Car insurance is an essential aspect of vehicle ownership, offering financial protection and peace of mind. But not all policies are created equal. When it comes to full coverage vs. liability car insurance benefits, the differences can be significant.

Full-coverage car insurance provides extensive protection, covering not only damages you cause but also those affecting your vehicle, while liability-only insurance focuses solely on damages and injuries caused to others.

In this article, we’ll explore full coverage vs. liability car insurance benefits in depth, focusing on the key advantages of full-coverage insurance. Let’s dive in and unpack the key differences, benefits, and considerations that can guide your decision-making process.

What Is Full-Coverage Car Insurance?

Definition and Components

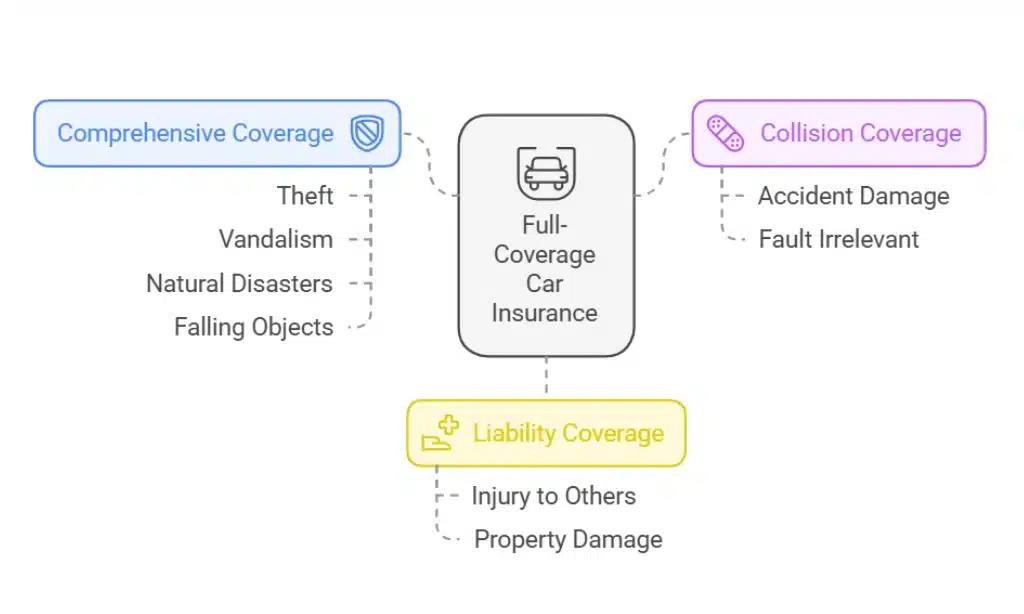

Full-coverage car insurance is a comprehensive policy designed to offer extensive protection for your vehicle and others involved in an accident. It typically includes:

- Comprehensive coverage: Protects against non-collision-related events such as theft, vandalism, natural disasters, or falling objects.

- Collision coverage: Covers damages to your car following an accident, regardless of fault.

- Liability coverage: Protects you financially if you’re responsible for causing injury or property damage to others.

This combination makes full-coverage insurance a robust option for safeguarding your vehicle and your finances. Additionally, it provides flexibility for additional endorsements like roadside assistance or rental car coverage, enhancing the full coverage vs. liability car insurance benefits further.

What Is Liability-Only Insurance?

Liability-only insurance is a basic policy that focuses on covering damages and injuries you cause to others. While it meets legal requirements in most states, it provides minimal protection for your vehicle. This policy includes:

- Bodily injury liability: Covers medical expenses for injuries you cause to others.

- Property damage liability: Pays for damages to someone else’s property.

Though more affordable upfront, liability-only insurance leaves you exposed to significant financial risks, especially if your vehicle is damaged. For drivers with older vehicles or limited budgets, it might seem like an economical choice, but it lacks the safety net offered by full coverage.

| Coverage Type | Full Coverage | Liability Only |

| Covers your vehicle damages | Yes | No |

| Legal liability protection | Yes | Yes |

| Natural disaster protection | Yes | No |

| Theft and vandalism | Yes | No |

12 Benefits of Full-Coverage Car Insurance vs. Liability Only

Financial Protection and Savings

1. Covers Damage to Your Vehicle

Full coverage protects your vehicle from a wide range of damages, whether caused by an accident, a falling tree branch, or a fender bender. For instance, if you’re involved in a multi-car collision, full coverage ensures repair or replacement costs are handled by your insurer, reducing your financial burden. Liability-only policies, on the other hand, won’t pay for repairs to your own vehicle, leaving you to bear the costs.

| Scenario | Full Coverage | Liability Only |

| Fender bender repair costs | Covered | Not covered |

| Multi-car collision damages | Covered | Not covered |

| Hit-animal incidents | Covered | Not covered |

2. Protection Against Natural Disasters

Comprehensive coverage under a full-coverage policy safeguards your car from damage caused by natural disasters such as hurricanes, floods, earthquakes, or hailstorms. For example, if a flood damages your parked car, your full-coverage policy will pay for repairs or replacement. Liability-only insurance doesn’t include these protections, leaving you vulnerable to costly repairs.

| Natural Disaster | Full Coverage | Liability Only |

| Flood damage | Covered | Not covered |

| Hailstorm damage | Covered | Not covered |

| Earthquake damage | Covered | Not covered |

3. Safeguards Against Theft or Vandalism

Vehicle theft and vandalism can lead to significant financial losses. Full-coverage insurance compensates you if your car is stolen or vandalized, ensuring you can recover quickly. For example, if your vehicle is stolen from a public parking lot, your policy will reimburse the vehicle’s value. Liability-only policies won’t cover these incidents, leaving you to absorb the loss.

| Incident | Full Coverage | Liability Only |

| Car stolen | Covered | Not covered |

| Window smashed (vandalism) | Covered | Not covered |

Peace of Mind

4. Roadside Assistance and Towing

Many full-coverage plans include perks like roadside assistance, towing, and jump-start services. This ensures you’re not stranded during emergencies. Imagine breaking down on a remote highway—a full-coverage policy can arrange towing services quickly, saving you time and stress. Liability-only policies typically lack such benefits, requiring you to pay out of pocket.

| Service | Full Coverage | Liability Only |

| Towing | Included | Not included |

| Jump-start assistance | Included | Not included |

| Flat tire assistance | Included | Not included |

5. Rental Car Reimbursement

If your car is being repaired after a covered incident, full-coverage insurance often provides reimbursement for rental car expenses. This ensures you can stay mobile while your car is in the shop—a benefit liability-only insurance doesn’t offer. For instance, if your car needs extensive repairs after an accident, full coverage will cover the cost of a rental car so you can continue with daily activities uninterrupted.

| Need | Full Coverage | Liability Only |

| Rental car after accident | Covered | Not covered |

| Repair reimbursement | Covered | Not covered |

Legal and Practical Advantages

6. Meets Lease or Loan Requirements

If you’re financing or leasing your car, lenders typically require full-coverage insurance to protect their investment. For example, if you’re leasing a brand-new SUV, full coverage ensures that the lender’s asset is protected from unexpected damages. Liability-only policies fail to meet these requirements, making full coverage the mandatory choice in such cases.

| Financing Status | Full Coverage Required | Liability Only |

| Leased vehicles | Yes | No |

| Owned outright | Optional | Optional |

7. Protects Against Lawsuits

Higher liability limits in full-coverage policies reduce the likelihood of paying out-of-pocket for legal expenses in case of a lawsuit. This is particularly beneficial in severe accidents where damages exceed standard liability coverage limits. For example, if you’re sued for medical bills after causing a significant accident, full coverage can shield you from financial ruin.

| Situation | Full Coverage | Liability Only |

| Lawsuit due to accident | Covered | Partial |

| Excess medical costs | Covered | Not covered |

Enhanced Safety Net

8. Covers Hit-and-Run Incidents

A full-coverage policy can protect you financially if your car is damaged in a hit-and-run accident. Imagine returning to your parked car only to find it damaged with no note left behind. Without full coverage, you’re left to shoulder the repair costs, but comprehensive policies cover these situations.

9. Uninsured/Underinsured Motorist Protection

This feature ensures you’re covered if the at-fault driver lacks sufficient insurance. It’s a crucial safety net that liability-only policies do not provide. For example, if you’re hit by a driver without insurance, your full-coverage policy will handle the expenses, ensuring you aren’t left financially stranded.

| Driver at Fault | Full Coverage | Liability Only |

| Uninsured driver accident | Covered | Not covered |

| Underinsured driver accident | Covered | Not covered |

Long-Term Benefits

10. Protects Vehicle Value

For new or high-value vehicles, full-coverage insurance ensures you receive compensation based on the car’s actual value. This is particularly beneficial for maintaining the long-term value of your investment. For instance, if your brand-new sedan is totaled in an accident, full coverage reimburses you for the car’s market value, helping you replace it without financial strain.

| Vehicle Age | Full Coverage Benefit | Liability Only |

| New (<3 years) | Full market value covered | Not covered |

| Old (>10 years) | Limited coverage | Optional |

11. Discounts and Bundling Opportunities

Full-coverage policies often come with opportunities to bundle with other insurance types, such as home or renters’ insurance, leading to significant savings. Additionally, many insurers offer discounts for features like anti-theft devices or safe driving records. For example, bundling your auto and homeowners insurance can result in discounts of up to 20%.

| Discount Type | Savings Potential |

| Anti-theft discount | 10-15% |

| Bundled policy discount | 15-20% |

12. Peace of Mind for New or High-Value Cars

For those with expensive or brand-new vehicles, full-coverage insurance provides the ultimate peace of mind. Knowing your investment is fully protected allows you to drive with confidence. For instance, if you own a luxury car, full coverage ensures you won’t face massive financial losses in case of accidents or theft.

Takeaways

Choosing between full coverage vs. liability car insurance benefits depends on your individual needs, budget, and circumstances. While liability-only insurance may be suitable for older, low-value vehicles, full-coverage insurance offers comprehensive protection, enhanced peace of mind, and valuable perks.

Ultimately, the benefits of full-coverage car insurance outweigh its costs for most drivers, especially those with newer or financed vehicles.

To make the best decision, consider consulting with an insurance expert who can tailor coverage to your needs.