Are you trying to figure out how South Korea’s fintech stacks up against big players like Japan and China? You might wonder about things like investments, stock market moves, or even why certain apps appear in business news every day.

With so much talk on LinkedIn and Twitter about new trading tools, it can feel confusing. People want smart ways to use their individual savings accounts, cut risks in markets, and spot the next big thing for investment funds.

Here’s a fact: since 2014, South Korea’s Financial Services Commission has pushed hard for strong fintech growth. Today, nearly 600 fintech companies work with fast internet access and massive smartphone use.

In this post, we break down five clear metrics that show how Korean fintech compares using sector allocation, shareholder value focus, asset management trends from index funds to hedging tactics.

Stick around—these numbers could change what you think about emerging markets!

Metric 1: Market Size and Adoption Rates

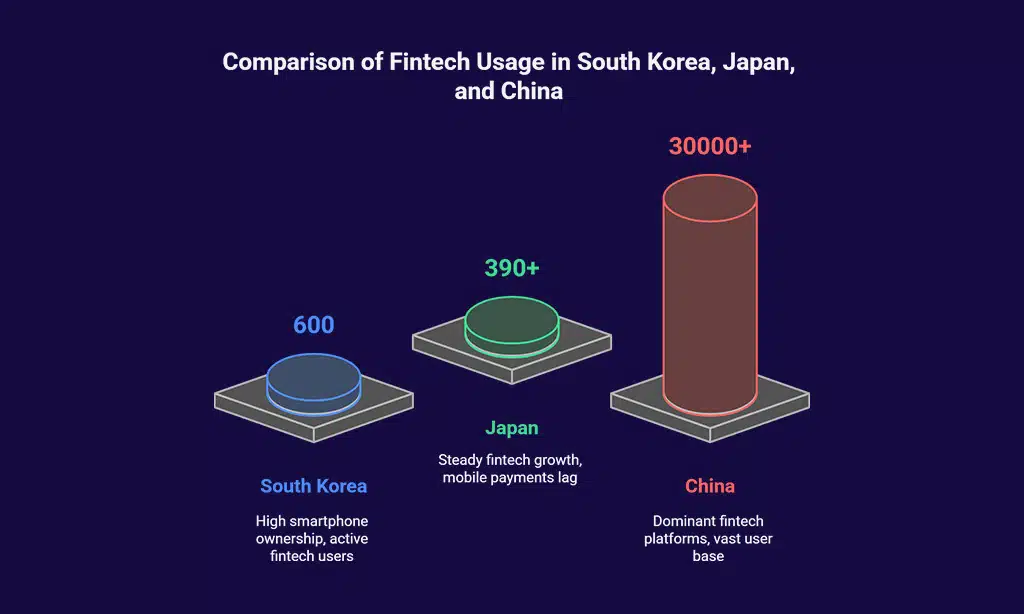

Shifting gears from the introduction, the real action starts with market size and how folks are actually using fintech. The table below lays out the story, comparing South Korea, Japan, and China by the numbers.

| Country | Registered Fintech Companies | Mobile Payment Daily Transactions | Major Fintech Platforms & Users | Smartphone Ownership Rate | Daily Internet Usage (%) |

|---|---|---|---|---|---|

| South Korea | 600

(2024) |

875.5 billion won

(2024) |

KakaoBank: 23+ million usersToss: 28 million members, 19 million active monthly | 97.8%

(Highest globally) |

93% |

| Japan | 390+

(Estimated 2024) |

About 250 billion yen

(2024, estimated) |

PayPay: 60 million usersLINE Pay: 40+ million users | 78% | 94% |

| China | 30,000+

(Estimated 2024; includes a mix of big and small players) |

Over 1.8 trillion yuan

(2024, estimated) |

Alipay: 1.3 billion usersWeChat Pay: 1.1 billion users | 68% | 75% |

- South Korea stands tall on smartphone ownership, nearly everyone’s got one.

- Daily mobile payment volume in Korea hit 875.5 billion won, up from 761 billion won last year. Staggering jump.

- KakaoBank and Toss lead in active accounts, both with millions of loyal users.

- Japan’s fintech growth feels steady, but mobile payment totals lag behind Korea, despite big platforms like PayPay and LINE Pay.

- China’s numbers are off the charts, with titans like Alipay and WeChat Pay. But, their daily internet usage trails South Korea and Japan.

- South Korea’s 93% daily internet rate means almost everyone’s plugged in, ready to pay with a tap.

Smartphones in hand, Koreans move cash in seconds. The pace isn’t slowing down.

Metric 2: Regulatory Environment and Government Support

South Korea keeps its fintech sector moving with smart rules and strong help from the government. The Financial Services Commission (FSC) has pushed changes since 2014, making life easier for companies that handle equities, securities, and new digital tools.

In April 2019, the FSC rolled out a Regulatory Sandbox Program. This bold move allowed over 200 projects to test out their ideas without jumping through every hoop right away. Some might say this was fintech’s training wheels phase—safe but fast.

The Ministry of SMEs and Startups joined in too; since 2017, it has supported fresh business news networks and small firms as they grow.

Open banking came online in 2019; banks now work smoother together so users can check all accounts at once—even pension balances or stock funds—from one app. Fintechs followed clear investment guidelines set by the regulators to manage risks like market value swings or privacy snags.

In March 2021, tough new rules made virtual asset service providers report transactions to fight money laundering under the revised Act on Reporting and Using Specified Financial Transaction Information.

Dividends got more attention as part of good corporate governance along with environmental, social, and governance standards—helping asset allocation stay fair across sectors like trading volume or markets risk tied to indexes such as MSCI Emerging Markets or Nikkei 225.

Metric 3: Technological Innovation and Infrastructure

Korea’s R&D spending as a slice of GDP leaves many neighbors eating its dust. The country pours big bucks into smart tech, beating China and Japan in percent spent. Digital trading volume shot up fast too; think of online banking at 83.2% in early 2024, way above last year’s 79.8%.

Old school? Fewer folks walk into physical bank branches, only about 4.1% did so back in 2020, with ATMs barely used by just 11% this year.

KakaoTalk holds the keys to the digital city; it reaches 96.1 out of every hundred internet users nationwide, acting like a superapp for messaging and money alike—almost like Facebook but more hands-on for finance.

Government loves to fuel fresh ideas here as well, pushing startups ahead while rewarding innovation that fits environmental or social needs. Tokyo Stock Exchange investors may chase better book value or dividend yielding stocks; Korean fintech firms often aim their rockets right at new infrastructure tools and sharp portfolio management services instead.

Metric 4: Investment and Funding Opportunities

Funding shapes growth, no two ways about it. Here’s how South Korean FinTech funding stands next to Japan and China, in plain sight.

| Country | 2023 Total Venture Investments (USD) | FinTech Startup Funding, 2020-2023 | Major Funds or Programs | Startup Ecosystem Valuation | Support Centers & Hubs |

|---|---|---|---|---|---|

| South Korea | Approx. $4.22 billion (5.39 trillion KRW) | $377 million (KRW 513.3 billion) |

|

$237 billion (Seoul, 2021-2023) | Seoul Startup Hub, Scale-up Center |

| Japan | Approx. $6-7 billion | Lower relative FinTech startup funding than Korea* |

|

Tokyo’s ecosystem at ~$62 billion | Tokyo Startup Gateway, Samurai Incubate |

| China | Over $30 billion | Largest FinTech deals in Asia* |

|

Beijing’s ecosystem exceeds $320 billion | Zhongguancun Science Park, Tsinghua x-lab |

Japan and China figures reflect estimates and recent public reports for 2023-2024.

South Korean startups tapped KRW 513.3 billion in FinTech funding between 2020 and 2023. No small potatoes. The Seoul Startup Hub Scale-up Center helps connect founders with global investors. The Fintech Innovation Fund recently doubled, reaching $781 million. It’s a shot in the arm for local disruptors.

Seoul’s startup ecosystem, boasting a $237 billion valuation, sits high among Asia’s capitals. China’s figures look like a mountain, with mammoth deals and state-backed investment, but heavy regulation can spook smaller players. Japan’s pace is steady, with a handful of major programs, yet remains less heated in venture capital and risk investment for FinTech.

In short: South Korean FinTech funding looks healthy, growing, and ready for bold ideas. So, what’s your take—would you back a local upstart, or place your chips on the heavyweights?

Metric 5: Talent Pool and Startup Ecosystem

South Korea’s talent pool is growing fast. The Seoul Fintech Lab houses 82 startups. This lab recently opened a second location. Tenity helps these startups grow through partnerships and accelerator programs.

This support boosts the chances for success in the fintech sector.

The country has seen fintech startups quadruple over nine years, hitting 592 by 2022. South Korea ranks third in Asia for banking and insurance markets, showing strong interest from investors too.

The Seoul Unicorn Startup Hub aims to create 60 unicorn companies by 2030, which speaks volumes about its ambition in shaping the startup scene. Companies here are getting better at meeting market demands and improving customer service, thanks in part to a skilled workforce focused on technology and innovation.

Key Strengths and Weaknesses of Korean FinTech Compared to Japan and China

Here’s a quick peek at where Korean FinTech shines, and where the shoes still pinch, stacked up next to Japan and China.

|

Aspect |

South Korean FinTech |

Japanese FinTech |

Chinese FinTech |

|---|---|---|---|

| Digital Adoption | 97% digital adoption.Daily use by 67% of digitally active adults.

Cities like Seoul buzz with QR payments and P2P lending. |

Slow to pick up digital wallets.Many still love cash and old-school cards.

Adoption lags behind neighbors. |

Nearly 90% adoption rate.Alipay and WeChat Pay rule daily life.

Rural and urban use alike. |

| Regulatory Support | Sandbox for FinTech launched.Government bets big on tech innovation.

Favors quick pivots. |

Cautious regulators.Rule changes are slow as molasses.

Tradition guides policy. |

Beijing steers with a strong hand.Clear push for self-reliance post-2025 plan.

Policies can shift fast. |

| Technological Edge | 60 years from rice fields to a top-14 global economy.Home to tech titans like Samsung.

AI and blockchain getting more heat. |

Once a kingpin in patents.Now sees slipping R&D spending.

Innovation engine stalling. |

Massive leap with mobile payments.Tech giants thrive, supported by a local user base.

“Made in China 2025” drives everything. |

| Funding & Investment | Venture capital up.Startups attract local and global investors.

Still not at China’s scale. |

Investors play it safe.Fewer unicorns coming out.

Old banks dominate. |

Giant investment pools in play.Alibaba and Tencent fuel the scene.

International capital flows. |

| Talent & Startups | Young, tech-hungry grads flow into FinTech.Thriving startup base.

Government training programs bolster skills. |

Shrinking youth population.Skilled labor shortage bites.

Older talent pool. |

Churns out engineers at scale.Startup output is jaw-dropping.

Fierce talent competition. |

Next, let’s look at how these strengths and gaps shape the future of Korean FinTech.

Takeaway

Korean FinTech has shown great growth compared to Japan and China. Its market size and user rates are impressive, thanks to strong government support. The tech scene is buzzing with startups like KakaoBank and Viva Republica leading the charge.

With smart regulations in place, South Korea creates a safe space for innovation. Think about how you can act on these lessons in your own work or investment choices! Explore more about these trends and see how they affect your area of interest.

Keep pushing forward; the future holds exciting possibilities for all in FinTech!