s a quick breakdown:

|

Factor |

How It Affects Insurance |

Example |

|---|---|---|

| Car Make & Model | Luxury or sports cars often cost more to insure due to expensive repairs. | A BMW 3 Series costs more to insure than a Toyota Corolla. |

| Age of the Car | New cars may have higher premiums due to their value, but safety features can offset costs. | A 2023 model with lane assist will often cost less than a 2010 model with no safety tech. |

| Safety Ratings | Cars with higher safety ratings typically qualify for lower premiums. | A Subaru Outback, with a 5-star safety rating, may be cheaper than a less secure model. |

| Engine Size | Bigger engines mean higher speeds and greater risk, leading to pricier coverage. | A 1.5L engine costs less to insure than a 3.0L engine. |

| Car Value | More expensive cars result in higher premiums due to replacement costs. | A $30,000 car will cost more to insure than a $10,000 car. |

| Theft Risk | Cars prone to theft often have higher premiums, even with alarms installed. | A Toyota Hilux may be pricer to insure compared to less popular models. |

Understanding these factors can help avoid surprises. Smart research on models can trim your premiums. Always weigh your options before you sign the dotted line.

Takeaway

Cutting your car insurance costs in Australia is easier than you think. Compare rates, pick higher deductibles, and keep a clean driving record. Pay yearly if possible, bundle policies, or reduce drivers on your plan.

Protecting your car and using it less can also help. Small steps today lead to big savings tomorrow!

FAQs on Tips To Lower Your Car Insurance Premiums In Australia

1. How can I lower my car insurance premiums in Australia?

You can reduce your premiums by comparing policies, driving safely, and choosing a higher excess. Parking your car securely and bundling policies also help.

2. Does the type of car I drive affect my insurance cost?

Yes, it does. Expensive or high-performance cars usually have higher premiums due to repair costs or theft risks.

3. Will reducing my annual mileage save me money on insurance?

Driving fewer miles often lowers your risk of accidents, which may lead to cheaper premiums.

4. Can adding safety features to my car make a difference?

Absolutely! Features like anti-theft devices or advanced braking systems can cut down your premium costs significantly.