Imagine a travel business firing on all cylinders, customers snapping up exotic tours, cozy hotel stays, and last-minute flights, with payments gliding through effortlessly. That’s the promise of a travel merchant account, a tailored payment solution that keeps the wheels of online bookings spinning. But here’s the rub: getting approved isn’t a cakewalk. Payment providers often view travel companies through a skeptical lens, rattled by high stakes, international reach, and the specter of chargebacks.

The approval process can feel like a maze, but it’s far from impossible. With a handful of smart strategies and insider tricks, travel businesses can unlock this vital tool and set the stage for growth. This post maps out the path to success step by step.

Why It’s Tricky

Travel merchant account aren’t your average payment setup. The industry’s profile thinks hefty transactions, global customers, and a rollercoaster of bookings put providers on edge. They’re looking for rock-solid proof that a business won’t flake under pressure. Grasping these concerns is half the battle; the other half is showing them a travel operation that’s built to last.

Foundation Plays: Laying the Groundwork

Approval hinges on a few must-do moves that signal reliability:

Play 1: Craft a Trustworthy Image

A slick, functional website is the first handshake. Active phone numbers, email support, and clear refund terms tell providers this isn’t a fly-by-night gig. A patchy online presence? That’s a fast pass to rejection.

Play 2: Prove Financial Grit

Money talks, and providers listen. Recent bank statements, tax returns, or sales reports flash a neon sign of stability, showing the business can handle big volumes and bounce back from hiccups.

Play 3: Neutralize Risks

A proactive stance on fraud and disputes seals the deal. Secure payment systems, fraud-detection software, and a watertight cancellation policy prove the business won’t let risks run wild.

Outpacing the Pack

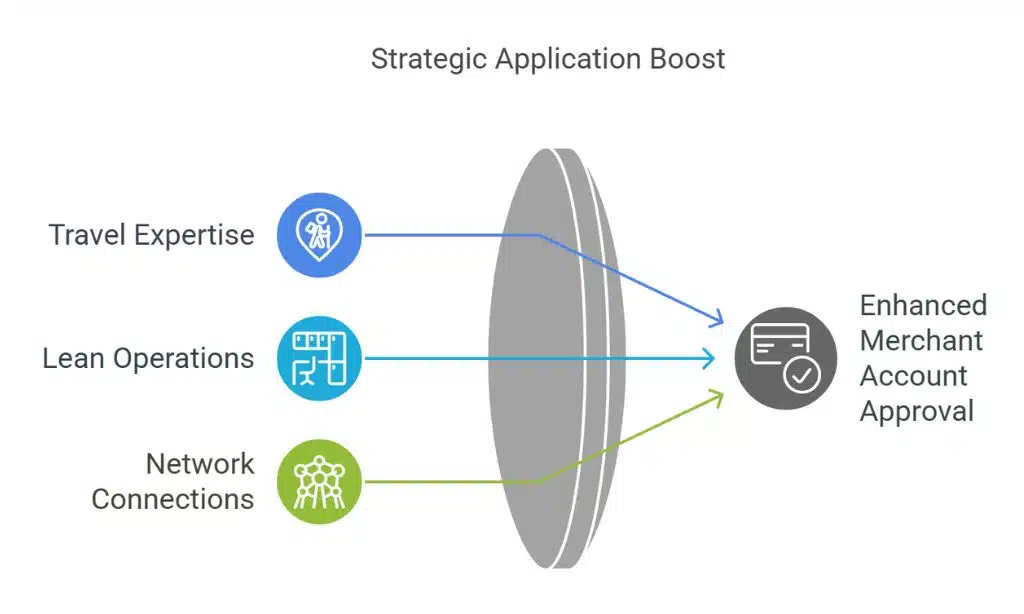

Some under-the-hood tactics can give an application extra oomph:

Boost #1: Hunt for Travel Experts

Not every provider gets the travel vibe. Zeroing in on ones who specialize in the industry cuts through the noise; they’re more likely to greenlight a travel merchant account.

Boost #2: Start Lean, Grow Big

Fresh outfits might spook providers with sky-high requests. Asking for modest limits at first builds a track record, paving the way for bigger asks later.

Boost #3: Tap Connections

A shoutout from a bank, trade body, or industry pal acts like a backstage pass, nudging providers to take the application seriously.

Red Flags: Sidestepping Slip-Ups

Even a strong case can tank with careless errors. Watch for these:

- Messy forms with blanks or typos scream amateur hour; every line needs to shine.

- Dodging a bumpy chargeback past looks shady; owning it with a cleanup plan builds trust instead.

- Wild sales guesses raise eyebrows; stick to data-backed figures that hold water.

Plan B: Bouncing Back From a Rejection

A “no” isn’t curtains. Digging into why it flopped, tightening the weak spots, and pitching to a new provider can turn the tide. Each try hones the approach, inching closer to that yes.

Once a travel merchant account is in hand, the benefits stack up fast. Global payment options, beefy fraud protection, and tools to upsell extras like travel perks become standard gear. It’s a launchpad for reaching more customers and raking in more cash.

Conclusion

Landing a travel merchant account isn’t a lottery ticket; it’s a prize earned through grit and strategy. With a polished image, airtight financials, and a knack for dodging pitfalls, travel businesses can flip the script on a daunting approval process. This isn’t just about clearing a hurdle; it’s about grabbing a tool that turbocharges operations, wins customer loyalty, and carves out a spot at the top of the travel game. The road might twist, but the destination,a payment system primed for success is worth every ounce of effort. For travel companies ready to thrive, this is the moment to make it happen.