Many startup founders struggle to find grants, venture capital or low-interest loans in Germany. Germany funds startups with the EXIST Business Start-Up Grant and the ERP-Gründerkredit Startgeld from Kreditanstalt für Wiederaufbau.

This guide will help you tap equity financing, public funding and tools like a funding database for your business plan. Keep reading.

Key Takeaways

- Startups at German universities can tap the EXIST Business Start-Up Grant for up to €150,000 in non-repayable funds for market research and early development.

- The ERP-Gründerkredit Startgeld from KfW offers low-interest loans for equipment, software, and working capital to early-stage ventures under the Federal Ministry for Economic Affairs and Energy.

- With the INVEST Zuschuss, the BMWi covers up to 50% of private venture capital to help startups attract angel investors and venture capitalists.

- Pro FIT gives startups in Berlin, Brandenburg, and Saxony vouchers to cover part of their consulting and R&D costs, backed by the BMWi and the European Regional Development Fund.

- BayTOU awards grants to Bavarian technology-oriented startups in machinery, automotive, electrical engineering, and medical technology for R&D and prototype testing.

EXIST Business Start-Up Grant

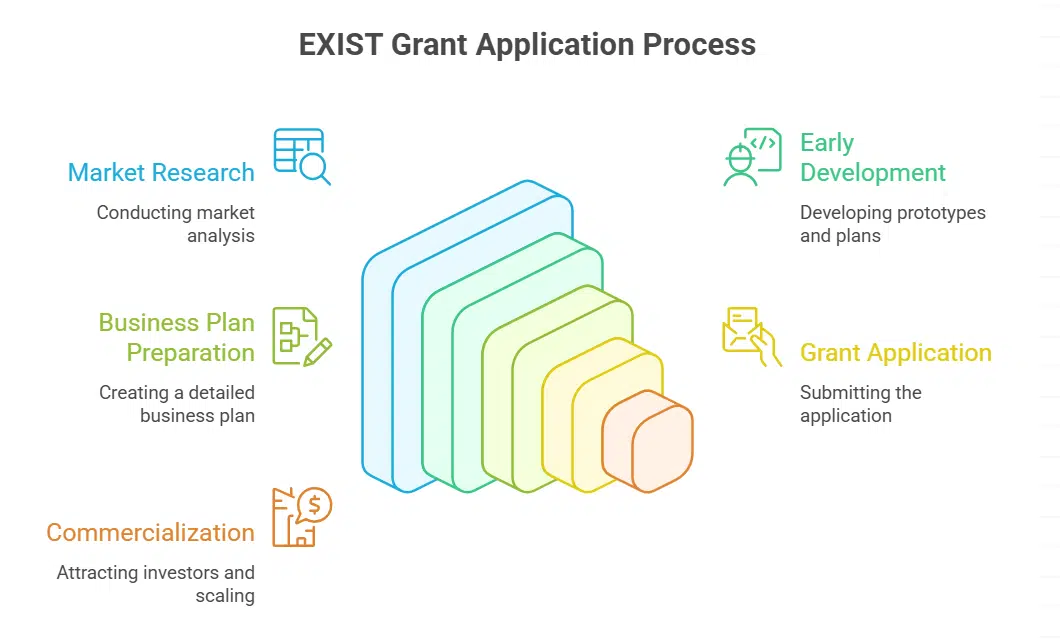

Startup teams in universities and research labs can tap the EXIST Business Start-Up Grant for pre-seed stage support. The program gives non-repayable funds up to 150,000 euros for market research and early development.

German Federal Ministry for Economic Affairs and Energy backs this public funding push. Teams use funds for R&D, prototype builds, and business plan costs. This spark can fuel a technology startup or an academic spinoff.

Project ideas need a clear innovation component and high market potential. Applicants prepare a business plan and register in a grant database. A small team of students or researchers can apply together.

EXIST-Forschungstransfer moves research results toward market fit and commercialization. This path attracts private investors, business angels, or venture capitalists alongside public funding.

ERP Start-Up Loan

The KfW Banking Group runs the ERP-Gründerkredit Startgeld under the German Federal Ministry for Economic Affairs and Energy. It offers low-interest loans to newly established companies and early-stage startups.

The program funds equipment, software, and working capital. This loan suits growth-stage ventures that chase market potential and need cash to scale.

Founders mix this plan with equity financing or a seed funding round. Drafting clear business plans helps win the loan. Tapping a funding database leads to more public funding options.

Micro-enterprises and small and medium-sized businesses use the loan to boost r&d and industry 4.0 projects. The model mirrors support from business angels and venture capital firms alike.

Repayment stays simple with low rates over long terms.

INVEST – Venture Capital Grant

INVEST Zuschuss helps German startups attract private venture capital. BMWi boosts funding by covering up to 50% of the venture capital amount. Public funding supports early-stage startups seeking equity financing.

Seed funding from business angels gains extra pull with this grant.

Growing firms expand their equity base and hire staff faster. Angel investors and VCs can tap the funding database at the German Federal Ministry for Economic Affairs and Energy. Founders refine business plans and plan r&d with fresh risk financing.

Innovative startups chase market potential with this support.

Pro FIT (Early-Stage Financing)

Pro FIT hands early-stage startups in Berlin, Brandenburg, and Saxony a voucher to cover part of their consulting and development costs. It springs from a tie-up between the German Federal Ministry for Economic Affairs and Energy and the European Regional Development Fund.

Small tech firms tap into this public funding to push r&d, build prototypes, or hire expert advisors.

Innovators link up with universities or research institutes for joint projects. This scheme bridges public support and venture capital, so teams can prove market potential before chasing equity financing or business angels.

SMEs find it easier to launch pilot trials, sharpen business plans, and secure low-interest loans later on.

BayTOU (Bavarian Technology-Oriented Startups)

BayTOU funds tech startups in Bavaria. It supports machinery, automotive, electrical engineering and medical technology efforts. The program awards grants for r&d on new products. Teams cut costs and test prototypes faster.

This boost reduces reliance on equity financing or venture capital. It links founders to a funding database and local mentors.

Teams refine computer vision systems and lab devices. They raise seed funding, hire more employees, and grow smes beyond small size. They boost their technology readiness level to reach pilot stages.

They meet venture capital firms and business angels, to expand budgets. They launch a crowdfunding campaign to prove market potential. They tap public funding and private equity financing side by side.

High-Tech Gründerfonds (HTGF)

High-Tech Gründerfonds stands as Germany’s biggest venture capital backer for early-stage ventures. Founders can secure up to €600,000 in seed funding, with follow-on rounds topping out at €3 million.

This fund targets tech and knowledge-based firms, especially those with heavy R&D needs. Many small and medium enterprises tap its support to build solid business plans. Partners include private equity investors and business angels, who boost equity financing.

Such a cash and counsel blend drives rapid market entry.

State-owned channels from the German Federal Ministry for Economic Affairs and Energy fuel the fund’s firepower. Advisors help founders map growth, expand into new markets, and chase follow-on financing.

Investors gain access to patent support, matchmaking events, and network hubs across major cities. That public funding boost often wins over later backers, easing entry to stock exchange investors.

Tech ventures enjoy both cash and counsel to scale past the startup phase.

GründungsBONUS Berlin

GründungsBONUS Berlin offers grants for early-stage startups in creative industries, IT, media, and tourism. It fuels seed funding for fresh business models and helps founders build solid business plans.

A public funding database, run by the German Federal Ministry for Economic Affairs and Energy, lists this scheme alongside ERDF support. Small firms can mix it with low-interest loans such as ERP-Gründerkredit.

Growth stage ventures reach further by using this subsidy for r&d or prototyping. They link it with equity financing from business angels or a venture capital trust. Berlin firms also access European Innovation Council channels for a bigger push.

This mix drives real growth in the local startup scene.

Additional Resources for Startup Support

Founders can tap many support tools to fund and grow. These resources link you to grants, equity financing, and loan programs.

- Funding Database at the German Federal Ministry for Economic Affairs and Energy helps founders find public funding and ERDF grants in a few clicks.

- EXISTENZGRÜNDUNGSZUSCHUSS gives unemployed founders a monthly subsidy for up to 15 months while they start a business.

- Mikromezzaninfonds invests up to €50,000 to boost the equity base of micro and small companies, making early-stage funding more stable.

- German Accelerator teams link startups with mentors and industry contacts to speed up entry into U.S. and Asian markets.

- Lean AI Startup Funding awards €30,000 over six months for material expenses, so you can test and validate AI ideas on a shoestring.

- EIC Accelerator, backed by the European Innovation Council, offers large grants and equity instruments for tech firms at TRL 6 to 8 aiming to launch new markets.

- Business angels networks connect you to seed funding, venture capital partners, and equity financing to turn bold plans into reality.

- Crowdfinancing platforms let you showcase your pitch to social investors, unicorn hunters, and the crowd, helping you build fans and capital.

- KfW funding database lists ERP-Gründerkredit, low-interest loans, and seed funding for SMEs.

Takeaways

You can tap venture capital, equity financing, or low-interest loans. Use the EIC Accelerator tool to spot EU funds. Business angels join in after seed rounds. Crowdfunding might boost your cash flow.

Check the funding database for open calls. The FS Entrepreneurship Centre guides each application. Germany’s mix of grants, loans, and seed funds powers growth. Pick your path and start building.

FAQs on Government Support Programs for Startups in Germany

1. What is the EXIST business start-up grant?

EXIST is a grant by the German Federal Ministry for Economic Affairs and Energy. It helps you launch a micro business or social enterprise. You keep your unemployment benefit while you write business plans, test market potential, and hire experts.

2. How do early-stage startups get seed funding or venture capital?

First, apply for seed funding from public start-up schemes. Next, pitch to business angels or equity financing firms. They bring cash and advice. Later, you can use the German stock exchange or tap the capital market.

3. Where can SMEs find low-interest loans?

SMEs can apply for ERP-Gründerkredit at the German state-owned investment and development bank. This loan has low interest. It can fund equipment, research and development, and staff costs.

4. What do the EIC Accelerator and ERDF offer?

The EIC Accelerator backs technology startups in artificial intelligence, image understanding, and information and communication technologies. You get grants and equity financing. The European Regional Development Fund supports R&D projects across German regions to boost local growth.

5. How can startups use the funding database?

Use the funding database to find public funding. Pick your sector, like innovative startups or social economy. The tool lists start-up funding, enterprise investment scheme, low-interest loans, and equity financing programs.

6. How do I craft a winning business plan for government grant or loan?

Think of your plan as a clear map. It shows your R&D path and market potential. Add numbers, timelines, and clear goals. Then link it to the Federal Economics Ministry to boost your chance for government funding.