Finding good health insurance in Brazil can feel like a maze for foreign nationals and digital nomads. The public healthcare system, SUS, gives free medical services to everyone and ANS sets rules for private medical insurance.

This guide shows ten providers that cover emergency care, outpatient services, and specialist treatments in private hospitals. Read on.

Key Takeaways

- Plans from Amil Saúde, SulAmérica Saúde, and Porto Seguro Saúde cost R$300–800 per month (US$55–150) and include outpatient, emergency, and specialist care.

- Unimed links over 9,500 doctors and 400 facilities nationwide, follows ANS rules, and uses SUS for referrals.

- Cigna Global’s Gold Core plan offers a US$2 million annual benefit, while IMG caps payouts at US$5 million with deductibles from US$250–10,000.

- Hapvida and Biovida use dense networks and digital portals for telemedicine, quick claims, and preventive‐care alerts.

- Every provider must meet ANS standards and often ties with SUS, giving expats and digital nomads fast private care.

Amil Saúde

Millions of Brazilians pick Amil Saúde for fast, private coverage. Private plans cost between R$300 and R$800 per month, roughly US$55 to US$150 for basic protection. Members can access outpatient services and emergency care without long lines in public hospitals.

This major Brazilian insurer links to the Sistema Único de Saúde (SUS) for smooth referrals.

Amil also invests in telemedicine tools to help members connect with a general practitioner late at night. You can hop on a video call like you would chat with a friend; that saves time and money.

Secure digital identity keeps medical records at your fingertips. The app flags pre-existing conditions and tracks preventive care checkups. These alerts keep policyholders on track with primary care visits and shield budgets from big bills.

SulAmérica Saúde

SulAmérica Saúde ranks high among health insurance companies in Brazil. This insurer acts like a safety net for families and digital nomads in Rio de Janeiro. Plans cost R$300-800 a month, USD $55-150, mirroring common healthcare costs in Brazil for basic medical care.

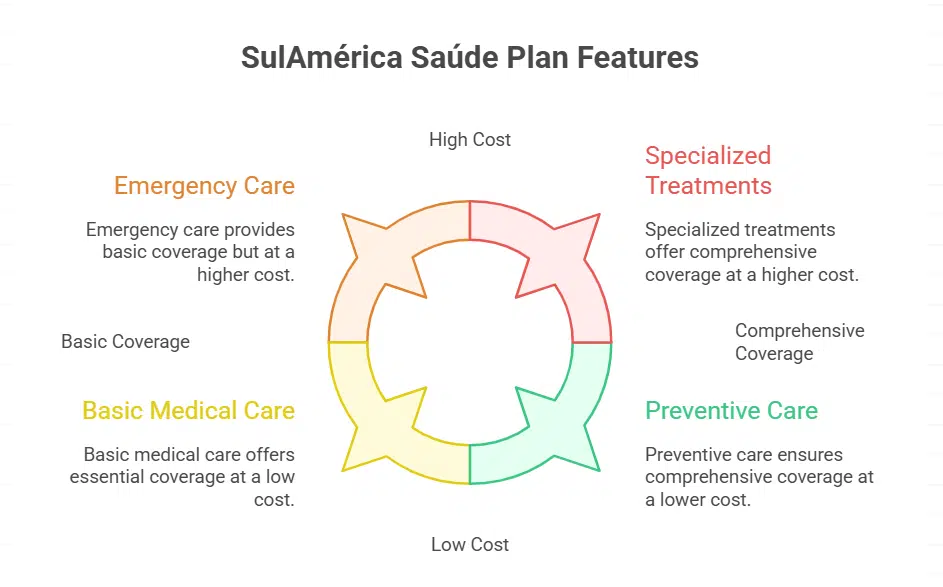

Coverage spans outpatient services, emergency care, and specialized treatments. Clients also get preventive care and access to a wide pharmacy network.

Customers tap the sistema único de saúde (sus) for major procedures, so they pay less out of pocket. Users praise the telemedicine system for quick doctor visits, rain or shine. One tech freelancer said she got medical care in minutes, no traffic jams.

This package suits expats and remote workers who juggle travel insurance and health insurance for expats in one plan. The policy uses a human resource information system to track claims and co-payments.

Unimed

Unimed ranks as Brazil’s top health insurer, joining cooperatives in every region. Its network features over 9,500 medical professionals, 400 care facilities, and a broad reach across states.

Readers tap Unimed for broad healthcare services in brazil, from checkups to major scans. Members get preventive care, outpatient services, emergency care, and links to the public sistema único de saúde, known as SUS.

It follows rules from the national supplementary health agency, ANS, to meet high standards.

Foreign residents find health insurance for expats with Unimed. Plans vary by city and by age, so clients can pick lower premiums or larger networks. Annual healthcare costs in brazil often include extra fees, but Unimed helps cut bills with in-network discounts.

It plays like a safety net for sudden flus or bigger scares. Many expats praise its medical professionals.

Hapvida Saúde

Hapvida Saúde has one of the densest provider networks in Brazil. It covers hospitals, clinics, and labs from the Amazon to Rio de Janeiro. Private plans from Hapvida speed people through emergency care and outpatient services, beating the public Sistema Único de Saúde, or SUS.

That speed can cut long waits into quick visits. The National Supplementary Health Agency, or ANS, regulates all policies in Brazil. Plans must meet strict rules on coverage. English-speaking professionals appear in key cities to help expat patients.

Network density also lowers healthcare costs in Brazil, since more clinics compete on price.

Many expats ask how health insurance for expats policies handle pre-existing conditions. Clinics in Sao Paulo and Brasilia treat most chronic cases under ANS rules on healthcare in Brazil.

Patients with diabetes or asthma find prompt tests and routine checkups. Staff often chat in English, easing stress for travelers and remote workers. A friend of mine who works remotely in Salvador got a plan in days.

He calls Hapvida a lifesaver, no joke. That quick setup beats public health insurance waiting lists. Preventive care visits also fit tight schedules for digital nomads.

Biovida Saúde

Biovida Saúde rides the insurtech wave in Brazil. It targets travelers, remote workers, and digital nomads with flexible plans. The company registers with the National Supplementary Health Agency, ANS, to back its offers.

Plans cover outpatient services, emergency care, and specialized treatments. The policies set waiting periods and review pre-existing conditions before payout. Customers must check these limits to avoid coverage gaps.

The model may help cut healthcare costs in Brazil.

The online portal feels light and swift, ideal for someone on the move. It gives basic preventive care, plus emergency treatment in network hospitals. Many expats buy this international health insurance to avoid long waits in the Sistema Único de Saúde, SUS.

A quick digital claim tracker cuts red tape. Members find plan tables and coverage details in a few clicks.

Porto Seguro Saúde

Porto Seguro Saúde rivals Amil and Bradesco Saúde in Brazil. It sells plans for outpatient services and hospital stays. Combined options cover lab tests, emergency care, and childbirth.

Basic premiums run from R$300 to R$800, or $55 to $150 per month. Digital nomads use a CPF and proof of address to sign up.

All plans match the national supplementary health agency (ANS) rules. They help keep healthcare costs in Brazil fair. A traveler in Rio de Janeiro can tap local clinics, community health centers, or private hospitals.

The policy handles preexisting conditions and offers preventive care. Many clients praise this health insurance for expats as a safety net under a carnival float. They also link to fintech tools for quick claims and track medical expenses online.

Cigna Global

Cigna Global rolls out the Gold Core Hospitalization plan, a top-tier international health insurance option, with a $2,000,000 yearly benefit. It covers comprehensive cancer care, private room access, and inpatient and day patient services.

Maternity stays fit right in, with no extra fees. It balances preventive care and emergency care well, lowering healthcare costs in Brazil. Expats can add pre-existing conditions cover under this global policy.

Digital nomads find it handy, as it skirts the limits that local universal healthcare sometimes hits. The national supplementary health agency (ANS) signs off on many network clinics, even in Rio de Janeiro.

The Platinum Core option takes coverage to the next level, with no limits on mental and behavioral health care. Cancer care and all hospital services drop any caps. It offers outpatient services, emergency medical care, and specialized treatments like pediatric care.

Folks using it for medical tourism report smooth stays, from Sao Paulo to Salvador. An online portal links to providers via simple internet tools. Travelers and those who work remotely rest easy.

International Medical Group (IMG)

IMG caps payouts at USD 5,000,000 per person. It offers deductibles from USD 250 to USD 10,000. The plan covers outpatient care, emergency care, and specialist visits, serving as international health insurance.

It pays 100 percent for costs in any country. You get full in-network pay in the U.S., and 80 percent for services out of network. The portal gives 24-hour secure access worldwide.

Plans let expats and digital nomads in Rio de Janeiro use Brazil’s sistema único de saúde (SUS). Coverage spans inpatient and outpatient care, with support for pre-existing conditions.

Routine checks and preventive care get covered too, plus over-the-counter meds. The system links with HRIS tools and fintech firms to speed claims. You pay premiums that match your budget, and dodge sky-high healthcare costs in Brazil.

Now Health International

Now Health International picks a wide network of clinics across Brazil and worldwide. It gives members an easy mobile portal and online system to handle claims and appointments. The plans cover organ transplant, hospital stays, surgery, cancer treatment and evacuation or repatriation.

They also include emergency care, outpatient services and preventive care. The company handles pre-existing conditions with clear terms, so expats can find peace of mind. The group follows rules from the national supplementary health agency in Brazil, and works alongside sistema único de saúde (sus) to fill the gaps.

Digital nomads and long-term travelers love this international health insurance for expats. It taps direct links to doctors, labs and pharmacies to keep healthcare costs in Brazil down.

The firm pushes timely reimbursements and online support. Users can add routine dental treatment if they wish, since options vary by plan. This insurer uses a simple portal, much like fintech tools or a human resource information system, to keep health data in one spot.

Takeaways

You can pick a plan that covers outpatient services and emergency care. Plans from local cooperatives, national giants, and an international insurer guard against pre-existing conditions.

SUS and ANS offer public and private safety nets. Expats and digital nomads spot solid backup in these offerings. Each option moves with fintech tools to track claims and cut costs.

FAQs on Health Insurance Providers in Brazil

1. What is the best health insurance for expats in Brazil?

You can pick international health insurance plans like Cigna Global or a local insurer such as Bradesco Saúde. They work in Rio de Janeiro and beyond, and they cover emergency care and outpatient services.

2. How does the sistema único de saúde (sus) differ from private cover?

SUS gives free preventive care and emergency care to all residents. A private plan cuts wait times, adds specialized treatments, and covers outpatient services faster.

3. Can I get cover for pre-existing conditions?

Yes, some insurers offer plans that cover pre-existing conditions after a set wait period. You should compare policies from different health insurance companies and check the ANS rules.

4. How can I keep healthcare costs in Brazil low?

Choose a plan with set caps on bills for inpatient care and outpatient services. Use over the counter medications when you can. Fintech companies also offer apps to track spending and pay bills easily.

5. Will my HRIS help manage my health plan data?

Many employers link plans to their human resource information systems, so you get plan updates in one place. You just log in, consent to data sharing, and avoid extra paperwork.