The debate surrounding Gold vs Bitcoin investment 2026 has been settled not by analysts or algorithms, but by the brutal reality of the market itself. As we stand in late January 2026, the financial landscape has fractured. Gold has shattered the $5,000 per ounce barrier, while Bitcoin, once heralded as the “Digital Gold” that would render physical vaults obsolete, struggles to hold the $86,000 line, down nearly 30% from its October 2025 peak.

The current market is defined by a “Fear Trade” that has revitalized the oldest forms of wealth while exposing the maturity gaps in the newest. To understand where we go from here, we must dissect the anatomy of this rally, the specific failures of the digital narrative, and whether this decoupling is a permanent divorce or a temporary separation.

The Great Decoupling: A Tale of Two Assets

For the better part of a decade, the “crypto-maximalist” thesis rested on the idea that in a time of rampant inflation and geopolitical instability, Bitcoin would act as the superior safe haven. The events of early 2026 have stress-tested this hypothesis, and the results are uncomfortable for the digital asset community.

When the world grew fearful this January, capital did not flee to the blockchain; it fled to the bunker. This divergence is not merely a pricing anomaly; it is a fundamental shift in asset correlation. We are witnessing the end of the “Bitcoin is Digital Gold” honeymoon. The market has decoupled: Gold has returned to its throne as the ultimate shield against sovereign risk, leaving Crypto to face an identity crisis. The question isn’t if Crypto will die, but if it can reinvent itself as “High-Growth Tech” rather than “Hard Money.”

The Gold & Silver Super-Cycle: Anatomy of a Rally

The surge of Gold to over $5,000 and Silver breaching the triple-digit mark of $100 is not a standard market fluctuation. It is a “super-cycle,” a rare economic event driven by a confluence of structural failures in the traditional monetary system.

The Weaponization of Trust

The primary driver of Gold’s ascent in 2026 is not retail speculation, but sovereign survival. For decades, the US Treasury bond was the undisputed “risk-free” asset of the world. However, the aggressive weaponization of the dollar through sanctions and trade tariffs, reignited by the renewed protectionist policies of the Trump administration in 2025, has forced nations to seek alternatives.

Central banks, particularly in the Global South and the BRICS+ bloc, have accelerated their “de-dollarization” efforts. This is no longer a theoretical threat; it is visible in the order books. The People’s Bank of China (PBOC) and the Reserve Bank of India have been relentless buyers, treating Gold not as an investment but as a strategic reserve asset that is immune to foreign seizure. This sovereign buying has created an impenetrable “floor” under the Gold price. Unlike ETF investors who might panic-sell during a dip, central banks buy with a multi-decade horizon. They are effectively removing supply from the market permanently, creating a liquidity squeeze that has propelled prices vertically.

The Return of the Inflation Hedge

While the official CPI numbers in the US and Europe have moderated to the 2-3% range, the “felt inflation” remains punitive. The cost of services, insurance, and energy continues to climb, eroding the purchasing power of the middle class. In this environment, Gold has reclaimed its historical role as the ultimate preserver of purchasing power. The narrative has shifted from “making money” to “keeping money.” Investors are no longer looking for the 100x returns of a meme coin; they are desperate to ensure their wealth still exists in five years. This psychological shift from greed to fear is the jet fuel for the precious metals market.

The Hidden Opportunity: The Miner’s Arbitrage [Financial Nuance]

While the spotlight is on the spot price of the metals, the real “millionaire-maker” trade of 2026 is happening quietly in the mining sector. For years, gold and silver miners were uninvestable, plagued by rising energy costs and poor management. But at $5,000 Gold and $100 Silver, the math has fundamentally changed. Sophisticated investors know that when commodities boom, the companies mining them often outperform the commodity itself due to operating leverage.

Major mining firms have their “all-in sustaining costs” (AISC) around $1,400–$1,800 per ounce. With Gold at $5,000, their profit margins have not just doubled; they have expanded by 300-400%. Yet, mining stocks are historically undervalued compared to the metal itself. This “valuation gap” presents a massive catch-up opportunity. For investors who feel they “missed” the move in physical gold, high-quality mining stocks offer a way to capture the rally with added leverage, potentially outperforming the metal by a factor of 2:1 or 3:1 in the coming quarters.

The Silver Squeeze 2.0: The Industrial Behemoth

While Gold grabs the headlines, Silver has quietly become the best-performing asset of 2026. The move to $100+ per ounce is not just a monetary phenomenon; it is a supply chain crisis.

The Dual Identity Crisis

Silver is unique because it serves two masters: it is a monetary metal (poor man’s gold) and an industrial imperative. In 2026, both masters are demanding more than the earth can yield.

- The Monetary Demand: As Gold became too expensive for the average retail investor (with a single ounce costing as much as a used car), Silver became the accessible alternative. The “stacking” community has expanded globally, with mints in Perth, Canada, and the US reporting persistent shortages of physical coins and bars.

- The Green Energy Void: The true catalyst, however, is the industrial sector. The aggressive push for renewable energy infrastructure, specifically solar photovoltaics (PV), has swallowed the silver supply. Modern solar panels, specifically the TOPCon and HJT cells that became the industry standard in 2025, require significantly more silver paste than previous generations. With global solar installations surpassing 650 GW in 2026, the solar industry alone is consuming nearly 20% of the annual silver supply.

The Deficit Reality

The mining industry cannot simply “turn on” more silver production. Most silver is mined as a by-product of zinc, lead, and copper. This inelastic supply means that even with prices hitting $100, production has remained flat. We are currently in the fifth consecutive year of a structural deficit. Above-ground stockpiles in London and New York vaults have been drawn down to critical levels, creating a “squeeze” where industrial users are forced to pay massive premiums to secure physical delivery. This is not a bubble; it is a repricing of a critical strategic resource.

The “Digital Gold” Stress Test: Why Bitcoin Failed the Audit

If 2026 has been a coronation for Gold, it has been an identity crisis for Bitcoin. The flagship cryptocurrency entered the year with high hopes. Following the approval of Spot ETFs and a record-breaking 2025, the path to $200,000 seemed clear. Instead, Bitcoin has languished, unable to break its correlation with risk assets.

The Correlation Trap

The core promise of Bitcoin was that it was an “uncorrelated asset”, a hedge against the system. January 2026 proved this wrong. When geopolitical tensions spiked over trade wars and territorial disputes, Gold rallied instantly. Bitcoin, however, sold off in tandem with the Nasdaq and the S&P 500.

Institutional investors, who now dominate the crypto market via ETFs, do not view Bitcoin as “Digital Gold.” They view it as “High-Beta Tech.” It is treated as a risk-on asset, similar to a leveraged bet on the software sector. When the market sentiment turns bearish or fearful, portfolio managers risk-off. They sell their most volatile assets first. In 2026, that meant selling Bitcoin to buy Treasuries and Gold. The institutionalization of Bitcoin, which was celebrated as its salvation, has also become its cage. It is now shackled to the whims of traditional finance algorithms that dump it the moment the VIX (volatility index) spikes.

The ETF Outflow Phenomenon

The data is damning. Late 2025 and early 2026 saw weeks of net outflows from major Bitcoin ETFs, even as Gold ETFs saw record inflows. This capital rotation is the “Great Decoupling” in action. It signals that the “smart money” does not trust Bitcoin to hold value during a true crisis. The volatility that attracts speculators during a bull market becomes a liability during a bear market. A store of value cannot drop 15% in a week because of a regulatory rumor or a tech stock correction. Gold’s “boring” stability, inching up 0.5% a day, has become its most attractive feature.

Regulatory Boredom

Irony abounds in the fact that as Crypto has become safer, it has become less attractive. The regulatory framework established globally in 2025 has sanitized the market. While this prevents the massive frauds of the past (like FTX), it also caps the upside. The days of 100x gains on major coins are over, dampened by strict capital controls and surveillance. For the “moon boys” and speculators, the thrill is gone. For the conservatives, the risk is still too high. Bitcoin is stuck in the middle—too volatile for a savings account, too regulated for a casino.

The Psychology of 2026: Boomers vs. Zoomers

The investment split of 2026 is also a demographic war. The Great Decoupling is, in many ways, a reflection of the generational wealth gap.

The Tangibility Premium

We live in an era of deepfakes, AI-generated content, and digital insecurity. In this context, “tangibility” has become a luxury feature. The Boomer and Gen X generations, who still control the vast majority of global capital, are reverting to what they can touch. There is a psychological comfort in holding a physical Gold bar that a cold storage wallet cannot replicate.

This “Tangibility Premium” is why physical gold dealers are commanding 10-15% premiums over spot price, while Bitcoin trades at par. In a world where digital systems feel increasingly fragile—vulnerable to cyber warfare, power grid failures, and quantum decryption threats—the offline nature of Gold is a feature, not a bug.

The Disillusioned Digital Native

Conversely, the younger demographic (Gen Z and Alpha), who were Bitcoin’s staunchest defenders, are facing liquidity crunches. The high cost of living has forced many retail crypto investors to liquidate their digital holdings to pay for real-world necessities. The “Diamond Hands” have been forced open by inflation. Furthermore, the lack of new, earth-shattering utility in the crypto space has led to narrative fatigue. The promise that crypto would “bank the unbanked” or destroy the credit card monopolies has not materialized fast enough to sustain the hype.

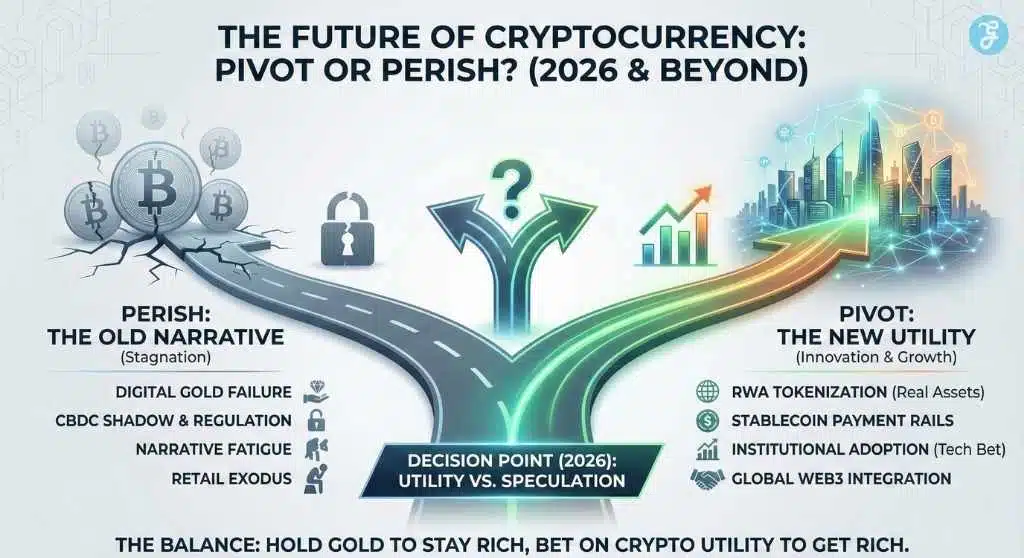

The Future of Cryptocurrency: Pivot or Perish?

Does this mean Crypto is dead? Absolutely not. But the narrative of “Bitcoin as Money” or “Bitcoin as Gold” is dying. To survive and thrive post-2026, the industry must pivot toward “Crypto as Tech.”

The Utility Pivot

The future of blockchain investment lies in utility, not speculation. While Bitcoin stagnates, we are seeing massive growth in Real World Asset (RWA) tokenization. This is the bridge between the two worlds. We are seeing gold-backed tokens (like PAXG) seeing higher volume than Bitcoin itself. Investors want the safety of Gold with the transferability of Crypto.

Stablecoins have also emerged as the true “killer app” of crypto. They aren’t investment vehicles; they are payment rails. The volume of USDC and USDT settlements in 2026 rivals Visa and Mastercard. This is where the value will accrue, not in the volatile assets, but in the infrastructure that moves tokenized dollars and tokenized gold around the world.

The CBDC Shadow: The Real Reason for the Crackdown

To understand the struggle of Bitcoin in 2026, one must look at what governments are building in the dark: Central Bank Digital Currencies (CBDCs). With the Digital Euro and Digital Dollar pilots moving to advanced stages this year, the “war on crypto” makes perfect strategic sense. Governments are not trying to ban digital currency; they are trying to nationalize it.

This creates a unique squeeze. Bitcoin is being regulated into submission to ensure it doesn’t compete with upcoming CBDCs. This reality has split the “liberty” vote. Investors who want digital freedom are sticking with Bitcoin, hoping it remains decentralized enough to survive. But investors who want total freedom, freedom from the digital surveillance grid entirely, are exiting the digital ecosystem altogether and moving into physical Gold. In a world of programmable money that can be tracked or frozen, a gold coin is the only asset that is truly “offline.”

The Cyclical Rotation Theory

Smart investors should also consider the cyclical nature of markets. “The Fear Trade” cannot last forever. Eventually, geopolitical tensions will thaw, or the market will simply grow accustomed to the chaos. When that happens, the trillions of dollars currently parked in Gold will look for yield. Gold pays no dividends; it has no earnings. When greed returns to the market, perhaps in late 2026 or 2027, we could see a violent rotation out of Gold and back into high-risk assets like Bitcoin.

In this view, the current Gold rally is actually funding the next Crypto bull run. The profits taken from Gold at $5,500 or $6,000 will eventually need a new home, and Bitcoin at a discounted $80,000 might look irresistible to a flush investor class.

Investment Scenario Planner: What to Watch in Q2 2026

Markets move fast. Use this simple heuristic to navigate the next three months:

| Scenario | Likely Winner | Likely Loser | The Logic |

| Escalation (War spreads/Sanctions increase) | Gold & Silver | Bitcoin & Tech Stocks | Fear intensifies; capital flees to physical safety and offline assets. |

| Stabilization (Peace treaties/Trade deals) | Bitcoin & Alts | Gold (Short-term) | Fear subsides; “Risk-On” trade returns. Gold profits rotate into depressed Crypto prices. |

| Stagflation (High Inflation + Low Growth) | Silver & Gold | Bonds & Cash | Tangible assets win when cash loses value. Silver leads due to industrial scarcity. |

| Tech Breakthrough (New AI/Blockchain utility) | Ethereum/Solana | Bitcoin Dominance | Utility tokens decouple from “Store of Value” tokens; capital chases innovation. |

Final Words: The New World Order of Assets

As we navigate 2026, the market has delivered a clear verdict: Gold and Silver have reclaimed their throne as the ultimate guardians of wealth, decoupling from digital assets to offer true safety without counterparty risk. However, writing the obituary for cryptocurrency is premature. Bitcoin has simply clarified its purpose, not as a digital shield, but as a high-growth bet on a digital future.

The lesson of 2026 is one of balance. You buy Gold to stay rich; you buy Bitcoin to get rich. Currently, the world is focused on preservation, but history confirms the pendulum always swings back. The smartest investors are holding bullion with one hand while keeping a finger on the “Buy” button for crypto, ready for when the fear finally fades.